Is Stamp Duty An Expense Or Capital

2 Expenditure incurred wholly and exclusively for the purpose of transfer is brokerage commission and advertisement expenses. If the Stamp Duty relates to a capital purchase normally it is capitalised with the associated asset ie.

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

You could use a GST code Capital Acquisition - No GST.

Is stamp duty an expense or capital. 25022020 Stamp Duty General Relief From Stamp Duty. 20062020 Stamp duty is the tax governments place on legal documents usually in the transfer of assets or property. Another reason to use an accountant.

It is held that Impugned expenditure did not involve any element of premium. A tax deduction will be given on expenses incurred by the companies for provision of disposable PPE such as face masks to the employees. STAMP DUTY 1 100 Stamp Duty Exemption on Loan Restructuring and Rescheduling Agreements.

Stamp duty is a capital cost and isnt immediately tax deductible. Posted 4 years ago. Stamp Duty on land would be a capital expense.

As a new tax code with 0 as the rate. Appropriate tax planning can help ensure you minimise any stamp duty and capital gains tax liabilities when you buy or restructure a business. 03062020 Assessee-company claimed deduction of Rs.

When selling an investment stamp duty can decrease your capital gains tax CGT liability through increasing the property cost base. Stamp duty on buying shares is cost to the purchaser. But remember if you are a first home buyer many States and Territories offer stamp duty concessions or exemptions along with first home owner grants for properties valued up to a certain amount which can help you with your costs.

Stamp Duty is not liable for GST. Amendments To The Stamp Act 1949. 27012016 You are correct.

The Supreme Court in the case of Brooke Bond India Ltd5 and Punjab State Industries Development Corpn. Governments impose stamp duties also known as stamp taxes on. The payment of stamp duty can be relating to various transactions which can be capital or revenue in nature depending upon the facts of each case.

Business licence renewal fee. Any help would be appreciated. 1 Stamp duty and registration cost are treated as part of cost of acquisition and will be indexed for the calculation of long term capital gain.

Renovation costs except for qualifying expenditure which can be claimed under Section 14Q deduction Start-up expenses such as licence fee registration fee signboard fee Running Costs. Real Estate Motor Vehicle Etc. You may need to create this in Tax Codes.

They have logged this under legal fees but is Stamp Duty on share transfers a revenue expense or capital expenditure. Capital allowances on fixed assets purchased for business use. Ltd6 while dealing with the stamp dutiesfees paid for increase in authorised capital of the.

Stamp duty charged by your state or territory government on the transfer purchase of the property title this is a capital expense legal expenses including solicitors and conveyancers fees for the purchase of the property this is a capital expense. Purchase of fixed assets. Non-disposable PPE will be entitled to capital allowance.

Legal fees and stamp duty on new lease agreement. Stamp duty capital gains tax and other tax considerations can be important elements of a corporate finance transaction. This means that ultimately stamp duty is in fact tax deductible on an investment property just not when filing your annual tax return.

Unfortunately home buyers who plan to live in the property they buy cannot claim stamp duty as a tax deduction. 192 lakhs incurred towards stamp duty and registration charges for execution of lease deed by Noida unit of assessee. 19122018 Is Stamp Duty a business expense.

20012020 Stamp duty is a form of tax charged by State and Territory Governments. A company client of mine has transferred shares to another company and paid the relevant Stamp Duty. 19032018 This is because your stamp duty costs qualify for being deducted from your overall Capital Gains Tax bill when you sell the property.

Tax planning is also a key issue if you are thinking of selling a business. AO held the expenditure to be of capital in nature.

Zenith Bank Dragged By Twitter User Over N500 Stamp Duty Charges First Bank Zenith Banking Services

Zenith Bank Dragged By Twitter User Over N500 Stamp Duty Charges First Bank Zenith Banking Services

Nidhi Company Vs Micro Finance Company Company Finance Stamp Duty

Nidhi Company Vs Micro Finance Company Company Finance Stamp Duty

Brighton Accountant As Your Appointed Tax Advisers We Can Help Reduce Your Income Tax Ensuring All Allowable Expense Capital Gains Tax Tax Advisor Business Tax

Brighton Accountant As Your Appointed Tax Advisers We Can Help Reduce Your Income Tax Ensuring All Allowable Expense Capital Gains Tax Tax Advisor Business Tax

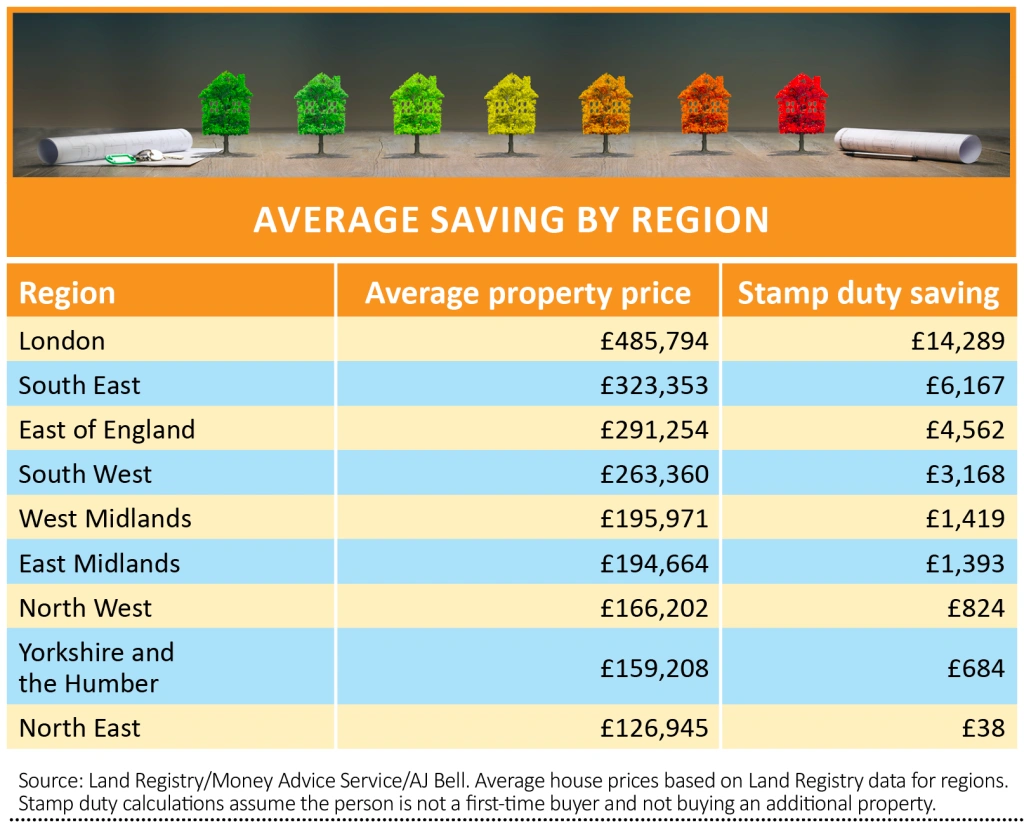

Doing The Maths On The Temporary Stamp Duty Relief Shares Magazine

Doing The Maths On The Temporary Stamp Duty Relief Shares Magazine

Indirect Tax Indirect Tax Tax Custom

Indirect Tax Indirect Tax Tax Custom

Stamp Duty Legal Fees For Purchasing A House Wma Property

Stamp Duty Legal Fees For Purchasing A House Wma Property

Doing The Maths On The Temporary Stamp Duty Relief Shares Magazine

Doing The Maths On The Temporary Stamp Duty Relief Shares Magazine

Indirect Tax Indirect Tax Tax Custom

Indirect Tax Indirect Tax Tax Custom

Stamp Duty Housing Ministry Advises States To Reduce Stamp Duty On Property Transactions Real Estate News Et Realestate

Stamp Duty Housing Ministry Advises States To Reduce Stamp Duty On Property Transactions Real Estate News Et Realestate

A Guide To China S Stamp Duty China Briefing News

A Guide To China S Stamp Duty China Briefing News

Top Builders In Bangalore Commercial Complex Development Home Buying

Top Builders In Bangalore Commercial Complex Development Home Buying

Record Fixed Asset Purchase Properly Manager Forum

Record Fixed Asset Purchase Properly Manager Forum

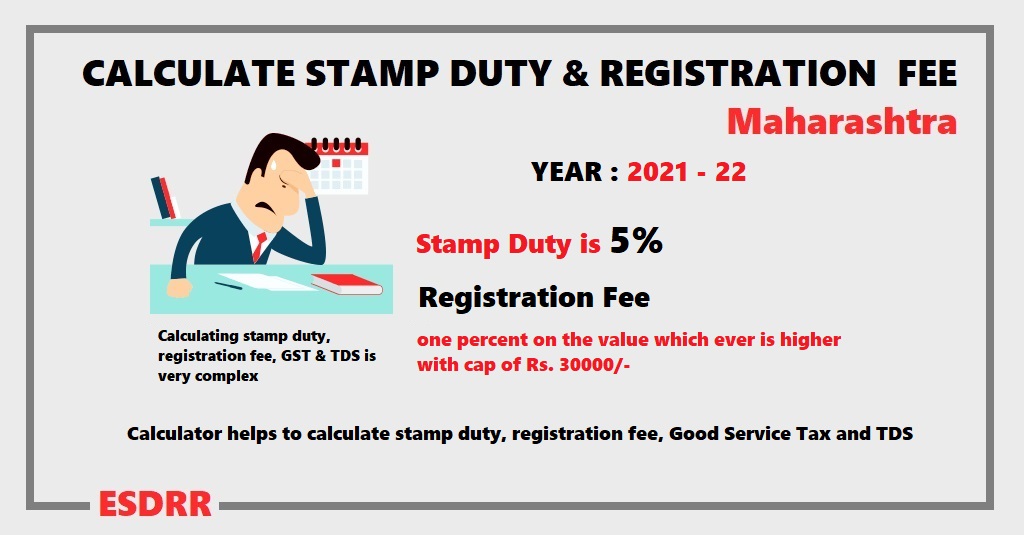

Stamp Duty And Registration Fee Calculator Mahrashtra

Stamp Duty And Registration Fee Calculator Mahrashtra

Calculate Stamp Duty And Registration Charges On Property

Calculate Stamp Duty And Registration Charges On Property

Income Under The Head House Property With Questions And Answers Accounting Taxation This Or That Questions Income House Property

Income Under The Head House Property With Questions And Answers Accounting Taxation This Or That Questions Income House Property

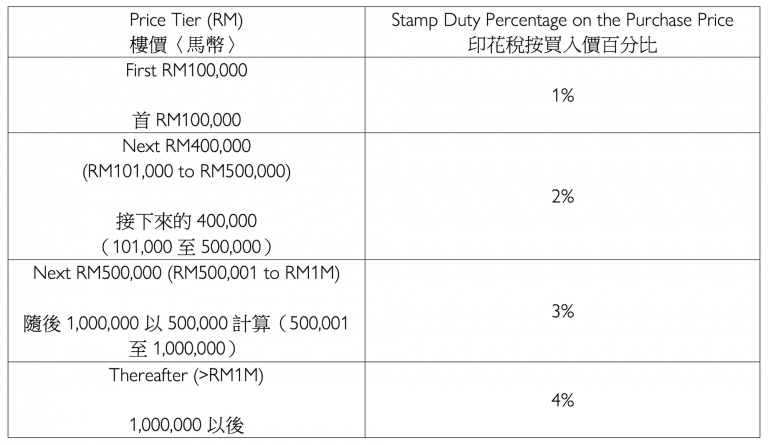

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Https Www Skrine Com Skrine Media Assets Alert 260620 Taxes Buy Sell Prty Pdf

Post a Comment for "Is Stamp Duty An Expense Or Capital"