Is Stamp Duty Allowable For Cgt

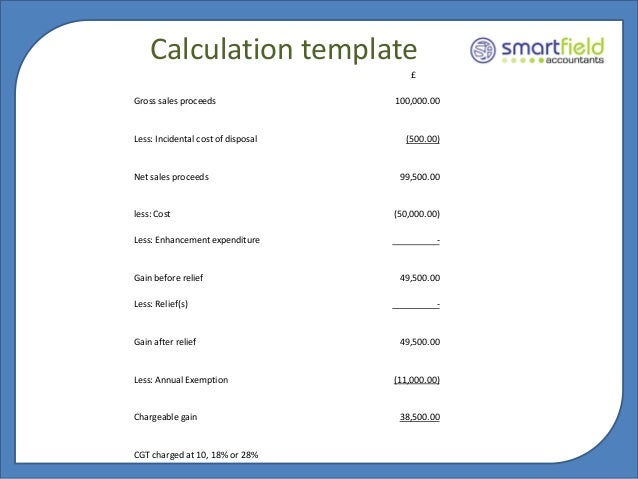

I assume that stockbrokers commission is an agents fee but is stamp duty allowable as an expense. Your total taxable gain or net profit is.

Ultimate Guide To Capital Gains Tax Rates In The Uk

Ultimate Guide To Capital Gains Tax Rates In The Uk

CGT on house sale - allowable deductions Post by djtjuk.

Is stamp duty allowable for cgt. 300000 - 12300 287700. We are assuming the legal fees on the lease are not allowable. If your chargeable gain is less than this you will not have to pay any CGT.

Your main residence your home as defined by the Australian Taxation Office is generally exempt from CGT. Wed Dec 12 2018 836 pm Ok thanks the only thing that is a little unclear is what constitutes the professional services of any surveyor or valuer or auctioneer or accountant or agent or legal adviser and costs of transfer or conveyance including stamp duty. If the property was acquired as a gift there may not be any purchase costs.

It is a common misconception that claiming capital allowances for plant and machinery will reduce the CGT base cost of an asset and hence increase any gain. The final thing we have to do to calculate Kates taxable gain is deduct her annual capital gains tax exemption. When you calculate capital gains tax you need to calculate the tax based on the final sale or market value.

Until 30 September 2021 no stamp duty will be charged on a residential property bought for. 31032010 Bear in mind that any capital gains will be included when working out your tax status for the year and may push you into a higher bracket. Stamp duty land tax SDLT in England and Northern Ireland land and buildings transaction tax LBTT in Scotland and land transaction tax LTT in Wales.

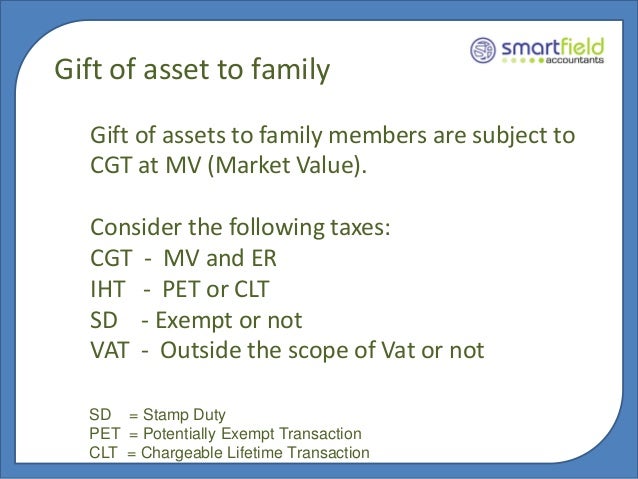

In 2021-22 you can make tax-free capital gains of up to 12300 - the same as 2020-21. On 1 July 2015 Kris bought a block of land for 240000 including legal fees stamp duty and related expenses. Disposals are not limited to sales of assets a gift of an asset counts as a disposal and will be liable to CGT if a gain is made.

There are other rates for specific types of gains. During the five years he owned the block he paid 25000 for rates land tax and interest. 15042007 The Revenue CGT leaflet mentions costs of aquisition and disposal as allowable expenses but doesnt really say what isisnt allowed.

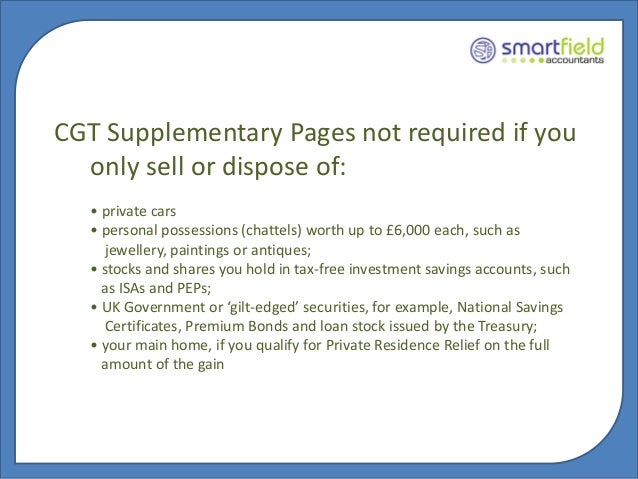

Taxable gain 44000 - 11300 32700. Fees for the cost of abortive purchases are not allowable for CGT nor are mortgage arrangement or financing fees. C The costs reasonably incurred in making any valuation or apportionment required for the purpose of computing the chargeable gain or allowable loss.

In general terms Capital Gains Tax CGT is charged on the value of the capital gain made on the disposal of an asset. The net gain calculated after deducting these allowable costs is often known as the chargeable gain. Is the annual charge allowable for corporation tax.

This covers the majority of houses and flats in the UK. If you are purchasing land or property stamp duty land tax may be payable. If a disposal by.

If you sold the property for cheaper than its market value eg. 8 regarding the costs of appeals on questions of market value. As he did not use the land to generate any income he could not claim a deduction for any of these expenses.

If your total taxable gains are under the Capital Gains Tax allowance then you dont need to report them to HMRC or pay CGT. No other expenditure is allowable unless specifically provided for by TCGA92 see for example TCGA92s143 6 see CG56084. Your taxable gains after your allowance is.

29052016 So what does s38 TCGA 1992 say. CGT was introduced in 1975 following the publication in 1974 of the White Paper on. 04112009 We are writing off stamp duty over the period of the lease five years.

19032018 Offsetting stamp duty against capital gains tax. Net Gain - 44000. Fundamentally CGT is a tax you pay on the profit made from the sale of a property.

All taxpayers have an annual CGT allowance meaning they can earn a certain amount tax-free. You can offset any stamp duty you paid originally for your property against the final value for the purposes of capital gains tax. 09042021 stamp taxes namely.

25022021 If you are an individual you have a personal exemption of 1270 each year. The rate of CGT is 33 for most gains. Stamp duty land tax can apply to both freehold and leasehold purchases.

Athe amount or value of the consideration in money or moneys worth given by him or on his behalf wholly and. He sold it on 30 June 2020. 07042021 These will include legal fees stamp duty land tax SDLT surveyors and valuers fees and irrecoverable VAT.

20012020 The good news for property investors is that as stamp duty forms a part of your cost base it can reduce the CGT liability when you sell the property. 40 for gains from foreign life policies and foreign investment products. 03032021 Consequently until 30 June 2021 no stamp duty will be charged on a residential property bought for up to 500000.

1Except as otherwise expressly provided the sums allowable as a deduction from the consideration in the computation of the gain accruing to a person on the disposal of an asset shall be restricted to. The definition is exhaustive. B The costs of transfer or conveyance including Stamp Duty and the cost of advertising to find a seller or buyer.

Stamp duty is not payable on transactions with a total value of 1000 or less but stamp duty reserve tax is.

Capital Gains Tax Australia Property Investment Uk Property Investment Csi Prop

Capital Gains Tax Australia Property Investment Uk Property Investment Csi Prop

Tax Lecture 3 Capital Gains Tax See Chapters

Tax Lecture 3 Capital Gains Tax See Chapters

Welcome To The Professional Accountants In Brighton London Hove Capital Gains Tax Capital Gain Tax Advisor

Welcome To The Professional Accountants In Brighton London Hove Capital Gains Tax Capital Gain Tax Advisor

Section 40 A Ia 2 Blows To Special Bench Merilyn Shipping Decision Http Taxworry Com Section 40aia 2 Blows Special Ben Decisions Capital Gains Tax Taxact

Section 40 A Ia 2 Blows To Special Bench Merilyn Shipping Decision Http Taxworry Com Section 40aia 2 Blows Special Ben Decisions Capital Gains Tax Taxact

Tax Lecture 3 Capital Gains Tax See Chapters

Tax Lecture 3 Capital Gains Tax See Chapters

Tax Lecture 3 Capital Gains Tax See Chapters

Tax Lecture 3 Capital Gains Tax See Chapters

Why Freelancers From India Working For Foreign Clients Online May Not Be Liable For Service Tax Taxworry Com Tax Service Capital Gains Tax

Why Freelancers From India Working For Foreign Clients Online May Not Be Liable For Service Tax Taxworry Com Tax Service Capital Gains Tax

Tax Lecture 3 Capital Gains Tax See Chapters

Tax Lecture 3 Capital Gains Tax See Chapters

Tax Lecture 3 Capital Gains Tax See Chapters

Tax Lecture 3 Capital Gains Tax See Chapters

Tax Lecture 3 Capital Gains Tax See Chapters

Tax Lecture 3 Capital Gains Tax See Chapters

Tax Lecture 3 Capital Gains Tax See Chapters

With Accountants Brighton As Your Appointed Tax Advisers Brighton We Can Help Reduce Your Income T Mortgage Interest Rates Home Mortgage Current Mortgage Rates

With Accountants Brighton As Your Appointed Tax Advisers Brighton We Can Help Reduce Your Income T Mortgage Interest Rates Home Mortgage Current Mortgage Rates

Call Brighton Accountant Tax Consultants Accountants Hove For Your Tax Needs Tax Planning And Reducing Tax Bill Capital Gains Tax Tax Advisor Capital Gain

Call Brighton Accountant Tax Consultants Accountants Hove For Your Tax Needs Tax Planning And Reducing Tax Bill Capital Gains Tax Tax Advisor Capital Gain

Brighton Accountant As Your Appointed Tax Advisers We Can Help Reduce Your Income Tax Ensuring All Allowable Expense Capital Gains Tax Tax Advisor Business Tax

Brighton Accountant As Your Appointed Tax Advisers We Can Help Reduce Your Income Tax Ensuring All Allowable Expense Capital Gains Tax Tax Advisor Business Tax

Post a Comment for "Is Stamp Duty Allowable For Cgt"