Is Stamp Duty Going To Change In 2020

08072020 Stamp Duty Land Tax. Instead of paying stamp duty upfront it would be replaced by an annual land tax.

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Budget 2020 changes 14102019.

Is stamp duty going to change in 2020. Excessive Stamp Duty charges have been an obstacle for those on all levels of the property ladder. 05032020 What are the changes to Stamp Duty going to be in 2020. Stamp duty is a.

The rate of Stamp Duty charged on the premium component of a. Stamp duty collection under the new system. Until 31 March 2021 buyers in England and Northern Ireland wont.

Temporary reduced rates Reduced rates of Stamp Duty Land Tax SDLT will apply for residential properties purchased from 8 July 2020 until 30 June 2021 and from 1 July 2021 to. Stamp duty and planning changes in the 2020 Budget. 03032021 Now after intense pre-Budget speculation the Chancellor has announced that the stamp duty holiday will continue until 30 June 2021.

02092020 Stamp duty changes 2020 Chancellor Rishi Sunak announced temporary stamp duty changes in 2020 which could save home buyers money. First time buyer rates are currently the same as previous homeowners with all individuals benefitting from the stamp duty holiday which is set to last until 31st March 2021. 19112020 The New South Wales government is proposing to abolish stamp duty as part of its 2020-21 budget announcement on 17 November 2020.

After weeks of speculation on how Rishi Sunak would plan for the future of the UK housing industry his speech yesterday. Will There Be Changes In 2020. 17112020 Stamp duty in NSW is approximately 4 per cent so based on Sydneys median house price of 1154406 buyers currently pay approximately 46176.

This would mean nine out of 10 people buying a main home this year would pay no Stamp Duty. Changes in Stamp Duty. Here are some of the key points for the property market.

After that the point at which you start paying stamp duty will be reduced to 250000 double the normal level until the end of September. The cut is applicable to lease agreements of over 29 years. The stamp duty on lease deed has been reduced to 2 from 5 till December 31 2020 and to 3 from January 1 2021 to March 31 2021.

14042021 The state government on December 24 2020 announced a reduction in the stamp duty on lease agreements of immovable property. 5 March 2020 Theres been much excitement over the last few months about the prospect of some quite drastic changes to Stamp Duty that could mean a substantial reduction in tax liability for many. 19042021 Stamp duty is a tax paid on property purchases.

07072020 Currently stamp duty is not payable on the first 125000 with the rate being two percent up to 250000. The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949 TYPES OF DUTY. Revenue has brought important changes in Stamp Duty practice to the Societys attention.

The stamp duty holiday will be applied. 08072020 According to Mr Sunak the average Stamp Duty bill will fall by 4500 due to the changes. 08012020 Last summer Prime Minister Boris Johnson said during his Tory leadership campaign that he would consider raising the stamp duty threshold from 125000 to 500000 and cutting the top SDLT rate from 12 to seven per cent.

19032013 The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. Visitors This Year. As you know the rate of Stamp Duty on the transfer of non-residential property head of charge is increased from 6 to 75.

Several people in the property industry have called upon current Prime Minister Boris Johnson to act decisively on his previously proposed plan of scrapping Stamp Duty for homes costing less than 500000. Please refer to our stamp duty for first time buyers page for more information. 15072020 The Government of India recently announced certain changes to the stamp duty which will be effective from 1 st July 2020.

The level at which it starts having to be paid was raised from 125000 to 500000 in July. The changes in stamp duty were earlier scheduled to be implemented from January but it was put off to April and then July. New Chancellor Rishi Sunak pledged to get Britain building in his first Budget speech yesterday.

A stamp duty holiday was introduced by the UK Government on 8th July 2020. Homebuyers will pay five percent.

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Access Bank To Refund Controversial Stamp Duty Changes Stamp Duty Paid Stamp Stamp

Access Bank To Refund Controversial Stamp Duty Changes Stamp Duty Paid Stamp Stamp

Income Tax Changes For Ay 2018 19 Ay 2019 20 And Ay 2020 21 Accounting Taxation Income Tax Tax Deductions Tax Payment

Income Tax Changes For Ay 2018 19 Ay 2019 20 And Ay 2020 21 Accounting Taxation Income Tax Tax Deductions Tax Payment

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate And Construction Malaysia

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate And Construction Malaysia

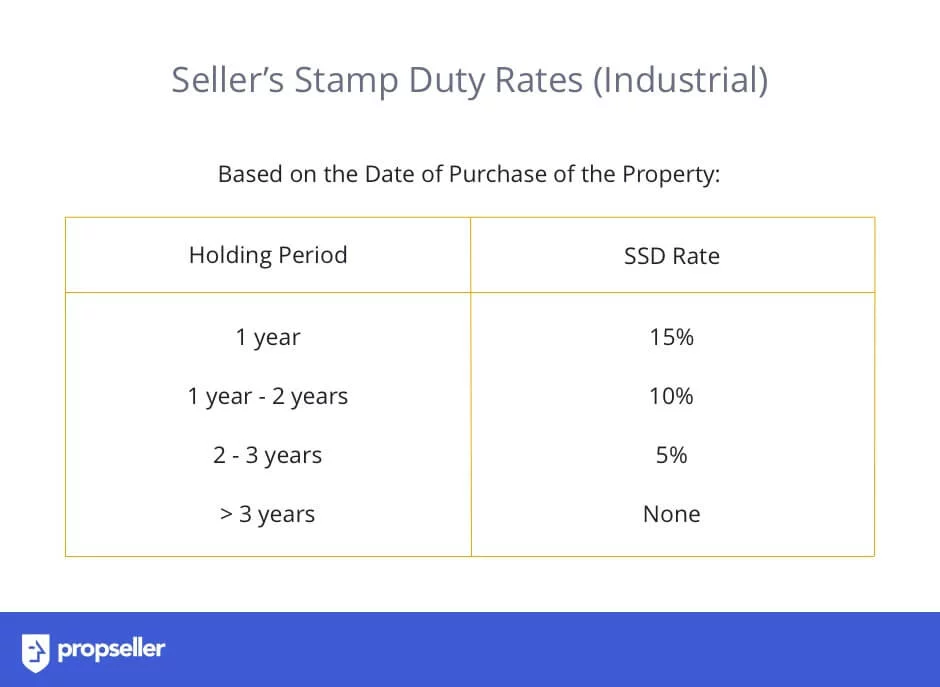

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

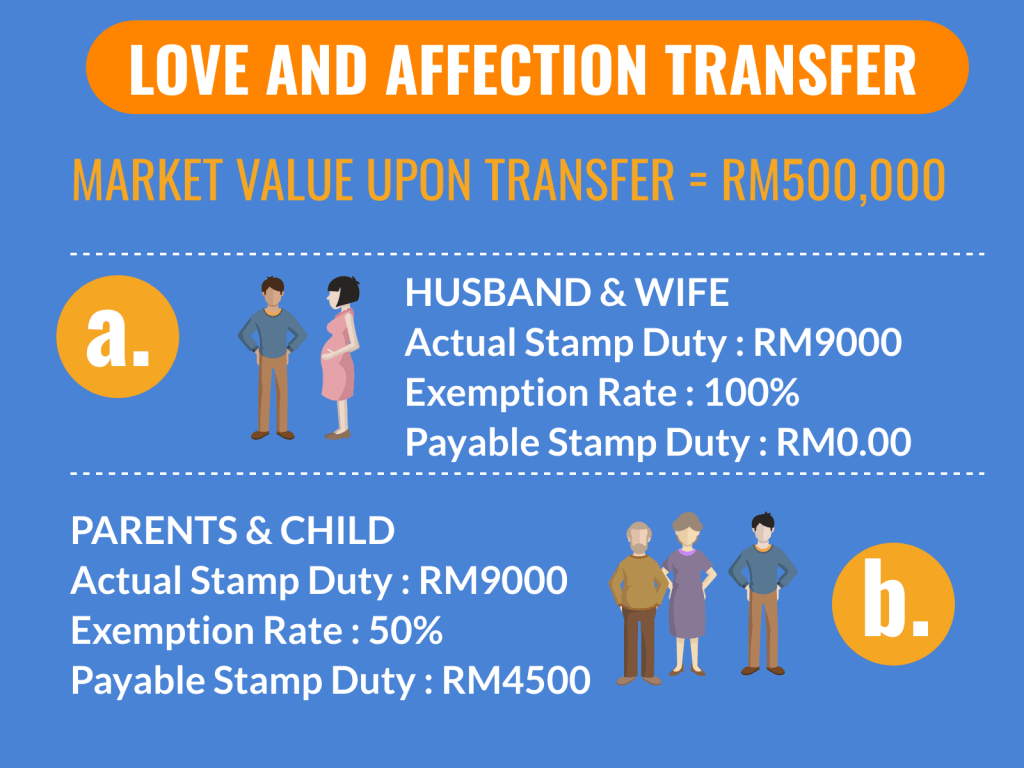

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

Stamp Duty Holiday Explained Who Will Benefit From It And Who Will Not Stamp Duty Real Estate Buying Stamp

Stamp Duty Holiday Explained Who Will Benefit From It And Who Will Not Stamp Duty Real Estate Buying Stamp

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Cover Story Secondary Market Seeing More Interest The Edge Markets

Cover Story Secondary Market Seeing More Interest The Edge Markets

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

What Bubble At The Moment After Pent Up Demand And Changes In Stamp Duty The Property Market Has Gone Cray Cr Stamp Duty Property Marketing Investing

What Bubble At The Moment After Pent Up Demand And Changes In Stamp Duty The Property Market Has Gone Cray Cr Stamp Duty Property Marketing Investing

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Stamp Duty Holiday Explained What Does It Mean For You

Stamp Duty Holiday Explained What Does It Mean For You

Post a Comment for "Is Stamp Duty Going To Change In 2020"