Stamp Duty Lhdn

Ad-valorem stamp duty is assessed based on the consideration sum as stated in the instrument of transfer or the market value of the property as at the date of Sale and Purchase Agreement or Instrument of Transfer. 17022021 Attached herewith the Latest Stamp Duty Order Exemption PU A 532021.

150 Tarikh Kemaskini.

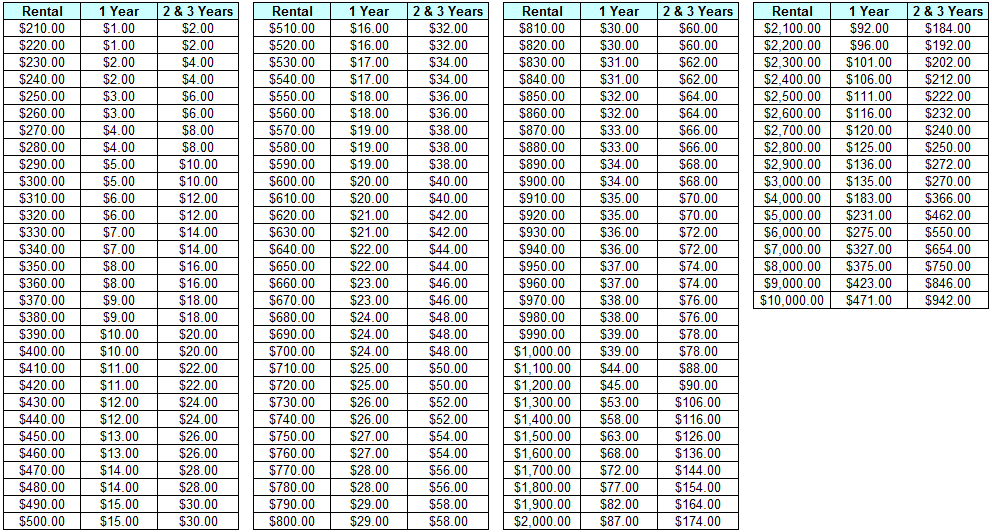

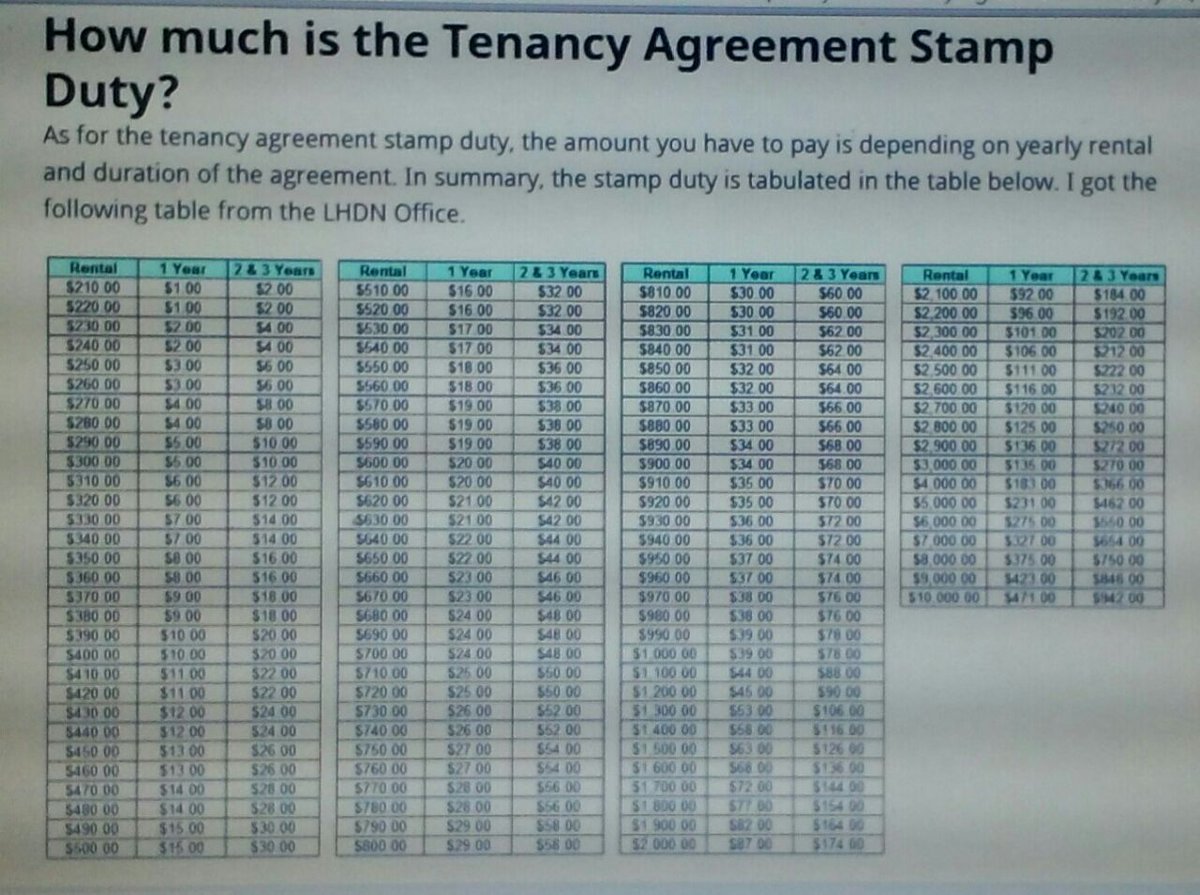

Stamp duty lhdn. Stamp Duty for Sale. You will be asking to pay the Stamp Duty according to the Rental rate table. Sila pastikan borang ini telah diisi dengan lengkap sebelum diserahkan kepada.

10032020 Form PDS L3. 07042017 Calculating Stamp Duty payable. Purchase Agreement Loan.

23052020 Setiap peringkat mengandungi peratusan masing-masing. Stamp Duty is fixed as they are governed by law. Stamp duties are imposed on instruments and not transactions.

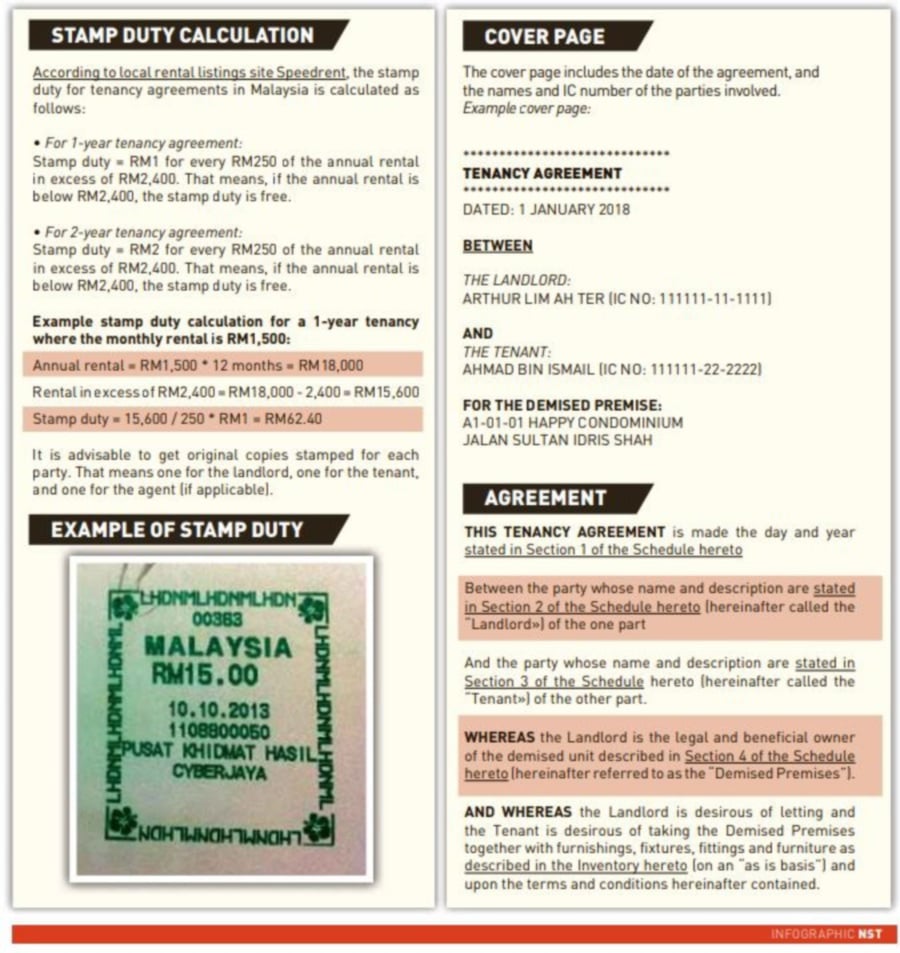

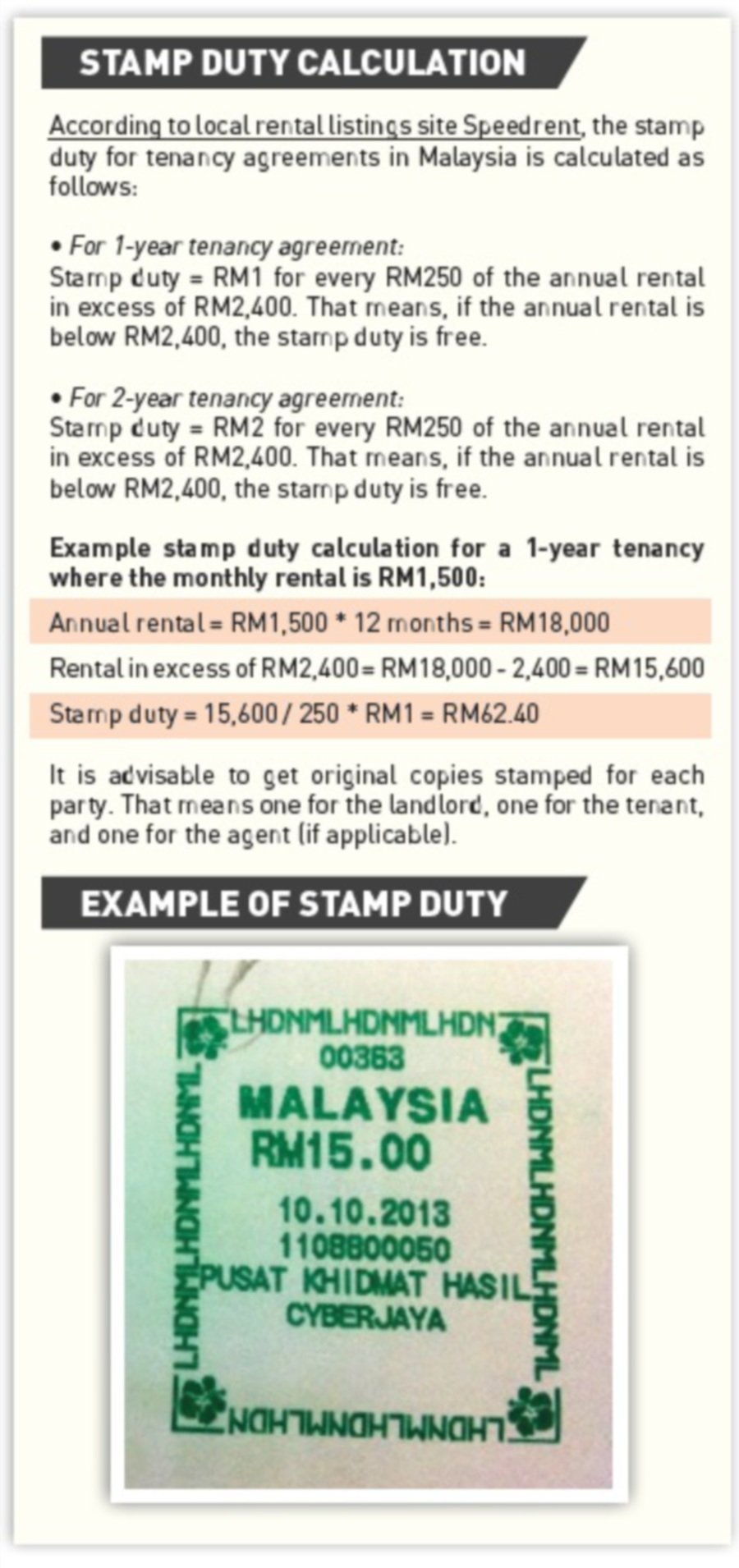

An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. Above table listed are for the main copy of tenancy agreement if you have 2nd or 3rd duplicate copy the stamp duty is 1000 for each copy. Penalty for Late Submission or Failure to Submit Tax Return.

The calculation formula for Legal Fee. The exemption on the instrument of transfer is limited to the first RM1Million of the property price and the stamp duty will be charged RM3 for every RM100 of the balance property price which is more than RM1Million. In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949.

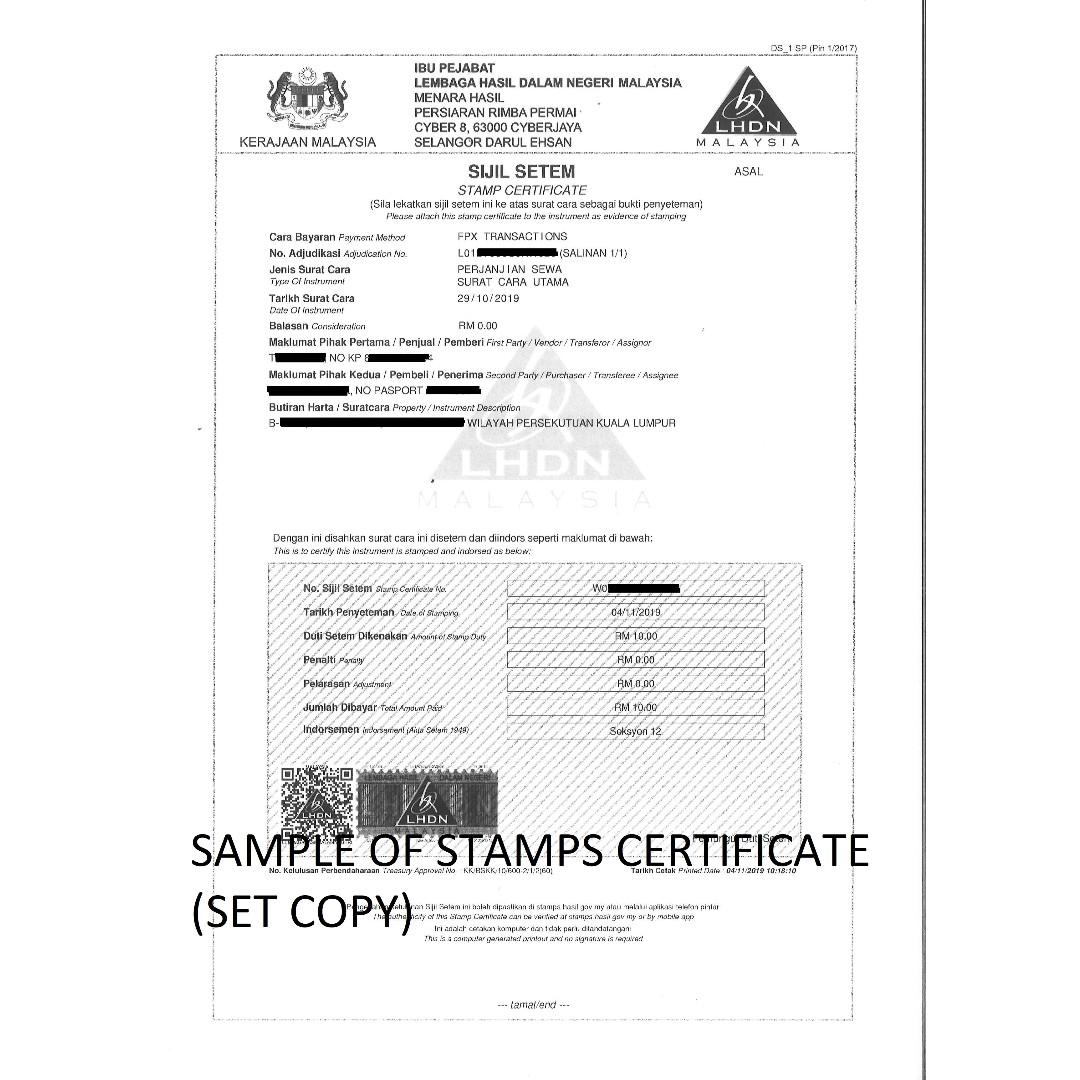

1 caj dikenakan untuk RM100000 yang pertama. Penyata Bayaran Duti Setem Secara KompaunKe Atas Surat Cara Nota Kontrak. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

21052015 In summary the stamp duty is tabulated in the table below. Stamp Duty Exemption no3 Order 2020 and Stamp Duty Exemption no4 Order 2020. 3 caj dikenakan untuk RM500001 sehingga RM1 juta.

4 caj dikenakan untuk semua yang lebih daripada RM1 juta. In general stamp duty imposed to legal commercial and financial instruments. So how much stamp duty will my rental unit incur.

You may pay on the spot. 21062011 Lembaga Hasil Dalam Negeri Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949. Stamp Duty Exemption Order PU A 532021 and the format of Statutory Declaration Letter a Download PU A 532021.

03082020 The exemption of stamp duty with effective on 1 June 2020 for the residential property price between RM300000 to RM25Million. 10022021 Download STAMP DUTY EXEMPTION ORDER 2021 P 326MB. 2 caj dikenakan untuk RM100001 sehingga RM500000.

The lease or tenancy instrument which secures annual rent not exceeding RM2400 is EXEMPTED from duty and presentation of these instruments at a stamping office or. 121 views 0 comments. Available in Malay language only.

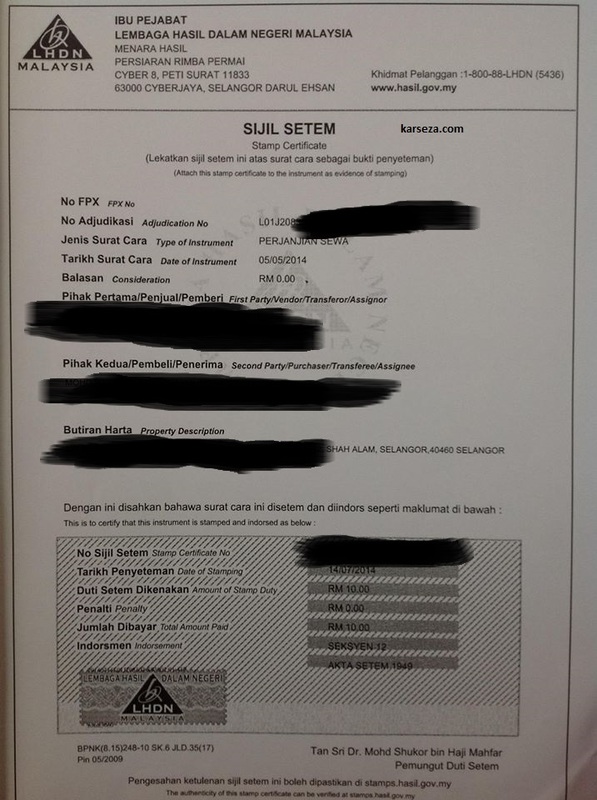

09032020 Key updates include. Duty payers are encouraged to make online genuine checking of Affixed Stamp of Digital Franking after completion of the stamping at STAMPS homepage. 02042020 Stamp duty payers companies or agencies without an urgent need to process stamp duties have been asked to postpone their applications until the end of the MCO.

The Assessment and collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949. This is the official statement from LHDN Inland Revenue Board of Malaysia. Year 2021 LHDN.

The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. 09042019 After completing entry of document information the duty payer only has to show identification identity card passport to the officer of LHDNM Stamp Duty counter for the subsequent stamping process. There are two types of Stamp.

Stamp Duty for Transfer of Shares in Non-Listed Companies. Sekiranya terdapat sebarang pertanyaan tuanpuan boleh menghubungi Pejabat Setem Cawangan Pusat Khidmat Hasil LHDNM yang berdekatan atau emel kepada STAMPS. However for Kulim branch you will need to buy the stamp Hasil from POS office first before going to Kulim LHDN Office.

Sila pastikan borang ini telah diisi dengan lengkap sebelum diserahkan kepada Pejabat Duti Setem Lembaga Hasil Dalam Negeri Malaysia. PU A 542021 and click the link below to download Statutory Declaration Letter from LHDN for your good selves attention. Updates on Special Tax Deduction on Rental Reduction.

19032013 Lembaga Hasil Dalam Negeri. Immediately after the stamping fee is paid the document will passed to another officer just beside it. In general term stamp duty will be imposed to legal commercial and financial instruments.

Stamp Duty Exemption No. Please contact us for a quotation for services required. LHDN has provided an extension of.

Pengiraan stamp duty lhdn adalah seperti berikut. I got the following table from the LHDN Office. Nominal stamp duty is a fixed duty being imposed regardless the consideration sum or market value.

How To Stamp The Tenancy Agreement Property Malaysia

How To Stamp The Tenancy Agreement Property Malaysia

Rpgt Cukai Untung Selepas Jual Rumah Di Malaysia Hartabumihartabumi

Rpgt Cukai Untung Selepas Jual Rumah Di Malaysia Hartabumihartabumi

Drafting And Stamping Tenancy Agreement

Drafting And Stamping Tenancy Agreement

Forum Lowyat Net Uploads Attach 65 Post 58065

Forum Lowyat Net Uploads Attach 65 Post 58065

Drafting And Stamping Tenancy Agreement

Drafting And Stamping Tenancy Agreement

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Property Malaysia

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Property Malaysia

Suryati Hartanah On Twitter Kos Stamp Duty Lhdn Ada Rumah Nak Disewakan Cari Hana Ya 010 2275948

Suryati Hartanah On Twitter Kos Stamp Duty Lhdn Ada Rumah Nak Disewakan Cari Hana Ya 010 2275948

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Post a Comment for "Stamp Duty Lhdn"