What Is The Stamp Duty Rate In Ireland

There are currently two main reduced rates of VAT. Written leases of land and buildings situated in Ireland.

What Is Stamp Duty In Hong Kong And How Much Is It Zegal

What Is Stamp Duty In Hong Kong And How Much Is It Zegal

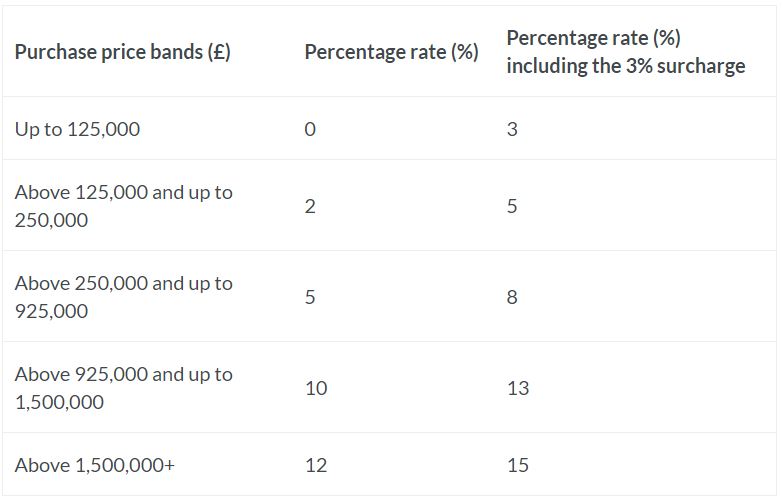

The increase in stamp duty means that for an additional property the top rate of SDLT will now be 17.

What is the stamp duty rate in ireland. Exchange partition release or surrender property. However the heading Other Stamp Duty covers electronic share trading CREST Stamp Duty on financial cards and Stamp Duty levies. The stamp duty rate on the purchase of non-residential property in 2021 is 75.

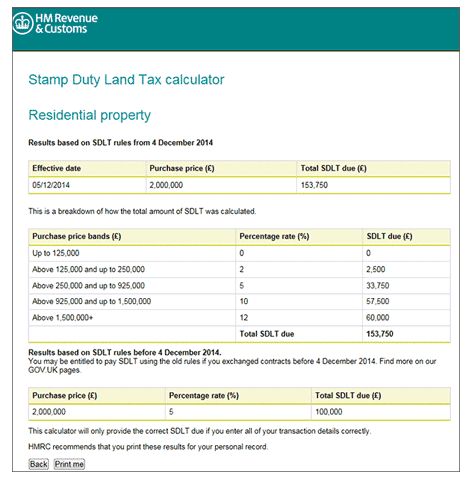

Stamp Duty is chargeable on instruments that transfer land and buildings situated in Ireland. 08072020 Rather than ending on 31 March 2021 the temporary nil rate band of 500000 will be in place until 30 June 2021. Residential for example houses and apartments.

04062010 The rate was 2 until the budget announced in October 2017 which saw an increase in stamp duty on commercial property increasing to 6. Buy or receive a gift of property. Stamp Duty This section deals with Stamp Duty on instruments written documents.

17062000 The arrangements apply to house purchases where contracts were signed before June 15th. It increased from 6 to 75 in 10 October 2019. A lease made at a later date for an agreement already stamped any other lease relating to Irish land and buildings or a right or interest in Irish land and buildings.

For properties valued over 1 million the rate of 10 applies to the first 1 million and a rate of 20 applies to the balance. 10072020 Property value SDLT rate Up to 500000 3. From April 2021 someone living overseas could pay an additional 2 percent in stamp duty if they purchase a property in England or Northern Ireland.

07012021 Stamp Duty is a tax on certain instruments written documents. Stamp duty 2020 From October 2019 the stamp duty rate on non-residential is 75 this rate applies to instruments written documents executed on or after 9 October 2019. 27042021 The Chancellors stamp duty changes came into effect for both England and Northern Ireland last year.

Clawback of stamp duty relief. Further information about Farm Consolidation Relief is available on revenueie. This relief is due to expire on 31 December 2022.

The 9 per cent stamp duty rate applies to all purchases by investors of new and second-hand residential. He extended the initial holiday limit from 125000 by. The following rates.

The surcharge will apply to anyone who is non-UK resident including British expats based overseas. Stamp Duty is also chargeable on the following instruments. This stamp duty is collected in arrears.

Sadly Wales doesnt offer first-time buyers stamp duty relief. 06022021 More information on conveyancing and legal costs when buying a house in Ireland Stamp duty on non-residential property. Then from 1 July 2021 to 30 September 2021 the nil rate.

If you havent owned a property before and are buying in England or Northern Ireland theres no Stamp Duty on properties worth up to 300000. 11032021 VAT is charged at the standard rate of 23 temporarily reduced to 21 which is expected to end on 28 February 2021 on the supply of the majority of goods and services in the course or furtherance of business. 07012021 You pay Stamp Duty when you.

The next 575000 the portion from 925001 to 15 million 10. 30032020 Since 1 January 2016 a government stamp duty of 12 cent applies to ATM withdrawals this is in addition to any charge from your bank. Stamp duty on residential property For properties valued up to 1 million the new rate is 10 of the full value.

07012021 You pay a fixed Stamp Duty of 1250 for each of the following. In Scotland the amount is 175000. The next 425000 the portion from 500001 to 925000 5.

This is capped at 250 for ATM cards and 5 for combined ATM and debit cards. You also pay Stamp Duty on certain written agreements or contracts to transfer property situated in Ireland. Such instruments are usually called Deeds of Transfer or Deeds of Conveyance.

18102019 It provides for a stamp duty rate of 1 on these transactions.

The Stamp Duty Paid Mark That Appeared On British Cheques From 1956 To 1971 When The Tax On Cheques Was Cancelled 5 British Stamp Duty Stamp Mortgage Advice

The Stamp Duty Paid Mark That Appeared On British Cheques From 1956 To 1971 When The Tax On Cheques Was Cancelled 5 British Stamp Duty Stamp Mortgage Advice

Gov Uk On Twitter The Stamp Duty Holiday Extension Applies For Residential Properties Purchased From 8 July 2020 Until 30 June 2021 And From 1 July 2021 To 30 September 2021 If You Re

Gov Uk On Twitter The Stamp Duty Holiday Extension Applies For Residential Properties Purchased From 8 July 2020 Until 30 June 2021 And From 1 July 2021 To 30 September 2021 If You Re

.webp) Sdlt Stamp Duty Calculator Uk Calculate Stamp Duty Land Tax

Sdlt Stamp Duty Calculator Uk Calculate Stamp Duty Land Tax

Calculate Online Stamp Duty Land Tax For Your Uk Commercial Or Residential Property Save On Stamp Duty Via Our Stamp Duty Mitigation Cool Stuff My Style Style

Calculate Online Stamp Duty Land Tax For Your Uk Commercial Or Residential Property Save On Stamp Duty Via Our Stamp Duty Mitigation Cool Stuff My Style Style

Foreigners Rush To Save Thousands In Uk Stamp Duty Hike Australia Property Investment Uk Property Investment Csi Prop

Foreigners Rush To Save Thousands In Uk Stamp Duty Hike Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty High Res Stock Images Shutterstock

Stamp Duty High Res Stock Images Shutterstock

Collecters Item Kinmen Kai Character On Taiwan 50c Sys Bridge Stamp Dutyrevenue Tax Used Stamp Duty Character Taiwan

Collecters Item Kinmen Kai Character On Taiwan 50c Sys Bridge Stamp Dutyrevenue Tax Used Stamp Duty Character Taiwan

Guide For Landlords On Stamp Duty Changes Cpc Commercial Finance

Guide For Landlords On Stamp Duty Changes Cpc Commercial Finance

Insight Stamp Duty Land Tax For Uk Property Next Steps

Insight Stamp Duty Land Tax For Uk Property Next Steps

Pdf Property Transfer Tax And Stamp Duty

Pdf Property Transfer Tax And Stamp Duty

Stamp Duty Rate Calculator Property Land Tax Calculator

Stamp Duty Rate Calculator Property Land Tax Calculator

Why Wait Move In Today Near Kalyan Shilphata Road No Emis For First 12 Months City Alava Students Day

Why Wait Move In Today Near Kalyan Shilphata Road No Emis For First 12 Months City Alava Students Day

Stamp Duty In Madhya Pradesh Madhya Pradesh Reduces Cess On Stamp Duty To 1 For Property Registration Real Estate News Et Realestate

Stamp Duty In Madhya Pradesh Madhya Pradesh Reduces Cess On Stamp Duty To 1 For Property Registration Real Estate News Et Realestate

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate And Construction Malaysia

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate And Construction Malaysia

Stamp Duty Holiday The Winners And The Losers Bbc News

Stamp Duty Holiday The Winners And The Losers Bbc News

Stamp Duty Revamp What You Need To Know Tax United States

Stamp Duty Revamp What You Need To Know Tax United States

Post a Comment for "What Is The Stamp Duty Rate In Ireland"