Who Is Exempt From Paying Stamp Duty In Victoria

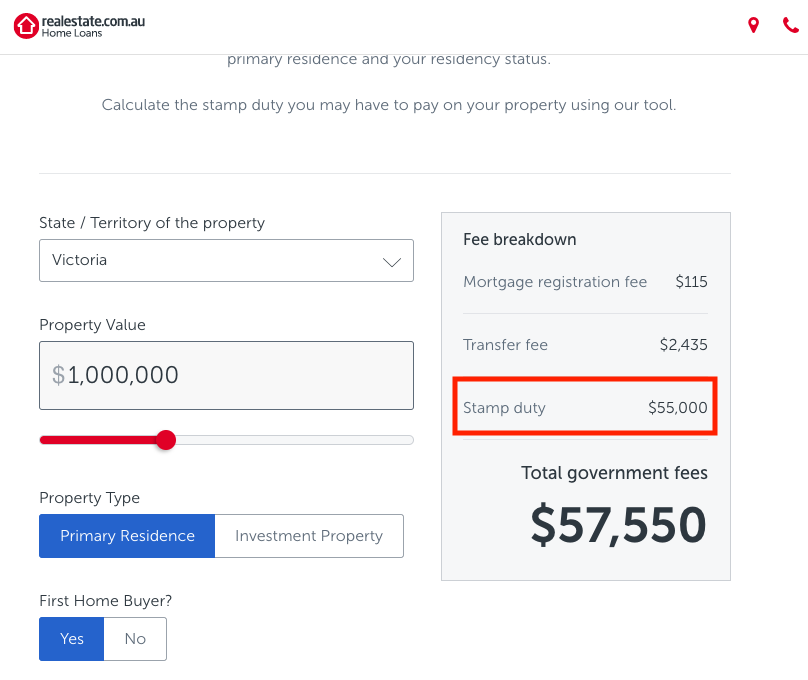

They can provide you with a duty statement to show how much duty has been paid. For an 800000 property in Victoria the normal stamp duty is 43070.

You enter into a contract of sale to buy your first home on or after 1 July 2017.

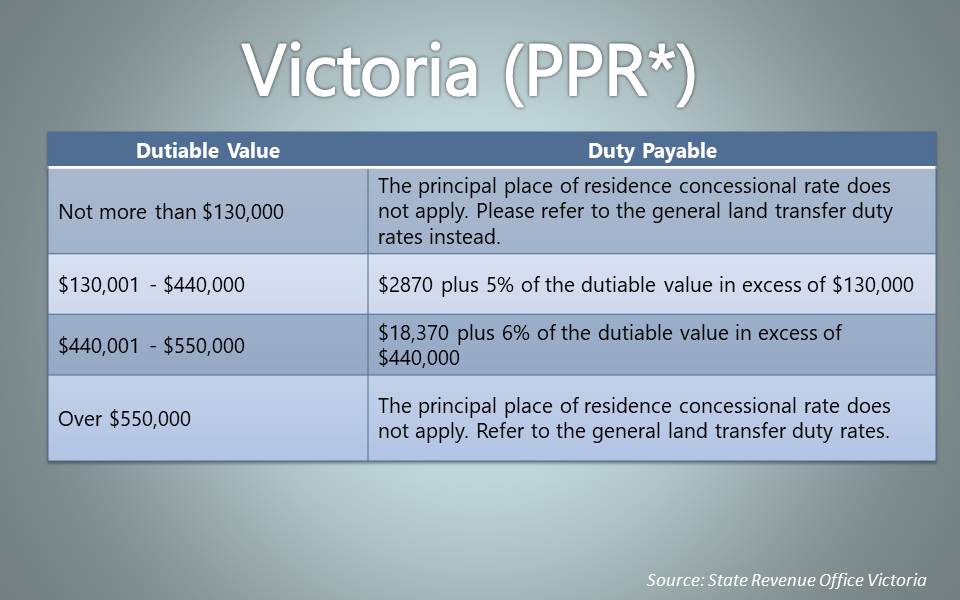

Who is exempt from paying stamp duty in victoria. 05052015 You may be eligible for Stamp Duty Land Tax SDLT reliefs if youre buying your first home and in certain other situationsThese reliefs can reduce the amount of tax you pay. The Principal Place of Residence PPR concession is available to all homebuyers whose property does not exceed a value of 550000 and who reside in that property for a continuous period of at least 12 months. For those purchasing a property between 600000 and 750000 a concession will be applied on a.

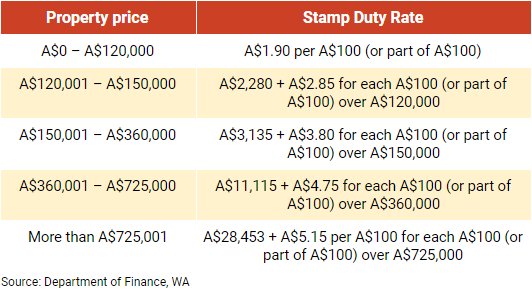

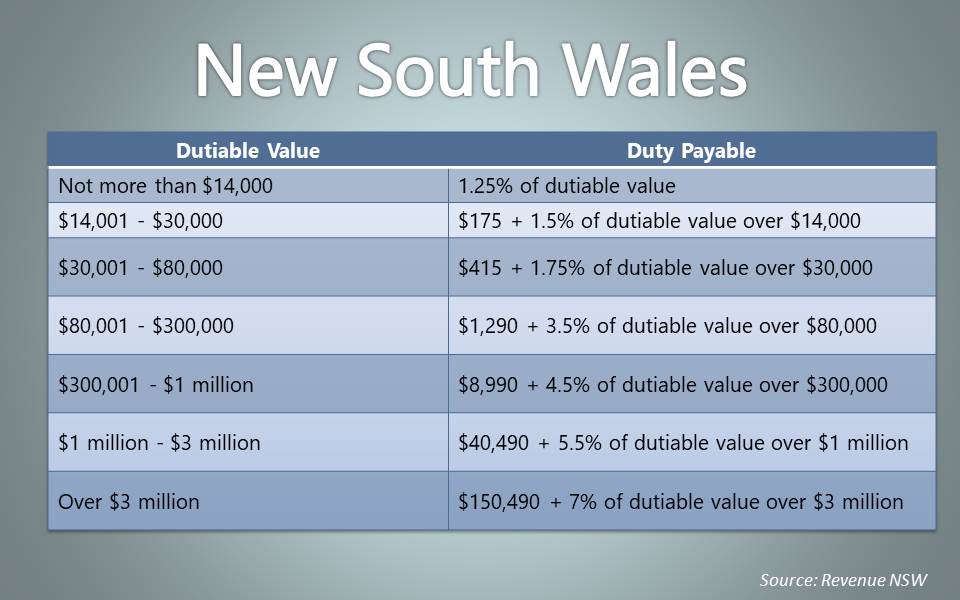

The standard rates are as follows. Properties valued up to 330000 are exempt from transfer duty while properties valued between 330001 and 750000 may qualify for a concessional rate to their duty. When does it apply.

The stamp duty amount can be. Finally the Victorian government also provides a stamp duty exemption to pensioners buying a home valued at under 330000 and a concessional rate to pensioners buying a home valued between 330001 and 750000. For certain types of buyers such as first home buyers or pensioners.

09122020 Victoria Stamp Duty Cost. When you buy your property your conveyancersolicitor or bank will normally claim any exemption or concessions organise and pay duty on your behalf via Duties Online. Stamp duty is an additional charge based on a percentage of your insurance premium and the GST.

There are a number of concessions and exemptions from stamp duty in Victoria such as the first home owner exemption and the concession for transferring residential premises. First home buyers in Victoria are offered stamp duty. It can range from 7 - 10 depending on which state you are based.

23102017 On an ongoing basis first home buyers in Victoria may be exempt from stamp duty on eligible purchases. For foreigners and certain visa holders your stamp duty now shoots up to 107070 for the same property. Youre a foreign citizen or temporary resident including a 457 visa holder.

Full exemption for new properties with a dutiable value of 470000 or less Partial exemption for new properties valued between 470000 and 607000 No transfer duty applies to vacant land valued at 281200 or less. When buying a 400000 property the stamp duty is 16370. Are there stamp duty exemptions for first home buyers in Victoria.

Youll need to pay stamp duty for things like. The rules dealing with all of these matters are contained in the Duties Act 2000. Exception is 444 visa holders.

Transfers of property such as a business real estate or certain shares. You and your partner if applicable must both qualify as first home buyers and be Australian citizens or permanent residents. Victorias stamp duty also has differences depending on whether you are going to be permanently residing in the property or using it as an investment.

It will then be broken down as follows. 17122020 Current property thresholds for full and partial duty exemptions are as follows. 08122020 If you dont pay your duty within 30 days of settlement penalty tax and interest may apply.

New Zealanders on a. Both of the above. Motor vehicle registration and transfers.

The State Revenue Office is the body you will deal with when a stamp duty issue arises. Victoria is one of the most expensive states for stamp duty in Australia and this new exemption will be warmly welcomed by first home buyers trying to get on the property ladder. This table shows the rates of stamp duty payable in Victoria.

In order to be eligible pensioners must hold an approved concession card buy the property at market value and intend to live in the home as their principal place of residence. Many Not for Profit and community groups are eligible for an exemption on the stamp duty added to their insurance premiums. Unless an exemptions or concession applies the transaction is charged with land transfer duty based on the greater of the market value of the property or the consideration price paid - including any GST.

Who is exempt from paying stamp duty land transfer duty in Victoria. You are exempted from paying stamp duty if the value of the property is 600000 or less. See VIC calculator above.

27 rows 03062020 Over 90 of private transfers require transfer fee and duty payment and. 26062020 Stamp duty is tax that state and territory governments charge for certain documents and transactions. Yes there are stamp duty exemptions and concessions for first home buyers in Victoria under the following conditions.

On certain types of properties especially new homes and off the plan purchases or. All transfers of land including gifts attract stamp duty in Victoria. Pensioner stamp duty exemption and concession.

State and Territory governments recognise this so on occasions they will waive stamp duty or allow a reduced rate to be paid.

Stamp Duty What Is It How Much Exemptions And Concessions Guide

Stamp Duty What Is It How Much Exemptions And Concessions Guide

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

This Comparative Infographic Highlights The Advantages Of Doing Business In Asia S Two Most Popular Business Destina Singapore Business Business Regulations Singapore

This Comparative Infographic Highlights The Advantages Of Doing Business In Asia S Two Most Popular Business Destina Singapore Business Business Regulations Singapore

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Exemption Under The Family Law Act 1975

Stamp Duty Exemption Under The Family Law Act 1975

A Guide To The Australia Property Investment Purchase Cycle Australia Property Investment Uk Property Investment Csi Prop

A Guide To The Australia Property Investment Purchase Cycle Australia Property Investment Uk Property Investment Csi Prop

A Guide To Stamp Duty In Victoria A Guide To Stamp Duty In Victoria

A Guide To Stamp Duty In Victoria A Guide To Stamp Duty In Victoria

Indirect Tax Bulletin July 2019 Ashurst

Indirect Tax Bulletin July 2019 Ashurst

Https Www Herbertsmithfreehills Com Hsfpdf Latest Thinking 2019 Update Key Changes To Australian Stamp Duty Pdf 1

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

.webp) Sdlt Stamp Duty Calculator Uk Calculate Stamp Duty Land Tax

Sdlt Stamp Duty Calculator Uk Calculate Stamp Duty Land Tax

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

What Is Stamp Duty A Guide To Stamp Duty In Victoria Urban

What Is Stamp Duty A Guide To Stamp Duty In Victoria Urban

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Post a Comment for "Who Is Exempt From Paying Stamp Duty In Victoria"