Stamp Duty On Transfer Of Shares In India

Shares are moveable property Section 44 of the Companies. 21102020 Rate of stamp duty.

Sag Rta Profitable Rta Service Provider Company In Rajasthan Communication Methods Rta Investment Companies

Sag Rta Profitable Rta Service Provider Company In Rajasthan Communication Methods Rta Investment Companies

Article 62 a of the Indian Stamp Act 1899.

Stamp duty on transfer of shares in india. Transfer of unlisted shares in physical form was subject to stamp duty at a uniform rate of 0. 12082016 There is no stamp duty on transfer of shares or debentures in a depository scheme. The stamp duty payable of transfer of shares in physical form shall be 0015 of the total market value of the shares.

12122019 The new stamp duty for equity delivery trades would be only on the buy-side of the transaction at 0015 per cent or Rs 1500 per crore. According to the Companies Act 2013 stamp duty is to be paid for any transaction that involves a transfer deed whether for the. The Supreme Court in the case of Brooke Bond India Ltd5 and Punjab State Industries Development Corpn.

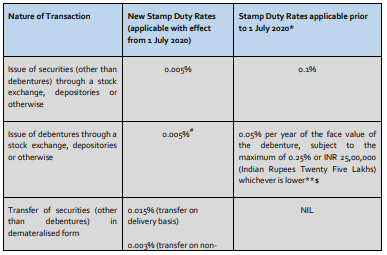

STAMP DUTY PAYABLE ON ISSUE TRANSFER OF OTHER SECURITIES. 03042019 Stamp Duty on Transfer of Shares is the tax which is levied by the government on transfer or exchange of financial securities. Transfer of debentures including re-issue of the same will be liable to stamp duty 00001.

The Central Government has also notified Clearing Corporation of India Limited and the registrars to issue and or share transfer agents to act as collecting agents. 27072020 The official share transfer rate is 25 Paise for every 100 rupees of the share value or part thereof. Section 21 of the Indian Stamp Act states that where an instrument is chargeable ad valorem duty in respect of any stock such duty has to calculate the value of such stock to the average of the value of such stock of such an instrument.

It may be noted that in case the shares issued or transferred by the Company or shareholders up to the date of 30th June 2020 the stamp duty shall continue to be paid by existing stamp duty structure as prescribed by the respective State. The stamp-duty on sale of securities transfer of securities and issue of securities shall be collected on behalf of the State Government by the Stock Exchange or Clearing Corporation authorized or Depositories authorized collecting agents. The rate of stamp duty is 0005 issue of share certificates or 0015 transfer of shares as the case may be.

Should not forget to cancel the stamps that were issued at. Stamp Duty on Transfer of Shares under Indian Stamp Act o The Government of India Ministry of Finance Department of Revenue has fixed the stamp duty on transfer of shares at the rate of twenty-five paise Re. 20082012 In the case of transfer of shares of a company it is the seller who is responsible for payment of stamp duty Union of India vs.

Ltd6 while dealing with the stamp dutiesfees paid for increase in authorised capital of the. The Central Government has also notified the Clearing Corporation of India Limited CCIL and the Registrars. 05062018 Under the Companies Act 1956 stamp duty is payable when a transfer deed is executed for transfer of shares which is done using Form 7-B.

09012020 Issue of debentures will be liable for payment of ad valorem stamp duty 0005. 025 for every hundred rupees Rs. It is levied by the Central Government in accordance with The Indian Stamp Act 1899.

The payment of stamp duty can be relating to various transactions which can be capital or revenue in nature depending upon the facts of each case. Currently it is charged on both buy and sell trades. 25 of the value of shares vide Article 62 of Schedule I of the ISA across all states in India.

The cost of transferring shares from one account to another including off-market trades is set to go up from next year. 28092020 Revised Stamp Rates. Prior to the introduction of the Amended Stamp Act stamp duty was payable at a flat rate of 025 of the consideration on a transfer of sharesThere was no stamp duty prescribed on the issue of shares apart from the share certificate issued to the shareholder.

Market Value means Price consideration mentioned in the particular instrument ie. 100 or part thereof of the value of the shares. 22032021 Transfer of Securities in Physical mode.

15072020 The stamp duty on sale transfer and issue of securities will be collected on behalf of the state government by the Stock Exchange or Clearing Corporation authorized or depositories. 01072020 The amendment in the Indian Stamp Act 1899 which casts an obligation on stock exchanges depositories and authorised clearing corporation to collect stamp duty on transfer of securities like equity shares debentures and mutual fund units comes into effect from July 1. The transferee is not liable for stamp duty simply because an instrument of transfer of shares is required to be executed both by the transferor and transferee.

The Amended Stamp Act specifies the following rates of stamp duty for different.

All Information About Form Pas 6 Public Company Informative Company Secretary

All Information About Form Pas 6 Public Company Informative Company Secretary

What Is The Need Process And Benefits Of Preferential Allotment Of Shares Allotment Fundraising Methods Benefit

What Is The Need Process And Benefits Of Preferential Allotment Of Shares Allotment Fundraising Methods Benefit

Indirect Tax Indirect Tax Tax Custom

Indirect Tax Indirect Tax Tax Custom

Share Transfer Procedure In A Private Limited Company Private Limited Company Limited Company Secretarial Services

Share Transfer Procedure In A Private Limited Company Private Limited Company Limited Company Secretarial Services

Sag Rta Sebi Authorized Registrar And Share Transfer Agent Tax Software Rta Financial Services

Sag Rta Sebi Authorized Registrar And Share Transfer Agent Tax Software Rta Financial Services

Find Out Importance Of Demat Account For Shareholders Physics Accounting System

Find Out Importance Of Demat Account For Shareholders Physics Accounting System

Let S Find Out What Is Allotment Of Shares Offer And Acceptance Allotment Shared

Let S Find Out What Is Allotment Of Shares Offer And Acceptance Allotment Shared

Sag Rta Sebi Authorized Registrar And Share Transfer Agent Company Rta Transfer Informative

Sag Rta Sebi Authorized Registrar And Share Transfer Agent Company Rta Transfer Informative

Sag Rta Best Registrar Transfer Agent Services Provider Transfer Provider Rta

Sag Rta Best Registrar Transfer Agent Services Provider Transfer Provider Rta

Stamp Duty On Transfer Of Shares Statewise In India Chart

Stamp Duty On Transfer Of Shares Statewise In India Chart

Sag Rta Profitable Rta Service Provider Company In Rajasthan Communication Methods Rta Finance

Sag Rta Profitable Rta Service Provider Company In Rajasthan Communication Methods Rta Finance

Indirect Tax Indirect Tax Tax Custom

Indirect Tax Indirect Tax Tax Custom

Procedure For Pvt Ltd Company Registration In India Corpbiz Private Limited Company Company Starting A Business

Procedure For Pvt Ltd Company Registration In India Corpbiz Private Limited Company Company Starting A Business

What Are The Key Differences Between Transfer Transmission Of Shares Transmission Transfer How To Find Out

What Are The Key Differences Between Transfer Transmission Of Shares Transmission Transfer How To Find Out

Stamp Duty On Issuance And Transfer Of Shares Ipleaders

Importance Of Registrar And Transfer Agent Transfer Security Certificate Rta

Importance Of Registrar And Transfer Agent Transfer Security Certificate Rta

Post a Comment for "Stamp Duty On Transfer Of Shares In India"