How To Avoid Paying Stamp Duty On Shares

Pay Stamp Duty Land Tax. When purchasing UK shares which are able to settle through the UK electronic settlement system CREST you will pay 05 of the value of the trade as Stamp Duty Reserve Tax SDRT.

Home Loan Mistakes To Avoid Indian Stock Market Hot Tips Picks In Shares Of India Home Loans Loan Money Plan

Home Loan Mistakes To Avoid Indian Stock Market Hot Tips Picks In Shares Of India Home Loans Loan Money Plan

30102014 Stamp Duty reliefs and exemptions on share transfers.

How to avoid paying stamp duty on shares. Mail it with the payment slip to the address stated on the payment slip. But if you plan to buy a property to use as your main residence and theres a hold-up to the sale of your current home you will need to pay the higher Stamp Duty rates. 23042008 So do we always have to pay stamp duty whenever we buy shares.

09082019 If you increase the share to 75 per cent by paying another 200000 you still wont have to pay any stamp duty. The price paid for shares is greater than 1000 and. The amount of stamp duty you pay depends on a number of factors.

Insurance documents Leases Mortgages Motor vehicles transfers including cars boats and motorcycles Share transfers and most significantly Land andor house. 06032020 To avoid paying stamp duty for a second home under this scenario the two of you can agree to buy the property under your name. The sale is recorded on a Stock Transfer Form.

Stamp Duty Reserve Tax to give it its technical name is charged at 05 on share purchases of UK companies that are made electronically for example in an online share. This is where the property is transferred to the buyer in multiple stages or sub-sales to avoid paying Stamp Duty on the full purchase price of the property. There are other circumstances in which Stamp Duty is either not payable or can be reduced.

Haggle on the property price. 22122019 In the UK Stamp Duty tax is payable on the transfer of existing shares. Actually we dont always have to pay stamp duty for share purchases because this tax only applies for shares in a company thats incorporated in the UK or in a foreign company that maintains a share register in the UK.

10022017 If you own a share of a property currently worth less than 40000 and you are buying a main residence you do not need to pay the additional 3 Stamp Duty. Notify a purchase of own shares SH03 Pay Stamp Duty. In general term stamp duty will be imposed to legal commercial and financial instruments.

In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949. But if you want to increase to 90 per cent youll have to. Transfer of property in separation or divorce.

05052021 Here we look at ways to reduce your stamp duty bill or even avoid paying the tax altogether. 19032013 If your duties include registration acceptance or authentication of any instrument including share transfer and Deed of Assignment contact the Deputy Collector of Stamp Duty if in doubt as to whether fixed duty or ad valorem duty is payable on the instrument. 01022017 This means that the new purchaser and any future purchaser of the shares pays stamp duty at 05 percent provided it is a UK company or no stamp duty if an offshore company is used on the purchase price of the shares rather than SDLT at 4 percent or 5 percent on the purchase price of the property.

Please take note of the following. So if you buy shares in a company that is not incorporated in the UK and. Slightly over rate band.

If the price is only just within a higher band ask the seller or estate agent if they would accept a slightly lower price. 03032021 The methods used by Stamp Duty mitigation companies can be complex and may include. Please attach this with your cheque payment and write the 14-digit payment slip number on the reverse side of your cheque or cashiers order made payable to Commissioner of Stamp Duties.

This can be effective provided the two of you are not married or in a civil partnership. There are two types of Stamp Duty namely ad valorem duty and fixed duty. Calculated at a rate of 05 of the sale price of the shares Stamp Duty SD must be paid to HMRC by the purchaser the new shareholder when.

Completing a stock transfer form. When is Stamp Duty not payable. 11012017 The following documents can attract Stamp Duty.

25112016 If the same person were to move somewhere else with the same amount of space as the two properties combined they would avoid paying the added duty but would probably pay more in total because the. Print the payment slip from the e-Stamping Portal. Most of us will pay Stamp Duty at some point in our lives most commonly when we buy a home.

Stamp duty on shares. The easiest way to acquire Irish and UK shares without paying stamp duty is to find eligible candidates from the High Growth Segment and LSEs London Stock Exchanges AIM Alternative Investment Market.

Property Stamp Duty Registration Charges In India Property Marketing Stamp Duty Real Estate Marketing

Property Stamp Duty Registration Charges In India Property Marketing Stamp Duty Real Estate Marketing

Stamp Duty Exemption London Stock Exchange

Stamp Duty Exemption London Stock Exchange

How To Calculate Long Term Capital Gain Tax On Equity Shares And Mutual Fund From 1st April 2018 Capital Gains Tax Capital Gain Mutuals Funds

How To Calculate Long Term Capital Gain Tax On Equity Shares And Mutual Fund From 1st April 2018 Capital Gains Tax Capital Gain Mutuals Funds

20 Types Of Taxes In India Types Of Taxes Money Management Advice Capital Gains Tax

20 Types Of Taxes In India Types Of Taxes Money Management Advice Capital Gains Tax

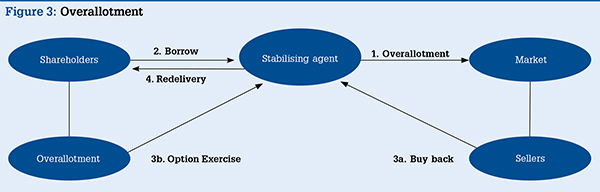

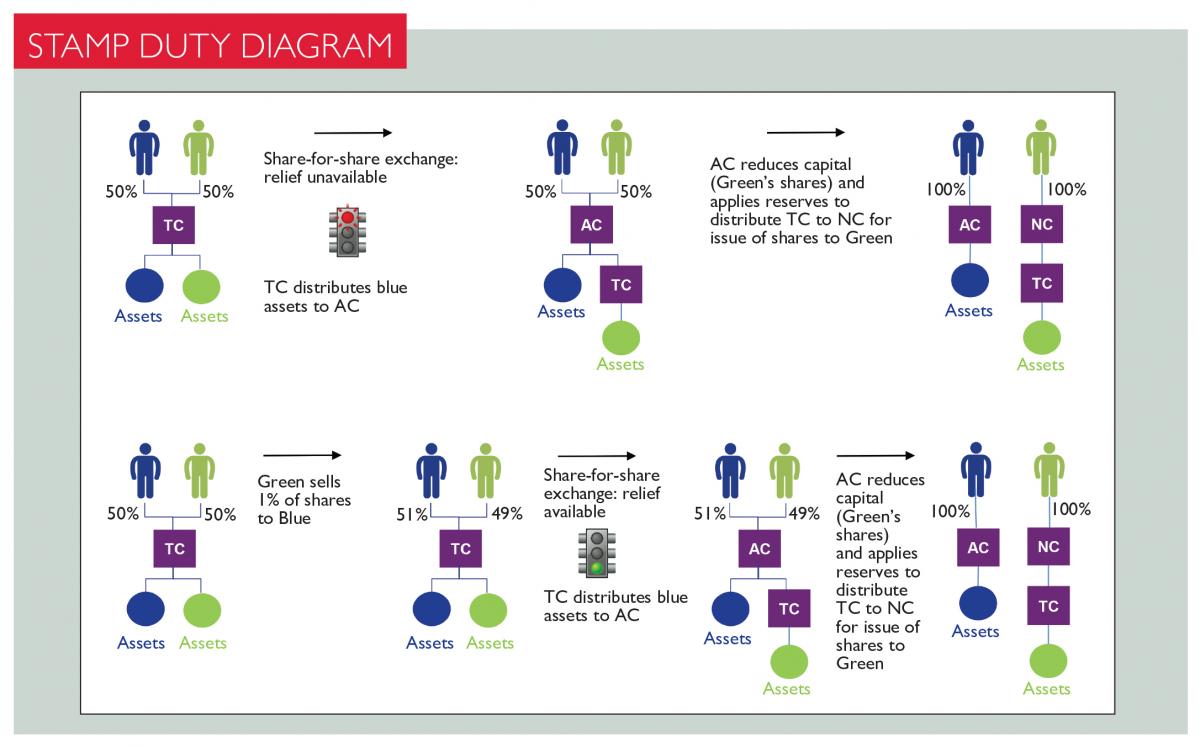

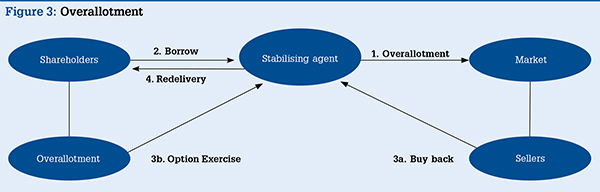

Stamp Duty Relief On Share For Share Exchanges Taxation

Stamp Duty Relief On Share For Share Exchanges Taxation

Transfer Of Shares In A Real Property Company Donovan Ho

Transfer Of Shares In A Real Property Company Donovan Ho

Where To Invest In Real Estate Or Gd N Demat Investing Investment Quotes Real Estate Investing Books

Where To Invest In Real Estate Or Gd N Demat Investing Investment Quotes Real Estate Investing Books

Who Ll Benefit From Unified Stamp Duty

Who Ll Benefit From Unified Stamp Duty

5 Tips On Intraday Trading In Share Market By Indiabulls Ventures Intraday Trading Online Share Trading Investing

5 Tips On Intraday Trading In Share Market By Indiabulls Ventures Intraday Trading Online Share Trading Investing

Guide To Transferring Shares In A Singapore Private Company Singaporelegaladvice Com

Guide To Transferring Shares In A Singapore Private Company Singaporelegaladvice Com

All You Need To Know How Stock Markets Function Stock Market Bombay Stock Exchange London Stock Exchange

All You Need To Know How Stock Markets Function Stock Market Bombay Stock Exchange London Stock Exchange

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Https Www Iras Gov Sg Irashome Uploadedfiles Irashome E Services Other Taxes Faqs 20on 20shares Pdf

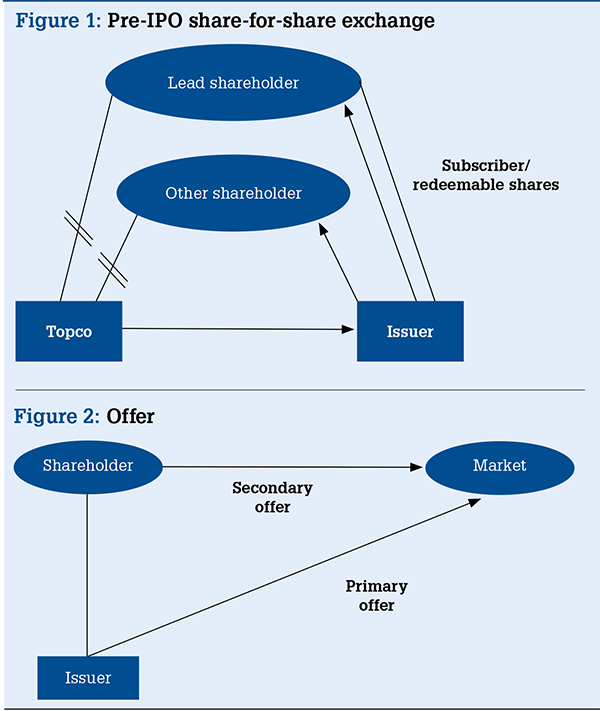

Avoiding Stamp Tax Traps On Ipos

Avoiding Stamp Tax Traps On Ipos

How To Trade Stock At Bursa Malaysia Investing Basic Kclau Com

How To Trade Stock At Bursa Malaysia Investing Basic Kclau Com

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Avoiding Stamp Tax Traps On Ipos

Avoiding Stamp Tax Traps On Ipos

Post a Comment for "How To Avoid Paying Stamp Duty On Shares"