Does The Current Stamp Duty Exemption Apply To Second Homes

08072020 Reduced rates of Stamp Duty Land Tax SDLT will apply for residential properties purchased from 8 July 2020 until 30 June 2021 and from 1 July 2021 to. Landlords and those purchasing additional dwellings still get the tax cut but.

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Can You Avoid Paying Stamp Duty On A Second Home Metro News

From 1 October 2021 youll pay no Stamp Duty on properties costing up to 125000 unless youre a first-time buyer.

Does the current stamp duty exemption apply to second homes. But second home buyers currently benefit from stamp duty relief as well. To qualify for this relief you must be related to the person transferring the land and do. You purchase a property valued under 40000 or the share of the property you buy is valued under 40000 You buy a caravan mobile home or house boat Even if youre not exempt from paying Stamp Duty on a second property you can sometimes claim back the Stamp Duty surcharge.

Thats because youll only own one property. 01042021 If you dont own any property but decide to purchase a buy-to-let property then you wont pay the stamp duty for second homes. But you will pay if you have a part-share in another property have inherited a property or are buying with someone else who already owns a property.

Purchases of caravans mobile homes or houseboats are also exempt. Relief on farmland transfers within a family. 18112020 Some second-home purchases are exempt from stamp duty altogether however.

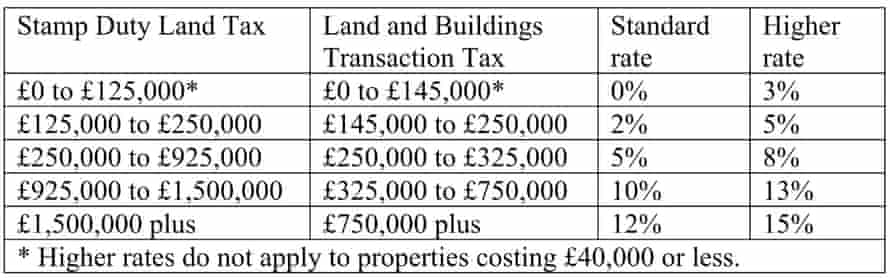

19042021 The new scheme will be available to anyone buying a home costing up to 600000 unless they are buy-to-let second homes or in some cases new-builds. The main driving force behind the change was to stimulate the housing market following the coronavirus pandemic. Stamp Duty on second homes If youre buying an additional property such as a second home youll have to pay an extra 3 in Stamp Duty on top of the revised rates for each band up until 30 June 2021.

The government has said that nearly nine out of ten people. 04032021 Buy-to-let landlords and second home buyers are eligible for the tax cut but must pay an additional three per cent tax. 08072020 The tax holiday will apply from July 8 2020 until March 31 2021 and cut the payments due for everyone who would have paid stamp duty.

However the pre-existing 3 surcharge on such purchases will still apply. 11122020 Youre only exempt from the Stamp Duty on a second home if. 01102020 The good news is that yes the stamp duty holiday does apply to second homes.

All property buyers benefit from the tax break announced by Chancellor Rishi. However you may be eligible for the ABSD refund if you dispose of your interest in the house that is co-owned with your mother within 6 months from the date of purchaseTOPCSC whichever is applicable of your matrimonial home. The matrimonial home will be your second property and therefore both of you will have to pay ABSD at 12 even though it will be your spouses first property.

02032021 If youre buying a second property or a property on a buy-to-let basis you will still benefit from the increased 500000 threshold however you will still have to pay the Stamp Duty. If the value of your second home or the share of the property you buy is less than 40000 you dont need to pay the tax. Dailymotion Video Player - Rishi Sunak says 500000 stamp duty threshold.

This starts at 3 and then rises in bands climbing to 15 for the most expensive properties. 13072020 Does stamp duty holiday apply to a second home. 18032021 Under the current stamp duty holiday buyers are exempt from paying stamp duty on residential property worth up to 500000 rather than 125000.

Yes the stamp duty holiday applies when purchasing a second home. 04032021 Buy-to-let landlords and second home buyers are eligible for the tax cut. You can apply for a refund if you sell your previous main home within 36 months.

A special consanguinity relief is available when transferring farmland between certain family members. 22032021 Second home buyers and buy-to-let investors could potentially save thousands of pounds due to the stamp duty holiday. Property investors who purchase through limited companies will also be exempt up to 500000.

05052015 This is because you own 2 properties. 09072020 But this does not just apply to homeowners. Those purchasing second homes or buy-to-let properties also benefit from the stamp duty holiday.

18102019 While the above transactions are in general exempt from stamp duty the exemption does not apply if any other person is a party to the instrument. The same rates apply to those buying second. 24022021 When you buy any property in addition to your main residence be it a second home a holiday home or a buy-to-let there is an additional stamp duty charge.

However they still have to pay the additional three per cent rate that has always been in place for second home.

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Does The Stamp Duty Holiday Apply To Second Homes Mywallethero

Does The Stamp Duty Holiday Apply To Second Homes Mywallethero

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

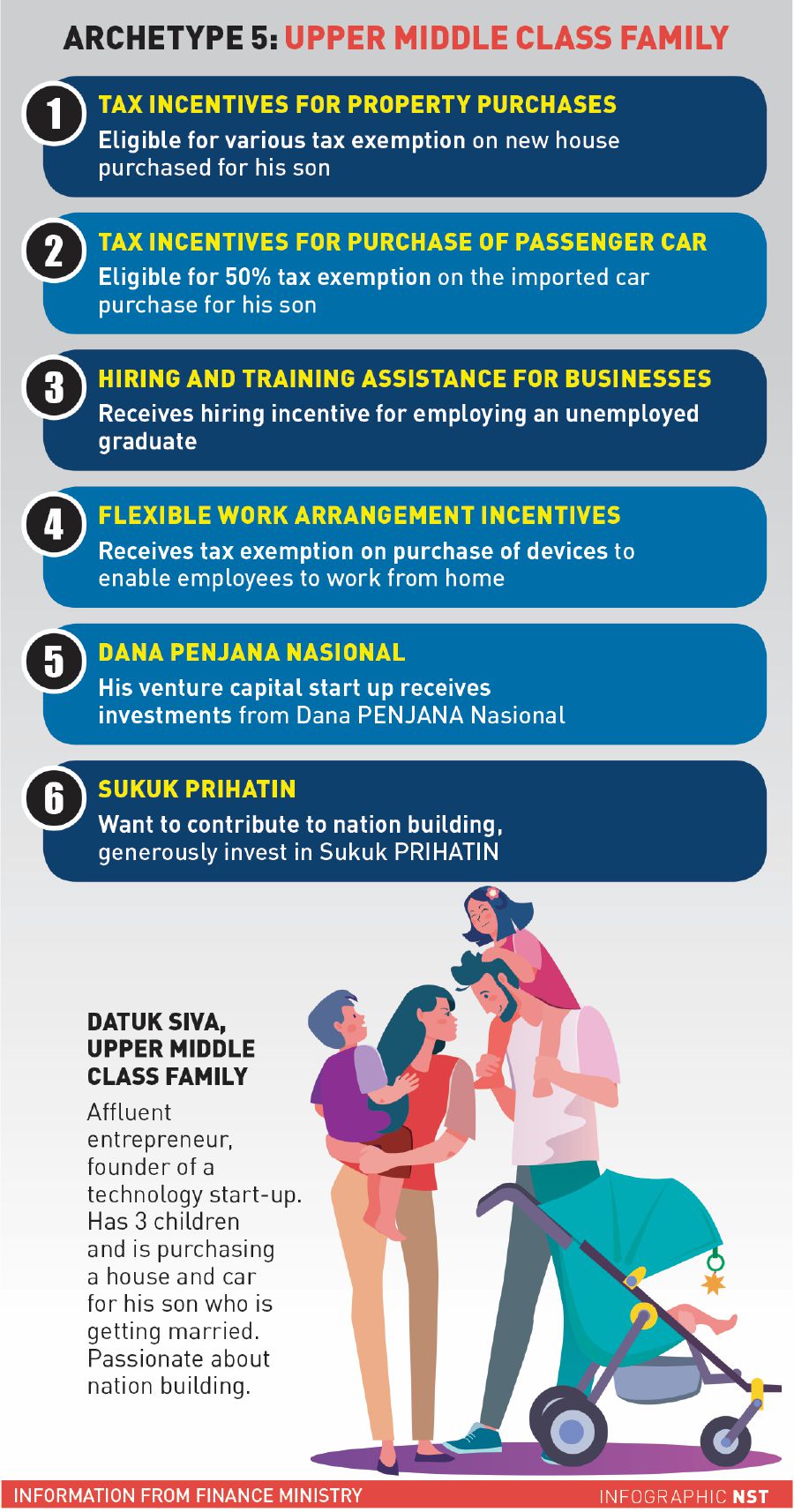

Penjana Economic Package New Property Incentives In 2020 Donovan Ho

Penjana Economic Package New Property Incentives In 2020 Donovan Ho

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Does The Stamp Duty Holiday Apply For A Second Home Or Buy To Let Property How The Tax Break Extension Works

Does The Stamp Duty Holiday Apply For A Second Home Or Buy To Let Property How The Tax Break Extension Works

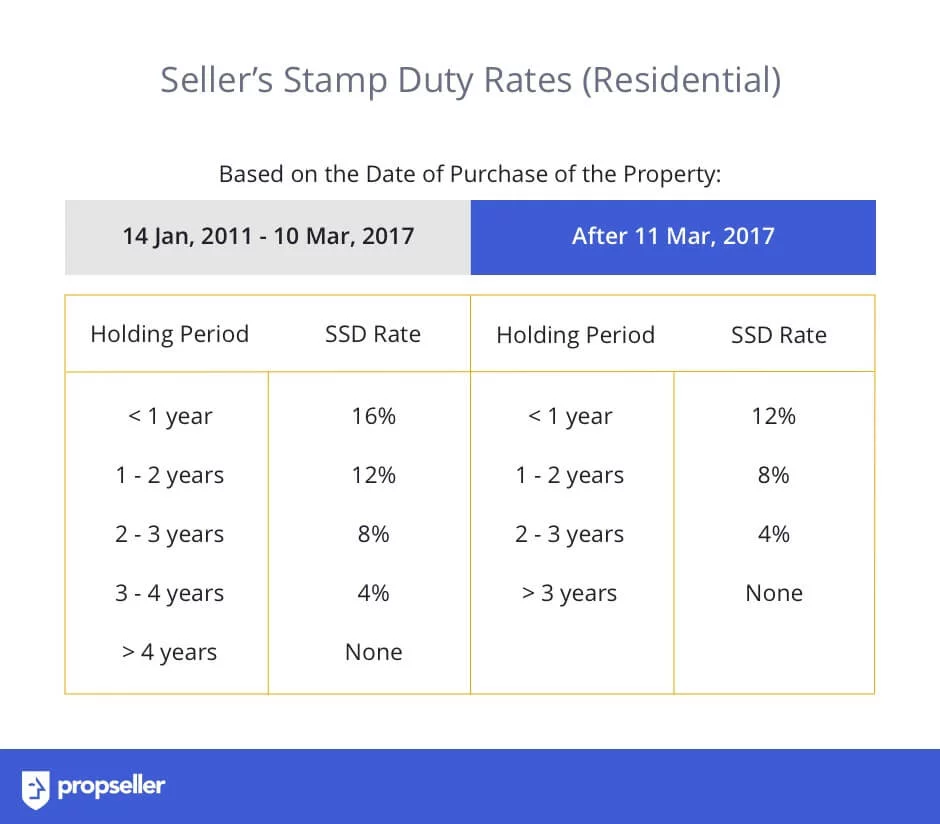

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Home Ownership Campaign Hoc 2020 Projects The Pros And Cons Propertyguru Malaysia

Home Ownership Campaign Hoc 2020 Projects The Pros And Cons Propertyguru Malaysia

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Cover Story Secondary Market Seeing More Interest The Edge Markets

Cover Story Secondary Market Seeing More Interest The Edge Markets

Rpgt Stamp Duty Exempted Will You Buy Or Sell Your House

Rpgt Stamp Duty Exempted Will You Buy Or Sell Your House

Does The 3 Stamp Duty For Second Properties Apply In Scotland Money The Guardian

Does The 3 Stamp Duty For Second Properties Apply In Scotland Money The Guardian

Transfer Of Property Between Family Members In Malaysia 2020 Love And Affection Property Transfer Malaysia Housing Loan

Transfer Of Property Between Family Members In Malaysia 2020 Love And Affection Property Transfer Malaysia Housing Loan

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Post a Comment for "Does The Current Stamp Duty Exemption Apply To Second Homes"