Irish Stamp Duty On Shares Exemptions

For example you do not pay Stamp. 361 For an exemption from stamp duty to be available to a recognised intermediary on any particular transfer to it of Irish securities as a general rule it is necessary that the transfer to it must be in connection with the intermediarys business of dealing in securities and not.

Http Taxinstitute Ie Wp Content Uploads 2020 12 2020 11 20 Talc Direct Capital Taxes Iti Request For Amendment To Stamp Duty Provisions In Finance Bill 2020 Pdf

This duty is levied on the market value of the shares or the consideration provided whichever is greater.

Irish stamp duty on shares exemptions. Rates of stamp duty with effect from 6 December 2001 as amended on the 2 December 2004 to 31 March 2007. Stamp duty exempt trades in UK or Irish shares mean there a few things you dont need to do. You should pay the Stamp Duty and any late filing or late payment charges.

A gift of shares. However further documentation may be required should a chargeable consideration in excess of 1000 be submitted for transfer in which a specific exemption exists. The standard rate of stamp duty is 1 of the stampable consideration amount see below.

Exemptions to this are if. For more information see When is an instrument liable to Stamp Duty. Charge to stamp duty.

07012021 You pay Stamp Duty when you buy existing shares stocks or marketable securities shares. The exemption does not directly benefit the company itself but. Transfers of existing share options.

For asset deals the stamp duty rate is 2 of the consideration paid or of the market value if higher. Rates of stamp duty between 15 June 2000 and 6 December 2001. Stamp Duty and leases.

Documentation does not need to be stamped or sent to HMRC. Agreements to buy a beneficial interest in shares. The interaction of the stamp duty code with the business of member firms of exchanges and other markets when dealing in Irish securities.

11072014 You usually need to pay Stamp Duty on the transfer of shares. In connection with various business. Although there is a stamp duty exemption for the transfer issue repurchase or redemption of units of a fund there is no such exemption where the fund is involved in a transaction involving Irish immoveable property.

28042021 Unless an exemption applies transactions in Irish equities are in principle subject to Irish stamp duty stamp duty. Other Stamp Duty refunds. Marketable securities are securities that are sold on the Irish Stock Exchange.

Residential Development Stamp Duty Refund Scheme. As with any form of transfer of Irish immoveable property there will be a charge to Irish stamp duty unless the transfer. On the transfer of land and buildings.

Stamp Duty applies if the shares are in an Irish company. 75 percent stamp duty on the transfer or sale which results in a change of control of shares in a company deriving its value from defined Irish non-residential property. 24102011 The transfer of shares in Irish incorporated companies quoted or unquoted with a value in excess of 1000 is liable to Irish stamp duty at the rate of 1.

Stamp Duty and shares stocks and marketable securities. You may be able to claim an exemption or relief. Options to buy or sell shares.

Unless an exemption applies stamp duty is payable by the receiving customer. If you claim an exemption or relief in error you should amend the return and remove the exemption or relief you claimed. If the shares are not in an Irish company you may still have to pay Stamp Duty.

Section 88 provides for a stamp duty exemption for the conveyance or transfer of shares in certain collective investment schemes subject inter alia to the shares in such a foreign entity not being related to Irish property. 07102020 The Stamp Duty Manual states. 07012021 The clawback is usually the amount of Stamp Duty that you would have paid if you had not claimed the exemption or relief.

Part 08 - Sections 114-122 Companies Capital Duty This manual is currently unavailable as it is being updated. Part 07 - Sections 79-113 Exemptions and reliefs from stamp duty This manual is currently unavailable as it is being updated. The measure is a tax relief ie.

Claiming a Stamp Duty refund. The transaction is exempt. Part 09 - Sections 123-126B Levies PDF 30-Jan-2015 PDF 12-Jan-2016 PDF 29-Sep-2016 PDF 20-May-2019.

01072020 Stamp duty at a rate of 1 provided the shares do not derive their value from immovable property of the consideration paid for or where relevant the market value of the shares of an Irish incorporated company may be payable by. 01062020 1 percent stamp duty on shares in Irish incorporated companies. 06122001 Rates of stamp duty between 23 April 1998 and 14 June 2000.

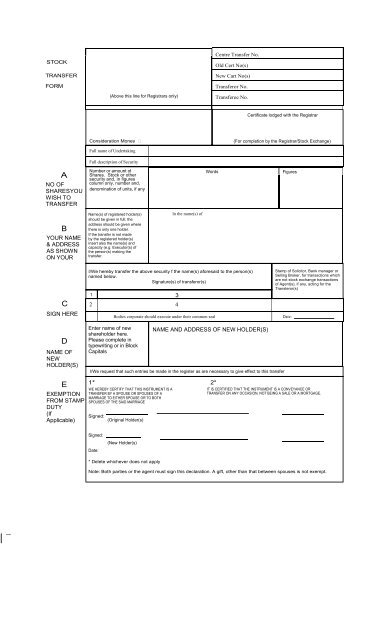

Current rates of stamp duty Each different class of property has a different effective date starting from 31 March 2007. The consideration you. 24122008 You pay Stamp Duty on the stock transfer form which transfers the shares to you.

An exemption from Stamp Duty on transfers of shares in Irish companies admitted to the ESM. The purpose of these Guidance Notes is to summarise the relevant changes to the Irish stamp duty code paragraph 2 set out in detail the relief for recognised intermediaries paragraph 3. Provided certain conditions are complied with an exemption from stamp duty is available on the sale of shares where the amount or value of the consideration is 1000 or less.

You also pay Stamp Duty on.

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate And Construction Malaysia

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate And Construction Malaysia

Https Www2 Deloitte Com Content Dam Deloitte Ie Documents Tax 2014 Deloitte Ireland Finance Bill 2013 Reits Pdf

How To Trade Irish And Uk Shares Without Paying Stamp Duty

Https Www Taxand Com Wp Content Uploads 2017 09 Ma Ireland Pdf

Https Www Revenue Ie En Tax Professionals Documents Notes For Guidance Stamp Duty 2014 Part7 Exemptions Reliefs From Stamp Duty Pdf

Taxation In The Republic Of Ireland Wikipedia

Taxation In The Republic Of Ireland Wikipedia

Chartered Tax Consultant Stage 3 Module 10 Withholding Taxes Ppt Download

Chartered Tax Consultant Stage 3 Module 10 Withholding Taxes Ppt Download

Https Www Euroclear Com Dam Eui Issuerdeclarationstampduty Pdf

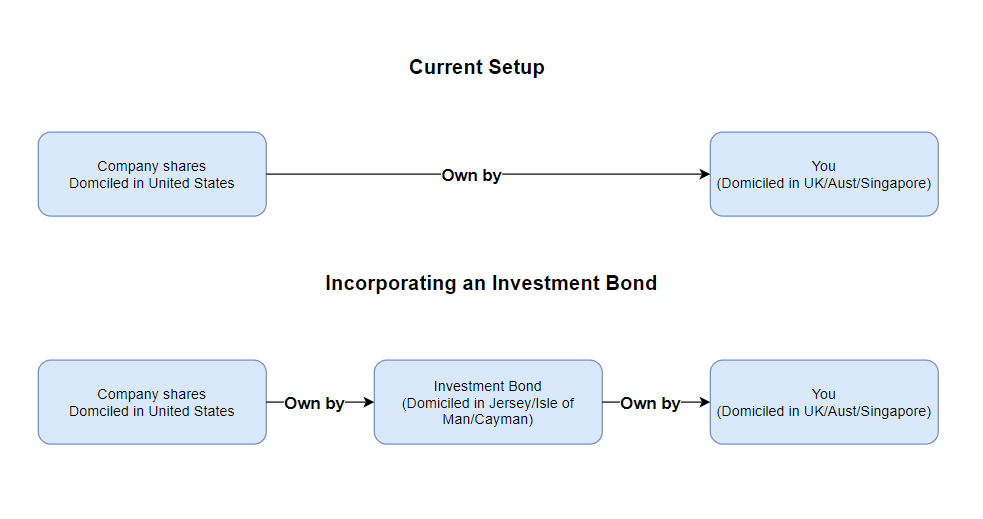

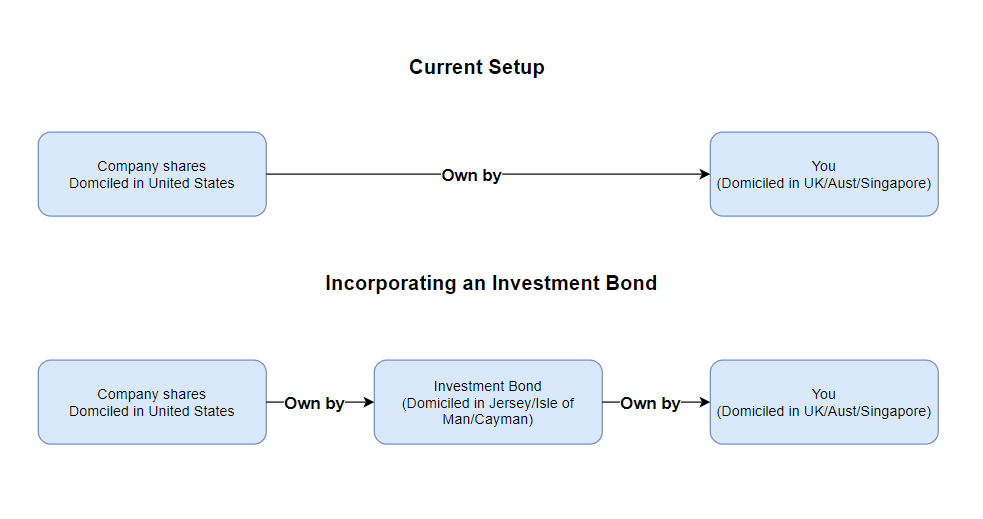

4 Potential Ways To Estate Tax Proof Your Investments Investment Moats

4 Potential Ways To Estate Tax Proof Your Investments Investment Moats

4 Potential Ways To Estate Tax Proof Your Investments Investment Moats

4 Potential Ways To Estate Tax Proof Your Investments Investment Moats

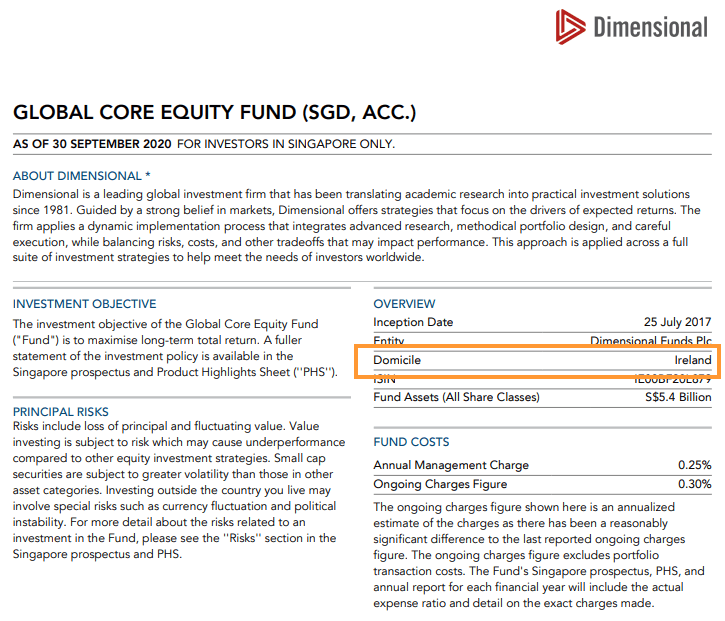

Stamp Taxes Manual Pdf 2 2mb Hm Revenue Customs

Stamp Taxes Manual Pdf 2 2mb Hm Revenue Customs

Https Www Revenue Ie En Tax Professionals Tdm Stamp Duty Stamp Duty Manual Part 07 20180517082547 Pdf

Stamp Duty Exemption London Stock Exchange

Stamp Duty Exemption London Stock Exchange

Https Maples Com Media Files Pdfs Articles And Chapters Article Share Purchases A Tax Overview Ireland Pdf

Stamp Duty Reserve Tax In Crest A Guide To Market Practice Pdf Free Download

Stamp Duty Reserve Tax In Crest A Guide To Market Practice Pdf Free Download

Https Assets Gov Ie 7753 80b99210664f496ebde20b72d59350ab Pdf

Post a Comment for "Irish Stamp Duty On Shares Exemptions"