For Stamp Duty Meaning

If youre buying your main property up until 30 June 2021 you will not have to pay Stamp Duty on properties costing up to 500000. 03032021 With the zero-rated stamp duty limit extended to 250k until the end of September and the average UK house price being 252k it means that thousands of people can benefit from this incentive particularly first and second-time buyers.

Estate Agents Call Osborne S Stamp Duty Shake Up A Kick In The Guts Stamp Duty Osborne Estate Agent

Estate Agents Call Osborne S Stamp Duty Shake Up A Kick In The Guts Stamp Duty Osborne Estate Agent

The level at which it starts having to be paid was raised from 125000 to 500000 in July 2020.

For stamp duty meaning. Where a stamp is essential to the legal validity of an instrument that instrument cannot be used as evidence in civil. Equitable mortgage means an agreement or memorandum under. Heres when the stamp duty holiday has been extended until what happens after it ends.

Stamp duties are either AD VALOREM where the amount of duty payable varies according to the value of the transaction effected by the instrument or fixed in amount whatever the effected value. Historically this included the majority of legal documents such as cheques receipts military commissions marriage licences and land transactions. The term stamp duty land tax SDLT refers to a tax imposed by the UK.

The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. 1 day ago The extension of the stamp duty holiday has been welcomed by many prospective homebuyers. The duty may be fixed or ad valorem meaning that the tax paid as a stamp duty may be a fixed amount or an amount which varies based on the value of the products services or property on which it is levied.

A UK tax that you pay when you buy a house apartment etc or when you buy shares. This means that anything that is owned by one of the partners is considered to be jointly owned. 19042021 Stamp duty is a tax paid on property purchases.

Economics A tax levied upon certain documents. The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949. Stamp Duty is a tax you might have to pay if you buy a residential property or a piece of land in England or Northern Ireland over a certain price.

14092011 Stamp duty means a tax payable on certain legal documents specified by statute. Stamp duty is a tax that is levied on documents. 28022014 Subject to the conditions set out in section 45 of the Stamp Duty Ordinance the Ordinance stamp duty relief is available for the transfer of immovable property or shares from one associated body corporate to another.

The move was aimed at helping buyers whose finances. Stamp duty - a tax collected by requiring a stamp to be purchased and attached usually on documents or publications stamp tax revenue enhancement tax taxation - charge against a citizens person or property or activity for the support of government. A physical stamp had to be attached to or impressed upon the document to denote that stamp duty had been paid before the document was.

16112020 Stamp duty is a tax on legal documents and is divided into two categories. In Britain stamp duty is a tax that you pay to the government when you buy a house. Government on the purchase of land and properties with values over a certain threshold.

The move means there is more time to buy a home with no stamp duty to pay on properties under 500000. Duty means any stamp duty for the time being chargeable under this Act or under any written law. A stamp being applied to show that tax has been paid.

Stamp duty is an important consideration in. We cover the tiers how to calculate it stamp duty exemption for first-time homebuyers as well as updates to stamp duty for 2021. The government is really looking to turn Generation Rent into Generation Buy.

19032013 An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. Meaning pronunciation translations and examples. For the purposes of the stamp duty land tax surcharge couples who are married or in a civil partnership are treated as one person.

Stamp duty a tax imposed on written instruments eg.

Stamp Duty Valuation And Property Management Department Portal

Stamp Duty Valuation And Property Management Department Portal

Youtube Chartered Accountant Taxact Stamp Duty

Youtube Chartered Accountant Taxact Stamp Duty

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

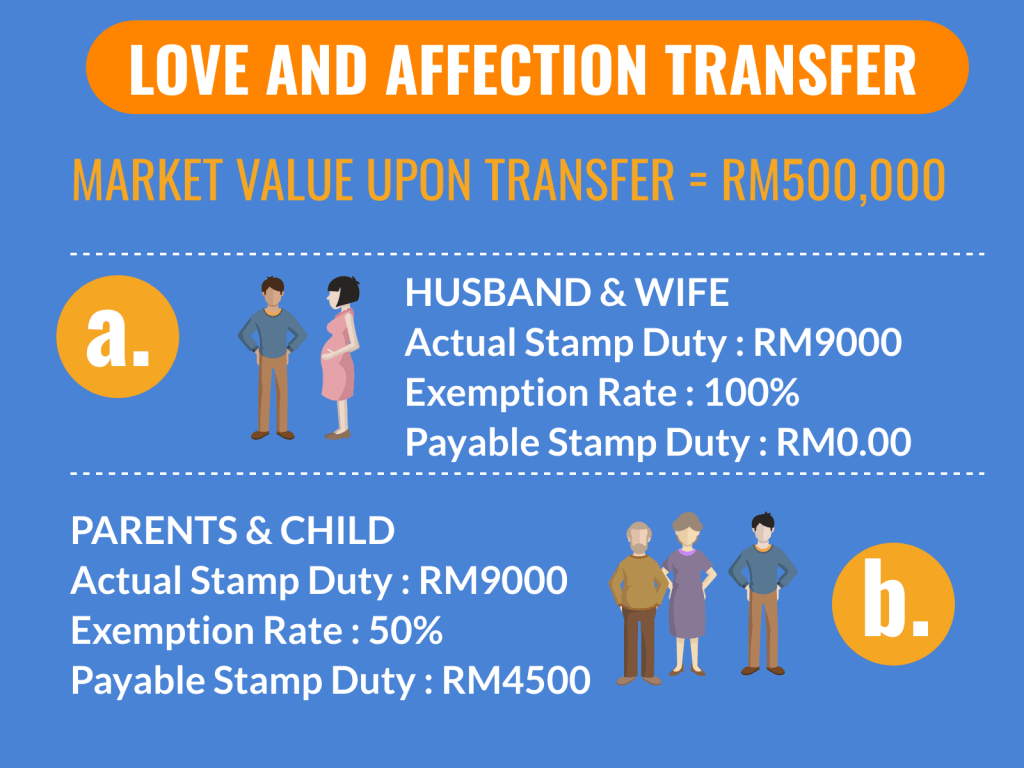

Transfer Of Property Between Family Members In Malaysia 2020 Love And Affection Property Transfer Malaysia Housing Loan

Transfer Of Property Between Family Members In Malaysia 2020 Love And Affection Property Transfer Malaysia Housing Loan

Burma Official 1947 Scott O55 10r Dark Violet Carmine Regular 1947 Overprinted Issue With Additional Service Op In Black Burma Stamp World Stamp

Burma Official 1947 Scott O55 10r Dark Violet Carmine Regular 1947 Overprinted Issue With Additional Service Op In Black Burma Stamp World Stamp

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Market Valuation Guidelines Of Land Property For Stamp Duty In Mp Ch Government Market Valuation Value Guideline Chhattisgarh Marketing Stamp Duty

Market Valuation Guidelines Of Land Property For Stamp Duty In Mp Ch Government Market Valuation Value Guideline Chhattisgarh Marketing Stamp Duty

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Legal Fees Calculator Stamp Duty Malaysia Housing Loan 2021

Legal Fees Calculator Stamp Duty Malaysia Housing Loan 2021

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Indirect Tax Indirect Tax Tax Custom

Indirect Tax Indirect Tax Tax Custom

Indirect Tax Indirect Tax Tax Custom

Indirect Tax Indirect Tax Tax Custom

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Hoc 2020 Get 10 Discounts Free Stamp Duty When You Buy A House

Hoc 2020 Get 10 Discounts Free Stamp Duty When You Buy A House

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Dlc Rates In Rajasthan Igrs Stamp Duty Property Registration What Are Dlc Rates In Rajasthan For Stamp Duty Calculation P Stamp Duty Property Rajasthan

Dlc Rates In Rajasthan Igrs Stamp Duty Property Registration What Are Dlc Rates In Rajasthan For Stamp Duty Calculation P Stamp Duty Property Rajasthan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Post a Comment for "For Stamp Duty Meaning"