7500 Stamp Duty

Total stamp duty 7500. Between June and September 2021 the stamp duty threshold is 250000.

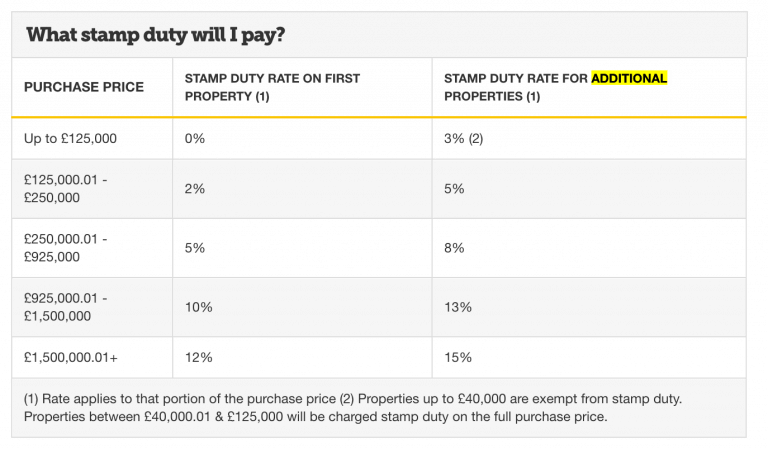

I cant believe how much stamp duty a buy-to-let investor now has to pay.

7500 stamp duty. If you are not liable for the higher rate surcharge and you are a UK resident your Stamp Duty calculation would be as below. 03032021 5 on the next 150000 7500. All those buying the property should be first time buyers.

28032019 The tax man has lost a legal challenge against paying enhanced stamp duty rates on the purchase of a derelict bungalow scheduled for demolition. Stamp Duty payable 27500. No 8 Jalan PJU 88A.

Your property cannot have a value of over 500000. Your total Stamp Duty Land Tax liability would be 7500. 03 - 7725 2201.

29092019 How Much Stamp Duty Do I Have to Pay During the Stamp Duty Holiday. Customs claimed the bungalow was a home even if the property was unfit to live in and sent buyers Paul and Nikki Bewley a stamp duty bill for 7500 as they were buying an additional home and already had a main. 01062020 petaling jaya branch menara hasil pj trade centre no 8 jalan pju 88a bandar damansara perdana 47820 petaling jaya selangor tel.

04052021 Stamp Duty payable 7500. This is in addition to the 7500 Stamp Duty bill that would need to be paid on a home of this value bringing the total payable to 27000. 25012013 Stamp duty to bill to hit 7500 for average homebuyer as official figures undercook actual house prices by 90000 By Simon Lambert Published.

Homebuyers in Scotland and Wales can also take advantage of. From 1 July 2021 - 5 of the value of the property above 250001 and. From 1 October 2021 2 of the value above 125001.

06082013 Higher stamp duty hits 25 of buyers. First-time buyers are losing out on more than 7500 when they move. The governments Stamp Duty temporary reduced rates are in place from 8 July 2020 to 30 June 2021.

To be eligible for this discount. They have increased the Stamp Duty threshold to 500000 which means you wont pay any Stamp Duty if youre buying a property in England or Northern Ireland for. The last time I invested I paid 2000 in stamp duty now it would be 7500.

0 on the first 250000 0 5 on the next 350000 17500. The rate you paid in terms of a percentage increased with the value of the property. With the new stamp duty holiday set to last until the end of June 2021 the new stamp duty tax threshold for buy-to-live purchases of a primary residence is 500000.

The stamp duty calculation is as follows. Thousands forced to pay more than 7500 when buying a home. With the new stamp duty in place you wont have to pay any stamp duty at all.

Stamp Duty payable 71250. If youre a first time buyer and the property youre buying is over 500000 youll need to follow the standard rate bands. 10000 calculated by 0 - 125k at 0 125K - 250k at 2 2500 250K- 400K at 5 7500 Stamp Duty is different for first time buyers.

04032021 For example if you buy a house for 350000 youd originally pay 7500 in stamp duty. It is important to remember that if the property you are buying replaces your main residence you will not be liable for the surcharge even if you own additional properties such as a second home or a flat you rent out at the same time. On a property purchased for 250000 the total stamp duty payable would be 7500.

Whilst homebuyers will start paying. For example this means that a house worth 350000 would incur a 7500 stamp duty charge. 03 - 7882 7500.

21072014 Home buyers will be paying an average of 7500 in stamp duty within two years if the current house price surge continues it is claimed. 05032007 One homebuyer in five is now paying stamp duty of at least 7500 representing nearly a fourfold increase in five years latest figures show. According to Chancellor Rishi.

0809 EDT 25 January 2013 Updated. 05052021 Total stamp duty 7500 You can work out how much you will have to pay by using a free stamp duty calculator on the government website. Theres never been a better time to buy a new home whether youre a first time buyer you already own a home or youre buying a second home.

In August 2021 you purchase a property for 600000. Stamp duty is payable at 3 within the initial band for purchases below 500000.

Maximise Stamp Duty Savings On London S Most Enviable New Builds Metro News

Maximise Stamp Duty Savings On London S Most Enviable New Builds Metro News

When Does The Stamp Duty Holiday End Manchester Evening News

When Does The Stamp Duty Holiday End Manchester Evening News

Stamp Duty Holiday Should I Buy A Property Now Hill Abbott Solicitors Chelmsford

Stamp Duty Holiday Should I Buy A Property Now Hill Abbott Solicitors Chelmsford

Returning Expats Face Property Tax Stamp Duty Forth Capital

Returning Expats Face Property Tax Stamp Duty Forth Capital

The Stamp Duty Effect Zoopla Co Uk Blog

The Stamp Duty Effect Zoopla Co Uk Blog

Stamp Duty In The United Kingdom Wikiwand

Stamp Duty In The United Kingdom Wikiwand

The Stamp Duty Effect Zoopla Co Uk Blog

The Stamp Duty Effect Zoopla Co Uk Blog

Stamp Duty Additional Residences Gard And Co Solicitors Plymouth

Stamp Duty Additional Residences Gard And Co Solicitors Plymouth

Investing In Property Without Paying Stamp Duty

Investing In Property Without Paying Stamp Duty

Sindh Collects Rs6bn From Stamp Duty Stamp Duty National Insurance Number Stamp

Sindh Collects Rs6bn From Stamp Duty Stamp Duty National Insurance Number Stamp

Stamp Duty Reform The Key Facts Stamp Duty The Guardian

Stamp Duty Reform The Key Facts Stamp Duty The Guardian

Stamp Duty Calculator Metric Investments

Stamp Duty Calculator Metric Investments

Stamp Duty In The United Kingdom Wikiwand

Stamp Duty In The United Kingdom Wikiwand

Post a Comment for "7500 Stamp Duty"