What Shares Are Exempt From Stamp Duty

11072014 Check guidance on reliefs and exemptions for Stamp Duty Reserve Tax on shares transactions made without a stock transfer form and Stamp Duty for land transfers made before December 2003. You do not pay Stamp Duty on the.

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Shares that are inherited under a Will.

What shares are exempt from stamp duty. Stamp duty exempt trades in UK or Irish shares mean there a few things you dont need to do. Purchases made by Private Investors in an eligible security are therefore SDRT Stamp Duty exempt. 10122014 Stamp duty is only payable if the company that one is buying shares from is incorporated or based in the UK.

22122019 If the transfer qualifies for relief you must apply to HMRC for confirmation of the relief otherwise you will need to pay the full amount of Stamp Duty or SDRT. You pay Stamp Duty on. Shares that you receive as a gift and that you do not pay anything for either money or some other consideration shares that your spouse or civil partner transfers to you when you marry or.

Any document signed by on behalf of or in favour of the government not applicable to statutory boards and government-owned companies and where the government is liable to pay the Stamp Duty on the document. Certifying a transfer as exempt from stamp duty. It was introduced in 2003 replacing stamp duty which was first introduced in England in 1694.

Basically a foreign company is exempt from stamp duty as it does not maintains its shareholders register in the UK. Balance Sheet as at 3092000 Current Assets Development work-in-progress Trade debtors Cash and bank balances. This note considers the practical impact of stamp duty on commercial transactions involving shares.

By Practical Law Tax based on a practice note originally contributed by Ashurst. Stamp Duty on the issue of shares. Stamp duty on shares.

Stamp duty is only charged when you buy existing shares in a UK company. The HGS will be exempt from the tax. Shares based on NTA is the highest.

Shares that are received as a gift with no consideration due. Documentation does not need to be stamped or sent to HMRC. You may be able to claim an exemption or relief.

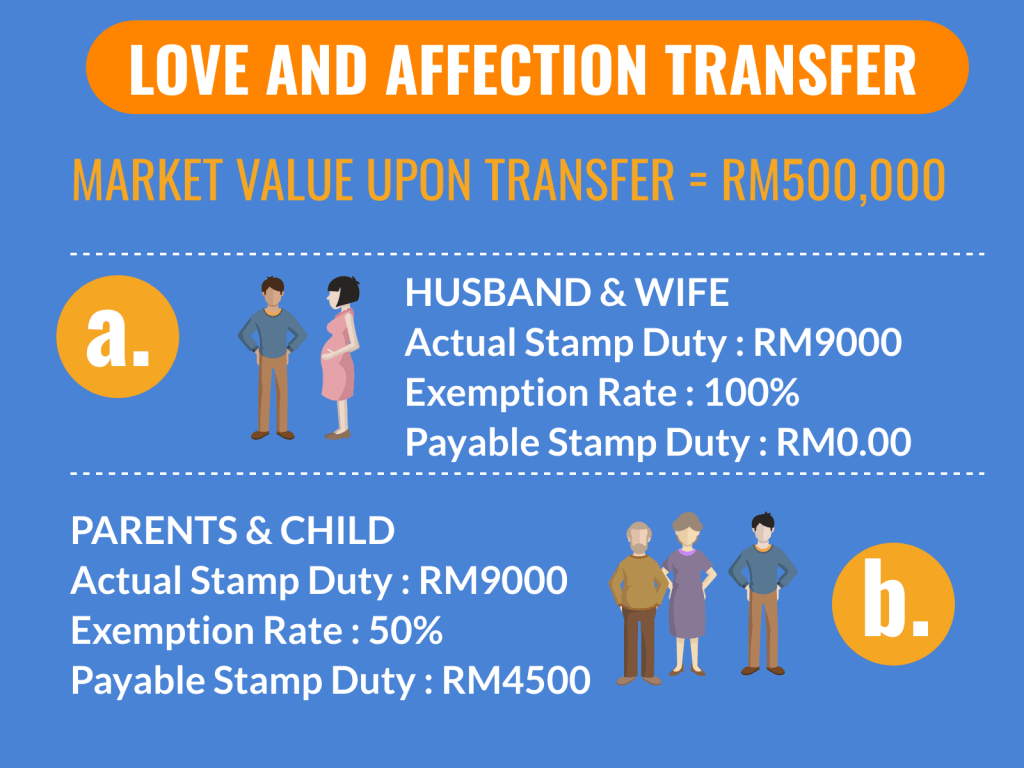

How to Claim Refunds. 03082020 Stamp Duty Exemption No4 Order 2020 The exemption of stamp duty with effective on 1 June 2020 for the residential property price between RM300000 to RM25Million. 02072019 Most bond transactions are exempt.

Terms_and_conditions 1 The abolition of stamp duty on shares admitted to AIM will help attract more investment and liquidity into some of the UKs most ambitious dynamic and innovative companies Xavier Rolet CEO London Stock Exchange Group. Stamp duty concessions and exemptions In some circumstances you may be able to get a concession or exemption from paying stamp duty. Free Practical Law trial.

The exemption on the instrument of transfer is limited to the first RM1Million of the property price and the stamp duty will be charged RM3 for every RM100 of the balance property. Stamp duty still applies to paper share certificates over 1000 in. 24122008 Stamp Duty on share options.

28022014 Stamp Duty Exemption - Instruments of Transfer relating to Indirect Allotment or Redemption of 1 Units under Unit Trust Schemes and 2 Shares under Open-ended Fund Companies U3SOGPN08A Stock Borrowing Relief - Electronic Registration of Stock Borrowing and Lending Agreement U3SOGPN09A. Shares in a foreign company with a share register in the UK. 01092020 Certificated shares are also exempt in the following circumstances.

UK stamp duty will be applied to all UK share purchases except the majority of. Share transfers that are normally exempt from Stamp Duty and SDRT include. 26062020 transfers of property such as a business real estate or certain shares The amount of stamp duty youll need to pay depends on the type and value of your transaction.

Since 28 April 2014 SDRT. However further documentation may be required should a chargeable consideration in excess of 1000 be submitted for transfer in which a specific exemption exists. Stamp Duty have not been chargeable on transactions in eligible securities on London Stock Exchanges AIM and High Growth Segment.

Stamp duty reserve tax SDRT applies to electronic transfers of shares. Written transfers of existing share options. Remember tax rules can change and depend on your personal circumstances.

07012019 Stamp duty exemption on contract notes for sale and purchase transaction of shares of a medium and small capital company in Bursa Malaysia Securities Berhad executed from 1 March 2018 to 28 February 2021. Written options to buy or sell shares. Common Stamp Duty Remissions and Reliefs for Shares at a Glance.

Stamp duty payable RM925000 x RM300 RM1000 RM277500 APPENDIX 2A ABC SDN. The stamp duty payable is therefore calculated based on NTA value ie. Claiming Refunds Remissions Reliefs.

Except in rare circumstances it doesnt cover shares in foreign companies new shares issued when a. For example most option agreements and transfers of existing share option agreements are exempt from Stamp Duty. Stamp Duty Exemption under Section 36 of the Stamp Duties Act The following documents are exempt from stamp duty.

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Sme Corporation Malaysia Stamp Duty Rate

Sme Corporation Malaysia Stamp Duty Rate

Stamp Duty Exemption How To Save Money Property Investments Malaysia

Stamp Duty Valuation And Property Management Department Portal

Stamp Duty Valuation And Property Management Department Portal

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

Lock Stock Barrel Set Aside Sum For Stamp Duty

Lock Stock Barrel Set Aside Sum For Stamp Duty

Stamp Duty Malaysia 2021 Commonly Asked Questions Malaysia Housing Loan

Stamp Duty Malaysia 2021 Commonly Asked Questions Malaysia Housing Loan

Stamp Duties Michael Mccarthy Co Accountants

Stamp Duties Michael Mccarthy Co Accountants

Updates On Stamp Duty Malaysia For Year 2021 Malaysia Housing Loan

Updates On Stamp Duty Malaysia For Year 2021 Malaysia Housing Loan

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia Klse Screener

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Stamp Duty Exemption London Stock Exchange

Stamp Duty Exemption London Stock Exchange

Most Important Stamp Duty Exemptions For Holding And Subsidiary Companies

Most Important Stamp Duty Exemptions For Holding And Subsidiary Companies

Stamp Duty Malaysia 2021 Commonly Asked Questions Malaysia Housing Loan

Stamp Duty Malaysia 2021 Commonly Asked Questions Malaysia Housing Loan

Post a Comment for "What Shares Are Exempt From Stamp Duty"