Is Stamp Duty Land Tax An Allowable Expense

Property agent feescommission to obtain the first tenant. 34 Incorporation expenses Income Tax Deduction of Incorporation Expenses Rules 1974 341 For a company incorporated in Malaysia on or after 1 January 1973 with an authorized capital not exceeding RM250000 the following expenses of incorporation are allowed as a deduction against the gross income from its business.

Our Ultimate Guide To Stamp Duty Land Tax

Our Ultimate Guide To Stamp Duty Land Tax

19032018 This includes holiday lets and also properties bought for children if the parents names are put on the deeds.

Is stamp duty land tax an allowable expense. The main allowable expenses that can be taken into account for tax deductions are. Contact HM Revenue and Customs HMRC if youre not sure whether you can deduct a certain cost. 11022020 The expenses that are not income tax deductible are initial expenses before the property is rented out including.

Can I claim SDLT as a business expense on my tax return. Stamp Duty on land would be a capital expense. 19032013 Instruments liable to stamp duty are those listed in the First Schedule of the Stamp Act 1949 EXEMPTIONS RELIEF FROM STAMP DUTY General exemptions under Section 35 in First Schedule Stamp Act 1949 and Specific exemptions under item 2 4 and 32 in First Schedule Stamp Act 1949.

D The costs of legal and actuarial services including Stamp Duty on transfers and ancillary expenses incurred in varying or ending a settlement see CIR. Payment is allowed as revenue expenditure. So if you buy an investment property even at the cost of 100000 as a property investor you will pay 3 SDLT surcharge.

Land or holding investments by qualifying individuals are charged at 20 up to a lifetime limit of 1 million in chargeable gains. This changes on 1. If you buy a property for less than the threshold theres no SDLT to pay.

Costs you can claim as business expenses. Expenses incurred in the production of income Example. Given the shares are likely held on acquirer companys balance sheet as an investment the duty will likewise be a part of said cost of investment.

In accounting terms you could-a Put it through the PL and add it back in the tax comp. Stamp duty on buying shares is cost to the purchaser. Payment of telephone bills.

19122018 It is part of the cost to the company acquiring the shares of their purchase of the investment in targetIt accordingly will follow the treatment of these shares acquired re its accounting treatment. You may be able to claim an exemption or relief. Transferring property can involve issues for other taxes particularly Local Property Tax Capital Gains Tax and Capital Acquisitions Tax.

20012020 Stamp duty for property transfers is a large expense and property investors often ask if it is tax deductible. V Chubbs Trustee 1971 47 TC. Deductibility of lease renewal costs We are increasingly coming across renewal of leases and in accordance with normal practice we have claimed the professional fees as allowable although it is noted that HMRC manuals refer to de minimis amounts.

EPF Payment Rental of business premise Interest on business loan. This type of tax applies to bricks and mortar of a property. Stamp duty is not payable on transactions with a total value of 1000 or less but stamp duty reserve tax is.

As noted the stamp duty is added to the tax basis of businessshares and is deducted when. Stamp duty land tax can apply to both freehold and leasehold purchases. Payment for wages salary.

The current SDLT threshold for residential properties is 500000. Advertising cost to get the first tenant. 353 or upon the termination of a life interest in possession.

Expenses for repair of premise and vehicles used for business purpose. The allowable expenditure may include fees in respect of. Part of the cost of the renewal of a lease is the stamp duty land tax on the lease.

04072018 Stamp Duty Land Tax and VAT unless you can reclaim the VAT You cant deduct certain costs. Interest on a loan to buy your asset. The short answer is no.

The High Court held that stamp duty paid by the taxpayer during the year is a compulsory statutory levy and would not restrict the profits of the future years and ordinarily revenue expenditure incurred wholly and exclusively for the purpose of business. Unfortunately for property investors you cant claim a deduction for stamp duty straight away. Because the expenditure is capital the expense will be relievable at the time of disposal of the lease.

07012021 If the property is situated outside Ireland there may still be a charge to Stamp Duty. Legal cost and stamp duty for initial tenancy agreement. 26012009 2- Concering stamp duty - I think Im correct in saying that the costs of raising the mortgage for the 2nd BTL ie mortgage app fees mortgage broker fees surveys legals I will call these 4 items incedentals and stamp duty stamp was considerable at 50k are not allowed to be offset against the rental income on the 2nd BTL but are alowable expenses when you.

01022019 Before I go into detail about the costs that may be allowed to reduce property profits and tax I wish to discuss Stamp Duty Land Tax SDLT. If you are purchasing land or property stamp duty land tax may be payable. However it can reduce the capital gains tax liability when you sell the property.

B Treat it as a fixed asset and write it off over the period of the lease. To qualify among other conditions an individual. It must be allowed in its entirety in the year in which it is incurred.

This is a cost of 3000. Personal expenses Example. Then the SDLT paid is capital expenditure.

Stamp duty must be paid within 30 days of purchasing a property. For more information see When is an instrument liable to Stamp Duty.

Pkf Francis Clark 2018 Property Seminar Full Presentation

Pkf Francis Clark 2018 Property Seminar Full Presentation

Stamp Duty Land Tax Tips For Business Taxation

Stamp Duty Land Tax Tips For Business Taxation

:max_bytes(150000):strip_icc()/153221908-5bfc2b8c4cedfd0026c118f2.jpg) Stamp Duty Land Tax Sdlt Definition

Stamp Duty Land Tax Sdlt Definition

Call Brighton Accountant Tax Consultants Accountants Hove For Your Tax Needs Tax Planning And Reducing Tax Bill Capital Gains Tax Tax Advisor Capital Gain

Call Brighton Accountant Tax Consultants Accountants Hove For Your Tax Needs Tax Planning And Reducing Tax Bill Capital Gains Tax Tax Advisor Capital Gain

![]() Accounting For Stamp Duty Land Tax Wave Community

Accounting For Stamp Duty Land Tax Wave Community

Pkf Francis Clark 2018 Property Seminar Full Presentation

Pkf Francis Clark 2018 Property Seminar Full Presentation

/45380855254_ab34885c7e_o-afffd41f46404d0f94bed80fd88dde5b.jpg) Stamp Duty Land Tax Sdlt Definition

Stamp Duty Land Tax Sdlt Definition

Stamp Duty Land Tax Sdlt Payable On Leases

Stamp Duty Land Tax Sdlt Payable On Leases

Stamp Duty Land Tax Tips For Business Taxation

Stamp Duty Land Tax Tips For Business Taxation

Pkf Francis Clark 2018 Property Seminar Full Presentation

Pkf Francis Clark 2018 Property Seminar Full Presentation

With Accountants Brighton As Your Appointed Tax Advisers Brighton We Can Help Reduce Your Income T Mortgage Interest Rates Home Mortgage Current Mortgage Rates

With Accountants Brighton As Your Appointed Tax Advisers Brighton We Can Help Reduce Your Income T Mortgage Interest Rates Home Mortgage Current Mortgage Rates

Self Assessment Tax Returns And The Uk Housing Market Brighton London Hove Capital Gains Tax Tax Advisor Tax Accountant

Self Assessment Tax Returns And The Uk Housing Market Brighton London Hove Capital Gains Tax Tax Advisor Tax Accountant

Self Assessment Tax Returns Expertise Every Tax Payer Be It A Sole Trader Partnership Company Director High Net Tax Return Self Assessment Tax Accountant

Self Assessment Tax Returns Expertise Every Tax Payer Be It A Sole Trader Partnership Company Director High Net Tax Return Self Assessment Tax Accountant

Stamp Duty Land Tax Sdlt Experts For Expats

Stamp Duty Land Tax Sdlt Experts For Expats

What Are The Costs Of Buying A Property In Australia Iqi Global

What Are The Costs Of Buying A Property In Australia Iqi Global

Reduce Stamp Duty Land Tax 3 Higher Rate Youtube

Reduce Stamp Duty Land Tax 3 Higher Rate Youtube

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Property Developers Pay 0 Stamp Duty Land Tax Optimise

Property Developers Pay 0 Stamp Duty Land Tax Optimise

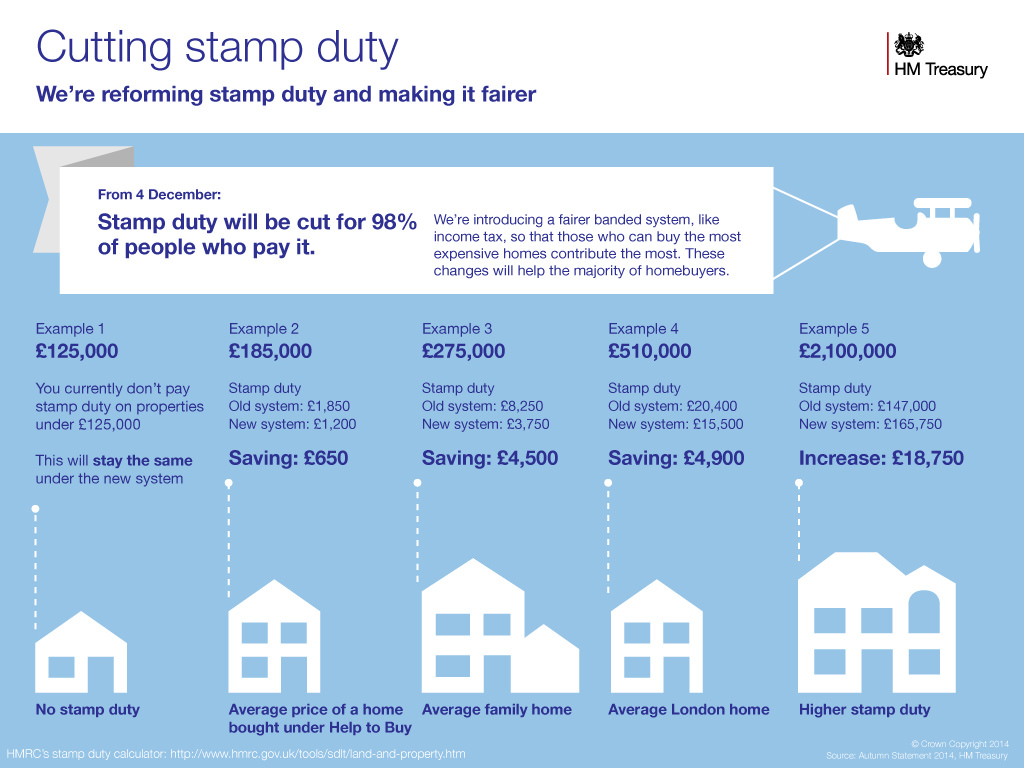

Infographic Stamp Duty Changes Good News For Most The Tax Blog

Infographic Stamp Duty Changes Good News For Most The Tax Blog

Post a Comment for "Is Stamp Duty Land Tax An Allowable Expense"