Stamp Duty Calculator For Tenancy Agreement In Malaysia

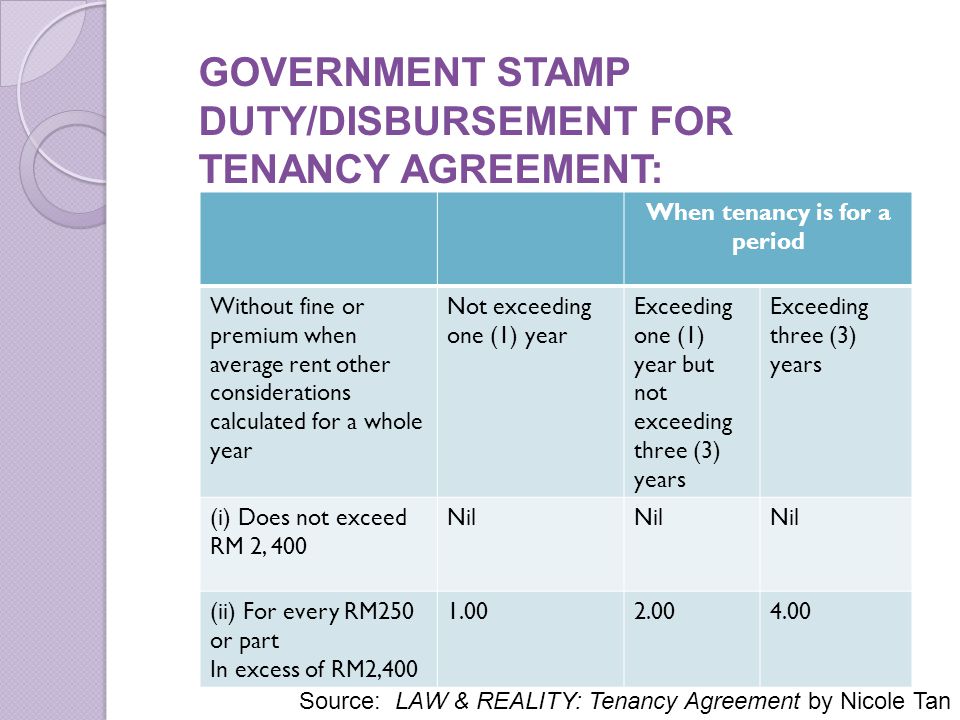

To find out the exact stamp duty you need to pay you can visit our free stamp duty calculator. Based on the table below this means that for tenancy periods less than 1 year the stamp duty fee is RM1 per RM250.

If your tenancy period is between 1 - 3 years the stamp duty fee is RM2 per RM250.

Stamp duty calculator for tenancy agreement in malaysia. This will be an accompanying document to prove that you have additional rental income. Please contact us for a quotation for services required. 1 Legal Calculator App in Malaysia.

The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949. Understand the formula on how Stamping Fee is calculated for a rental within Malaysia by reading our article here. Financially Happy Dot Com Calculate Stamp Duty For Your Tenancy Agreement.

The above calculator is for legal fees andor stamp duty in respect of the principal document only. Annual rental below RM 2400 no stamp duty. 13092017 The standard stamp duty chargeable for tenancy agreement are as follows-.

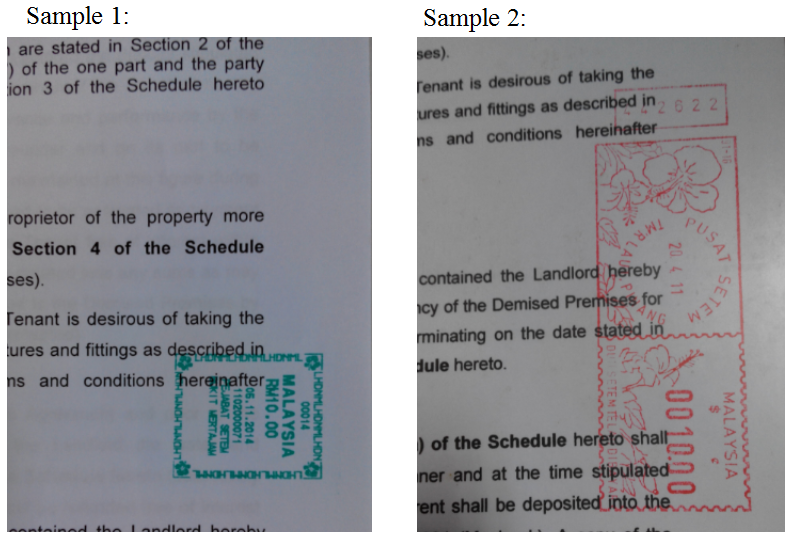

I got the following table from the LHDN Office. Franking Machine and Revenue Stamp will be replaced by receiptstamp certificate which generate by STAMPS. 12042021 Stamp Duty Calculation For Tenancy Agreement Malaysia.

25092018 STAMPS is an Electronic Stamp Duty Assessment and Payment System via internet. Tenancy Period 3 years Payable Stamp Duty RM30000 RM250 x RM4 120 x RM4 RM480 figures will be rounded up Step 4. Sheldon Property Malaysia Property Stamp Duty Calculation Facebook.

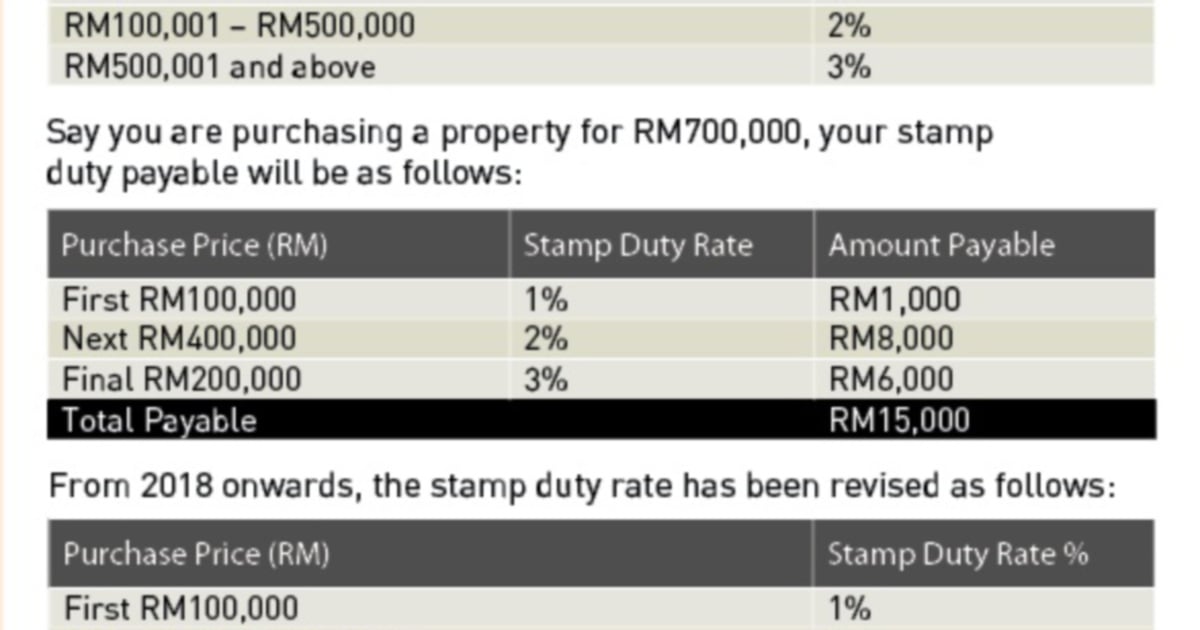

Stamp Duty Waiver For First-Time House Buyer. For second copy of tenancy agreement the stamping cost is RM10. The stamp duty for sale and purchase agreements and loan agreements are determined by the Stamp Act 1949 and Finance Act 2018The latest stamp duty scale will apply to loan agreements dated 1 January 2019 or later and to sale and purchase agreements and instruments of transfer dated 1 July or later.

Total Cost Involved for tenancy period of 1 year DIY tenancy agreement Stamp Duty Stamping for 2nd Copy RM120 RM10 RM130. The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. Number of additional copies to be stamped.

12012021 Rather than a single fixed fee stamp duty for tenancy agreements are calculated based on every RM250 of the annual rental. Stamp Duty is fixed as they are governed by law. Annual rental below RM 2400.

Legal Fee and Stamp Duty Calculator Calculation of legal fees is governed by Solicitors Remuneration Amendment Order 2017 and calculation of stamp duties is governed by Stamp Act 1949. Feel free to use our calculators below. Both the stamp duty for the SPA and the MOT are calculated based on the purchase price Refer below to 18 for the price tiers.

How To Write Your. 2020 Stamp Duty Exemptions News Articles By Hhq Law Firm In Kl Malaysia. The calculation formula for Legal Fee.

09012015 Tenancy Agreement Stamp Duty Calculator. 19032013 An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. The stamp duty of the loan agreement is 05 of the total loan.

With the calculator calculating tenancy agreement stamp duty. Please contact us for a detailed quotation as the following tables exclude any taxes disbursements and reimbursement charges. Above table listed are for the main copy of tenancy agreement if you have 2nd or 3rd duplicate copy the stamp duty is 1000 for each copy.

To use this calculator. Subject to the terms of the tenancy agreement the lessor may be allowed to ask the tenant for compensation for the repair of damaged furniturefixations. Usually there are other fees and charges payable such as legal fees for subsidiary documents GST and other disbursements out-of-pocket expenses.

Between 1- 3 years. 17122020 Stamp duty on a tenancy agreement must be paid by the tenant while the copy must be paid by the landlord. You can also find a rental agreement stamping fee calculator below where we calculate for you.

Tenancy Agreement Charges And Stamping Fee Calculation In Malaysia. Less than 1 year. More than 3 years.

The standard stamp duty chargeable for tenancy agreement are as follows-. Rental for every RM 250 in excess of RM 2400 rental. Less than 1 year.

ASB Unitholders Get Up to 700 sen Dividend. 21052015 In summary the stamp duty is tabulated in the table below. 06112019 Fill in your monthly rental and lease period of the property in the calculator below to know how much you would need to pay for the stamping of the tenancy agreement.

Who is required to use STAMPS. Rental for every RM 250 in excess of RM 2400 rental. More than 3 years.

Meanwhile if you wish to know more about the Real Property Gain Tax we recommend users to contact us or download EasyLaw mobile - The No. How To Calculate Stamp Duty Malaysia in 2020. Enter the monthly rental duration.

There is another additional benefit from a lease. Instahome S Tenancy Agreement Guide. Stamp duty on a lease in Malaysia is calculated as follows.

This method will replace the manual system in LHDNM s counter which use Franking Machine and Revenue Stamp.

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Lock Stock Barrel Set Aside Sum For Stamp Duty

Lock Stock Barrel Set Aside Sum For Stamp Duty

How To Calculate Tenancy Agreement Stamping Fee

How To Calculate Tenancy Agreement Stamping Fee

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Legal Fees Calculator Stamp Duty Malaysia 2017 Malaysia Housing Loan 2017 Legal Malaysia Calculator

Legal Fees Calculator Stamp Duty Malaysia 2017 Malaysia Housing Loan 2017 Legal Malaysia Calculator

Landlord S Guide How To Rent Out Your Hdb Flat In Singapore

Landlord S Guide How To Rent Out Your Hdb Flat In Singapore

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

How To Stamp The Tenancy Agreement Property Malaysia

How To Stamp The Tenancy Agreement Property Malaysia

Drafting And Stamping Tenancy Agreement

Drafting And Stamping Tenancy Agreement

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

Financially Happy Dot Com Calculate Stamp Duty For Your Tenancy Agreement

Tenancy Agreement Charges And Stamping Fee Calculation In Malaysia

Tenancy Agreement Charges And Stamping Fee Calculation In Malaysia

Drafting And Stamping Tenancy Agreement

Drafting And Stamping Tenancy Agreement

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Ec Realty

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Ec Realty

Issues In Tenancy Matters In Malaysia Ppt Download

Issues In Tenancy Matters In Malaysia Ppt Download

Post a Comment for "Stamp Duty Calculator For Tenancy Agreement In Malaysia"