How To Avoid Stamp Duty On Shares

25112016 If the same person were to move somewhere else with the same amount of space as the two properties combined they would avoid paying the added duty but would probably pay more in total because the. Haggle on the property price.

Https Www Iras Gov Sg Irashome Uploadedfiles Irashome E Services Other Taxes Faqs 20on 20shares Pdf

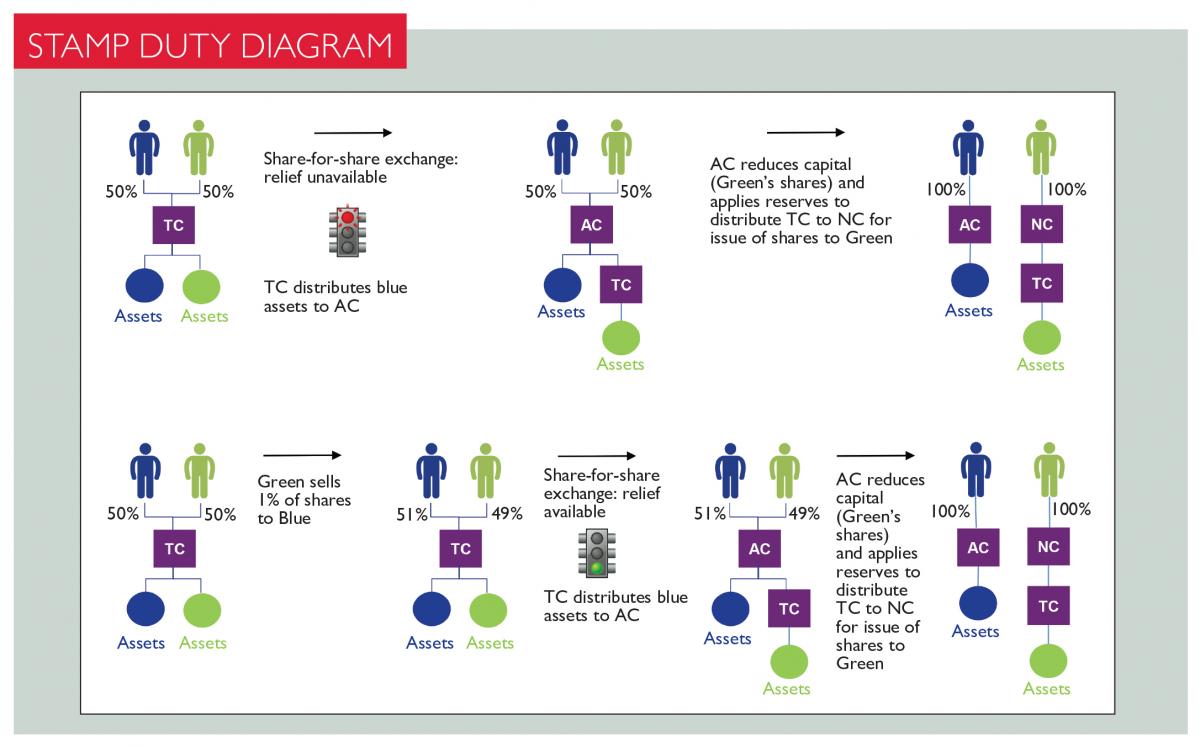

Example 2 If the facts are the same as in Example 1 but there is a plan for control of Newco to change for example in a partition demerger then the relief will not be available.

How to avoid stamp duty on shares. 03032021 Stamp Duty mitigation is another way of saying Stamp Duty avoidance. Of land by way of a sale of shares in a company was. Lawyers and accountants need to be wary of hidden stamp duty costs which can be triggered by transfers and other dealings in shares and units in unlisted companies and unit trust schemes.

26112003 How to avoidreduce stamp duty was one of the topics discussed at a recent property seminar organised by law firm Reddy Charlton McKnight. RM10000 or 20 of the deficient duty whichever is the greater if stamped after 6 months from the time for stamping. However if you exchange properties with another person you will each have to pay Stamp.

There are numerous specialist companies who operate tax-planning schemes that claim to reduce your Stamp Duty bill. A Stamp Duty mitigation scheme may reduce or even eliminate the Stamp Duty payable on a property purchase. RM5000 or 10 of the deficient duty whichever is the greater if stamped after 3 months but not later than 6 months after the time for stamping.

However there is a way around this. 22122019 When a share transfer is exempt from Stamp Duty there is no need to send the Stock Transfer Form to HMRC to be stamped. So do we always have to pay stamp duty whenever we buy shares.

EToro our recommended UK broker absorbs the cost of stamp duty so that you can invest in the stock market without paying that 05 tax. This can be effective provided the two of you are not married or in a civil partnership. At least two documents will attract stamp duty in a conveyancing transaction.

30102014 Stamp Duty reliefs and exemptions on share transfers. 06032020 To avoid paying stamp duty for a second home under this scenario the two of you can agree to buy the property under your name. B RM5000 or 10 of the deficient duty whichever is the greater if stamped after 3 months but.

Stamp duty is only charged when you buy existing shares in a UK company. This is the law and its just part of the costs of buying shares along with broker commissions. Indeed the Swiss Stamp Tax is not levied on CFD trading.

19032013 a RM2500 or 5 of the deficient duty whichever is the greater if stamped within 3 months after the time for stamping. Notify a purchase of. 26072019 The shares in Newco will mirror the shares in Company A and therefore this acquisition will usually be exempt from stamp duty.

RM2500 or 5 of the deficient duty whichever is the greater if stamped within 3 months after the time for stamping. 05052021 Here we look at ways to reduce your stamp duty bill or even avoid paying the tax altogether. 01022017 This means that the new purchaser and any future purchaser of the shares pays stamp duty at 05 percent provided it is a UK company or no stamp duty if an offshore company is used on the purchase price of the shares rather than SDLT at 4 percent or 5 percent on the purchase price of the property.

Stamp duty is one of the unavoidable costs in property purchase in Malaysia. Avoiding Hidden Stamp Duty Traps in Transfers of Shares and Units in Private Companies and Trusts by James Johnson Minter Ellison Released November 1999. If you transfer the deeds of your home to someone else either as a gift or in your will they wont have to pay Stamp Duty on the market value of the property.

EToro also allows you to buy shares with. Using Contracts for Difference CFDs. 24072019 Stamp Duty Imposed For Transfer Of Properties In Malaysia.

Completing a stock transfer form. Under the Stamp Act stamp duty is tax payable on the written documents during the sale andor transfer of a real property. Pay Stamp Duty Land Tax.

The amount of stamp duty you pay depends on a number of factors. Except in rare circumstances it doesnt cover shares in foreign companies new shares issued when a. Now I strongly advise against trading with CFDs.

21052020 Just for completeness I want to mention the other way to avoid the Swiss Stamp Tax. Shares gifted to you or acquired free of charge Shares transferred into your name from a spouse when you marry Shares transferred between trustees. 23042008 Stamp duty is also payable if any shares are transferred to you either electronically or by stock transfer forms.

Acquiring shares via the following methods attracts no stamp duty. While there are several exemptions such as AIM shares in most cases the 05 stamp duty tax will automatically be taken when you complete shares transactions. Actually we dont always have to pay stamp duty for share purchases because this tax only.

You will however need to complete Certificate 2 on the back of the form if you give a chargeable consideration of more than 1000 for a share transfer that is exempt from Stamp Duty.

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

كل عام و انتم بافضل حال رمضان مبارك عليكم و على جميع الامه الاسلاميه رمضان كريم Clementcanopyprice Clementcanopycondo Clenme Real Estate Estates Acre

كل عام و انتم بافضل حال رمضان مبارك عليكم و على جميع الامه الاسلاميه رمضان كريم Clementcanopyprice Clementcanopycondo Clenme Real Estate Estates Acre

Stamp Duty Exemption London Stock Exchange

Stamp Duty Exemption London Stock Exchange

Https Www Jstor Org Stable 40913079

All You Need To Know How Stock Markets Function Stock Market Bombay Stock Exchange London Stock Exchange

All You Need To Know How Stock Markets Function Stock Market Bombay Stock Exchange London Stock Exchange

Home Loan Mistakes To Avoid Indian Stock Market Hot Tips Picks In Shares Of India Home Loans Loan Money Plan

Home Loan Mistakes To Avoid Indian Stock Market Hot Tips Picks In Shares Of India Home Loans Loan Money Plan

Stamp Duty Relief On Share For Share Exchanges Taxation

Stamp Duty Relief On Share For Share Exchanges Taxation

How To Calculate Long Term Capital Gain Tax On Equity Shares And Mutual Fund From 1st April 2018 Capital Gains Tax Capital Gain Mutuals Funds

How To Calculate Long Term Capital Gain Tax On Equity Shares And Mutual Fund From 1st April 2018 Capital Gains Tax Capital Gain Mutuals Funds

Art Of Gifting Http Economictimes Indiatimes Com Business News Today Latest Business News Growing Wealth

Art Of Gifting Http Economictimes Indiatimes Com Business News Today Latest Business News Growing Wealth

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Stamp Duty On Transfer Of Shares Statewise In India Chart

Stamp Duty On Transfer Of Shares Statewise In India Chart

Who Ll Benefit From Unified Stamp Duty

Who Ll Benefit From Unified Stamp Duty

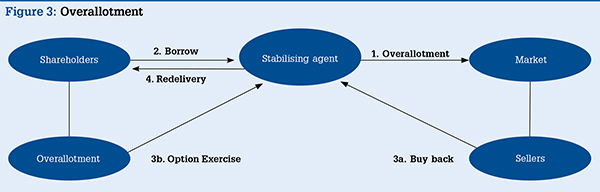

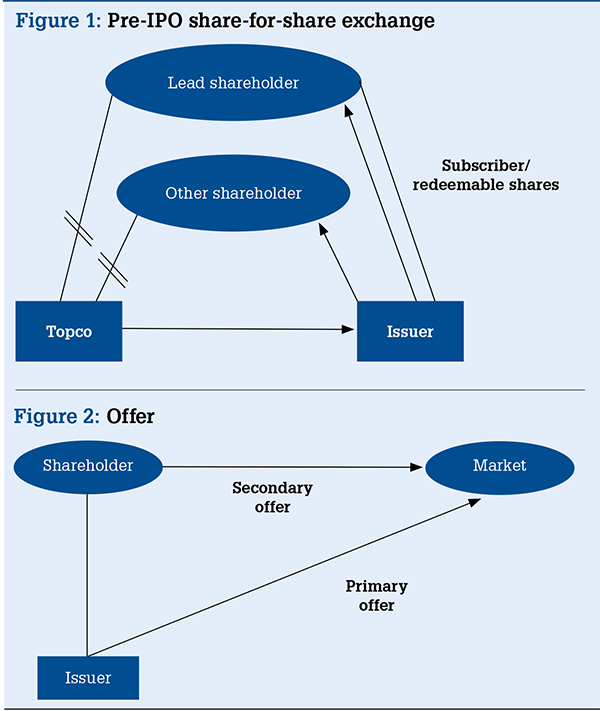

Avoiding Stamp Tax Traps On Ipos

Avoiding Stamp Tax Traps On Ipos

Avoiding Stamp Tax Traps On Ipos

Avoiding Stamp Tax Traps On Ipos

5 Tips On Intraday Trading In Share Market By Indiabulls Ventures Intraday Trading Online Share Trading Investing

5 Tips On Intraday Trading In Share Market By Indiabulls Ventures Intraday Trading Online Share Trading Investing

Government Intends To Plug A Loophole That Allows Property Buyers To Avoid Stamp Duty By Purchasing Shares In A Holding Firm Rather Property Buyers Condo Acre

Government Intends To Plug A Loophole That Allows Property Buyers To Avoid Stamp Duty By Purchasing Shares In A Holding Firm Rather Property Buyers Condo Acre

20 Types Of Taxes In India Types Of Taxes Money Management Advice Capital Gains Tax

20 Types Of Taxes In India Types Of Taxes Money Management Advice Capital Gains Tax

Post a Comment for "How To Avoid Stamp Duty On Shares"