Stamp Duty Calculator For Rent Agreement Delhi

User mentions the delivery contact details or email details for E-stamped Rent Agreements and makes a successful payment. A security deposit of Rs 100 will also need to be paid.

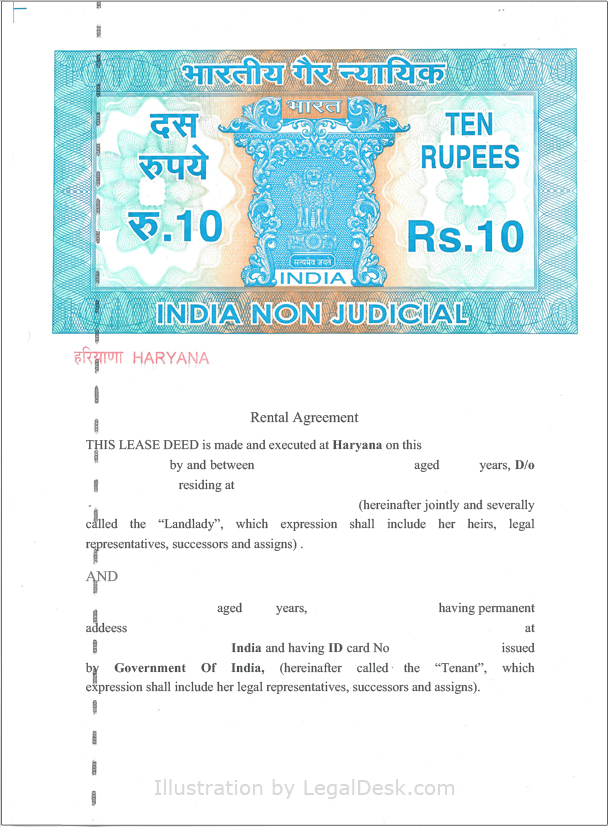

Legaldesk Com Haryana Rental Things You Should Know

Legaldesk Com Haryana Rental Things You Should Know

500- through various banks as per Bank list.

Stamp duty calculator for rent agreement delhi. Estimated Gross Rent Per Month. Registered price of property. The additional rent 400 100 6100.

100- and the Total will be. The amount of stamp duty currently payable on. Mode of payment for Stamp Duty.

100- and the Total will be. Calculation is for a period of 12 months irrespective of period of leave. 2 of the total average annual rent plus Rs 100 for the security deposit paid if the least stretches up to 4 year.

The additional rent subject to stamp duty would be 600. 2400 100 Rs. User customizes the Rent agreement Template by entering all the requisite details.

2500- for the Rent Agreement up to 11 months. Now on the amount 120000- there will be the Stamp Duty of 2 Calculate 2 of 120000 2 of 120000 Rs. 04 x 219600 87840.

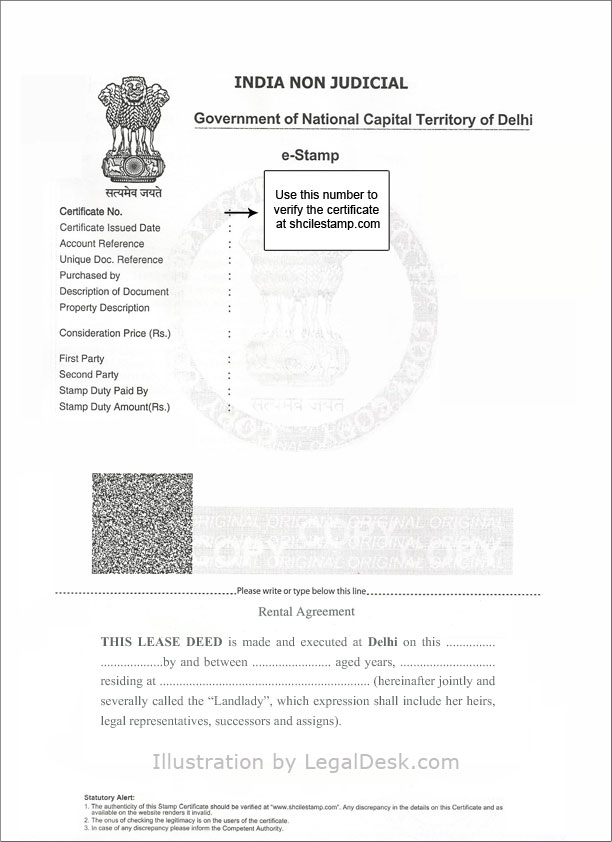

You may also order multiple copies to the same address. Registration fee 5000000 1100 Rs 50000. E-stamping is the most convenient way to pay stamp duty charges as you can do so online via the SHCIL website Stock Holding Corporation of India.

Add a flat fee of Rs100 if a security deposit is part of the agreement. Licence and includes any advance rent paid or to be paid and further includes any deposit made or to be made with or without any interest. 31012020 Important points to note in relation to registration of Lease Agreement in Delhi are.

Calculate Stamp Duty as Per Delhi Circle Rate Calculate Stamp Duty - Enter Area in SqYds. 2400 100 Rs. For rent agreement between 5 and 10 years stamps worth 5 percent of the total annual rent.

Stamp Duty Rates for Leave. 16022020 Stamp duty payable by Man 5000000 7100 Rs 350000. Being a woman Simran gets a rebate of Rs 10000 on the total stamp duty charged.

878 rounded down to. Through e-stamp paper to be purchased from any authorized vendor up to a value of Rs. 2500 Now Purchase the Stamp Paper of Value Rs.

12102017 For instance in Delhi for a lease of up to five years the stamp paper cost is 2 of the total average annual rent of a year. 14122019 For rental agreements made for a tenancy period of 11 months or less a stamp paper of Rs 100 or Rs 200 can be utilized. Both Property Registration Charges and Stamp Duty are based on either of the two following factors.

Hence total cost of the property Rs 5000000 Rs 350000 Rs 50000 Rs 5400000 Stamp duty payable by Woman 5000000 7100 Rs 350000. 5000 600 ie. 6100 x 36 months 219600.

2500 Now Purchase the Stamp Paper of Value Rs. In Jharkhand the property registration charge is 3 of the property value. Home buyers in Delhi pay 6 stamp duty on property registration while it is 3 in Mumbai at present.

If there is Security also with Monthly Rent then on Stamp Duty add Rs. 2500- for the Rent Agreement up to 11 months. 18092020 For example if the agreement value of your flat is Rs 60 lakh and the circle rate is Rs 50 lakh then the stamp duty would be computed on the higher value ie Rs 60 lakh.

Simply visit the website select the state in which your property is located fill out the application form and submit it to the collection centre along with the funds required. 20012021 For other deeds as per details in Schedule I of Indian Stamp Act 1899. Calculation is same whether licence period is for 1 month or for 60 months.

Who has to pay stamp duty and registration charge. 03122019 The cost of Stamp paper is. For rent agreement between 1 and 4 years stamps worth 2 percent of the total annual rent are required to be bought.

Stamp duty is payable 2 of the average annual rent in the case of lease agreements for a term upto 5 years and 3 of the average annual rent in case of agreements for a term greater than 5 years but upto 10 years. Stamp Duty Computation Landed Properties - Tenancy Agreement Please input the tenancy details and then press Compute. 21042021 This is why stamp duty on property registration in India differs from one state to another.

Now on the amount 120000 there will be the Stamp Duty of 2 Calculate 2 of 120000 2 of 1202000 Rs. Know all factors that help in the computation of stamp duty charges in India. Along with this a stamp duty.

Ready reckoner rate It is based on which stamp duty is collected from property buyers by the Stamps and Registration Department The ready reckoner rate is also known as the circle rate. 500- and for a value exceeding Rs. If there is Security also with Monthly Rent than on Stamp Duty add Rs.

User enters the denomination of stamp paper required. 07012019 Stamp duty registration and other charges on rent agreement registration.

Who Should Buy A Stamp Paper For A House Rental Agreement Quora

How To Make Rent Agreements In Delhi Quora

Legaldesk Com Delhi Rental Agreement All You Need To Know

Legaldesk Com Delhi Rental Agreement All You Need To Know

How To Register Rent Agreement In Mumbai Maharashtra

How To Register Rent Agreement In Mumbai Maharashtra

Is Online Rent Agreement E Stamp Paper Valid As Address Proof For A Passport In India Quora

Legaldesk Com Delhi Rental Agreement All You Need To Know

Legaldesk Com Delhi Rental Agreement All You Need To Know

What Can I Do When The Landlord Is Not Providing The Original Rent Agreement Quora

House Rent Agreement How To Register A Rent Agreement Business Times Of India

House Rent Agreement How To Register A Rent Agreement Business Times Of India

Is There Any Website That Can Deliver Rent Agreements To Our Doorstep In Bangalore Quora

How Does It Cost To Make A Rental Agreement In Indore Quora

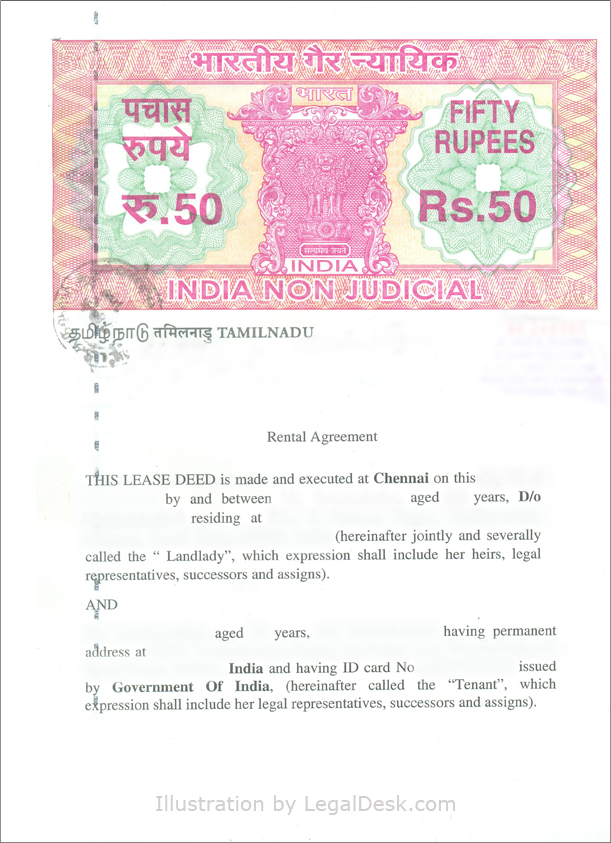

Legaldesk Com Rental Agreements For Chennai And Tamil Nadu

Legaldesk Com Rental Agreements For Chennai And Tamil Nadu

Is Backdate Rent Agreement Created On Today S Date Stamp Paper Allowed Quora

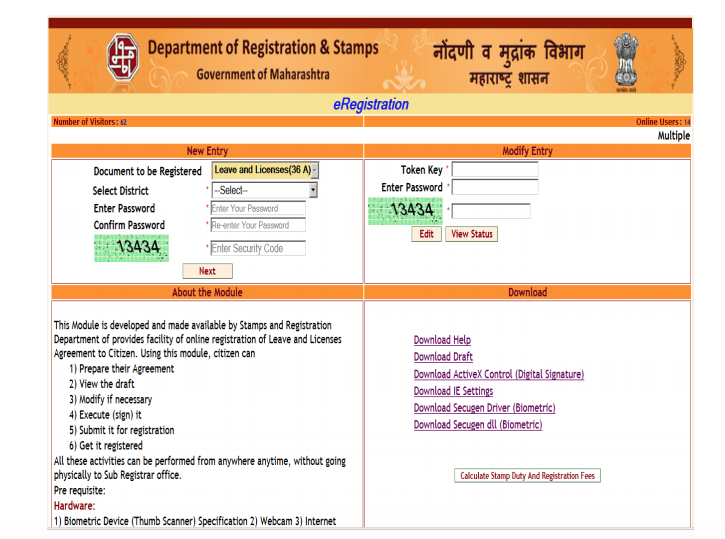

How To Register Rent Agreement Pay Stamp Duty Online In Maharashtra

How To Register Rent Agreement In Mumbai Maharashtra

How To Register Rent Agreement In Mumbai Maharashtra

What Is The Stamp Duty On Rent Agreement Housing News

What Is The Stamp Duty On Rent Agreement Housing News

Rent Agreement Registration In Delhi Process Cost Format Important Clauses

Rent Agreement Registration In Delhi Process Cost Format Important Clauses

Legaldesk Com Rental Agreements For Hyderabad Telangana

Legaldesk Com Rental Agreements For Hyderabad Telangana

Why Rent Agreements Are Prepared For 11 Months Times Of India

Why Rent Agreements Are Prepared For 11 Months Times Of India

How To Claim Hra Rental Agreement And Rental Receipt

How To Claim Hra Rental Agreement And Rental Receipt

Post a Comment for "Stamp Duty Calculator For Rent Agreement Delhi"