Can I Pay Stamp Duty In Installments Nsw

Commercial or industrial properties or. The purchaser or transferee becomes liable when the sale or transfer takes place.

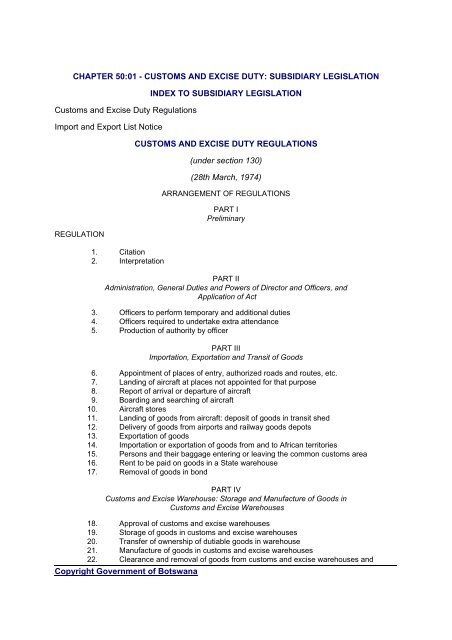

Cap 50 03 Customs And Excise Duty Act Burs

Cap 50 03 Customs And Excise Duty Act Burs

In NSW stamp duty must be paid within three months of settlement.

Can i pay stamp duty in installments nsw. The New South Wales government is proposing to abolish stamp duty as part of its 2020-21 budget announcement on 17 November 2020. After your solicitor or conveyancer has lodged your assessment well send them a duties notice of assessment with the total tax duty and any interest payable and the due date for payment. In NSW Stamp duty is payable within 90 of exchange of contracts.

In NSW the purchaser of the property or the transferee is liable to pay stamp duty. In Queensland an established property sold for the same price would attract stamp duty of 19480 regardless of whether a buyer was a first home buyer or not. However if the sale or transfer is influenced by a written document then the liability arises when the written document is executed.

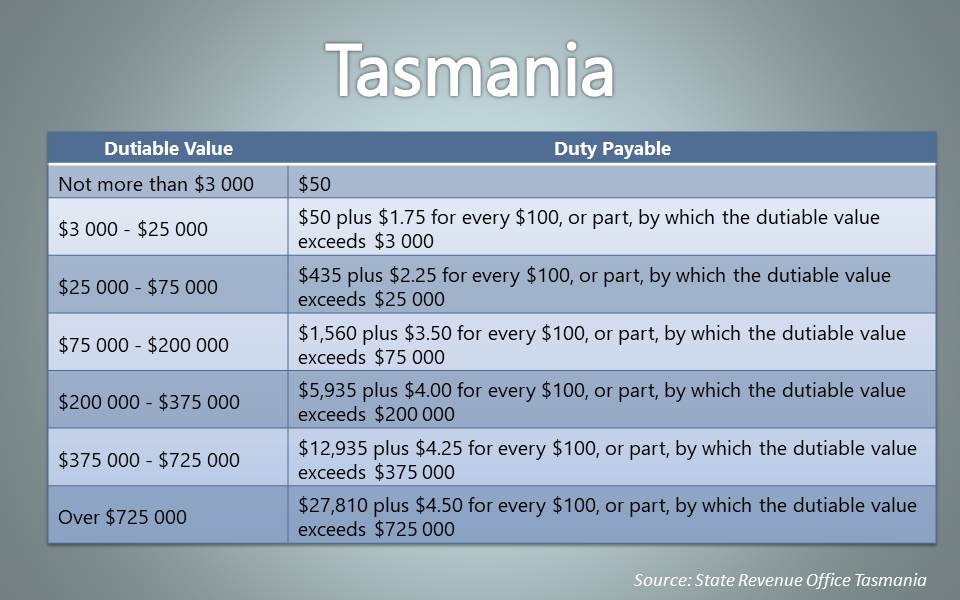

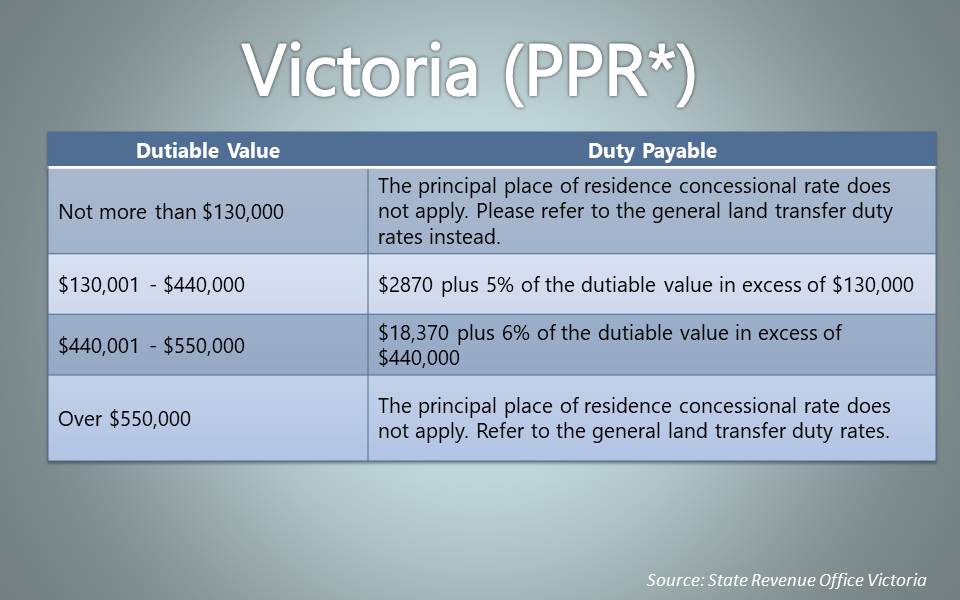

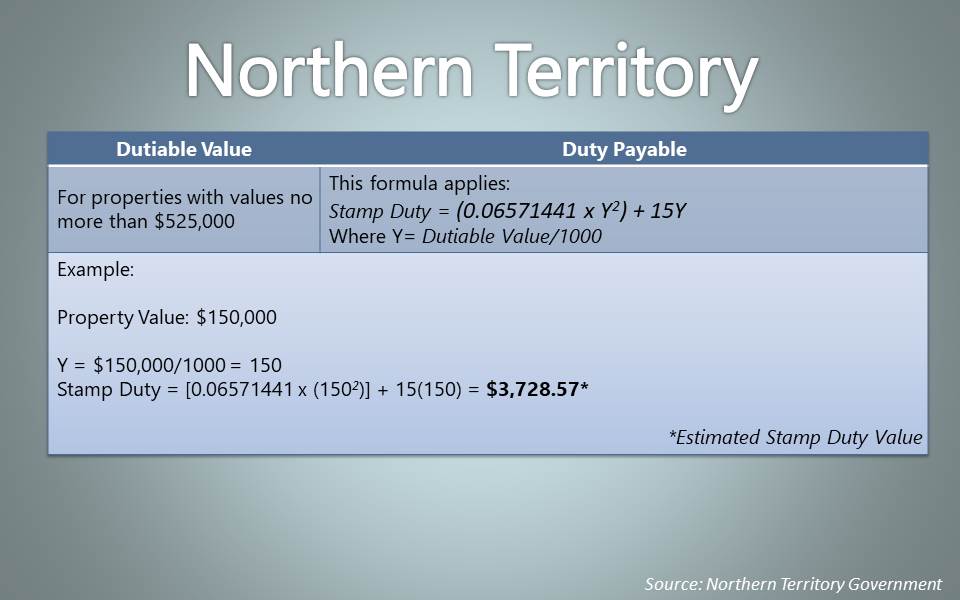

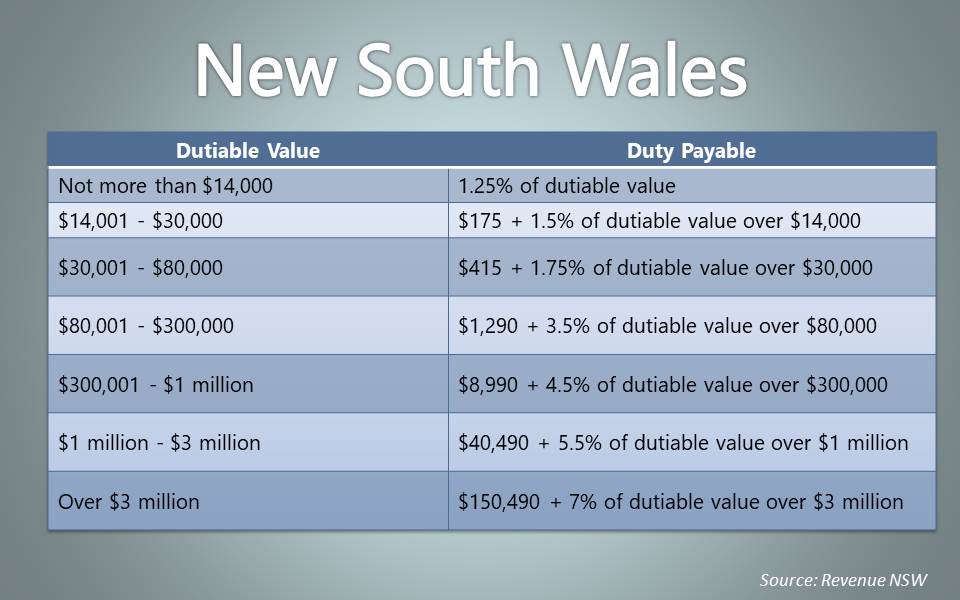

19112020 Published by Otto Dargan on November 19 2020. In New South Wales stamp duty is administered under the Duties Act 1997 and is payable to the Office of State Revenue. 27042021 Get the basic estimate of what you may have to pay depending in which Australian state or territory you reside.

Thus taking it into account is vital whenever you plan to buy your new home. Stamp duty is a government tax paid when you buy a property. 02012019 The NSW Government offers the First Home Buyers Assistance scheme which is a stamp duty exemption scheme or stamp duty concession scheme.

You must pay transfer duty once known as stamp duty in NSW when you buy. Then it goes up incrementally by 10 each year I think. Typically transfer duty is paid with other funds transferred at the time of the property settlement so you will not need to use the payment channels below.

If a property purchase is made off the plan stamp duty is payable within three months of the date of the completion of the agreement or within three months of the assignment of the purchasers interest in the agreement. 24022007 with payment of stamp duty the time limit doesnt normally start until your contract is unconditional. 31032014 Well stamp duty is an amount of money that you are liable to pay on the purchase or transfer of property.

This means stamp duty. The change to the thresholds will only apply to newly-built homes and vacant land not to existing homes and will last for 12-months. 26072017 Who pays the stamp duty.

09032015 NSW Labor will allow first home buyers to pay stamp duty in instalments in an attempt to lure young potential home owners into the market if elected. There are several ways you can pay including by mail and BPay. AAP March 9 2015 1204pm FIRST home buyers of properties worth up to 750000 will be able to pay stamp duty in monthly instalments over a five-year period if Labor wins the state election.

In Vic is payable when the tile transfers. Im looking at a 400k property first-time buyer. You must also pay transfer duty when you acquire land or an interest in land without buying it.

First home buyers that buy NEW homes under 800000 will pay NO stamp duty from August 1st 2020 NSW Government announced. If I dont pay stamp duty within 30 days of purchasing the property I am charged 10 of the amount capped at 300 within the first year. Stamp duty can add significantly to the purchase price of a property.

Fingers crossed the soaring revenue from stamp duty is put to good use by the State Government. 650000 is the most popular property value entered into our stamp duty calculator for New South Wales. Therefore if I was in your situation I would buy the property off your in-laws with a vendor finance Instalment Contract.

In NSW stamp duty is payable to the Office of State Revenue. 11072019 When do I have to pay stamp duty. In New South Wales you must pay stamp duty within 30 days after the liability arises to pay transfer duty on the transaction.

Property including your home or holiday home. 01032010 But stamp duty does not have to be paid immediately. For example eligible first home buyers when purchasing an established property existing home up to the value of 650000 will receive a stamp duty exemption.

This would mean 5k upfront cost. How much is the stamp duty on a 650000 house in NSW. Stamp duty is a tax and therefore the money will go towards the NSW state government budget.

If I can defer this for a year at the cost of only 300 that. 02032012 Regarding the traditional sales process Victorias timing for the payment of Stamp Duty is different from NSW. However the stamp duty amount youll need to pay can be factored into the amount you borrow in your mortgage.

For example from 1 July 2017 a first home buyer in NSW would pay 10490 in stamp duty for a 700000 property thats not new while non-first home buyers in NSW would pay 26990. Who is stamp duty payable to in NSW. You have 60 days from the date on the contract to pay it.

Learn more about duty payable in New South Wales here. So if you made your contract subject to finance or some other condition which was to be satisfied say 14 days after the contract you will have the opportunity to stamp documents between settlement and the new time period. Instead of paying stamp duty upfront it would be replaced by an annual land tax.

So utilise our stamp duty calculator to estimate how much you will need to pay. Stamp Duty Calculator NSW NSW Stamp Duty News. If you do not pay in that time they then charge you interest.

Vacant land or a farming property. A business which includes land. Stamp duty cannot be paid off periodically with your mortgage buyers are required to pay it in full at the time of purchasing.

Aami Third Party Property Damage Motorcycle Insurance A Premium

Aami Third Party Property Damage Motorcycle Insurance A Premium

Https Www Legalink Ch Xms Files Publications Legalink Real State 3rd Edition 2019 Digital Version Pdf

Keep Your Offset Patio Umbrella Secure With A Functional And Durable Base Our Umbrella Base Is Built With A S Offset Patio Umbrella Patio Umbrella Stand Patio

Keep Your Offset Patio Umbrella Secure With A Functional And Durable Base Our Umbrella Base Is Built With A S Offset Patio Umbrella Patio Umbrella Stand Patio

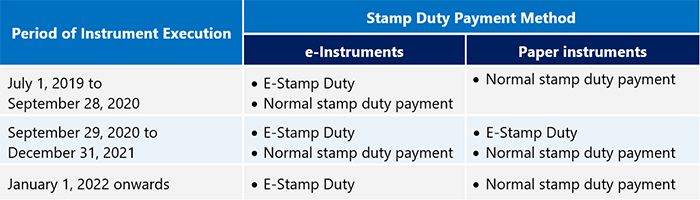

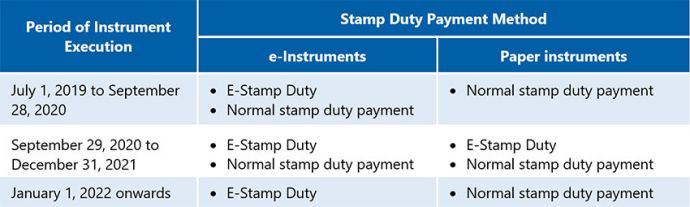

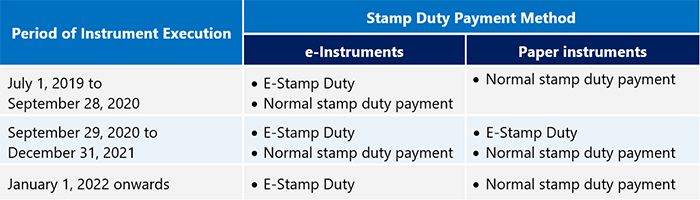

Thailand Extends E Stamp Duty Grace Period Tax Thailand

Thailand Extends E Stamp Duty Grace Period Tax Thailand

Methods Of Stamp Duty Payment In Thailand Tax Thailand

Methods Of Stamp Duty Payment In Thailand Tax Thailand

Nsw To Phase Out Stamp Duty In Billion Dollar Move

I B Australia Nsw Revenue Stamp Duty 5 Revenue Stamp Stamp Duty Stamp Catalogue

I B Australia Nsw Revenue Stamp Duty 5 Revenue Stamp Stamp Duty Stamp Catalogue

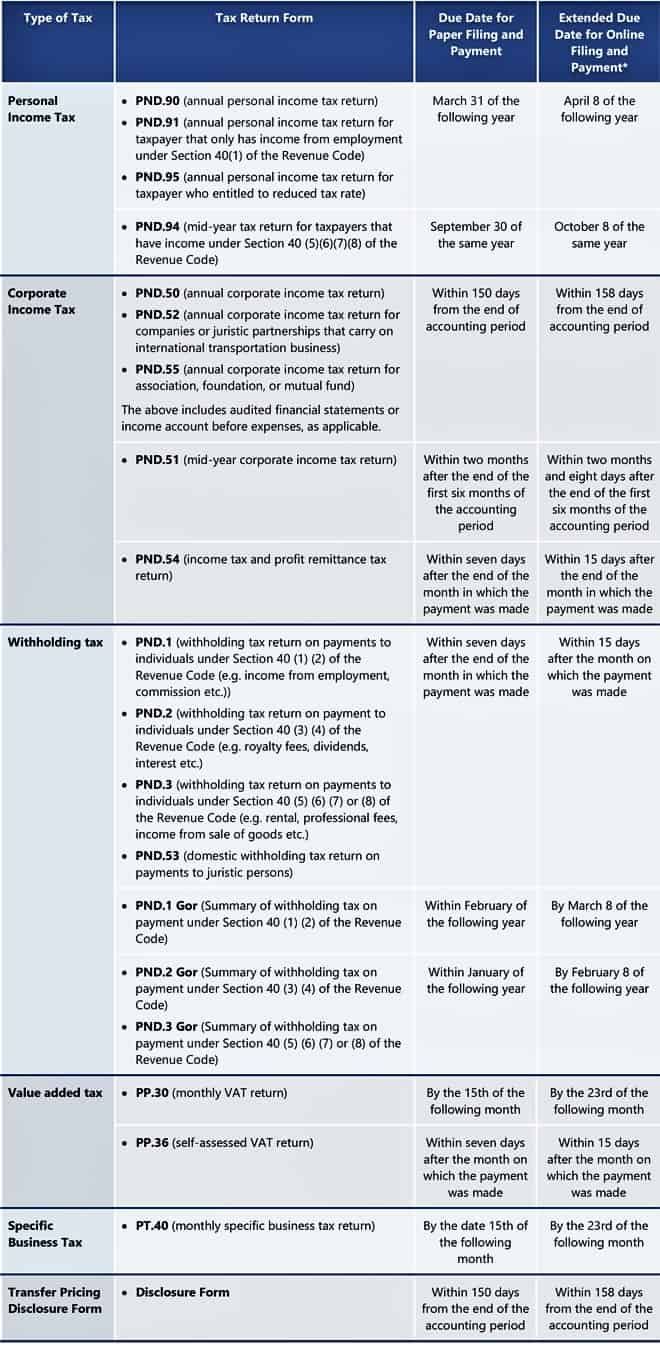

Further Extension For E Tax Filing And Payment In Thailand Tax Thailand

Further Extension For E Tax Filing And Payment In Thailand Tax Thailand

Methods Of Stamp Duty Payment In Thailand Tax Thailand

Methods Of Stamp Duty Payment In Thailand Tax Thailand

14k Gold Cultured Pearl Choker Vintage 1930s 1940s Large Etsy Cultured Pearls Pearl Choker Mimi Jewelry

14k Gold Cultured Pearl Choker Vintage 1930s 1940s Large Etsy Cultured Pearls Pearl Choker Mimi Jewelry

Post a Comment for "Can I Pay Stamp Duty In Installments Nsw"