Stamp Duty Calculator 2021 Second Home

And for NON-First Time Buyers purchasing Established Home for Primary Residence stamp duty is. After that the exemption value will reduce to 250000 until the 30th September 2021.

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

The dutiable value of the property generally the purchase price or.

Stamp duty calculator 2021 second home. Enter the purchase price to find out how much stamp duty you will pay on the purchase of a second property. 03122014 Between 1 July and 30 September 2021 homeowners wont need to pay stamp duty on the first 250000. The following section gives example stamp duty calculations for higher rate transactions including buy to let and second home purchasesThe SDLT calculations below apply to freehold residential purchases in England and Northern Ireland with a completion date between 8th July 2020.

Above that the usual percentage applies. Until 300621 you wont pay any standard Stamp Duty on the first 500000 of a first or second residential property or on a buy-to-let property however youll still pay the surcharge on a second residential property or a buy-to-let. Land transfer stamp duty calculator.

Stamp Duty Calculator - 2nd Properties - From October 2021. 11122018 Stamp duty on second homes If you already own a home and are buying another property either to rent out use as a holiday home or for any other purpose youll usually have to pay 3 on top of the normal stamp duty rates in England Wales and NI or 4 in Scotland. The date of the contract for your property purchase or if there is no contract the date it is transferred.

Stamp duty for buy to let property has increased substantially from April 2016. 152 days before the 30 June 2021 stamp duty holiday deadline is 29 January 2021. 01102020 Until 31 March 2021 if you are buying a second property or a property on a buy-to-let basis you will benefit from the raised tax threshold.

Max cost of property. Rates from 1 October 2021. These rates also apply if you bought a property before 8 July 2020.

Stamp Duty is paid at different rates depending on the purchase price. This calculator works out the land transfer duty previously stamp duty that applies when you buy a Victorian property based on. For second homes or Buy to Let properties there will be a discount where only 3 Stamp Duty is payable up to the first 500000.

The table below shows the rates of stamp duty for someone buying their next home with a completion date on or before 30 June 2021 would pay. 10092018 So if you bought a second home worth 100000 you would pay 3 stamp duty on the 100000 purchase price see the table above. Purchase Value in.

Stamp duty for second homes also attracts a 3 percent surcharge from April. 500000 is the most popular property value entered into our stamp duty calculator. From 1 October the 0 stamp duty threshold will return to 125000 or 300000 for first time buyers purchasing a property worth up to 500000.

New stamp duty rates are in effect July 8th 2020 until June 30th 2021 in England and Northern Ireland. Northern Ireland stamp duty rates from 1 July From 1 July 2021 the threshold at which you start paying stamp duty in England and Northern Ireland will decrease to 250000. After this date the 0 stamp duty threshold will be reduced from 500000 to 250000 for three months until 30 September 2021.

Stamp duty calculations - Additional property. 05052015 Use the SDLT calculator to work out how much tax youll pay. Stamp duty refunds are available for home movers replacing their main residence.

The field below will automatically show the stamp duty payable when you enter the purchase price. Rates are different depending on whether you are buying in England. Min cost of property.

03032021 The stamp duty holiday has been extended from 31 March to 30 June 2021. If the property is an additional property or second home there will be an extra 3 to pay on top of the relevant standard rates. Mobile homes caravans and houseboats are exempt.

Northern Ireland Wales or Scotland. However you will still have to pay the stamp duty. 03032021 Buy to let stamp duty and second home SDLT rates in England and NI.

The temporary rates for people buying main residences in England and NI between 1 July and the end of September are shown in the table below. 11122020 The Stamp Duty Tax rates for second homes and buy-to-let properties are the same because they both qualify as second residences. Homebuyers can enjoy full stamp duty malaysia exemptions on the instrument of transfer and loan agreement when buying a house.

01042021 Calculate how much stamp duty tax to pay when buying a UK second home or buy-to-let property in 2020 or 2021 with our buy to let stamp duty calculator. 01042021 How much is stamp duty for second homes. 156 days before the 30 June 2021 stamp duty holiday deadline is 25 January 2021.

If youre purchasing a buy-to-let property or second home youll pay 3 extra on each band. The original home must be sold within 3 years. For semi detached homes its 156 days.

And for terraced houses the median is 164 days.

Home Loan Approval Process Flowchart Home Loans Loan Mortgage Brokers

Home Loan Approval Process Flowchart Home Loans Loan Mortgage Brokers

With Accountants Brighton As Your Appointed Tax Advisers Brighton We Can Help Reduce Your Income T Mortgage Interest Rates Home Mortgage Current Mortgage Rates

With Accountants Brighton As Your Appointed Tax Advisers Brighton We Can Help Reduce Your Income T Mortgage Interest Rates Home Mortgage Current Mortgage Rates

Paying Stamp Duty On Property Not As Easy As 1 2 3 Business News Top Stories The Straits Times

Paying Stamp Duty On Property Not As Easy As 1 2 3 Business News Top Stories The Straits Times

Hoc 2020 Get 10 Discounts Free Stamp Duty When You Buy A House

Hoc 2020 Get 10 Discounts Free Stamp Duty When You Buy A House

Property Jargon Of The Day Buyers Stamp Duty Bsd 99 Co

Property Jargon Of The Day Buyers Stamp Duty Bsd 99 Co

Foreigners Rush To Save Thousands In Uk Stamp Duty Hike Australia Property Investment Uk Property Investment Csi Prop

Foreigners Rush To Save Thousands In Uk Stamp Duty Hike Australia Property Investment Uk Property Investment Csi Prop

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

New Tax Regime Tax Slabs Income Tax Income Tax

New Tax Regime Tax Slabs Income Tax Income Tax

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia Propertyguru Malaysia

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia Propertyguru Malaysia

Stamp Duty Legal Fees Malaysia 2021 For Purchasing A House

Stamp Duty Legal Fees Malaysia 2021 For Purchasing A House

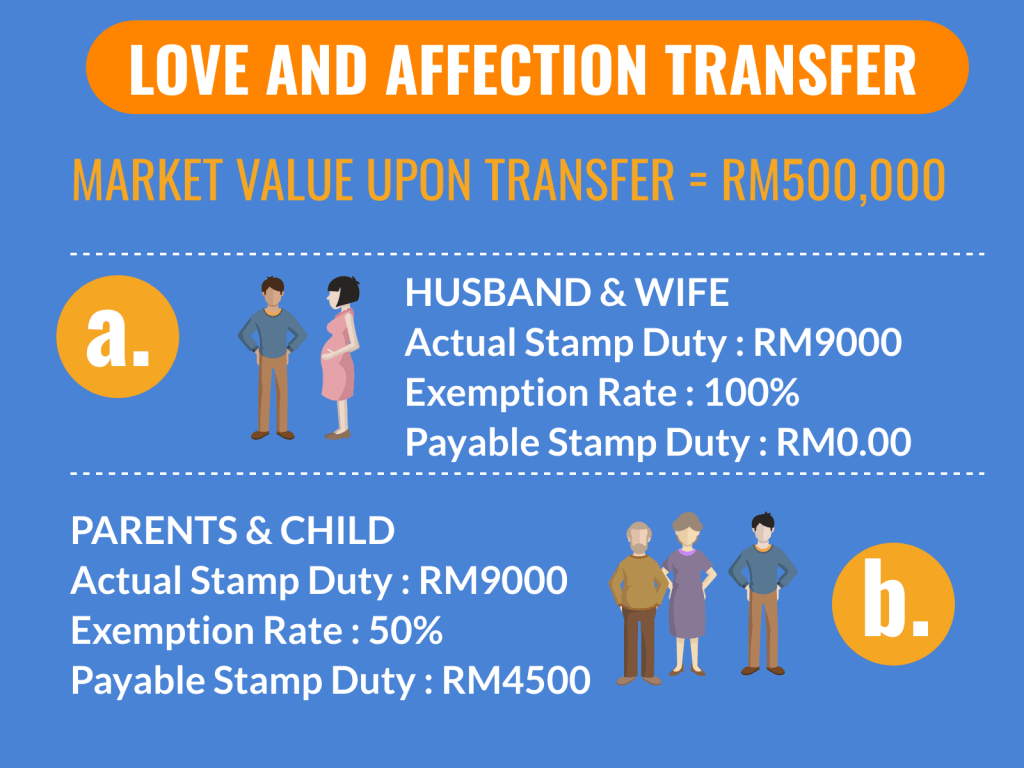

How To Transfer Property Ownership Between Family Members In Malaysia Propsocial

How To Transfer Property Ownership Between Family Members In Malaysia Propsocial

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

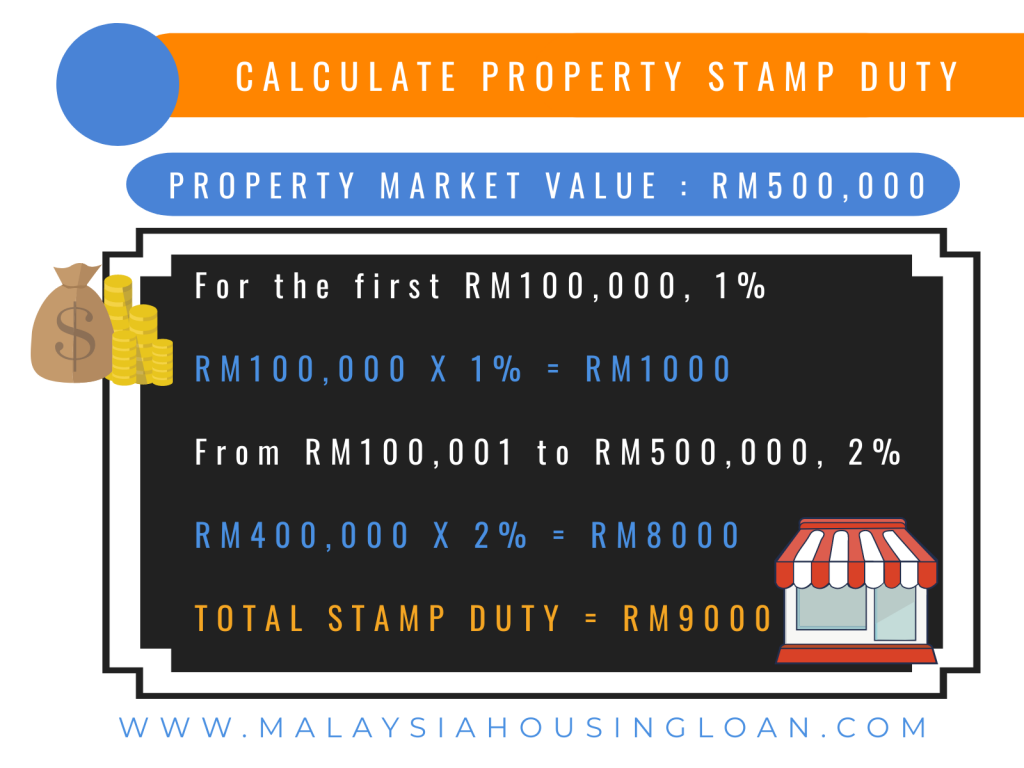

Legal Fees Calculator Stamp Duty Malaysia Housing Loan 2021

Legal Fees Calculator Stamp Duty Malaysia Housing Loan 2021

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Post a Comment for "Stamp Duty Calculator 2021 Second Home"