Is Stamp Duty Changes For Second Home

09062020 How much is the stamp duty for second homes. This Article is intended to illustrate how the changes will work in practice as well as identifying some areas where the effects of the tax increase might be.

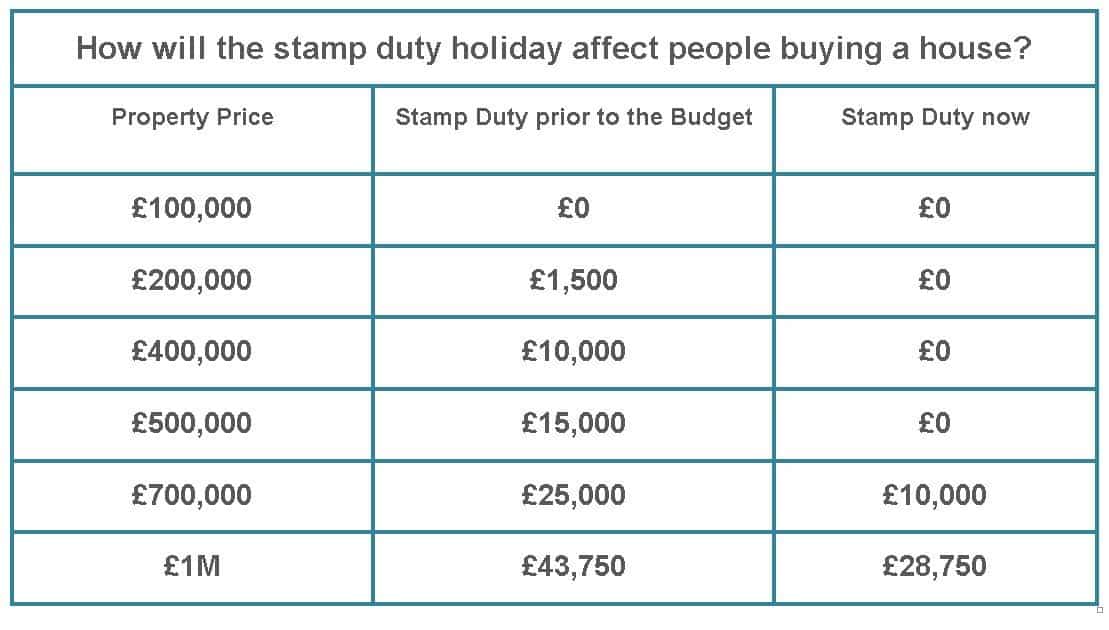

09072020 That means someone spending 248000 the average cost of a house until the 8 th July 2020 would pay 2460 in stamp duty to move home.

Is stamp duty changes for second home. From April 2016 homeowners purchasing a second home will pay considerably more in stamp. You pay 12 on anything over 15million. 02032021 If youre buying a second property or a property on a buy-to-let basis you will still benefit from the increased 500000 threshold however you will still have to pay the Stamp Duty.

24022021 Can I claim back Stamp Duty on second home. The charge applies above the. The rate applies to both leasehold and freehold properties particularly those costing over 40000.

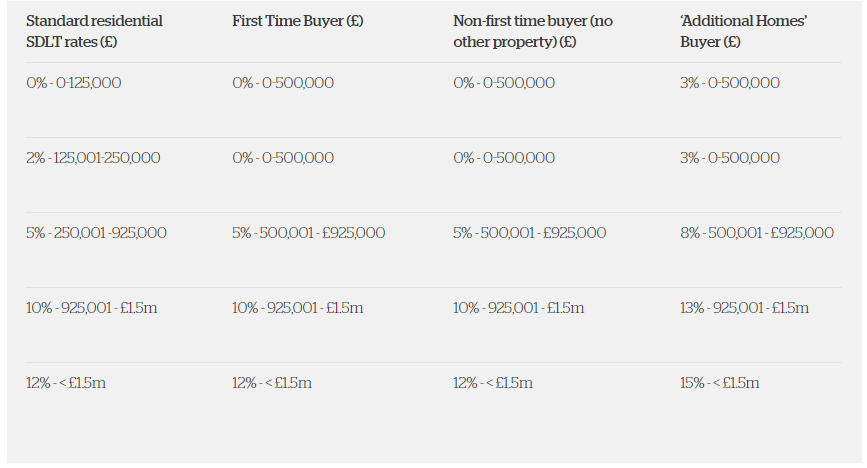

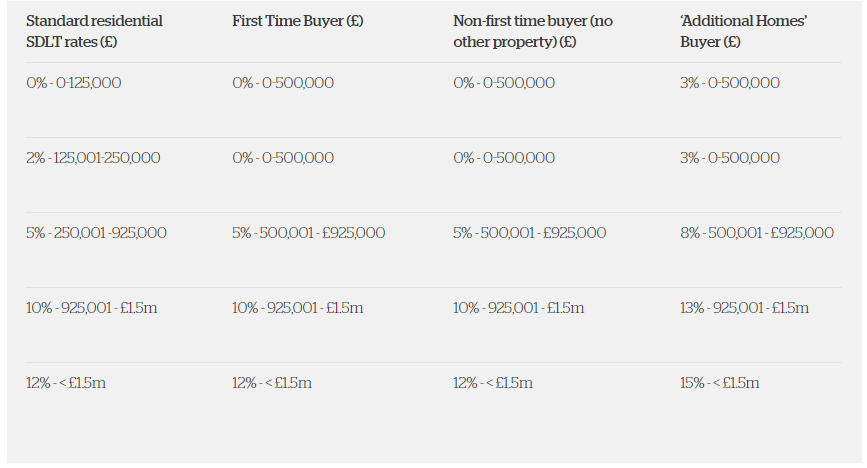

Shadow housing secretary Thangam Debbonaire called it an unnecessary subsidy for second homeowners She said the funds would be better used fixing shortfalls in local council finances during the pandemic. 06032020 Since April 2016 owners of second homes in England and Northern Ireland will have to pay an additional rate of stamp duty. 08072020 Second homes are taxed at higher rates of stamp duty its 3 per cent on purchases up to 125000 5 per cent on the portion worth between 125001 and 250000 and 8 per cent on the bit worth between 250001 and 925000.

Until 30 June the first 500000 spent on a property will be tax-free which. 22032021 Since April 2016 anyone buying an additional property essentially second homes and buy-to-lets has had to pay an additional three percentage points in stamp duty. 17012020 Stamp duty tax on second home Since April 1 2016 second homes have been subject to a three per cent stamp duty surcharge.

Stamp duty for second homes. Stamp Duty Changes Second Homes and Investment Properties Winners and Losers In the Spending Review and Autumn Statement of 2015 the Chancellor announced a 5-point plan for housing. 11122020 Stamp Duty is the only second home tax youll pay at the time of purchase.

08072020 You pay 5 if between 250001 and up to 925000. The short answer to this is yes you can. What stamp duty changes mean for the property market.

Any other taxes you pay on a second property will depend on what you use the property for and if you sell that property. 06032021 What is happening with stamp duty. For second homes.

Those worth between 125000 and 250000 now have a five per cent rate rather than two per cent and so on. 04032021 The rules are different for first-time buyers who are exempt from stamp duty for properties up to 300000 and then must pay five per cent on. This is because the stamp duty land tax holiday applies the 500000 nil rate band to purchases of second homes so that the first 500000 of the price of an additional dwelling is exempt from ordinary rates of stamp duty.

In April 2016 an extra 3 percent was added as stamp duty for the second property SDLT but the first time home buyers were given exemption from paying on homes worth up to 300000 in November 2017. Stamp duty tax for second home purchases has risen substantially from April 2016. If youre not exempt from paying Stamp Duty on a second home then you can claim a refund.

You pay 10 if it is between 925001 and 15million. The stamp duty holiday affects second homes. The temporary stamp duty holiday is being extended in England and Northern Ireland.

However the stamp duty holiday does not affect the 3 stamp duty surcharge. However youll have to pay Council Tax for the period you own the property. This is applicable whether you are purchasing the property outright or with a mortgage.

01102020 The good news is that yes the stamp duty holiday does apply to second homes. The main driving force behind the change was to stimulate the. 01042021 Anyone buying an additional residential property will usually have to pay the additional stamp duty for second homes.

This applies whether youre buying a second home as an investment buy-to-let for a holiday home or any other purpose. In his 2015 Autumn statement the chancellor announced an increase in stamp duty levels for anyone buying an additional property including second homes. But there are certain criteria that needs to be met in order for you to be eligible to claim a Stamp Duty refund.

You have to pay the extra rate even if the property you already own is abroad. Under the banding system second homes worth less than 125000 now attract three per cent tax instead of zero. Anyone buying a second property including buy-to-let paid the above rates plus a 3 surcharge.

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Paying Stamp Duty On Property Not As Easy As 1 2 3 Business News Top Stories The Straits Times Stamp Duty Buyer Profile Paid Stamp

Paying Stamp Duty On Property Not As Easy As 1 2 3 Business News Top Stories The Straits Times Stamp Duty Buyer Profile Paid Stamp

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty Malaysia 2021 Commonly Asked Questions Malaysia Housing Loan

Stamp Duty Malaysia 2021 Commonly Asked Questions Malaysia Housing Loan

Stamp Duty Rate Calculator Property Land Tax Calculator

Stamp Duty Rate Calculator Property Land Tax Calculator

How To Beat The Stamp Duty Surge On Second Homes

How To Beat The Stamp Duty Surge On Second Homes

What Is The New Stamp Duty Rate Will I Have To Pay Home Security Systems Best Home Security System Home Automation System

What Is The New Stamp Duty Rate Will I Have To Pay Home Security Systems Best Home Security System Home Automation System

Budget 2021 Stamp Duty Extensions Rto Scheme To Promote Home Ownership The Edge Markets

Budget 2021 Stamp Duty Extensions Rto Scheme To Promote Home Ownership The Edge Markets

Stamp Duty Malaysia 2021 Commonly Asked Questions Malaysia Housing Loan

Stamp Duty Malaysia 2021 Commonly Asked Questions Malaysia Housing Loan

New Stamp Duty Charges For Residential Property Purchases North Ainley Solicitors

New Stamp Duty Charges For Residential Property Purchases North Ainley Solicitors

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Post a Comment for "Is Stamp Duty Changes For Second Home"