What Costs Can Be Capitalized Under Ifrs

-1 Internal and external costs incurred during the preliminary project stage shall be expensed as they are incurred. Interest capitalisation is allowed as long as the production cycle takes a.

6 Necessary Conditions For Recognizing Development Cost As Intangible Assets Accounting Masterclass Intangible Asset Conditioner Development

6 Necessary Conditions For Recognizing Development Cost As Intangible Assets Accounting Masterclass Intangible Asset Conditioner Development

However some costs incurred in software development.

What costs can be capitalized under ifrs. 30032020 Examples of costs that should be expensed in PL as incurred are IFRS 1598. Costs of the design migration and testing of the data center assessed in accordance with IFRS 15 to determine whether an asset can be recognized for the costs to fulfil the contract. 20072020 The IFRIC received a request for guidance on the extent of transaction costs to be accounted for as a deduction from equity in accordance with IAS 32 paragraph 37 and on how the requirements of IAS 32 paragraph 38 to allocate transaction costs that relate jointly to one or more transaction should be applied.

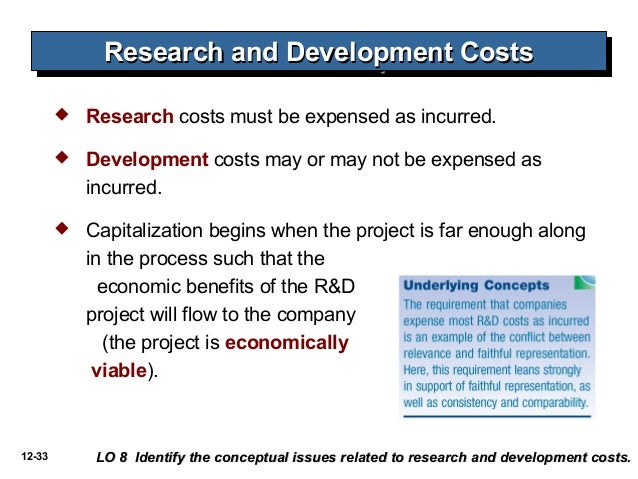

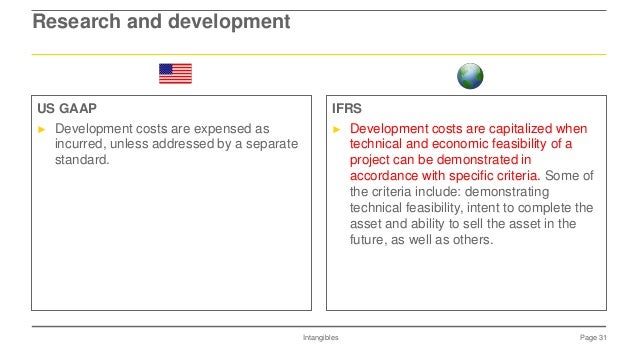

IAS 1615 Cost includes all costs necessary to bring the asset to working condition for its intended use. 29052015 Under IFRS the research expenditures are treated as expenses while the development expenditures are capitalized as an asset. 28022020 Costs you can capitalise are.

22062016 In the paragraph 17 of IAS 16 there are the examples of what expenses are considered to be directly attributable and therefore can be capitalizedor included in the cost of an asset. 05072017 An item of property plant and equipment should initially be recorded at cost. 20092012 That US GAAP ASC 350-40-25 is quite explicit.

-3 Costs to develop or obtain software that allows for. International Accounting Standards relevant to the capitalization of capital expenditures include IAS 18 and IAS 38 which are concerned with revenue recognition and intangible assets. 19022020 Hereof what expenses can be capitalized.

Materials used to construct an asset. IAS 23R does not mandate the capitalisation of borrowing costs for inventories that are manufactured in large quantities on a repetitive basis. The purchase price delivery and carriage costs legal fees brokerage fees import duties and taxes site preparation installation and assembly testing of functionality.

Interest incurred on the financing needed to construct an asset. Wage and benefit costs incurred to construct an asset. Sales taxes related to assets purchased for use in a fixed asset.

IFRS standards do not contain explicit guidance about a customers accounting for cloud computing arrangements so judgement will be required to account for them. 13 Can borrowing costs incurred to finance the production of inventories that has a long production period like wine or cheese be capitalised. This technical guidance discusses how an entity might account for a cloud computing arrangement and is intended to help companies consider the requirements in the various IFRS standards.

Under USGAAP both research and development costs are supposed to be expensed. General and administrative costs unless those costs are explicitly chargeable to the customer under the contract training costs costs of wasted materials labour or other resources to fulfil the contract that were not reflected in the price of the contract. This issue relates specifically to the meaning of the terms.

Capital and Revenue Expenditures. 23102017 1 Its meets the definition of PPE directly attribute costs and is capitalised the asset being the leasehold improvements 2 The stages of finding and developing a new hotel are similar to to research and development under IAS 38 and these fees if meet the definition of development costs should be capitalised as an intangible asset costs incurred finding an appropriate site are. 26092017 IFRS were established in 2001 and incorporated the older International Accounting Standards IAS.

General administrative costs should be expensed when incurred. Based on these criteria internally developed intangible assets eg. Examples of capitalized costs include.

Development expenses related to a prototype in the automotive industry are generally capitalized and amortized under IFRS and expensed under US GAAP. One may also ask what is an asset under. Costs of employee benefits IAS 19 Employee benefits arising directly from the construction or the acquisition of the item of PPE Costs of site preparation.

23122018 Software costs accounted for in accordance with IAS 38. -2 Internal and external costs incurred to develop internal-use computer software during the application development stage shall be capitalized.

Financial Accounting Standards Ias 28 Investments In Associates And Joint Investing Insurance Fund Financial Instrument

Financial Accounting Standards Ias 28 Investments In Associates And Joint Investing Insurance Fund Financial Instrument

Capitalized And Expensed Costs Cfa Level 1 Analystprep

Capitalized And Expensed Costs Cfa Level 1 Analystprep

Financial Assets Under Ifrs 9 The Basis For Classification Has Changed Bdo Australia

Financial Assets Under Ifrs 9 The Basis For Classification Has Changed Bdo Australia

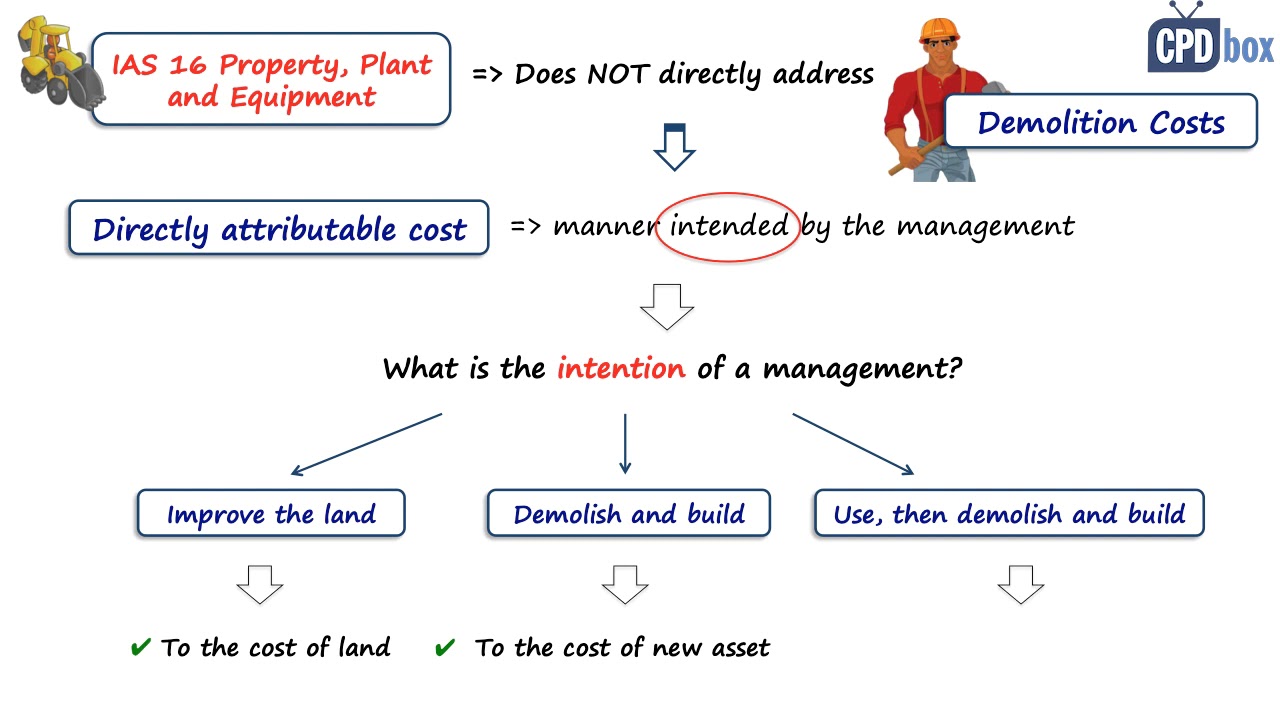

Can You Capitalize Demolition Costs Under Ifrs Cpdbox Answers Youtube

Can You Capitalize Demolition Costs Under Ifrs Cpdbox Answers Youtube

Pin On Financial Accounting Standards

Pin On Financial Accounting Standards

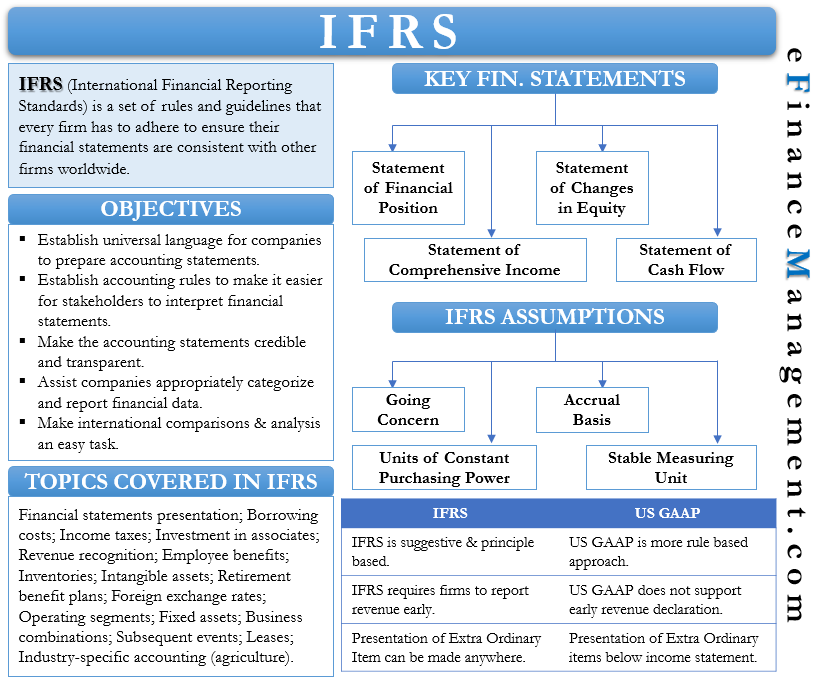

Ifrs Meaning Objectives Assumptions And More

Ifrs Meaning Objectives Assumptions And More

Ifrs 16 Leases Lease Finance Lease Finance

Ifrs 16 Leases Lease Finance Lease Finance

Complete Detection Of All Ifrs 3 Intangibles Annualreporting

Complete Detection Of All Ifrs 3 Intangibles Annualreporting

Ifrs 13 Fair Value Measurement Fair Value Financial Accounting Financial Asset

Ifrs 13 Fair Value Measurement Fair Value Financial Accounting Financial Asset

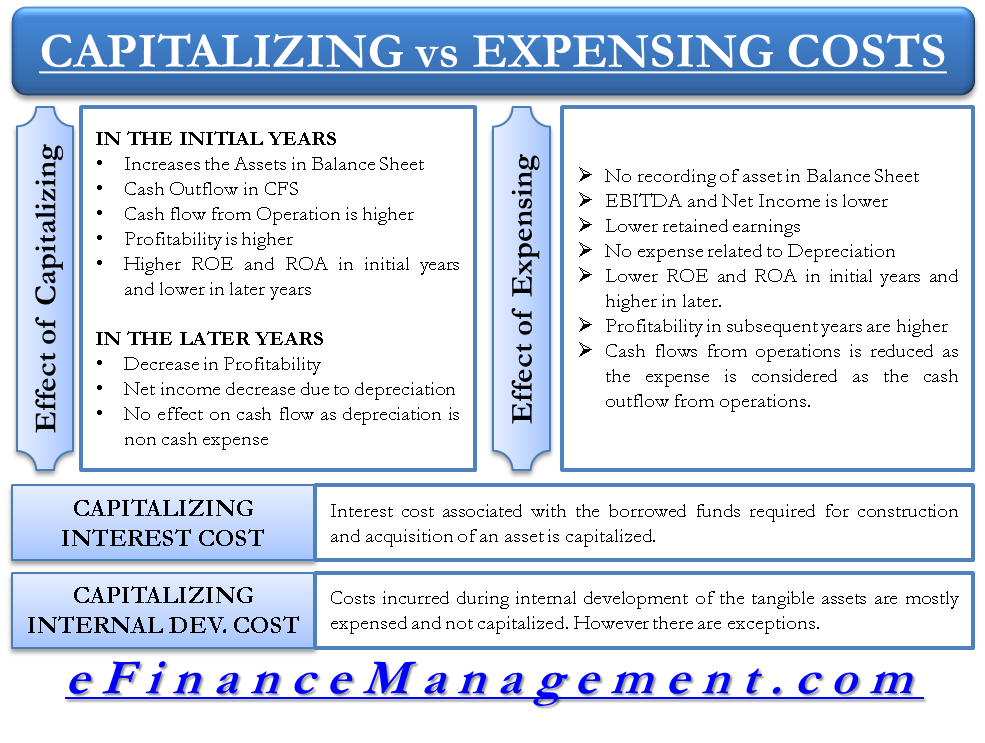

Capitalizing Versus Expensing Costs

Capitalizing Versus Expensing Costs

Example Lease Accounting Under Ifrs 16 Youtube

Example Lease Accounting Under Ifrs 16 Youtube

Ias 27 Separate Financial Statements Financial Statement Financial Financial Instrument

Ias 27 Separate Financial Statements Financial Statement Financial Financial Instrument

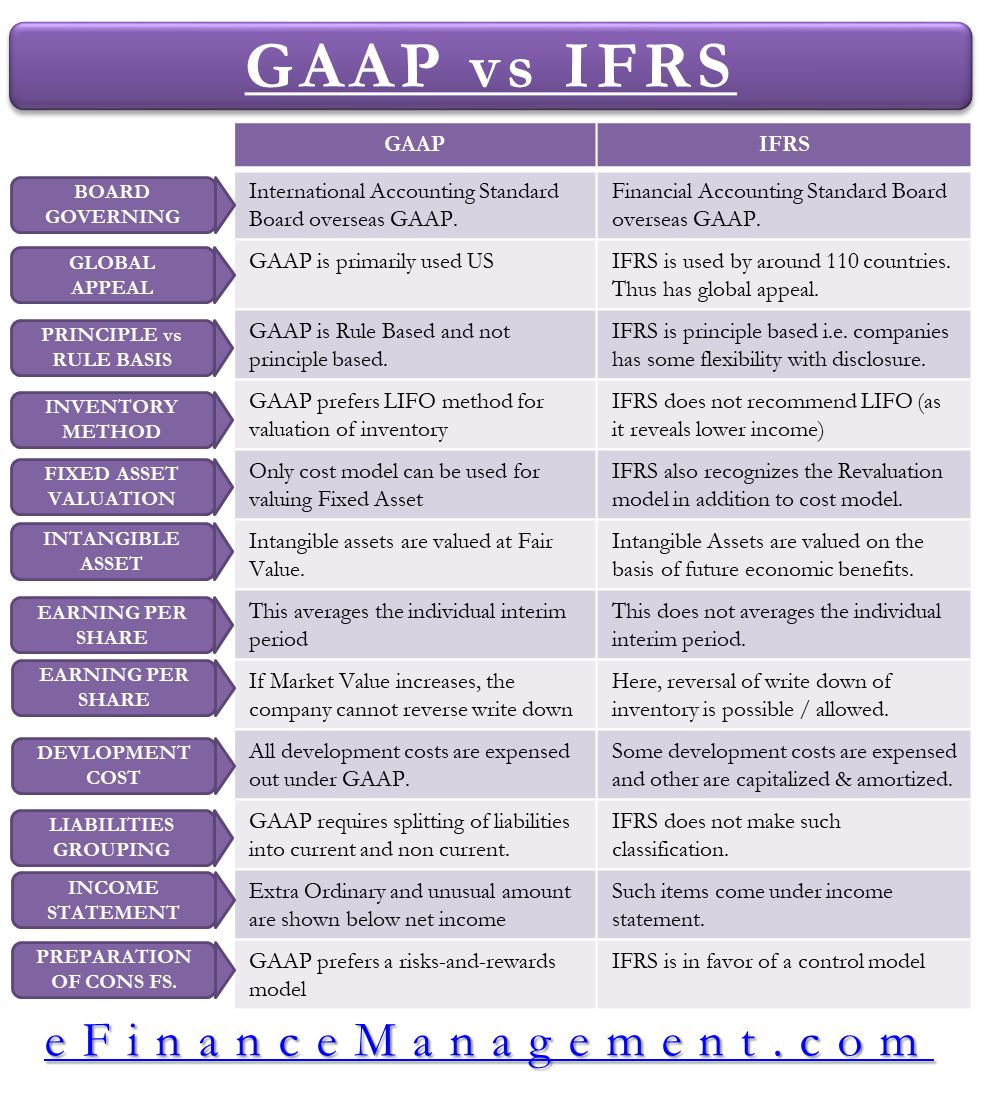

Gaap Vs Ifrs All You Need To Know

Gaap Vs Ifrs All You Need To Know

Slide 2c Intangible Assets Ifrs

Slide 2c Intangible Assets Ifrs

New Ifrs Operating Lease Rules To Have Major Balance Sheet Impact

New Ifrs Operating Lease Rules To Have Major Balance Sheet Impact

Post a Comment for "What Costs Can Be Capitalized Under Ifrs"