Is Stamp Duty An Allowable Business Expense

Is this allowable or disallowable for tax purp. Personal expenses Example.

Ce Qui Banque Le 1er Aout Contre Le Compte Des Menages Tax Accountant Certified Accountant Tax Advisor

Ce Qui Banque Le 1er Aout Contre Le Compte Des Menages Tax Accountant Certified Accountant Tax Advisor

08082020 Fiserv India Private Limited Vs ACIT ITAT Delhi In the present case the facts says that stamp duty was payable for the lease of a business premises at sector 62 Noida which were taken on lease from Galaxy Mercantile Ltd.

Is stamp duty an allowable business expense. Total Business Expenses 15000. For example taking your customer out for a meal. A company client of mine has transferred shares to another company and paid the relevant Stamp Duty.

11022020 The expenses that are income tax deductible including. 13102014 Costs you can deduct include. Act despite the ruling of Apex Court in the case of General Insurance Corporation Vs.

Restriction on interest expense Takes a business loan of RM2000000 and used it to finance a house cost RM450000. Business expenses may be deductible or non-deductible. Contact HM Revenue and Customs HMRC if youre not sure whether you can deduct a certain cost.

18012021 Whether the Tribunal was justified in law in holding that the expenditure incurred in connection with the issue of IPO inter alia stamp duty is an allowable expenditure under section 35D of the IT. 13042018 The compamny paid stamp duty on the transaction. 19122018 Is Stamp Duty a business expense.

A 134 1974. V Chubbs Trustee 1971 47 TC. The interest expense of RM120000 allowable against the business source has to be restricted under S332 of ITA.

13 Income Tax Deductions for Approved Training Rules 1992 PUA. Expenses incurred in the production of income Example. Allowable Business Expenses 5000.

Qualifying pre-operational business expenditure incurred for. 14052018 Expenditure incurred on customer or supplier entertaining is not allowed for tax purposes. Expenses on rental renewal including the stamp duty.

Business must be allowed in its entirety in the year in which it is incurred and it cannot be spread over a number of years. Interest on a loan to buy your asset. Accordingly the High Court allowed the payment of stamp duty as revenue expenditure.

CIT reported in 286 ITR page 232. Expenses on rental collection. Any help would be appreciated.

20012020 Stamp duty preparation and registration costs you incur on the crown lease of an ACT property are deductible to the extent that you used or will use the property to produce income. Income Subject to Tax. 04072018 Stamp Duty Land Tax and VAT unless you can reclaim the VAT You cant deduct certain costs.

This decision may help taxpayers to substantiate the claim of certain statutory payments like stamp duty payment as revenue expenditure. I assume you are talking about stamp duty land tax charged on buildings. Disallowable Business Expenses 10000.

Or ii the aggregate income in arriving at the total income. How Allowable Business Expenses Reduce Taxes Payable. D The costs of legal and actuarial services including Stamp Duty on transfers and ancillary expenses incurred in varying or ending a settlement see CIR.

Fees for example for valuing or advertising assets costs to improve assets but not normal repairs Stamp Duty Land Tax and VAT unless you can reclaim the VAT. The stamp duty was paid in accordance with The Stamp Duty Act 1899 being a statutory levy for registering of the lease deed. Payment for wages salary.

I the gross income in arriving at the adjusted income of the business. How to learn from Lookers. 12 Schedule 4B Income Tax Act 1967 - Qualifying Pre-Operational Business Expenditure.

When deductible they reduce your taxable income and the amount of. Payment of telephone bills. Expenses for repair of premise and vehicles used for business purpose.

So any stamp duty on the cost of the business is a capital cost and cannot be deducted. The allowable expenditure may include fees in respect of. Business gifts are not allowed for tax purposes unless it costs less than 50 it is neither food nor drink and it bears the business name.

Business expenses allowable to a company under the following. Expenses on replacement costs of furnishings. Deductibility of lease renewal costs We are increasingly coming across renewal of leases and in accordance with normal practice we have claimed the professional fees as allowable although it is noted that HMRC manuals refer to de minimis amounts.

Some examples are CPF contributions wages renovation advertising etc. Is this allowable or disallowable for tax purp. EPF Payment Rental of business premise Interest on business loan.

11 Income Tax Deduction of Incorporation Expenses Rules 1974 PU. 80000 - 5000 75000. A company bought back the shares from a minority shareholder.

The compamny paid stamp duty on the transaction. 353 or upon the termination of a life interest in possession. Part of the cost of the renewal of a lease is the stamp duty land tax on the lease.

Costs you can claim as business expenses. For example stationary bearing the company logo. They have logged this under legal fees but is Stamp Duty on share transfers a revenue expense or capital expenditure.

Expenses on repairs and maintenance. Business expenses are expenses you have paid to run the business. Commencement of business expenses that are allowable to a person as a deduction against.

See the interest restriction formula below.

Welcome To The Professional Accountants In Brighton London Hove Capital Gains Tax Capital Gain Tax Advisor

Welcome To The Professional Accountants In Brighton London Hove Capital Gains Tax Capital Gain Tax Advisor

Special Tax Deduction On Rental Reduction

Special Tax Deduction On Rental Reduction

Rm20 Billion Fiscal Stimulus Highlights Cheng Co

Rm20 Billion Fiscal Stimulus Highlights Cheng Co

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia Propertyguru Malaysia

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia Propertyguru Malaysia

Check Out This Amazing Template To Make Your Presentations Look Awesome At Project Management Change Management Presentation Example

Check Out This Amazing Template To Make Your Presentations Look Awesome At Project Management Change Management Presentation Example

Special Tax Deduction On Rental Reduction

Special Tax Deduction On Rental Reduction

Self Assessment Tax Returns Expertise Every Tax Payer Be It A Sole Trader Partnership Company Director High Net Tax Return Self Assessment Tax Accountant

Self Assessment Tax Returns Expertise Every Tax Payer Be It A Sole Trader Partnership Company Director High Net Tax Return Self Assessment Tax Accountant

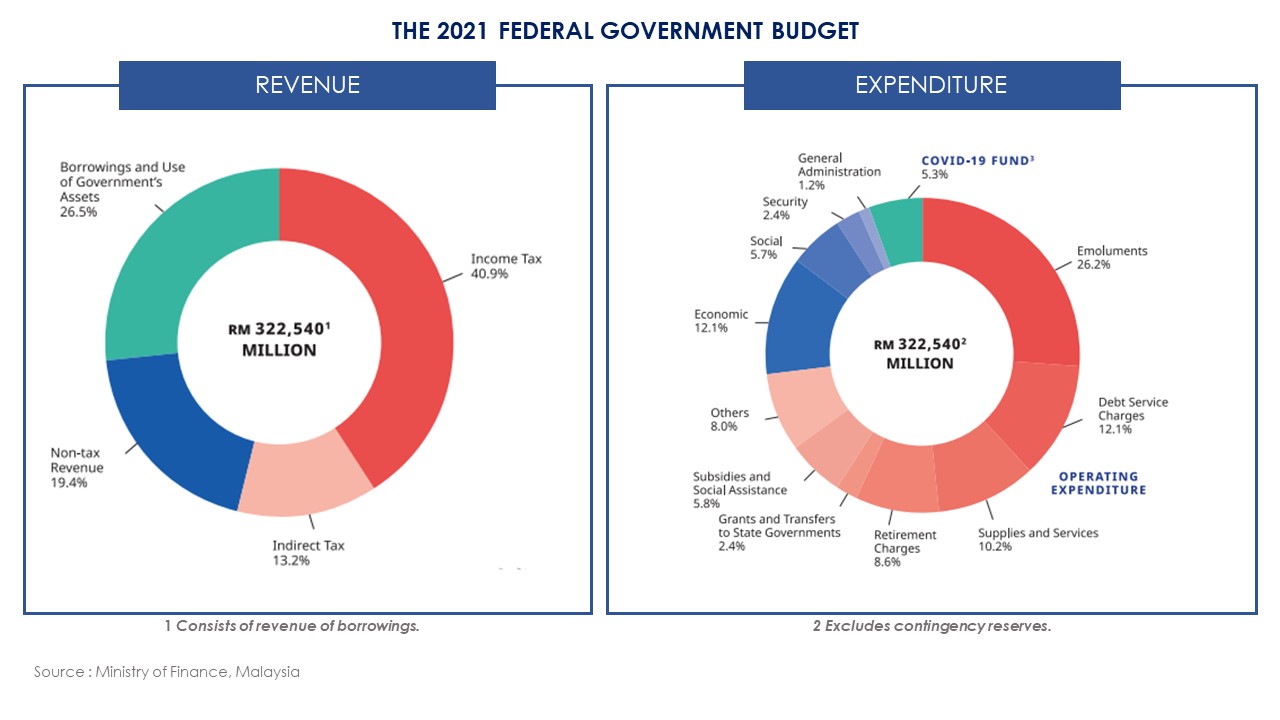

Highlights Of Budget 2021 Cheng Co

Highlights Of Budget 2021 Cheng Co

Call Brighton Accountant Tax Consultants Accountants Hove For Your Tax Needs Tax Planning And Reducing Tax Bill Capital Gains Tax Tax Advisor Capital Gain

Call Brighton Accountant Tax Consultants Accountants Hove For Your Tax Needs Tax Planning And Reducing Tax Bill Capital Gains Tax Tax Advisor Capital Gain

Stamp Duty Seller S Stamp Duty For Industrial Properties Iras

Stamp Duty Seller S Stamp Duty For Industrial Properties Iras

.jpg) Financing And Leases Tax Treatment Acca Global

Financing And Leases Tax Treatment Acca Global

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Few Things Small Dairy Farms Have To Consider Milk Processing Dairy Farms Dairy

Few Things Small Dairy Farms Have To Consider Milk Processing Dairy Farms Dairy

With Accountants Brighton As Your Appointed Tax Advisers Brighton We Can Help Reduce Your Income T Mortgage Interest Rates Home Mortgage Current Mortgage Rates

With Accountants Brighton As Your Appointed Tax Advisers Brighton We Can Help Reduce Your Income T Mortgage Interest Rates Home Mortgage Current Mortgage Rates

Rm20 Billion Fiscal Stimulus Highlights Cheng Co

Rm20 Billion Fiscal Stimulus Highlights Cheng Co

Brighton Accountant As Your Appointed Tax Advisers We Can Help Reduce Your Income Tax Ensuring All Allowable Expense Capital Gains Tax Tax Advisor Business Tax

Brighton Accountant As Your Appointed Tax Advisers We Can Help Reduce Your Income Tax Ensuring All Allowable Expense Capital Gains Tax Tax Advisor Business Tax

Self Assessment Tax Returns And The Uk Housing Market Brighton London Hove Capital Gains Tax Tax Advisor Tax Accountant

Self Assessment Tax Returns And The Uk Housing Market Brighton London Hove Capital Gains Tax Tax Advisor Tax Accountant

Check Out This Amazing Template To Make Your Presentations Look Awesome At Project Management Change Management Presentation Example

Tips To Boost The Value Of A Property Property Valuation Property House Valuations

Tips To Boost The Value Of A Property Property Valuation Property House Valuations

Post a Comment for "Is Stamp Duty An Allowable Business Expense"