Is Sdlt An Allowable Expense

SDLT may be payable on the grant assignment variation or surrender of a commercial lease. Stamp duty land tax payable on a lease renewal forms part of the incidental costs of the acquisition of the new lease and as the lease is a capital asset is part of the costs of acquisition falling within section 38 TCGA 1992.

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Rental Income Accounting Seminar Delivered By Smartfield Accountants

19032018 Offsetting stamp duty against capital gains tax.

Is sdlt an allowable expense. It confirmed that the surcharge will apply to the grant of a new lease or lease extension if the following conditions are satisfied. JEFFREY SHAW solicitor and Topic Expert Nether Edge Law 1. 19012009 It was replaced by Stamp Duty Land Tax quite a different and very much more complex system but SDLT is equally an allowable expense of purchase as SD used to be.

Sometimes a tenant will be able to claim an implied periodic tenancy but if it does SDLT will be payable on the new periodic lease under paragraph 4. Sun Jan 25 2009 355 pm 50000 of SDLT relates to a property at 1500000 15 Million. You add it to the cost of the properties purchased together with the legal fees and survey fees etc and thus include it in WIP pending sale.

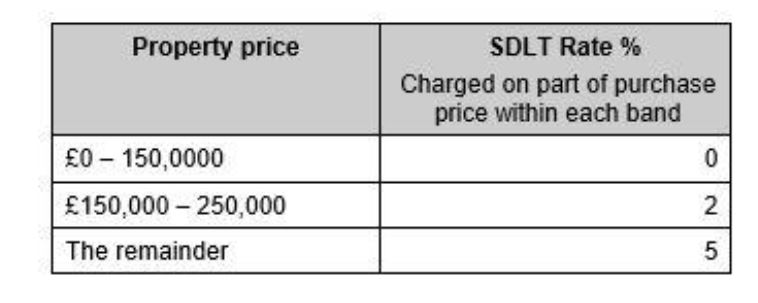

01092014 Stamp Duty Land Tax SDLT is a tax on land transactions. That threshold is currently 125000 for residential properties and 150000 for non-residential land and properties. They have logged this under legal fees but is Stamp Duty on share transfers a revenue expense or capital expenditure.

01022019 Before I go into detail about the costs that may be allowed to reduce property profits and tax I wish to discuss Stamp Duty Land Tax SDLT. 21062019 Professional development expenses. On a sale the SDLT is part of the cost you deduct in calculating the profit.

The Supreme Court in the case of India Cements Ltd. Allowed the expenditure on stamps registration fees etc. This type of tax applies to bricks and mortar of a property.

It is potentially payable whenever a tenancy is created. Post by Peter D. In 2016 HMRC issued some guidance as to the application of higher rates of Stamp Duty Land Tax including on lease extensions.

The rules surrounding SDLT are complex and it is the tenants responsibility to calculate and pay any stamp duty on. 19122018 Is Stamp Duty a business expense. You can offset any stamp duty you paid originally for your property against the final value for the purposes of capital gains tax.

Public advice is believed accurate but I accept no legal responsibility except to direct-paying private clients. Stamp Duty Land Tax SDLT must be paid on land transactions in England including commercial leases over a certain threshold. Posted 4 years ago br.

The allowability of statutory payments as revenue expenditure has been a matter of debate before the courts. Any help would be appreciated. 18052020 You are required to pay Stamp Duty Land Tax SDLT if you purchase a property over the SDLT threshold in England and NI.

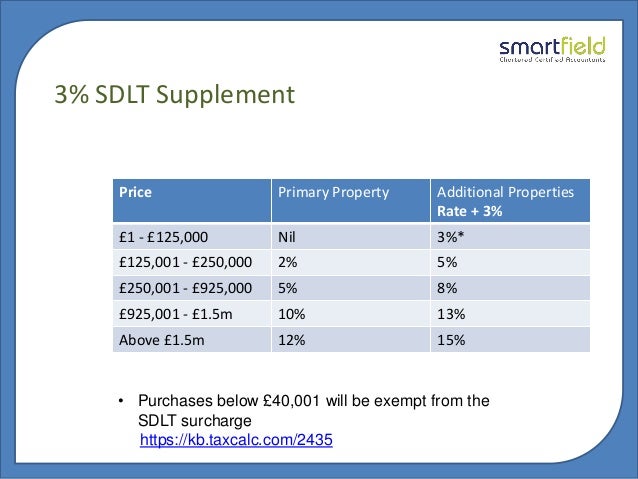

So if you buy an investment property even at the cost of 100000 as a property investor you will pay 3 SDLT surcharge. 12062017 You do neither. If the tenant is a trespasser or a licensee or a tenant at will no SDLT is payable.

Anything of monetary value that is given in exchange for the property is referred to as the consideration. However the tax department in this decision relying on the Supreme Courts. See the Travel expenses guidance note for more information of when Withholding tax.

A company client of mine has transferred shares to another company and paid the relevant Stamp Duty. The definition is exhaustive. Relating to loan taken as revenue expenditure.

A lease term cannot be extended by agreement. This can be cash or another type of payment. 03082018 3 August 2018.

Personal development and training courses can be claimed as limited company expenses just make sure you check its eligible before hitting the books. Thats when the company obtains its tax relief. The SDLT cost serves to increase the base cost of the shares for the purchasing entity person and thus reduces your gain if you ever sell the shares in the future.

If you sold the property for cheaper than its market value eg. While this is easy to remember at the start of. This is a cost of 3000.

25012021 These amounts are allowed because they are associated with the necessary travel. For example if youre an accountant any training you undergo to become a chartered accountant is an allowable expense. Stamp Duty Land Tax on lease extensions posted on 10012017 by Peter Scholl.

When you calculate capital gains tax you need to calculate the tax based on the final sale or market value. Stamp Duty and Interest and Allowable Expenses. No other expenditure is allowable unless specifically provided for by TCGA92 see for example TCGA92s143 6 see CG56084.

27072016 When a lease ends the tenant may stay in occupation. 01042018 SDLT replaces Stamp Duty may become payable when all or part of an interest in land or property is transferred from one person to another if anything of monetary value is given in exchange.

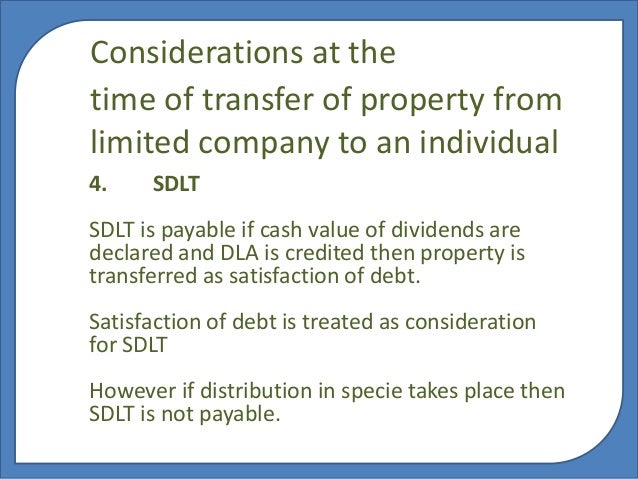

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Gabelle Abbey Tax And Accountax S Tax Conference Taxation

Gabelle Abbey Tax And Accountax S Tax Conference Taxation

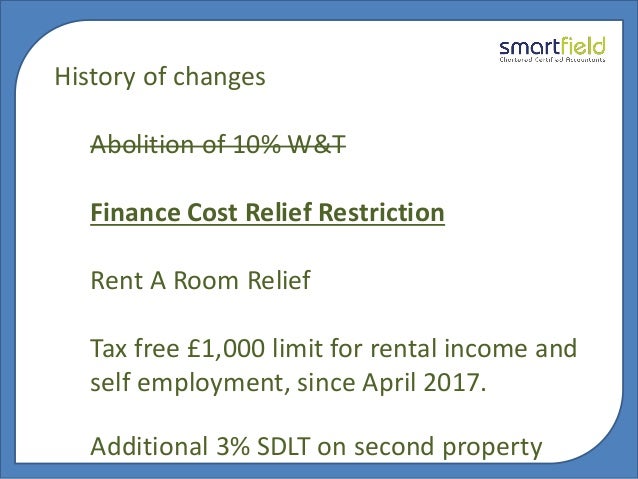

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Calameo Expenses Checklistfor Uk Residential Landlords

Calameo Expenses Checklistfor Uk Residential Landlords

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Stamp Duty Land Tax Tips For Business Taxation

Stamp Duty Land Tax Tips For Business Taxation

Stamp Duty Land Tax Tips For Business Taxation

Stamp Duty Land Tax Tips For Business Taxation

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Uk Commercial Property Tax For The Foreign Investor

Uk Commercial Property Tax For The Foreign Investor

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Reduce Stamp Duty Land Tax 3 Higher Rate Youtube

Reduce Stamp Duty Land Tax 3 Higher Rate Youtube

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Are Government Departments And Ndpbs Subject To Corporation

Are Government Departments And Ndpbs Subject To Corporation

Reduce Stamp Duty Land Tax 3 Higher Rate Youtube

Reduce Stamp Duty Land Tax 3 Higher Rate Youtube

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Https Www Hwfisher Co Uk App Uploads 2019 05 Hw Fisher Uk Residential Property Tax Summary For Overseas Investors En Pdf

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Rental Income Accounting Seminar Delivered By Smartfield Accountants

Post a Comment for "Is Sdlt An Allowable Expense"