Stamp Duty In Malaysia 2019

If it is not stamped within the period stipulated a penalty of. Calculation of legal fees is governed by Solicitors Remuneration Amendment Order 2017 and calculation of stamp duties is governed by Stamp Act 1949.

Property Tax Malaysia Www Peps Org My

Property Tax Malaysia Www Peps Org My

How To Calculate Stamp Duty Malaysia in 2020.

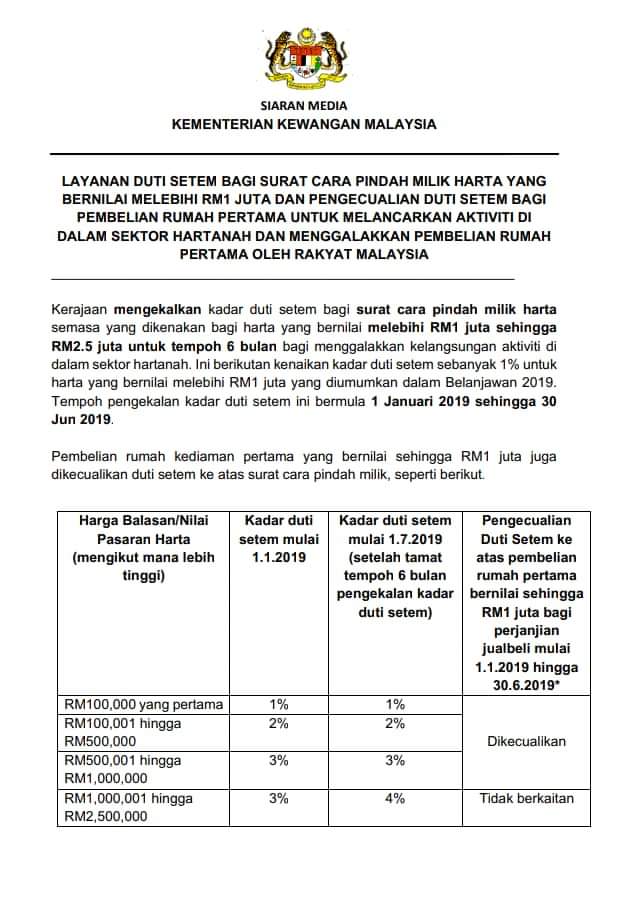

Stamp duty in malaysia 2019. The stamp duty shall only apply for sale and purchase agreement executed from 1 July 2019 to 31 December 2020 by an eligible Malaysian citizen. Maximize your returns and minimize costsrisks when selling property in Malaysia. In 2019 the government announced a stamp duty hike for properties costing more than RM1 million where the rate was increased from 3 to 4 refer to the table below.

Fixed Duty Duty. 01012019 The stamp duty exemptions are applicable for the purchase of residential units for Sale. Ad Valorem Duty is the rate of duty varies according to the nature of the instruments and the consideration stipulated in the instruments or the market value of the property.

Stamp Duty Waiver For First-Time House Buyer. 25092018 STAMPS is an Electronic Stamp Duty Assessment and Payment System via internet. Legal Fee and Stamp Duty Calculator.

19032013 PENALTY STAMP DUTY An instrument may be stamped within 30 days of its execution if executed within Malaysia or within 30 days after it has been first received in Malaysia if it has been executed outside Malaysia. Purchase Agreement executed between 1 January 2019 to 31 December 2019. In general term stamp duty will be imposed to legal commercial and financial instruments.

Who is required to use STAMPS. Learn about Malaysias property stamp duty and Real Property Gains Tax RPGT in 2019. There are two types of duty Ad Valorem Duty and Fixed Duty.

UPDATES ON STAMP DUTY MALAYSIA FOR YEAR 2020 - Malaysia Housing Loan 2020. 31012019 PETALING JAYA Jan 31. There are two types of Stamp.

Please contact us for a detailed quotation as the following tables exclude any taxes disbursements and reimbursement charges. 08112018 Stamp Duty increase and exemption Malaysias 2019 Budget will see an increase in stamp duties to 4 from 3 for transfer of real properties that are RM1 million and higher. 20042021 The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949.

In Budget 2020 it was proposed that the stamp duty remission of 50 given on the instrument of real property transferred between parents and children by way of love and affection be given to Malaysian citizens only previously Malaysian citizens and non-citizens were eligible see Special Tax Alert. Previously the relief was limited to RM6000 in YA 2018. To legislate the above proposal the Stamp Duty.

06022020 It provides for stamp duty remission of RM5000 on the instrument of transfer executed for the purchase of first residential property more than RM300000 but not exceeding RM500000. Franking Machine and Revenue Stamp will be replaced by receiptstamp certificate which generate by STAMPS. The Inland Revenue Board of Malaysia IRBM has issued two technical guidelines in Bahasa Malaysia only on 26 February 2019 to provide guidance in the application of stamp duty relief under Section 15 and Section 15A of the Stamp Act 1949.

This method will replace the manual system in LHDNM s counter which use Franking Machine and Revenue Stamp. 10112020 The sale or transfer of properties in Malaysia which are chargeable with stamp duty must be stamped within 30 days from the date of the execution property transaction. Previously life insurance and EPF contribution was a combined relief of RM6000 in YA 2018.

Stamp duty on foreign currency loan agreements is generally capped at RM2000. 07012019 Ringgit Malaysia loan agreements generally attract stamp duty at 05 However a reduced stamp duty liability of 01 is available for RM loan agreements or RM loan instruments without security and repayable on demand or in single bullet repayment. I remember the stamp duty exemption Malaysia 2018 is not as complicated as stamp duty exemption Malaysia 2019.

RPGTRPGT Calculation Chargeable Gain Disposal Price. 04012019 How will the recent changes in RPGT and stamp duty begin to affect you. For public servants under the pension scheme combined relief up to RM7000 is given on Takaful contributions or payment for life insurance premium wef YA 2019.

In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949. A minimum of 10 discount from selling price is applicable to all units that are. The stamp duties on property sales and purchase agreements SPA for properties priced up to RM1 million and for loan agreements of up to RM25 million that come under the National Home Ownership Campaign 2019 HOC 2019 will be waived Finance Minister Lim Guan Eng announced today.

Highlights of Budget 2020.

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia Propertyguru Malaysia

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia Propertyguru Malaysia

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Sme Corporation Malaysia Stamp Duty Rate

Sme Corporation Malaysia Stamp Duty Rate

2019 Is It A Good Timing To Buy House

2019 Is It A Good Timing To Buy House

Stamp Duty Increase For Properties Exceeding Rm1 Million Now Effective July 1 2019 Iproperty Com My

Stamp Duty Increase For Properties Exceeding Rm1 Million Now Effective July 1 2019 Iproperty Com My

Updates On Stamp Duty For Year 2021 Malaysia Housing Loan

Updates On Stamp Duty For Year 2021 Malaysia Housing Loan

Legal Fees Calculator Stamp Duty Malaysia Housing Loan 2021

Legal Fees Calculator Stamp Duty Malaysia Housing Loan 2021

Stamp Duty Exemption Malaysia 2019 Malaysia Housing Loan

Stamp Duty Exemption Malaysia 2019 Malaysia Housing Loan

How The New Rpgt Ruling Is Affecting The Rakyat

How The New Rpgt Ruling Is Affecting The Rakyat

Stamp Duty Legal Fees New Property Board

2020 Stamp Duty Exemptions News Articles By Hhq Law Firm In Kl Malaysia

2020 Stamp Duty Exemptions News Articles By Hhq Law Firm In Kl Malaysia

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Mot Calculation 2020 Property Paris Star

Mot Calculation 2020 Property Paris Star

Property Insight Stamp Duty 2019

Post a Comment for "Stamp Duty In Malaysia 2019"