Stamp Duty Exemptions On Share Transfers

Exemptions to this are if. Part 07 - Sections 79-113 Exemptions and reliefs from stamp duty This manual is currently unavailable as it is being updated.

Stamp Duty Exemption London Stock Exchange

Stamp Duty Exemption London Stock Exchange

What is share duty.

Stamp duty exemptions on share transfers. 28022014 Transfer of shares under stock borrowing and lending transactions may be exempted from stamp duty. Real Property Gains Tax Exemption Order 2020. It is payable on the actual price or market value of.

11072014 You usually need to pay Stamp Duty on the transfer of shares. 08122020 Whichever way you obtain your property you must pay land transfer duty previously known as stamp duty on the transfer of the land from one individual to another. You do not pay Stamp Duty on the issue of.

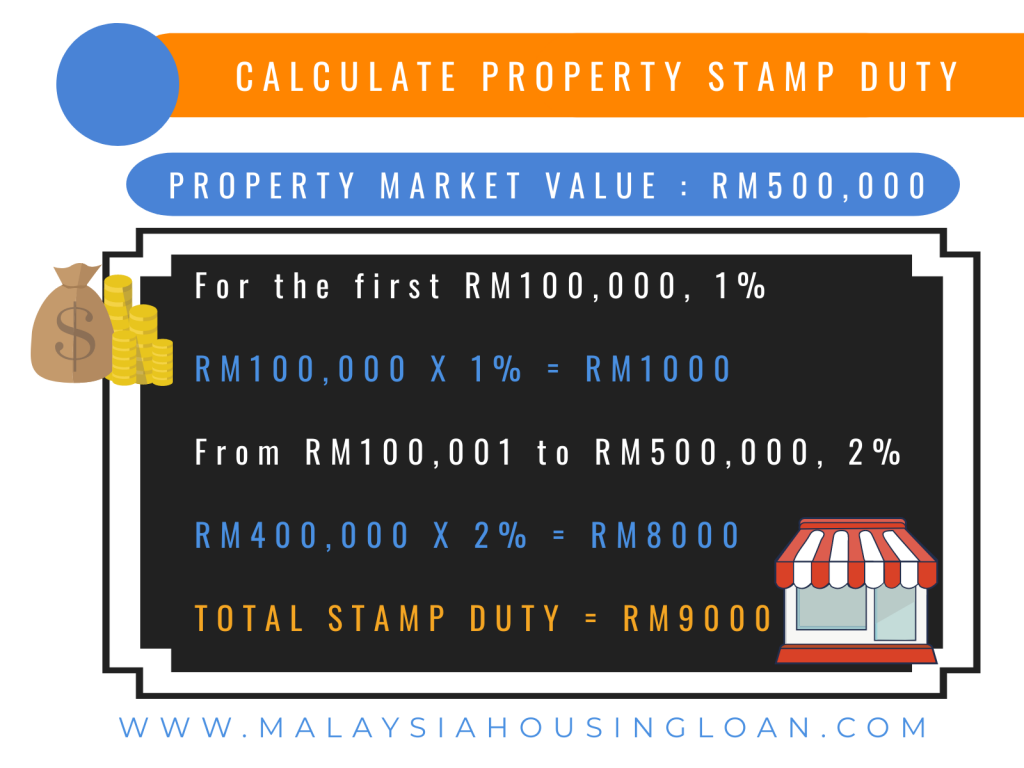

The amount of duty depends on the value of your property how you use it if you are a foreign purchaser and if you are eligible for any exemptions or concessions. However since last year stamp duty has been calculated on transfers of listed securities between connected companies on the market value of the securities transferred. The instruments of transfer on sale of any stock shares or marketable securities is subject to duty under item 32b of the First Schedule Stamp Act 1949 as follows.

Section 15A Relief from Stamp Duty in case of transfer of property between associated companies. 21102020 It is to be noted that issue or transfer of securities was historically subject to the stamp duty it was only after the introduction of Depositories Act 1996 and subsequent dematerialization of the securities especially shares and debentures that government to promote the transactions in the de-materialized form introduced the Section 8A and exempted the de. Written transfers of existing share options.

22122019 the share transfer is exempt from Stamp Duty and no relief is being claimed or the amount paid for the shares is not a chargeable consideration There is no requirement to complete either certificate when there is no chargeable consideration given for the shares or when you are claiming relief from Stamp Duty. 19032013 Relief may be given pursuant to Section 15 and Section 15A Stamp Act 1949. 24122008 Stamp Duty on share options.

The consideration you give is not chargeable consideration. Select Share Transfer 4. You pay Stamp Duty on.

On sale of any stock shares or marketable securities to be computed on the price or value thereof on the date of transfer whichever is the greater For every RM1000 or fractional part of RM1000. The transaction is exempt. Share duty Answer 1.

For example most option agreements and transfers of existing share option agreements are exempt from Stamp Duty. Part 08 - Sections 114-122 Companies Capital Duty This manual is currently unavailable as it is being updated. 20032019 Stamp Duty Exemption No3 Order 2019 EO.

26082014 Stamp duty is calculated on the market value of the property at the time of the acquisition whereas RPGT is calculated on the profit gained from the disposal of the property. Application for relief can be done online through STAMPS. Click here to view full PDF file.

In the case of a transfer of property between family members by way of love and affection the law provides for a full or partial exemption of stamp duty andor RPGT in. Return to Tax Articles. The duty is levied only on transfers of shares so cash-settled derivatives as well as ETFs and other index-based basket instruments are not taxed.

Part 09 - Sections 123-126B Levies PDF 30-Jan-2015 PDF 12-Jan-2016 PDF 29-Sep-2016 PDF 20-May-2019 Show less. Where do I e-Stamp for share duty. Stamp Duty Exemption no3 Order 2020 and Stamp Duty Exemption no4 Order 2020.

You can e-Stamp your document via e-Stamping Portal. Login with SingPass or CorpPass ID 2. 09032020 Stamp Duty for Transfer of Shares in Non-Listed Companies.

Stamp Duty Exemptions Firms can maximize trading opportunities without incurring stamp duties by trading in exempted products. 34 Lorong Thambi 2 off Jalan Brunei 55100 Kuala Lumpur. Charitable institutions registered with us may be able to claim a transfer duty exemption when acquiring property for a qualifying exempt purpose.

Other reliefs and exemptions may be available. Stamp duty exemption on all instruments of transfer of land business asset and share in relation to the conversion of a conventional partnership or a private company to be a limited liability partnership. 07012019 Exemption for instruments of transfer of immovable property operating as voluntary disposition between husband and wife.

Stamp Duty on the issue of shares. Share duty is payable on the share transfer document when you acquire shares. Written options to buy or sell shares.

You may be able to claim an exemption or relief. Transfer duty applies when you transfer land in Queenslandthis typically happens when a person signs a contract to buy a home or when their name is added to the title of land. Concessions and exemptions are available to reduce the amount of transfer duty sometimes called stamp duty you need to pay when buying a home.

Section 15 Relief from Stamp duty in case of reconstructions or amalgamations of companies. 319 provides that any instrument of transfer for the purchase of a residential property under the NHOC 2019 which is valued at more than RM300000 but not more than RM25 million and is executed by an individual is exempted from stamp duty in respect of RM1 million and below of the value of the residential property. For details please refer to the Stamp Office Interpretation and Practice Notes on Relief for Stock Borrowing and Lending Transactions.

The above has been the case historically even if the shares were transferred to connected companies.

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Lock Stock Barrel Set Aside Sum For Stamp Duty

Lock Stock Barrel Set Aside Sum For Stamp Duty

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Love And Affection Transfer Malaysia 2020 Malaysia Housing Loan

Love And Affection Transfer Malaysia 2020 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

First Time Home Buyer Entitlements Privileges And Benefits Propsocial

First Time Home Buyer Entitlements Privileges And Benefits Propsocial

Https Www Wongpartners Com Media Minisites Wongpartners Files Publications 2019 10 Taxpayer Succeeds In Stamp Duty Appeal On The Transfer Of Shares To A Labuan Entity Pdf

Stamp Duty Exemption How To Save Money Property Investments Malaysia

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate And Construction Malaysia

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate And Construction Malaysia

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Transfer Of Property Between Family Members In Malaysia Love And Affection Property Transfer 2021 Malaysia Housing Loan

Transfer Of Property Between Family Members In Malaysia Love And Affection Property Transfer 2021 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Post a Comment for "Stamp Duty Exemptions On Share Transfers"