Is Stamp Duty Changing In 2019

19042021 Stamp duty is a tax paid on property purchases. Stamp duty concessions for first home buyers will apply to both new and established homes from July 2017.

Income Tax Changes For Ay 2018 19 Ay 2019 20 And Ay 2020 21 Accounting Taxation Income Tax Tax Deductions Tax Payment

Income Tax Changes For Ay 2018 19 Ay 2019 20 And Ay 2020 21 Accounting Taxation Income Tax Tax Deductions Tax Payment

The instrument of transfer of the immovable property is executed on or after 1 January 2020.

Is stamp duty changing in 2019. 2 Order 2019 PU. During the five years since the program began rates and land taxes have significantly grown. There are also discounts for first home buyers for properties between 650000 and 800000.

21032019 Wednesday 24 April 2019. For these people stamp duty will be abolished on all houses and apartments up to 650000 up from 550000 previously. The changes to the economic entitlement provisions are sending.

19072019 Stamp Duty Land Tax SDLT is paid on over 1m residential sales a year and raises over 8bn annually double what it raised seven years ago. 22082019 Significant stamp duty changes have commenced in a number of Australian states and territories with ramifications for property development foreign investment and corporate restructures. The most significant changes have occurred in Victoria and Western Australia.

A buyer generally accepts that he she or it will pay 05 stamp duty in respect of a share acquisition. 08112018 Stamp Duty increase and exemption. The move was aimed at helping buyers whose finances.

20062019 ACT Chief Minister Andrew Barr and his cabinet announced stamp duty changes for everyone as part of the 2019-20 budget. A 3692019 reflects that the remission of fifty per centum 50 stamp duty shall only apply if the following conditions are met. 08072020 Stamp Duty Land Tax.

Therefore a 10M acquisition price will give rise to 50000 of stamp duty. Apologies that this article was previously titled 2019 Budget Stamp Duty Changes and it has now been amended. 22082019 Significant stamp duty changes have commenced in a number of Australian states and territories with ramifications for property development foreign investment and corporate restructures.

Stamp Duty 2019 Download pdf brochure Overview In November 2018 the Finance Minister announced changes to the rate of Real Property Gains Tax RPGT and Stamp Duty. 06022020 The stamp duty shall only apply for sale and purchase agreement executed from 1 July 2019 to 31 December 2020 by an eligible Malaysian citizen. The changes will have a significant impact on decisions about undertaking a restructure in either of these states.

Stamp duty corporate reconstruction exemption changes 2019 Victoria and Western Australia have recently made material changes to their respective stamp duty corporate reconstruction rules. 26072019 At 05 stamp duty is by no means the fiercest of taxes but when applied to a large enough figure it can be significant. 08102019 Budget Stamp Duty Changes 2019 Budget and Stamp Duty October 8 2019 Due to the ongoing political turmoil we are still waiting for an.

Stamp duty cuts and holidays have been used and moving the burden to sellers might well scupper the ability of future governments to use stamp duty in such a way. 27072019 Over the last 20 years stamp duty has been tweaked and changed in order to help stimulate certain parts of the housing market perhaps most notably for first-time buyers. The tax has now been devolved to the Welsh Government in 2018 and the Scottish Government in 2015 so the rates paid for homes of the same price vary across the UK.

These changes have been brought into force via Finance Act 2018 and have had an impact on the property market in Malaysia. Malaysias 2019 Budget will see an increase in stamp duties to 4 from 3 for transfer of real properties that are RM1 million and higher. Victoria - effective on 19 June 2019 Western Australia effective on 13 June 2019 Changes to definition of land.

The ACT government is phasing out stamp duty by increasing rates and land taxes. 30102018 This has now changed and you have 12 months after selling the old property to reclaim the extra stamp duty giving a bit more breathing space for reclaiming the money. 1230pm 230pm RPGT.

Recent changes to stamp duty reorganisation relief in Victoria and Western Australia There has been significant change to the stamp duty corporate reconstruction rules that will have an impact on decisions about. This article canvasses the key reforms in each Australian jurisdiction and also addresses proposed changes announced in the South Australian and Tasmanian Budgets. The level at which it starts having to be paid was raised from 125000 to 500000 in July 2020.

Income Tax and Stamp Duty Exemptions in relation to Malaysia Japanese Yen Bonds Series A 2019. 07062019 The State Taxation Acts Amendment Bill 2019 which was passed last night and is awaiting Royal Assent incorporates a number of significant stamp duty changes which were not announced as part of the Budget including in respect of fixtures and the overhaul of the economic entitlement. There will be a two-year stamp duty exemption for the first RM300000 for houses priced up to RM500000.

30082019 July 2019 heralded the commencement of a number of important stamp duty reforms. Reduced rates of Stamp Duty Land Tax SDLT will apply for residential properties purchased from 8 July 2020 until 30 June 2021 and from 1 July 2021. 03012020 The latest gazette announced on 26 December 2019 known as the Stamp Duty Remission No.

July 2019 heralded the commencement of a number of important stamp duty reforms. You can find out further information on that change here. The most significant changes have occurred in Victoria and Western Australia.

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Hmrc S Guide To Stamp Duty Changes Naea Propertymark

Hmrc S Guide To Stamp Duty Changes Naea Propertymark

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Access Bank Offers To Pay Customers February To April Stamp Duty Charges Finance Retail Banking Bank

Access Bank Offers To Pay Customers February To April Stamp Duty Charges Finance Retail Banking Bank

Nsw Stamp Duty Update No Stamp Duty On Newly Built Homes Below A 800 000 Move Realty

Nsw Stamp Duty Update No Stamp Duty On Newly Built Homes Below A 800 000 Move Realty

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

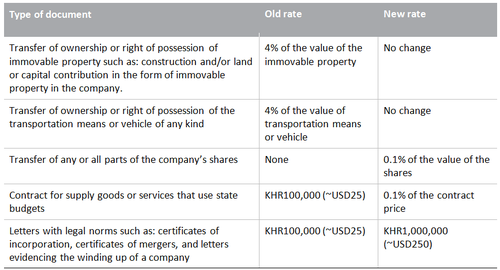

New Amendments On Stamp Duty Provisions In Cambodia Legal Tax Investment Expertise

New Amendments On Stamp Duty Provisions In Cambodia Legal Tax Investment Expertise

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Who Ll Benefit From Unified Stamp Duty

Who Ll Benefit From Unified Stamp Duty

Latest Changes On The Remission Of Stamp Duty For Immovable Property Under Stamp Duty Remission No 2 Order 2019

Latest Changes On The Remission Of Stamp Duty For Immovable Property Under Stamp Duty Remission No 2 Order 2019

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Gst Changes Change Indirect Tax Goods And Services

Gst Changes Change Indirect Tax Goods And Services

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Change Company Registered Address Audit Services Private Limited Company Company Secretary

Change Company Registered Address Audit Services Private Limited Company Company Secretary

Income Tax Deductions Fy 2019 2020 Income Tax Tax Refund Tax Deductions List

Income Tax Deductions Fy 2019 2020 Income Tax Tax Refund Tax Deductions List

Sell Hdb Buy Condo Costly Mistakes To Avoid Stuff To Buy Condo Things To Sell

Sell Hdb Buy Condo Costly Mistakes To Avoid Stuff To Buy Condo Things To Sell

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

What Bubble At The Moment After Pent Up Demand And Changes In Stamp Duty The Property Market Has Gone Cray Cr Stamp Duty Property Marketing Investing

What Bubble At The Moment After Pent Up Demand And Changes In Stamp Duty The Property Market Has Gone Cray Cr Stamp Duty Property Marketing Investing

Post a Comment for "Is Stamp Duty Changing In 2019"