Is Stamp Duty Allowable For Capital Gains

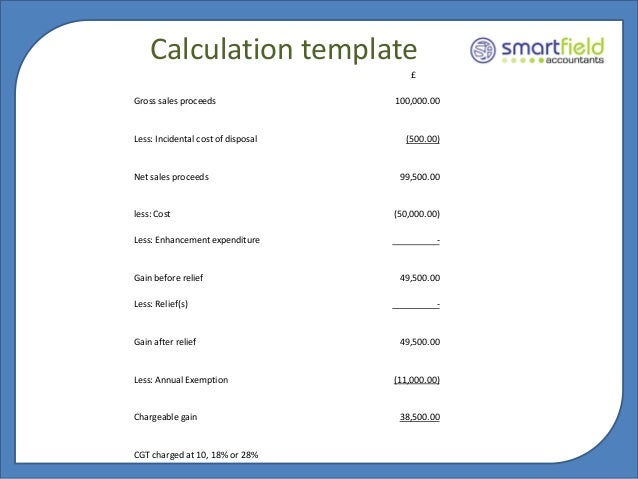

This is half of what they would have usually paid on a purchase price of 500000. CGT charged at basic 454860 25000 at 18 CGT charged at higher rate 1560440 55730 at 28 total capital gains bill 20153.

Tax Lecture 3 Capital Gains Tax See Chapters

If the asset was acquired prior to 6 April 1974 the allowable.

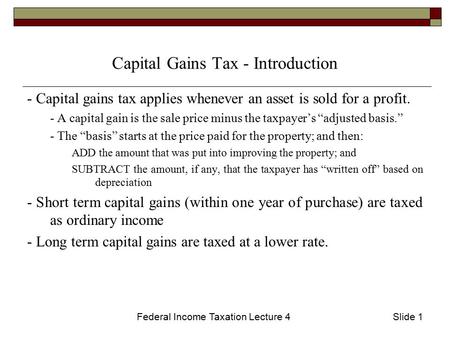

Is stamp duty allowable for capital gains. 07122011 In calculating the amount of tax payable deductions are allowable for incidental costs of acquisition such as solicitors fees stamp duty etc. Please note that these expenses are not allowed as a deduction from any other heads of income. Interest on a loan to buy your asset.

It is paid by the person making the disposal. 05012017 The remaining 75 of the gainloss is taxable. 25022021 The rate of CGT is 33 for most gains.

Tenants vacated September 2016. 31032010 gain after costs 93000 100000 less 7000 stamp duty estate agent and solicitors fees gain after CGT tax-free allowance 81000. House purchased for 300k December 2006 Stamp exempt as FTB.

Costs you can claim as. 03122018 Capital Gains Tax CGT is a tax charged on the capital gain profit made on the disposal of any asset. 15 for gains from venture capital funds for individuals and partnerships.

23072020 This means that for anyone that is a first-time buyer or only owns one property they wont pay any stamp duty up to 500000. The exemption is when an investment property is acquired in a Territory under a crown lease. The gainprofit the difference between the price you paid for the asset and the price you sold it for is considered taxable income.

For enhancement of the asset. Certain items are considered allowable deductions for capital gains where they are incurred wholly and exclusively in the following circumstances. 19032018 Offsetting stamp duty against capital gains tax You can offset any stamp duty you paid originally for your property against the final value for the purposes of capital gains tax.

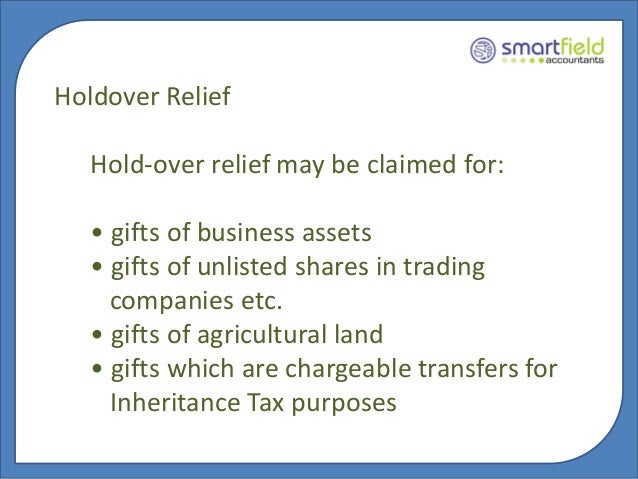

Disposals are not limited to sales of assets a gift of an asset counts as a disposal and will be liable to CGT if a gain is made. 13102014 Stamp Duty Land Tax and VAT unless you can reclaim the VAT You cannot deduct certain costs. Capital costs associated with acquiring a property such as stamp duty can only be used to offset capital gains.

40 for gains from foreign life policies and foreign investment products. Where incurred as incidental costs of acquiring an asset. To differentiate capital gains into long term and short term the period is 36 months and 12 months.

07032019 Stamp duty paid on transfer of property. Assume you have no other capital gains losses or allowable expenditure. In response to the ongoing coronavirus outbreak the Government has announced that from 8 July 2020 until 30 June 2021 no stamp duty will be payable on the first 500000 of a residential.

15102013 Section 48 of the Income Tax Act states that while computing the income chargeable under the head capital gains any payment made for securities transaction is not allowed. Stamp duty and costs to incur the crown lease are immediately tax deductible. Incidental costs of acquisition such as legal fees and stamp duty are allowable as part of the cost.

20012020 Is stamp duty tax deductible. Selling a buy-to-let property. Understand Stamp Duty and Capital Gains Tax.

If a disposal by. Stamp paid of 10k July 2008 Paid Stamp when rented out as no longer a FTB. No other expenditure is allowable unless specifically provided for by TCGA92 see for example TCGA92s143 6 see CG56084.

Disposal proceeds 8000 Cost price 5000 Chargeable Gain 3000 Deduct. And incidental costs of disposal such as solicitorsauctioneers fees etc. The acquisition and creation of the asset concerned.

Personal exemption 1270. This section sets out the basic rules for determining the expenditure to be allowed in computing chargeable gains. Stamp Duty paid when buying the property Estate agents fees.

There are other rates for specific types of gains. The definition is exhaustive. When you calculate capital gains tax you need to calculate.

Companies or investors that own two or more properties will also benefit as under this incentive they will only pay 3 in stamp duty. Capital Gains Tax CGT 21 Overview In general terms Capital Gains Tax CGT is charged on the value of the capital gain made on the disposal of an asset. Gains or profits from carrying on a business trade vocation or profession are liable to tax.

125 for gains from venture capital funds for companies. 25022020 Lembaga Hasil Dalam Negeri. Allowable expenditure includes cost of acquisition of an asset enhancement expenditure incurred during the period of ownership of the asset and costs incurred in disposing of the asset.

All these expenses are allowed as deduction only for the purpose of calculating the Capital Gains. You can deduct certain costs from taxable gains to reduce the Capital Gains Tax you pay on your property including.

Tax Lecture 3 Capital Gains Tax See Chapters

Tax Lecture 3 Capital Gains Tax See Chapters

Ultimate Guide To Capital Gains Tax Rates In The Uk

Ultimate Guide To Capital Gains Tax Rates In The Uk

Capital Gains Tax Brackets For Home Sellers What S Your Rate Tax Brackets Capital Gain Capital Gains Tax

Capital Gains Tax Brackets For Home Sellers What S Your Rate Tax Brackets Capital Gain Capital Gains Tax

Why Freelancers From India Working For Foreign Clients Online May Not Be Liable For Service Tax Taxworry Com Tax Service Capital Gains Tax

Why Freelancers From India Working For Foreign Clients Online May Not Be Liable For Service Tax Taxworry Com Tax Service Capital Gains Tax

Chapter 8 Investing In Property And Collectibles Ppt Download

Chapter 8 Investing In Property And Collectibles Ppt Download

Tax Lecture 3 Capital Gains Tax See Chapters

Tax Lecture 3 Capital Gains Tax See Chapters

Tax Lecture 3 Capital Gains Tax See Chapters

Tax Lecture 3 Capital Gains Tax See Chapters

Tax Lecture 3 Capital Gains Tax See Chapters 6 Ppt Download

Tax Lecture 3 Capital Gains Tax See Chapters 6 Ppt Download

Tax Lecture 3 Capital Gains Tax See Chapters 6 Ppt Download

Tax Lecture 3 Capital Gains Tax See Chapters 6 Ppt Download

Call Brighton Accountant Tax Consultants Accountants Hove For Your Tax Needs Tax Planning And Reducing Tax Bill Capital Gains Tax Tax Advisor Capital Gain

Call Brighton Accountant Tax Consultants Accountants Hove For Your Tax Needs Tax Planning And Reducing Tax Bill Capital Gains Tax Tax Advisor Capital Gain

How To Calculate Long Term Capital Gain Tax On Equity Shares And Mutual Fund From 1st April 2018 Capital Gains Tax Capital Gain Mutuals Funds

How To Calculate Long Term Capital Gain Tax On Equity Shares And Mutual Fund From 1st April 2018 Capital Gains Tax Capital Gain Mutuals Funds

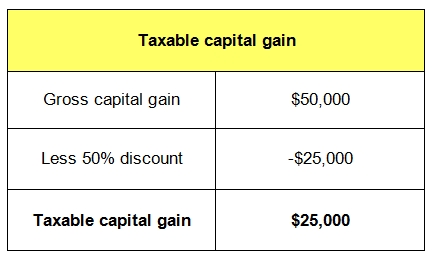

Capital Gains Tax Australia Property Investment Uk Property Investment Csi Prop

Capital Gains Tax Australia Property Investment Uk Property Investment Csi Prop

Brighton Accountant As Your Appointed Tax Advisers We Can Help Reduce Your Income Tax Ensuring All Allowable Expense Capital Gains Tax Tax Advisor Business Tax

Brighton Accountant As Your Appointed Tax Advisers We Can Help Reduce Your Income Tax Ensuring All Allowable Expense Capital Gains Tax Tax Advisor Business Tax

Section 40 A Ia 2 Blows To Special Bench Merilyn Shipping Decision Http Taxworry Com Section 40aia 2 Blows Special Ben Decisions Capital Gains Tax Taxact

Section 40 A Ia 2 Blows To Special Bench Merilyn Shipping Decision Http Taxworry Com Section 40aia 2 Blows Special Ben Decisions Capital Gains Tax Taxact

Post a Comment for "Is Stamp Duty Allowable For Capital Gains"