Should Stamp Duty On A Lease Be Capitalised

Stamp duties are imposed on instruments and not transactions. 30062017 Stamp duty is generally not payable on the registration of a lease unless key money or a premium has been paid.

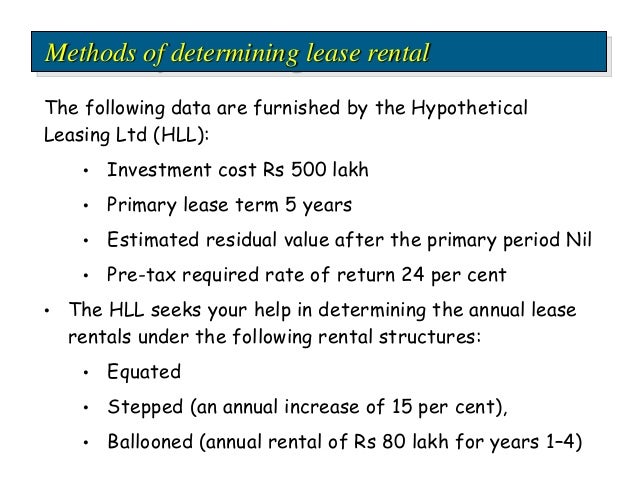

Leasing Hire Purchase Factoring Forfeiting And Venture Capital

Leasing Hire Purchase Factoring Forfeiting And Venture Capital

Adhesive stamps postage stamps impressed or embossed stamps by the means of a die ie plate tool or instrument.

Should stamp duty on a lease be capitalised. Stamp duty land tax payable on a lease renewal forms part of the incidental costs of the acquisition of the new lease and as the lease is a capital asset is part of the costs of acquisition falling within section 38 TCGA 1992. Assigned leases Residential and. Sale and Purchase Agreement Buyers Stamp Duty.

Sale and Purchase Agreement Sellers Stamp Duty if applicable Seller Transferor. Party to Pay Stamp Duty Conveyance duty for documents such as. However in the present case the stamp duty was incurred by the.

In addition s tamp duty will not be payable for the registration of a retail lease. Ltd6 while dealing with the stamp dutiesfees paid for increase in authorised capital of the company held that such duties were paid for expansion of capital base of the company and hence these are capital expenditure and cannot be allowed as revenue expenditure. 29102018 In the paragraph 17 of IAS 16 there are the examples of what expenses are considered to be directly attributable and therefore can be capitalized or included in the cost of an asset.

14042016 The lease is for 25 years and cannot be cancelled. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. 19032013 Lembaga Hasil Dalam Negeri.

I feel that we should be able to capitalise the stamp duty incurred though we do not own the asset itself we will benefit from its use over the lease term or at least we should recognise the cost over the life of the asset. The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. This is however a grey area and usually no penalty will be levied if the stamp duty is paid within 14 days of the tenancy agreement being signed in Singapore and 30 days if it is being signed overseas.

The party who is liable to pay stamp duty is usually stated in the agreement. 24112020 The standard practice is for the tenancy agreement to be stamped and the stamp duty to be paid before the landlord and the tenant signs the document. Expenses should be supported by proper and complete source documents that should be kept for at least five years to substantiate your claims.

Since stamp duty is a non-refundable tax you can capitalize with the land cost. The rules surrounding SDLT are complex and it is the tenants responsibility to calculate and pay any stamp duty on. If there is an increase in rental or the lease period is extended stamp duty is payable on the document based on the increase in rental or the rental for the extended lease period.

Document of Transfer where contracts and agreements are not applicable. Answered Dec 21 2016 by Peterz Level 2 Member 46k points selected Dec 22 2016 by Peterz. Posted 4 years ago.

The rules regarding payment of SDLT are complex and while the tax is not payable on all commercial leases it is. SDLT may be payable on the grant assignment variation or surrender of a commercial lease. 21122016 a its purchase price including import duties and non-refundable purchase taxes after deducting trade discounts and rebates.

Other variations where stamp duty is not payable. The landlord tenant and any other persons signing the tenancy agreement are liable for payment of stamp duty. 16042021 Many commercial tenants are unaware of the fact that Stamp Duty Land Tax SDLT can be payable on the grant assignment variation or surrender of a commercial lease where the total value of the transaction is above certain thresholds.

Costs of employee benefits IAS 19 Employee benefits arising directly from the construction or the acquisition of the item of PPE Costs of site preparation. 18082013 The amount of SDLT you pay when you buy a leasehold property depends on if its an existing lease an assigned lease or a new one. Additional Buyers Stamp Duty Purchaser Transferee.

Stamp duty and registration charges for execution of lease deed did not involve any element of premium. However depreciation of fixed assets may be claimed as capital allowances. A tenancy agreement has to be stamped.

If shares in a company are bought which carries on a businessthen no deduction for the cost of the shares capital cost or for the stamp duty either also capital cost. Expenses that are capital in nature eg. Lease agreement for lease and any other document of similar effect including their duplicate and counterpart hereinafter called tenancy agreement are chargeable with stamp duty.

S5 of the Stamp provides that Stamp duties paid may be evidenced on a document in various forms as permitted by law which include. It was incurred only to draw up and get registered an effective and proper lease deed and would have remained the same irrespective of the period of lease as long as it was more than one year. Chargeability to Stamp Duty.

Purchase of fixed assets such as plant and machinery are not allowable business expenses. Stamp duty on leases is payable based on the actual rent amount or the market rent whichever is higher at the lease duty rates. However if there is a decrease in rental or the lease period is shortened stamp duty is not payable for the document.

Who should pay stamp duty for Lease Tenancy Agreement. 03062020 Stamp duty and registration charges for execution of lease deed is a Capital or revenue expenditure. 03082018 3 August 2018.

What is stamp duty for leases. Stamp Duty Land Tax SDLT must be paid on land transactions in England including commercial leases over a certain threshold. You will have to pay a nominal 10 for a transfer or voluntary surrender of a lease if no other money is specifically being paid.

Here S What You Need To Know About Leasehold Renewal And Reselling Propertyguru Malaysia

Here S What You Need To Know About Leasehold Renewal And Reselling Propertyguru Malaysia

Https Links Sgx Com Fileopen Smfl Us 5bn 20emtn 20programme 20base 20prospectus 20dated 2025 20aug 202020 Ashx App Prospectus Fileid 46165

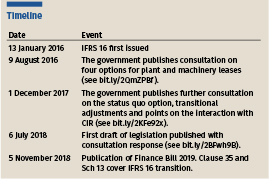

.jpg) Financing And Leases Tax Treatment Acca Global

Financing And Leases Tax Treatment Acca Global

Leasing Hire Purchase Factoring Forfeiting And Venture Capital

Leasing Hire Purchase Factoring Forfeiting And Venture Capital

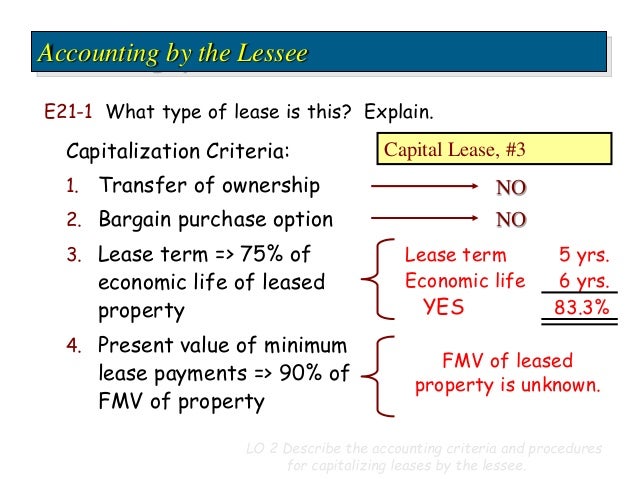

Can I Capitalise My Lease Or Not Caseron Cloud Accounting

Can I Capitalise My Lease Or Not Caseron Cloud Accounting

.jpg) Financing And Leases Tax Treatment Acca Global

Financing And Leases Tax Treatment Acca Global

The Accounting And Tax Treatment Of Leased Chattels

The Accounting And Tax Treatment Of Leased Chattels

Frs 102 And Leasing Aat Comment

Frs 102 And Leasing Aat Comment

.jpg) Financing And Leases Tax Treatment Acca Global

Financing And Leases Tax Treatment Acca Global

Https Www Pwc Com My En Assets Publications Alert126 Leases Pdf

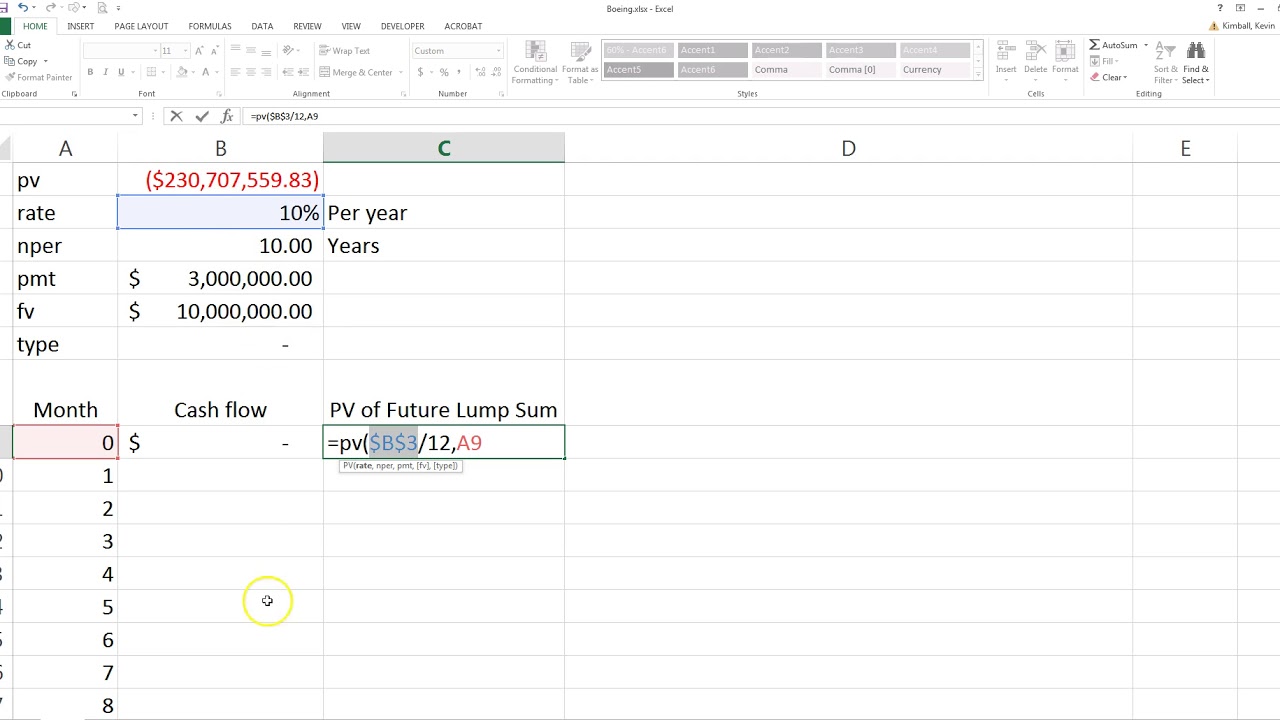

Compute The Present Value Of Minimum Future Lease Payments Youtube

Compute The Present Value Of Minimum Future Lease Payments Youtube

Here S What You Need To Know About Leasehold Renewal And Reselling Propertyguru Malaysia

Here S What You Need To Know About Leasehold Renewal And Reselling Propertyguru Malaysia

Cell Tower Lease Rates 2018 2019 Increase Your Rent Immediately Cell Tower Lease Tower

Cell Tower Lease Rates 2018 2019 Increase Your Rent Immediately Cell Tower Lease Tower

Applying Asc 842 Calculating The Right Of Use Rou Asset

Https Www Pwc Com Jm En Services Ifrs Ifrs 16 Leases Pdf

Equipment Lease Agreement Types Examples And Key Terms

Equipment Lease Agreement Types Examples And Key Terms

How To Use The Core Accounting And Tax Service Icaew

Post a Comment for "Should Stamp Duty On A Lease Be Capitalised"