Can Stamp Duty Be Capitalize Ias 16

IAS 16 shall be applied in accounting for property plant and equipment except for. 20092017 Incentives received before commencement date of the lease these are defined within IFRS 16 as Payments made by a lessor to a lessee associated with a lease or the reimbursement or assumption by a lessor of costs of a lessee.

Cost Of Property Plant And Equipment Ias 16 Ifrscommunity Com

Cost Of Property Plant And Equipment Ias 16 Ifrscommunity Com

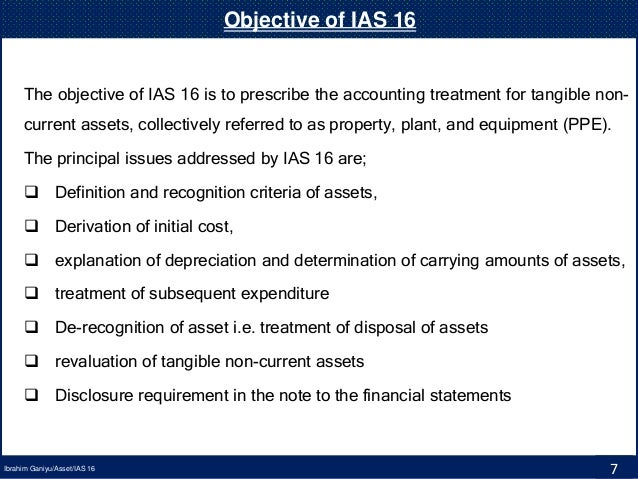

The stamp duty is an example non- refundable tax which must be capitalized as part of the cost of the asset acquired.

Can stamp duty be capitalize ias 16. Pro fees are expensed under IAS 16 but im not sure about the Stamp Duty. IAS 16 specifies that exchange of items of property plant. Judgement is therefore required in applying the recognition criteria to an entitys specific circumstances.

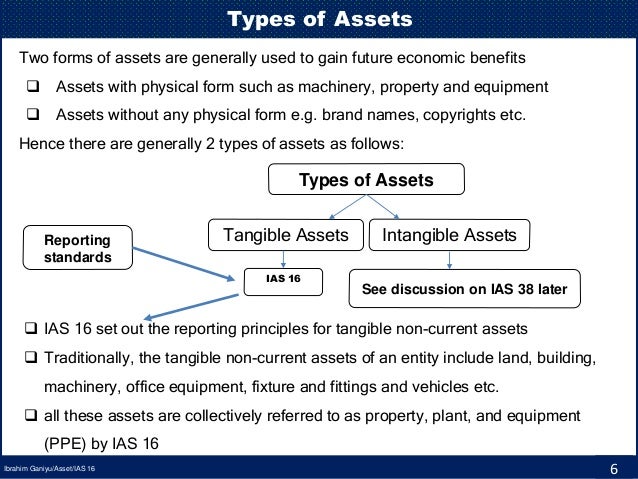

When you construct an item of PPE and your pre-operating expenses were incurred in relation to constructing that PPE then you can capitalize them if they meet the IAS 16 criteria. 06122011 Software essential to the operation of the hardware is capitalized as part of the hardware cost as per IAS 16. Biological assets related to agricultural activity refer IAS.

Initial Recognition for Allowable Internally-Generated Intangible Assets. According to IAS 16 these costs can be capitalized. Cost of the plant 2500000 2.

I normally capitilise the expense IN NCA. Can be capitalized in accordance with IAS 16. According to IAS 16 the purchase price of the asset includes the amount of non-refundable taxes ie.

Examples of lease incentives could be an initial cash payment to the lessee or a reimbursement of certain lessee costs associated. In April 2001 the International Accounting Standards Board Board adopted IAS 16 Property Plant and Equipment which had originally been issued by the International Accounting Standards Committee in December 1993. 06022009 I have found no mention for the treatment of Stamp Duty of a Property.

12022021 IAS 16 is more specific with replacement parts which are included in the cost of PPE but the parts being replaced must be derecognised IAS 1613. Initial delivery and handling costs 200000 3. Such taxes which cannot be claimed back are capitalized and are included in the cost of the asset at the time of purchase.

It may be appropriate to aggregate individually insignificant items and to apply the criteria to the aggregate value IAS 169. Machineries and it. If the acquired item is not measured at.

Equipment regardless of whether the assets are similar are measured at fair value unless the exchange transaction lacks commercial substance or the fair value of neither of the assets exchanged can be measured reliably. 02122010 We have purchased land and buildings and I am wondering whether the stamp duty can be capitalised. Capitalization is allowed only for costs incurred to defend or register a patent trademark or similar intellectual property successfully.

IAS 16 Property Plant and Equipment replaced IAS 16 Accounting for Property Plant and Equipment issued in March 1982. IAS 16 does not prescribe the unit of measure for recognition that is what constitutes an item of PPE. The depreciation period of RoU should not exceed the lease term unless the lease contract transfers ownership of the underlying asset to the customer lessee by the end of the lease term or if the cost of the right-of-use asset reflects that the lessee will exercise a purchase option IFRS 16.

21122016 Yes non-refundable taxes incurred on the acquisition of items of PPE is to be capitalized according to IAS 16 PPE. Can anyone advise me on the correct treatemnt and the relevant standard in question. 02052009 The question is.

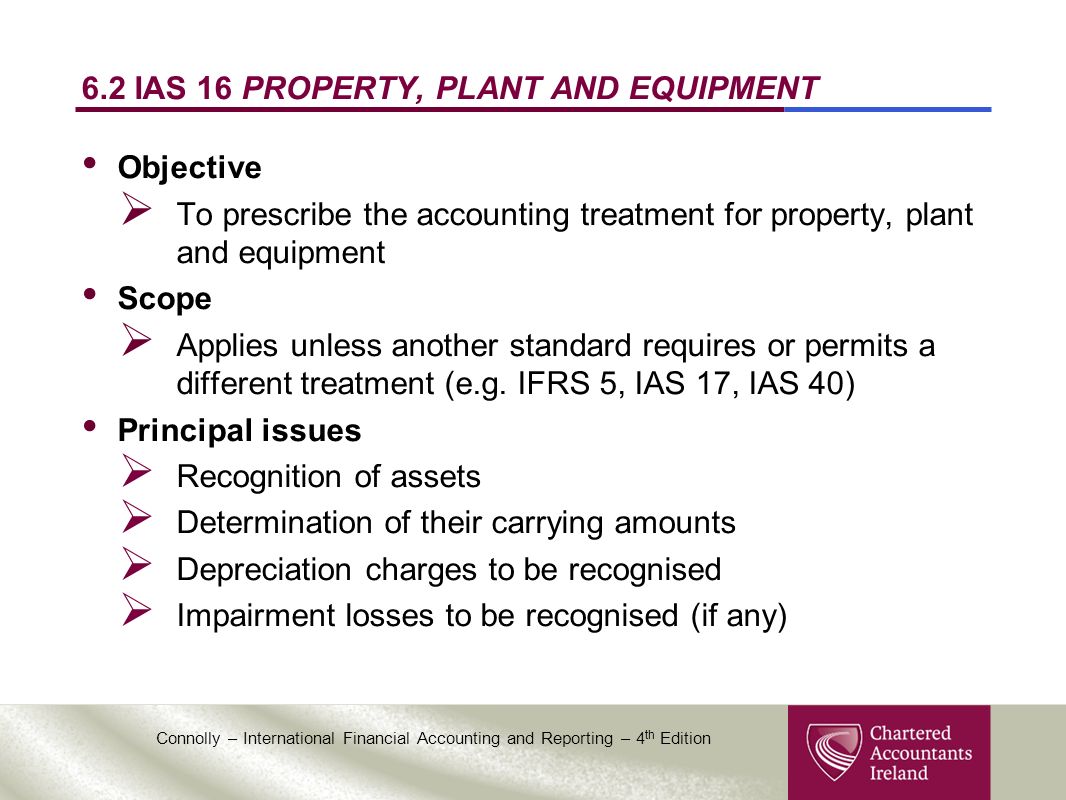

IAS 16 outlines the accounting treatment for most types of property plant and equipment. 23102017 There is one exception when you actually can capitalize pre-operating expenses. 01032010 In addition to the above Ias 16 also states that initial costs to be capitalized includes the costs which are necessary for its present location and conditionAs registration charges are necessary b4 we can use the asset so it shall be capitalized and we cannot expense it.

Standalone software packages will fall under IAS 38 to be put through the BEAUTI test. 22082018 According to IAS 16 if one asset is revalued all assets in that class should be revalued. 22062016 In short no this is a relocation cost and IAS 16 specifically says it cannot be capitalized but expensed as incurred.

08032021 The right-of-use RoU asset is depreciated in accordance with IAS 16 requirements IFRS 1631. Insurance of an asset Insurance premiums paid to the insurance companies cannot be capitalized but expensed in. Also companies can capitalize on the costs that they.

Property plant and equipment classified as held for sale in accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operations. 12082020 Exchange of assets. Property plant and equipment is initially measured at its cost subsequently measured either using a cost or revaluation model and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life.

Which costs of Dharma Putra Inc. It will often be the case that an entity will not know what is the cost of the replaced part as it was never separated when PPE was recognised IAS 16 requires a separation of significant parts for depreciation purposes. For example when the asset is purchased or imported then buyerimporter is required to pay different duties and taxes.

For instance if the company chooses to revalue its buildings.

Ias 16 Property Plant Equipment Ppe Ca Anuradha Jain Ppt Video Online Download

Ias 16 Property Plant Equipment Ppe Ca Anuradha Jain Ppt Video Online Download

Ifrs 16 Is Business As Usual For Lessors But Creates Complexity For Subleasing Arrangements Bdo Australia

Ifrs 16 Is Business As Usual For Lessors But Creates Complexity For Subleasing Arrangements Bdo Australia

Ias 16 Property Plant Equipment Ppe Ca Anuradha Jain Ppt Video Online Download

Ias 16 Property Plant Equipment Ppe Ca Anuradha Jain Ppt Video Online Download

Ias 16 Property Plant Equipment Ppe Ca Anuradha Jain Ppt Video Online Download

Ias 16 Property Plant Equipment Ppe Ca Anuradha Jain Ppt Video Online Download

Property Plant And Equipment Ias 16 Nhyira Premium University

Property Plant And Equipment Ias 16 Nhyira Premium University

Property Plant And Equipment Ias 16 Assignment

Property Plant And Equipment Ias 16 Assignment

Ifrs 16 Are You Ready Grant Thornton Insights

Ifrs 16 Are You Ready Grant Thornton Insights

Treatment Of Non Financial Assets Ias 16 17 40

Treatment Of Non Financial Assets Ias 16 17 40

Best Guide Ifrs 16 Lessor Modifications Annualreporting

Best Guide Ifrs 16 Lessor Modifications Annualreporting

Property Plant Equipment Ias 16 Ppt Download

Property Plant Equipment Ias 16 Ppt Download

Property Plant And Equipment Ppt Video Online Download

Property Plant And Equipment Ppt Video Online Download

F7 Financial Reporting Ias16 Studocu

F7 Financial Reporting Ias16 Studocu

Example Lease Accounting Under Ifrs 16 Youtube

Example Lease Accounting Under Ifrs 16 Youtube

Property Plant And Equipment Ppt Video Online Download

Property Plant And Equipment Ppt Video Online Download

Post a Comment for "Can Stamp Duty Be Capitalize Ias 16"