Is Stamp Duty Likely To Change In The Budget

The stamp duty cut is most likely to favour those living in the south of the country where house prices are more expensive especially in London where house prices have. 08052021 In March the government announced an extension to the stamp duty holiday launched last year for England and Northern Ireland.

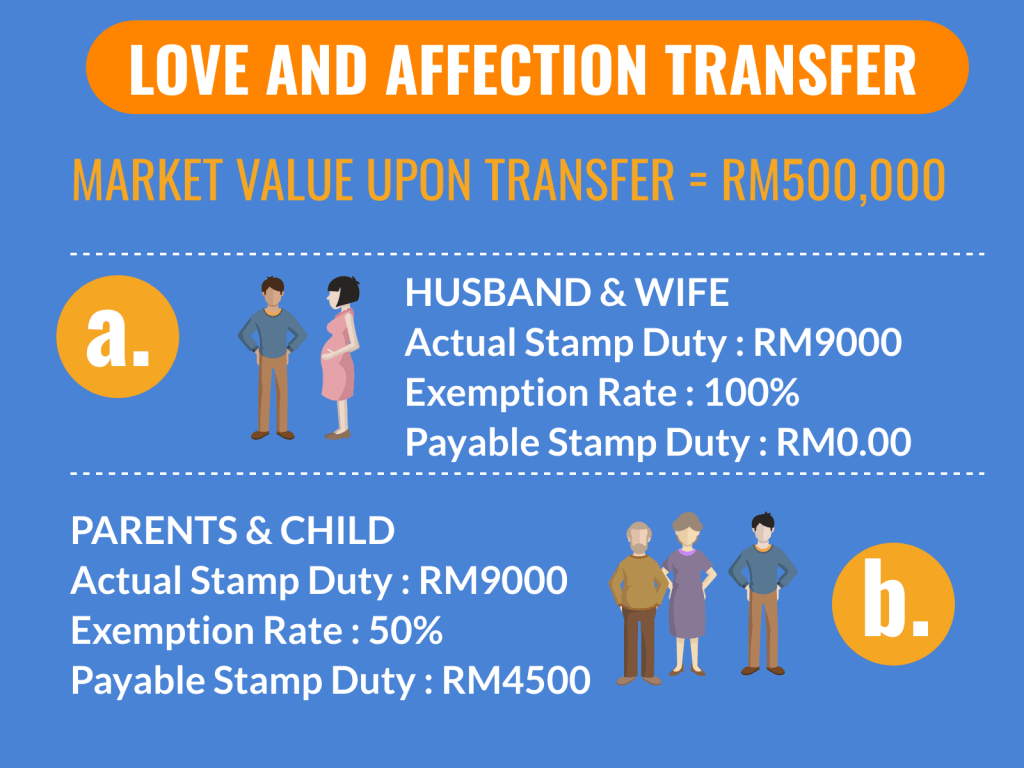

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

The stamp duty change on sub-500000 properties could have benefits for not only first-time buyers but also downsizers at the end of their lifespan.

Is stamp duty likely to change in the budget. 27022021 Rishi Sunaks budget on 3 March is set to unveil a range of measures to help support the recovery of the UK economy but tax rises are in the offing too. 28062019 Johnson is looking to prepare an emergency Budget to prepare for a no deal Brexit in September brought forward by October or November. First-time buyers of shared ownership.

19042021 Stamp duty is a tax paid on property purchases. More from Todays Conveyancer. The level at which it starts having to be paid was raised from 125000 to 500000 in July 2020.

The move was aimed at helping buyers whose finances. After that the point at which you start paying stamp duty will be reduced to 250000 double the normal level until the end of September. 11032020 Stamp duty was recently abolished for first-time buyers spending up to 300000.

David Hollingworth director of communication at LC Mortgages said. 10032020 Plans for a radical shake-up to stamp duty were dropped by the Tories in their manifesto. 03032020 No official announcements have been given for SDLT yet and that will likely remain the case until the budget is laid out.

27012021 On October 1 2021 stamp duty in England and Northern Ireland is set to return to previous levels. Until 30 June the first 500000 spent on a property. Stamp duty The threshold.

21012020 Property management firms has warned that the Stamp Duty cut expected in the upcoming budget may collapse less over-heated housing markets. 08032021 The stamp duty holiday is due to come to an end on June 30 2021 as announced by Rishi Sunak in the Budget. 06032021 The temporary stamp duty holiday is being extended in England and Northern Ireland.

24012020 If Boris Johnson and Sajid Javid stay true to their word then some significant change is likely to be on the way potentially cutting stamp duty to nil for all those purchasing properties up to 500000 although this is unlikely to be mirrored by any changes to those purchasing additional properties. HMRC set to recoup over 8bn in SDLT. 22022020 One change thats almost certain to appear in the budget is a 3 stamp duty surcharge for overseas homebuyers individuals and companies including expats wanting to move back home.

Home buyers face unexpected tax bill when stamp duty kicks in Rightmove says buyers could be hit with 15000 bill as rush to complete is causing delays Published. 08012020 Having looked at budgets from previous years it seems that stamp duty changes tend to take effect from the day of the budget with the exception of budget 2018 where changes were made for first time buyers which were backdated for around 12 months. Until 30 June the first 500000 spent on a property will be tax-free.

From July the tax-free threshold will drop for home buyers to 250000 until September. 08102019 There have been many people postulating on what changes to stamp duty may happen in the next budget there is a lot of pressure on Boris Johnson and the current government to reverse the changes to stamp duty that were introduced by George Osborne in terms of the additional stamp duty payable on second properties. 03032021 Now after intense pre-Budget speculation the Chancellor has announced that the stamp duty holiday will continue until 30 June 2021.

It would have seen the threshold raised from 125000 to 500000 as well as lowering the top rate of. However rules concerning SDLT are often changed. First-time buyers pay tax of 5 per cent between 300000 and 500000.

08012020 Last summer Prime Minister Boris Johnson said during his Tory leadership campaign that he would consider raising the stamp duty threshold from 125000 to 500000 and cutting the top SDLT rate from 12 to seven per cent. Mar 26 2021. Would be paid for as well as any details for a proposed Stamp Duty change.

Up to 125000 no stamp duty tax applied The portion between 125001 and 250000 2 The.

Stamp Duty Holiday Explained Who Will Benefit From It And Who Will Not Stamp Duty Real Estate Buying Stamp

Stamp Duty Holiday Explained Who Will Benefit From It And Who Will Not Stamp Duty Real Estate Buying Stamp

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Budget 2021 Stamp Duty Extensions Rto Scheme To Promote Home Ownership The Edge Markets

Budget 2021 Stamp Duty Extensions Rto Scheme To Promote Home Ownership The Edge Markets

Budget 2021 Key Property Highlights Donovan Ho

Budget 2021 Key Property Highlights Donovan Ho

Hoc 2020 Get 10 Discounts Free Stamp Duty When You Buy A House

Hoc 2020 Get 10 Discounts Free Stamp Duty When You Buy A House

Insight Stamp Duty Land Tax For Uk Property Next Steps

Insight Stamp Duty Land Tax For Uk Property Next Steps

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia Propertyguru Malaysia

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty Malaysia 2021 Commonly Asked Questions Malaysia Housing Loan

Stamp Duty Malaysia 2021 Commonly Asked Questions Malaysia Housing Loan

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

Scotland Urged To Follow Suit In Extending Stamp Duty Holiday Propertywire

Scotland Urged To Follow Suit In Extending Stamp Duty Holiday Propertywire

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Post a Comment for "Is Stamp Duty Likely To Change In The Budget"