Stamp Duty On Shares Exemptions Uk

Youll then pay Stamp Duty at the relevant rate of 5 on the remaining amount up to 200000. This Practice Note outlines the key exemptions and reliefs from stamp duty.

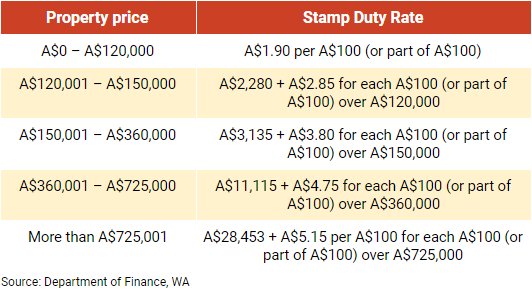

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Since 1986 both stamp duty and SDRT have been charged at a rate of 05 of the consideration for the transfer of shares in the case of stamp duty rounded up to the nearest 5.

Stamp duty on shares exemptions uk. 13102014 shares using a stock transfer form youll pay Stamp Duty if the transaction is over 1000 Youll have to pay tax at 15 if you transfer shares into. While there are several exemptions such as AIM shares in most cases the 05 stamp duty tax will automatically be taken when you complete shares transactions. Calculated at a rate of 05 of the sale price of the shares Stamp Duty SD must be paid to HMRC by the purchaser the new shareholder when.

02072019 Stamp duty on shares refers to two taxes on the purchase of most shares and some other financial instruments payable by the buyers. Stamp Duty Exemption Stamp Duty and Stamp Duty Reserve Tax exemption on eligible AIM and High Growth Segment securities From 28 April 2014 Stamp Duty and the Stamp Duty Reserve Tax SDRT will no longer be chargeable on transactions in securities admitted to trading on a recognised growth market provided they are not also. Exemptions to this are if.

The consideration you give is not chargeable consideration. HMRC guidanceStamp Taxes on Shares Manual. 22122019 In the UK Stamp Duty tax is payable on the transfer of existing shares.

Stamp Duty reliefs and exemptions on share transfers. For properties costing up to 500000 you will pay no Stamp Duty on the first 300000. Transfers which are otherwise exempt.

The transaction is exempt. To summarise stamp duty on UK shares is a 05 tax that is charged on the majority of share transactions. Transfers for no consideration.

Documentation does not need to be stamped or sent to HMRC. Stamp duty exempt trades in UK or Irish shares mean there a few things you dont need to do. The price paid for shares is greater than 1000 and the sale is recorded on a Stock Transfer Form.

Stamp Duty Exemption Stamp Duty Reserve Tax SDRT is automatically collected where due on the purchase of shares electronically settled in CREST. Stamp duty reserve tax SDRT applies to electronic transfers of shares. Documents within repealed heads of.

Shares that you receive as a. The rates are 2. 07042021 If an exemption from stamp duty applies a document ie an instrument of transfer which would otherwise be subject to UK stamp duty is exempt from such duty.

Certifying a transfer as exempt from stamp duty. From 1 July 2021 if youre a first-time buyer in England or Northern Ireland you will pay no Stamp Duty on properties worth up to 300000. However further documentation may be required should a chargeable consideration in excess of 1000 be submitted for transfer in which a specific exemption exists.

Completing a stock transfer form. It was introduced in 2003 replacing stamp duty which was first introduced in England in 1694. 11072014 You usually need to pay Stamp Duty on the transfer of shares.

Alternatively Stamp Duty is due on non-electronic settlements where the transaction is over 1000. Stamp duty on share purchases is charged when you buy shares that already exist in a UK-incorporated company. When purchasing UK shares which are able to settle through the UK electronic settlement system CREST you will pay 05 of the value of the trade as Stamp Duty Reserve Tax SDRT.

08032021 From 1 April 2021 different rates of Stamp Duty Land Tax SDLT will apply to purchasers of residential property in England and Northern Ireland who are not resident in the UK. Getting an opinion about a. Stamp Duty apply primarily to transactions when you buy.

The same transaction may include an agreement to transfer shares. Stamp duty on shares Practical Law UK Practice Note 9-525-8844 Approx. Penalties appeals and interest.

Stamp duty remains in force for shares and securities that are held in certificated form which can only be transferred by using a physical stock transfer form and runs in parallel to SDRT on agreements to transfer shares. Most bond transactions are exempt. You also have to pay it if you buy an.

30012012 Paperless transfers of stocks shares and other securities are exempt from SDRT there is no tax to pay if they are.

Lock Stock Barrel Set Aside Sum For Stamp Duty

Lock Stock Barrel Set Aside Sum For Stamp Duty

Doing The Maths On The Temporary Stamp Duty Relief Shares Magazine

Doing The Maths On The Temporary Stamp Duty Relief Shares Magazine

Stamp Duty Exemption London Stock Exchange

Stamp Duty Exemption London Stock Exchange

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

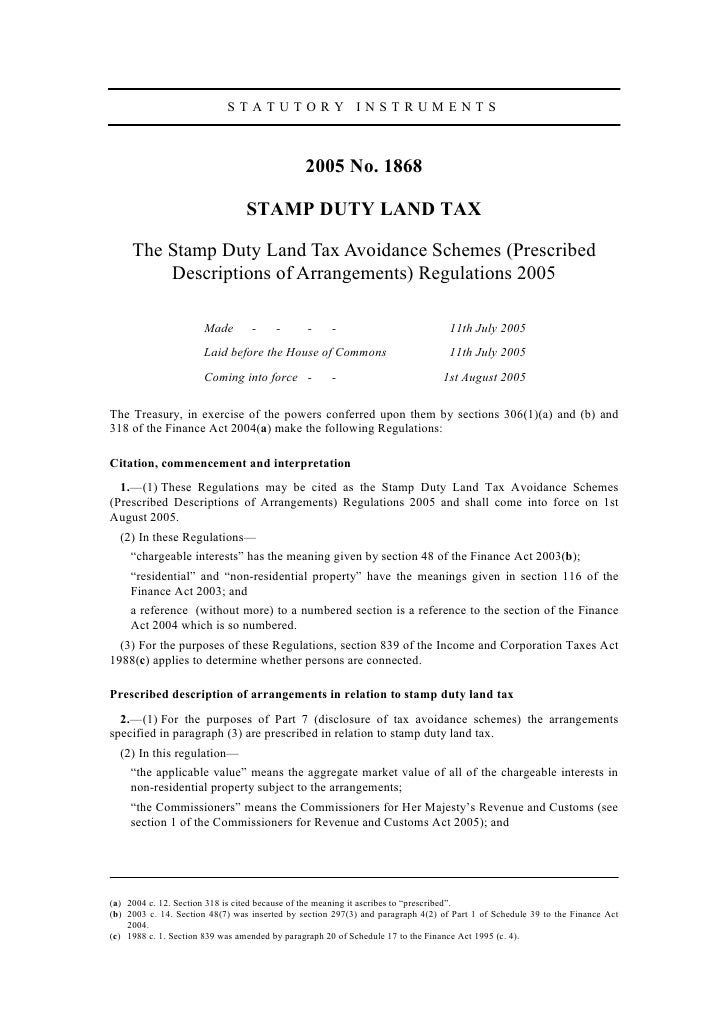

Insight Stamp Duty Land Tax For Uk Property Next Steps

Insight Stamp Duty Land Tax For Uk Property Next Steps

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty In The United Kingdom Wikiwand

Stamp Duty In The United Kingdom Wikiwand

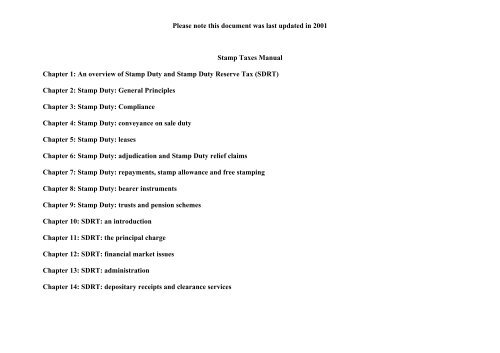

Stamp Taxes Manual Pdf 2 2mb Hm Revenue Customs

Stamp Taxes Manual Pdf 2 2mb Hm Revenue Customs

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Pdf Property Transfer Tax And Stamp Duty

Pdf Property Transfer Tax And Stamp Duty

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Why Are Cfds Free Of Uk Stamp Duty Contracts For Difference Com

Why Are Cfds Free Of Uk Stamp Duty Contracts For Difference Com

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Most Important Stamp Duty Exemptions For Holding And Subsidiary Companies Startups Solicitors Llp Law Firm Best Law Firm Jaipur Delhi Mumbai Gurgaon Dehradun India

Most Important Stamp Duty Exemptions For Holding And Subsidiary Companies Startups Solicitors Llp Law Firm Best Law Firm Jaipur Delhi Mumbai Gurgaon Dehradun India

.webp) Sdlt Stamp Duty Calculator Uk Calculate Stamp Duty Land Tax

Sdlt Stamp Duty Calculator Uk Calculate Stamp Duty Land Tax

Sme Corporation Malaysia Stamp Duty Rate

Sme Corporation Malaysia Stamp Duty Rate

Post a Comment for "Stamp Duty On Shares Exemptions Uk"