Stamp Duty Calculator For Rent Agreement Mumbai

Besides the registration charge for properties above Rs 30 lakh is Rs 30000 and for properties below Rs 30 lakh is 1 percent of the property cost. The leave and licence contract can be executed for up to 60 months.

Dlc Rates In Rajasthan Igrs Stamp Duty Property Registration What Are Dlc Rates In Rajasthan For Stamp Duty Calculation P Stamp Duty Property Rajasthan

Dlc Rates In Rajasthan Igrs Stamp Duty Property Registration What Are Dlc Rates In Rajasthan For Stamp Duty Calculation P Stamp Duty Property Rajasthan

Where stamp duty in mumbai is 10 of property value.

Stamp duty calculator for rent agreement mumbai. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. In Maharashtra holiday and licensing contracts must be stamped with a flat rate of 025 per cent of the total rent for this period. Stamp Duty and Registration Calculation for Leave and License Agreements TAGS.

09012015 Online calculator to calculate Tenancy Agreement Stamp Duty. Extra Visit- out of Maharashtra but within India- INR 1500. If a non-refundable bond is also paid to the lessor stamp duty will be levied at the same rate on these non-refundable bonds.

The onus of paying the stamp obligation generally vests on the customer of the property. 22022021 The formula to calculate stamp duty on rental agreement is 025 x D where D is Monthly rental x No of months Advance rent for the periodnon-refundable deposit 10 x Refundable deposit x No of years of the agreement. Stamp Duty Rates for Leave.

Extra Visit- within same city - INR 500. 05072015 The chart here shows how to Calculate Stamp Duty and Registration for Leave and License agreements. The payment of stamp duty on leave and licensing agreements are covered by Section 36A of the Bombay Stamp Act of 1958.

The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949. Rent Agreement Registration Online. As a result the Maharashtra government passed the Bombay Stamp Act in 1958.

REGISTRATION FEE along-with TAX. Stamp responsibility arrays from three percent to 10 percent 2 bhk flat for rent near Kharghar station depending on the piece chosen by the specific state. 18092020 The stamp duty in Mumbai is 2 percent till December 2020 and 3 percent from Jan 2021 to Mar 2021.

As per Maharashtra Rent Act 1999Maha XVIII of 2000 if the property location is in urban area then Registration fee is Rs 1000 If any other area then Rs 500. Licence and includes any advance rent paid or to be paid and further includes any deposit made or to be made with or without any interest. As such these charges can run into lakhs of rupees.

Average Rent per Month INR. The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. Here is a look at some of the frequently asked questions on stamp duty and rental agreements.

This amount varies from city to city and is paid by purchasing stamp paper worth the amount you owe to the government. 20062019 Stamp duty property value. Range 1 to 60.

Calculation is for a period of 12 months irrespective of period of leave. It is a new facility introduced by the Maharashtra Government which enables you to register Leave and License Rent Agreement online without visiting the sub registrar office. 03122020 An Example of rent agreement registration charges in Mumbai.

Rent Cant Not be Zero. For example if you enter into a leave and license agreement for 24 months with a monthly rent of Rs 25000 and a refundable deposit of Rs five lakhs you will have to pay a stamp duty of Rs 1750 being 025 on rent of Rs six lakhs for two years and interest of Rs one lakh for two. Fill in the basic details of owner tenant property and terms of agreement on our website.

04092020 To register a rent agreement you will need to pay a stamp duty on it. Out of claim credit reward only Rs 100- can be utilized while initiating your first agreement. Registration charges tend to be 1 of the propertys market value.

Extra Visit- out of city but within Maharashtra - INR 1000. The cost of stamp duty is generally 5-7 of the propertys market value. Number of additional copies to be stamped.

17122020 B enter into a leave and licence contract for 24 months with a monthly rent of Rs 25000 and a refundable deposit of five Lakhs you must pay a stamp duty of Rs 1750 with 025 on the rental of Rs six Lakhs for two years and Rs a Lakh for two years. 09082020 Stamp responsibility calculator. Calculation is same whether licence period is for 1 month or for 60 months.

To use this calculator. Remote Assistance- with device and within India - INR 2000. Stamp duty percentage of mumbai.

It is very easy to calculate for every term of twelve months just select the Months then input the Refundable Deposit Value and or Non Deposit Value if mentioned in document then select type of compensation rent and finally select property situated in Rural or Urban area and click on calculate button and you will get the STAMP DUTY. 10122020 The basic framework for stamp duty is defined in the Indian Stamp Act of 1899 which allows states to change the same rules according to their needs. Stamp Duty Calculation For Rental Agreement Registration.

To avoid any shortfall in funds when buying your home and registering the property in your name ensure that you also requisition for the stamp duty and. Remote Assistance- without device and within India - INR 500. Enter the monthly rental duration.

Stamp Duty Property Stamp Duty Stamp Duty Lease What Is Stamp Duty Stamp Duty Tax

Stamp Duty Property Stamp Duty Stamp Duty Lease What Is Stamp Duty Stamp Duty Tax

Charges For Stamp Duty Registration Mumbai

Charges For Stamp Duty Registration Mumbai

Stamp Duty In Uttar Pradesh Uttar Pradesh Notifies New Stamp Duty Rates On Registration Fee For Property Real Estate News Et Realestate

Stamp Duty In Uttar Pradesh Uttar Pradesh Notifies New Stamp Duty Rates On Registration Fee For Property Real Estate News Et Realestate

What Is The Stamp Duty On Rent Agreement Housing News

What Is The Stamp Duty On Rent Agreement Housing News

Rent Agreement Payslip Being A Landlord Agreement Notary Service

Rent Agreement Payslip Being A Landlord Agreement Notary Service

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Pin On Indian Real Estate And Property Market

Pin On Indian Real Estate And Property Market

Stamp Duty Attestation And Registration Of Lease And Agreements Ipleaders

Stamp Duty Attestation And Registration Of Lease And Agreements Ipleaders

States Must Consider Cutting Stamp Duty To Boost Demand Housing Secretary Real Estate News Et Realestate

States Must Consider Cutting Stamp Duty To Boost Demand Housing Secretary Real Estate News Et Realestate

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Whether All Agreements Should Be On Stamp Paper And Registered Legawise

Whether All Agreements Should Be On Stamp Paper And Registered Legawise

Karnataka Government Reduced Stamp Duty From 5 To 3 For Properties Up To Rs 35 Lakh

Karnataka Government Reduced Stamp Duty From 5 To 3 For Properties Up To Rs 35 Lakh

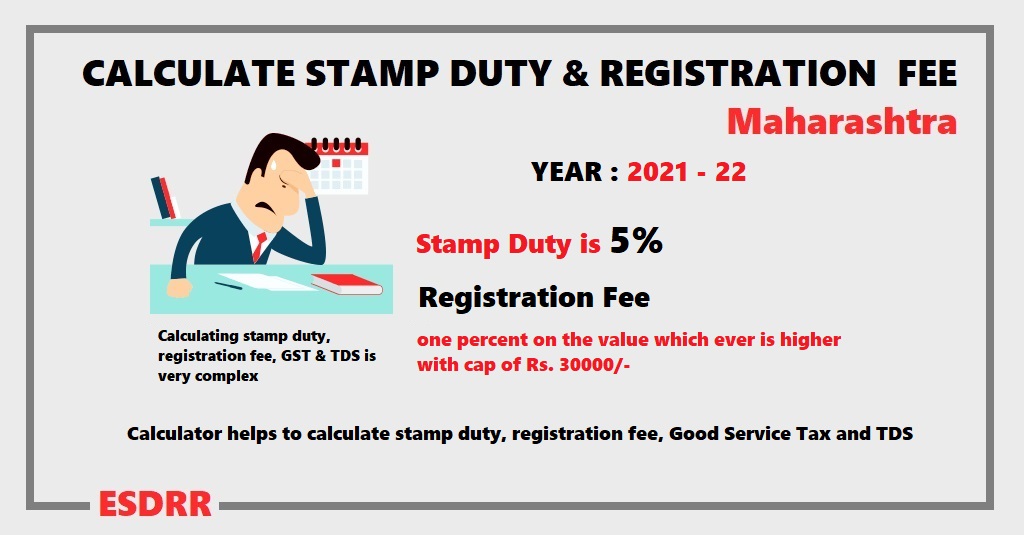

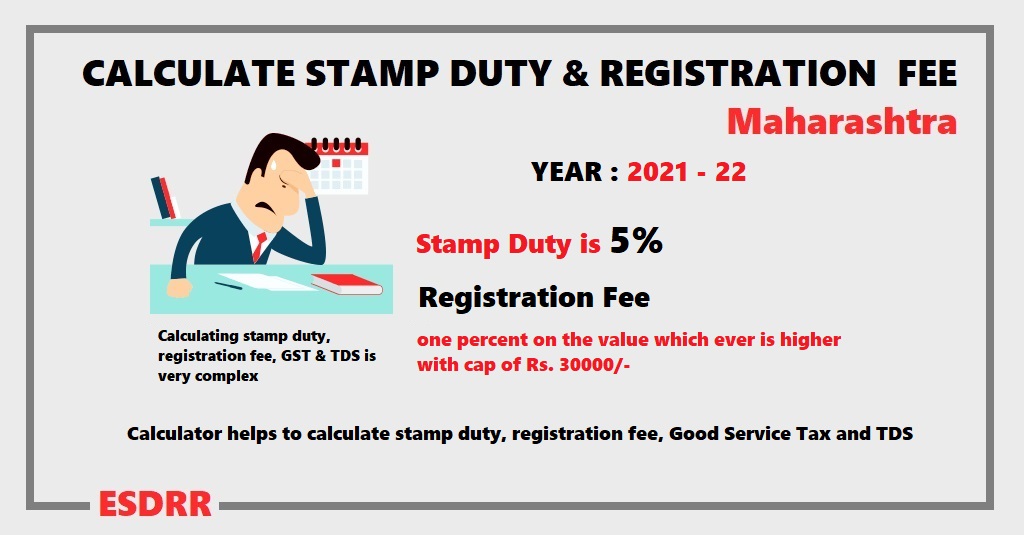

Stamp Duty And Registration Fee Calculator Mahrashtra

Stamp Duty And Registration Fee Calculator Mahrashtra

How To Register Rent Agreement Pay Stamp Duty Online In Maharashtra

How To Register Rent Agreement Pay Stamp Duty Online In Maharashtra

Facts About Stamp Duty In Property Purchase Housing News

Facts About Stamp Duty In Property Purchase Housing News

Pin By Sandeep Singh On Old Stamp Being A Landlord Paper

Pin By Sandeep Singh On Old Stamp Being A Landlord Paper

Who Bears The Rent Agreement Charges Tenant Or Landlord Quora

Post a Comment for "Stamp Duty Calculator For Rent Agreement Mumbai"