Singapore Stamp Duty Shares Calculator

How to calculate Sellers Stamp Duty SSD for Residential Property. Property transfer lease share transfer mortgage etc Note.

Investing Making It Easier To Invest In Foreign Stocks The Edge Markets

Investing Making It Easier To Invest In Foreign Stocks The Edge Markets

Following the rules of SSD the higher amount which is 1000000 will be the amount that is used in the calculations of how much SSD is payable.

Singapore stamp duty shares calculator. A mortgage for share document is signed when you transfer your shares to the bank to obtain a loan. Subject to a maximum amount of SGD500. Fixed and Nominal Duties.

How to calculate stamp duty. Purchase Agreement Loan. You have to stamp the documents within 14 days after the documents are signed in Singapore.

Learn how to calculate stamp duty from a trusted source with PropertyGuru Finance and use our reliable calculator to get an accurate quote on how much you have to pay. Stamp Duty Basics for Shares. The Stamp Duty calculator API enables you to check the amount of stamp duty payable for the different document types eg.

04052021 This application is a service of the Singapore Government. Where multiple properties are acquired collectively stamp duty will be calculated on the total purchase price of the multiple properties if. When to stamp the document.

The purchases of the multiple properties are. 02 x NAV for the total share transferred. Calculation of Net Asset Value NAV of shares.

The base will be calculated based on the actual price or net asset value of the shares depending on whichever is higher. Mortgage documents for shares. IRAS requires the last available balance sheet of the company not more than 24 months old to be used for calculation of stamp duty payable.

MyTax Portal is a secured personalised portal for you to view and manage your tax transactions with IRAS at. The calculation for stamp duty differs between types of documents. 12102014 If the document has been executed outside Singapore within 30 days of the arrival of documents in Singapore.

However if the date of incorporation of the company is within last 18 months IRAS accepts the issue price of shares. 02 on the purchase price or net asset value NAV of the shares whichever is higher. 22012020 The market value of the property is at 920000 but you manage to sell it at 1000000.

Stamp Duty is fixed as they are governed by law. E-Stamping is a secured portal for you to view and manage your stamp duty transactions with IRAS at your convenience. 04 of the total rent for the period of the lease period is four years below or four times the Average Annual Rent if the lease period is more than four years When should you pay stamp duty.

You should stamp the document before signing the documents. For share transfer documents stamp duty is 02 of the purchase price or the value of the shares. 04 of the loan amount.

The stamp duty payable is therefore calculated based on par value ie. It may not provide for all possible scenarios. Transfer of shares in the target company that owns ordinary shares and preference shares where the companys net asset value is insufficient to pay off all the shares.

There is a single contract for the purchase of the multiple properties. Stamp Duty for Sale. The calculation formula for Legal Fee.

09052018 Transfer of share document. If you are a Singaporean you pay 1 for the first 180000 2 for the next 180000 3 for the next 640000 and 4 for the remaining amount. First determine your nationality and the total sum you will be paying for your property.

E-Stamping and Where to e-Stamp Documents. Please contact us for a quotation for services required. Who Should Pay Stamp Duty.

Stamp duty payable RM150000 x RM300 RM1000 RM45000 4. The stamp duty. 20122018 Stamp duty is calculated with reference to the higher of the actual price paid for the shares or the actual value of the shares at a rate of 02.

The calculator API provides only estimates based on the stated assumptions and your inputs. Verifying the Authenticity of Stamp Certificate. Stamp Duty for Variable Capital Companies.

02 x 1x 5000 4 x 5000 02 x 5000 20000 02 x 25000. Value of shares based on par value is the highest. This application is a service of the Singapore Government.

Depending on the type of property transaction you will encounter Buyers Stamp Duty BSD Sellers Stamp Duty SSD Additional Buyer Stamp Duty ABSD or stamp duty for rental properties. The buyer or transferee is required to pay stamp duty of 02 on the purchase price or net asset value NAV of the shares whichever is higher. The calculator will help you estimate your Property Tax payable based on the Annual Value of your property.

23032018 Calculation of Stamp Duty. You can calculate. 24112020 How is stamp duty calculated.

However you can stamp the documents after signing on these conditions. No stamp duty is payable for the transfer of scriptless shares as there is no transfer document executed. The actual value of the shares is calculated by first taking the net asset value of the company net assets less net liabilities as reflected in the latest annual accounts and dividing that by the total number of shares in issue.

The mortgagor is required to pay stamp duty on the loan amount.

Maybank Stock Brokerage Fees For Malaysian And Us Stocks Balkoni Hijau Blog

Maybank Stock Brokerage Fees For Malaysian And Us Stocks Balkoni Hijau Blog

Sdn Bhd Share Transfers Malaysia Business

Sdn Bhd Share Transfers Malaysia Business

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Property Stamp Duty The Ultimate Guide To Ssd Bsd And Absd

Property Stamp Duty The Ultimate Guide To Ssd Bsd And Absd

Maybank Stock Brokerage Fees For Malaysian And Us Stocks Balkoni Hijau Blog

Maybank Stock Brokerage Fees For Malaysian And Us Stocks Balkoni Hijau Blog

Charging Stations In Malaysia Electric Vehicle Charging Electric Cars Electricity

Charging Stations In Malaysia Electric Vehicle Charging Electric Cars Electricity

Property Stamp Duty The Ultimate Guide To Ssd Bsd And Absd

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Stamp Duty For Shares Singapore Experienced Tax Advisers Singapore

Stamp Duty For Shares Singapore Experienced Tax Advisers Singapore

Preference Shares For Singapore Company Setup Singapore Business

Preference Shares For Singapore Company Setup Singapore Business

Guide To Transferring Shares In A Singapore Private Company Singaporelegaladvice Com

Guide To Transferring Shares In A Singapore Private Company Singaporelegaladvice Com

Https Www Iras Gov Sg Irashome Uploadedfiles Irashome E Services Other Taxes Faqs 20on 20shares Pdf

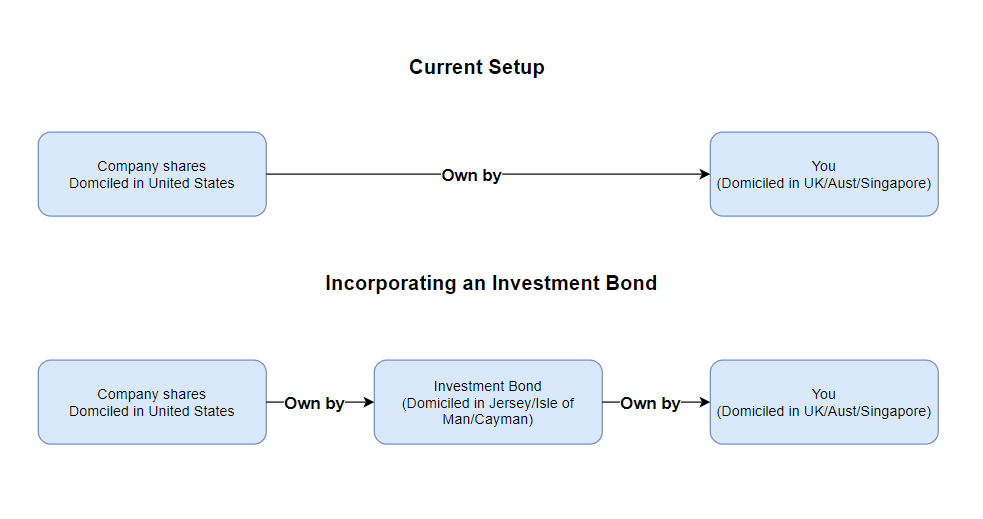

4 Potential Ways To Estate Tax Proof Your Investments Investment Moats

4 Potential Ways To Estate Tax Proof Your Investments Investment Moats

Form E4a Shares Home Iras E4a Commissioner Of Stamp Duties 55 Newton Road Revenue House Listed On The Stock Exchange Of Singapore Microsoft Word Form E4a

Form E4a Shares Home Iras E4a Commissioner Of Stamp Duties 55 Newton Road Revenue House Listed On The Stock Exchange Of Singapore Microsoft Word Form E4a

How Stamp Duty Applies When Buying A Singapore Company Singaporelegaladvice Com

How Stamp Duty Applies When Buying A Singapore Company Singaporelegaladvice Com

Https Www Iras Gov Sg Irashome Uploadedfiles Irashome Other Taxes 2004 Sd 3 Pdf

Form E4a Shares Home Iras E4a Commissioner Of Stamp Duties 55 Newton Road Revenue House Listed On The Stock Exchange Of Singapore Microsoft Word Form E4a

Form E4a Shares Home Iras E4a Commissioner Of Stamp Duties 55 Newton Road Revenue House Listed On The Stock Exchange Of Singapore Microsoft Word Form E4a

Post a Comment for "Singapore Stamp Duty Shares Calculator"