Does Stamp Duty Relief Apply To Second Homes

18102019 Stamp duty is charged when you transfer property. The charge applies above the.

Where To Buy A Second Home And Pay Less Stamp Duty Stamp Duty New Home Developments House Prices

Where To Buy A Second Home And Pay Less Stamp Duty Stamp Duty New Home Developments House Prices

The answer to this question is yes and no.

Does stamp duty relief apply to second homes. This can make things expensive if you are separating and need to buy another home for one partner. Outside of the stamp duty holiday if youre a landlord or otherwise buying a second home youre required to pay a 3 surcharge on top of the normal rates. You then pay a lump sum equivalent to two per cent of the value of the property up to 250000 and five per cent on.

04032021 Buyers do not pay any stamp duty on the value of a property up to 125000. Government documents published following the Chancellors speech this afternoon state that the tax relief for properties worth up to 500000 will apply for those buying a first or subsequent property. 01042021 For stamp duty purposes a married couple or civil partners are classed as one unit by HMRC.

14072020 Last week the Chancellor Rishi Sunak announced a cut in stamp duty to 0 for the first 500000 of the property purchase price in order to kick start the housing market. Claiming a stamp duty is valid only if. The main driving force behind the change was to stimulate the housing market following the coronavirus pandemic.

08072020 Reduced rates of Stamp Duty Land Tax SDLT will apply for residential properties purchased from 8 July 2020 until 30 June 2021 and from 1 July 2021 to. 09072020 Those purchasing second homes or buy-to-let properties also benefit from the stamp duty holiday. 11122020 If you buy a second home or a buy-to-let property youll pay Stamp Duty at the standard rates plus a 3 surcharge on each band.

It doesnt apply to. But does this stamp duty cut apply to second properties. The government has said that nearly nine out of ten people.

However the pre-existing 3 surcharge on such purchases will still apply. It is charged on the written documents that transfer ownership of land and buidings. 08072020 Second homes are taxed at higher rates of stamp duty its 3 per cent on purchases up to 125000 5 per cent on the portion worth between 125001 and 250000 and 8 per cent on the bit worth between 250001 and 925000.

Landlords and those purchasing additional dwellings still get the tax cut but will need to pay the extra three percent Stamp Duty. Stamp Duty on second homes If youre buying an additional property such as a second home youll have to pay an extra 3 in Stamp Duty on top of the revised rates for each band up until 30 June 2021. Dailymotion Video Player - Rishi Sunak says 500000 stamp duty threshold.

The Stamp Duty Tax rates for second homes and buy-to-let properties are the same because they both qualify as second residences. 09062020 How to avoid paying stamp duty on a second home. 13072020 Yes the stamp duty holiday applies when purchasing a second home.

08072020 The stamp duty cut announced in todays budget will also apply to those buying second homes and buy-to-let properties. SDLT does not apply on the property that has been received as a gift but in such conditions inheritance taxes will apply. 01102020 The good news is that yes the stamp duty holiday does apply to second homes.

Stamp duty applies to residential property such as houses apartments or sites with agreement to build. Some second-home purchases are exempt from stamp duty altogether however. So if one owns a buy-to-let property and the other buys a property the second home stamp duty rate still applies.

22032021 Since April 2016 anyone buying an additional property essentially second homes and buy-to-lets has had to pay an additional three percentage points in stamp duty. 02032021 If youre buying a second property or a property on a buy-to-let basis you will still benefit from the increased 500000 threshold however you will still have to pay the Stamp Duty. One is also exempt in conditions when the property has been transferred following a divorce or separation after the end of a civil partnership.

This applies to property purchases over 40000. In general the only factor affecting the amount of stamp duty is the value of the property. 08072020 The tax holiday will apply from July 8 2020 until March 31 2021 and cut the payments due for everyone who would have paid stamp duty.

You paid stamp duty for the second home by mistake. 04032021 Buy-to-let landlords and second home buyers are eligible for the tax cut but must pay an additional three per cent tax. Property investors who purchase through limited companies will also be exempt up to 500000.

06032020 If you are not exempted from paying stamp duty for your second home you can claim for a stamp duty refund. You sold your old main residential property within three years of purchasing your new main residence. 18112020 Does stamp duty apply to second homes.

Landlord Responsibilities Shelter England Being A Landlord Best Investments For Sale Sign

Landlord Responsibilities Shelter England Being A Landlord Best Investments For Sale Sign

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

Excellent Things To Know Before Selling Your House In India Https Www Edocr Com V Jen1nvog Realestatei Selling Your House Things To Know Amazing Funny Facts

Excellent Things To Know Before Selling Your House In India Https Www Edocr Com V Jen1nvog Realestatei Selling Your House Things To Know Amazing Funny Facts

Budget 2021 Stamp Duty Extensions Rto Scheme To Promote Home Ownership The Edge Markets

Budget 2021 Stamp Duty Extensions Rto Scheme To Promote Home Ownership The Edge Markets

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Section 8 Company Registration Company Company Id Section 8

Section 8 Company Registration Company Company Id Section 8

Things To Consider When Trying To Find The Right Danforth Homes Home House Styles Mansions

Things To Consider When Trying To Find The Right Danforth Homes Home House Styles Mansions

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Can You Avoid Paying Stamp Duty On A Second Home Metro News

What Is A Credit Score Its Importance For Loans Credit Score What Is Credit Score Credit Rating Agency

What Is A Credit Score Its Importance For Loans Credit Score What Is Credit Score Credit Rating Agency

Luxury Houses To Let Welcome In Order To My Own Blog Site In This Particular Occasion I Ll Demonstrate In Relati Being A Landlord Let It Be Best Investments

Luxury Houses To Let Welcome In Order To My Own Blog Site In This Particular Occasion I Ll Demonstrate In Relati Being A Landlord Let It Be Best Investments

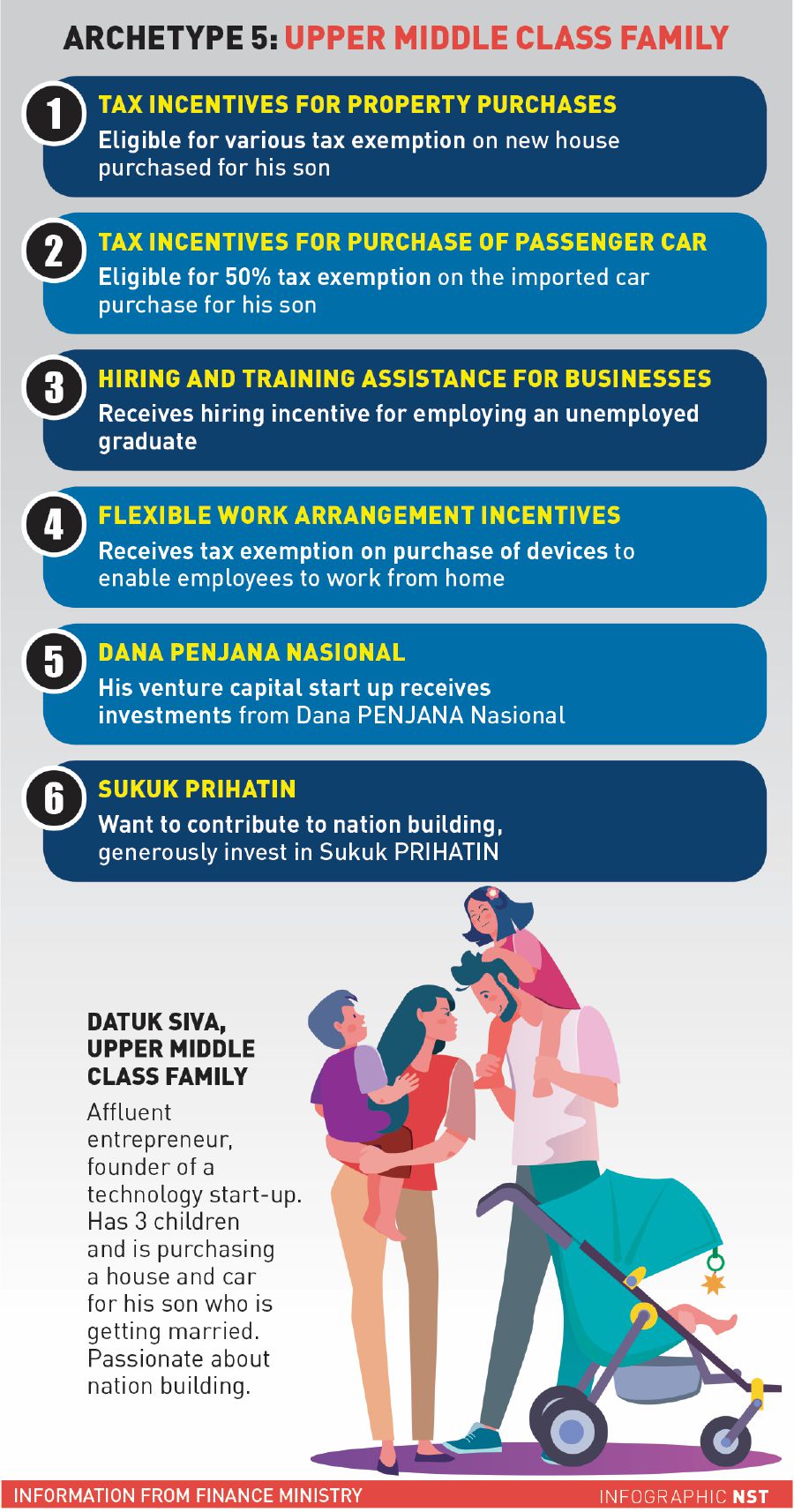

Penjana Economic Package New Property Incentives In 2020 Donovan Ho

Penjana Economic Package New Property Incentives In 2020 Donovan Ho

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Know The Transaction Costs And Taxes When Buying Property Overseas Transaction Cost Buying Property Cost

Know The Transaction Costs And Taxes When Buying Property Overseas Transaction Cost Buying Property Cost

New Tax Regime Tax Slabs Income Tax Income Tax

New Tax Regime Tax Slabs Income Tax Income Tax

With Accountants Brighton As Your Appointed Tax Advisers Brighton We Can Help Reduce Your Income T Mortgage Interest Rates Home Mortgage Current Mortgage Rates

With Accountants Brighton As Your Appointed Tax Advisers Brighton We Can Help Reduce Your Income T Mortgage Interest Rates Home Mortgage Current Mortgage Rates

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Rpgt Stamp Duty Exempted Will You Buy Or Sell Your House

Rpgt Stamp Duty Exempted Will You Buy Or Sell Your House

Post a Comment for "Does Stamp Duty Relief Apply To Second Homes"