Stamp Duty Calculator 2020 Btl

19032013 Stamp duties are imposed on instruments and not transactions. We now provide detailed information on UK stamp duty rates thresholds and recent changes.

All About Buy To Let Finance And How To Get It Property Secrets

If you buy a property for less than the threshold theres no SDLT to pay.

Stamp duty calculator 2020 btl. Properties valued at 40000 or less do not attract the surcharge. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. 27062019 Standard Stamp Duty Rate.

2020 stamp duty holiday calculator. You can claim a discount relief if you buy your first home before 8 July 2020. As the new changes come into effect the rates for landlords and anyone buying a second home is 3 on the portion of the property up to 500000 then 8 13 and 15 respectively for the price tiers.

Select First Time Buyer Moving Home. Once over this limit the 3 additional tax applies. 15 Million 12.

The following table and calculator show the total amount payable. Find out how much youll pay on a BTL purchase in England and Northern Ireland before June 2021 with our stamp duty holiday calculator below. There are several rate bands for Stamp Duty.

09072020 However the 3 surcharge for additional homes including buy-to-let properties still applies on top of the revised standard rates so purchases of homes valued up to 500000 will attract a 3 stamp duty bill. Calculate now and get free quotation. Income tax calculator for tax resident individuals.

The stamp duty calculators have been updated following the introduction of a stamp duty holiday between 8th July 2020 and 30th June 2021. For non-UK resident calculations from 1st April 2021 please use our non-UK resident stamp duty calculator. This stamp duty calculator is designed to give you an idea of your stamp duty liability when buying a freehold residential property in England.

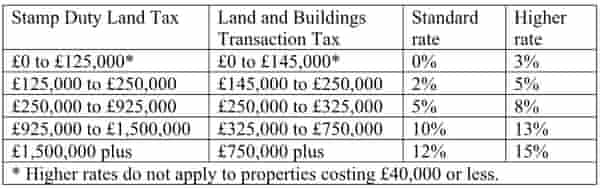

925001 15 Million. 01042021 Calculate how much stamp duty tax to pay when buying a UK second home or buy-to-let property in 2020 or 2021 with our buy to let stamp duty calculator. Similar to PAYE taxation stamp duty is calculated by dividing the property sale price into tiers each tiers taxation rate increases into higher rate bands as the propertyland value increases.

Stamp duty calculations are rounded down to the nearest pound. Exciting news on stamp duty from the 2021 Budget From now until 31st June 2021 youll only pay 3 stamp duty on buy-to-let property purchases up to the value of 500000. 08072020 From 8 July 2020 to 30 June 2021 the special rules for first time buyers are replaced by the reduced rates set out above.

Purchase mortgage loan refinance in Malaysia. Calculate how much stamp duty you will pay. Calculate Stamp Duty Legal Fees for property sales.

2020 24046897. YA 2020 XLS 122KB YA 2019 XLSX 42KB YA 2018 XLS 114KB YA 2017 XLS 114KB Compute income tax liability for tax resident individuals locals and foreigners who are in Singapore for 183 days or more 2. Buy-to-Let Stamp Duty Rates.

Calculate stamp duty SDLT in England and Northern Ireland with our instant stamp duty calculator. The current SDLT threshold for residential properties is 500000. Use the SDLT calculator to work out how much tax youll pay.

This calculator is intended to give an indication only and applies to England and Northern Ireland only. Our buy-to-let BTL Stamp Duty calculator for rental properties and second homes will tell you how much Stamp Duty you need to pay when purchasing a buy-to-let property or second home. In accordance with new rates introduced in 2016 people who own more than one property must pay 3 on top of the normal Stamp Duty rates.

From April 2016 the rates of Stamp Duty payable by private landlords increases by 3. BTLSecond Property Stamp Duty Rate. YA 2021 XLS 170KB New.

For more information you. Visitors This Year. 09072020 How is stamp duty calculated.

This calculator has been updated to reflect the temporary new stamp duty rules for England and Northern Ireland introduced by the Chancellor on 8 July 2020. Find out more at our blog. The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949.

If youre buying your first home. Table of Rates for Buy-to-let Properties. 05052015 Use the SDLT calculator to work out how much tax youll pay.

First time buyers in England or Northern Ireland will pay no Stamp Duty on properties. This changes on 1.

Countdown To Stamp Duty 37 Days Cpc Commercial Finance

Countdown To Stamp Duty 37 Days Cpc Commercial Finance

Legal Fees Calculator Stamp Duty Malaysia 2017 Malaysia Housing Loan 2017 Legal Malaysia Calculator

Legal Fees Calculator Stamp Duty Malaysia 2017 Malaysia Housing Loan 2017 Legal Malaysia Calculator

How To Avoid The Buy To Let Crackdown Shares Magazine

How To Avoid The Buy To Let Crackdown Shares Magazine

Stamp Duty Holiday Only Having Modest Impact In Wales Propertywire

Stamp Duty Holiday Only Having Modest Impact In Wales Propertywire

Does The 3 Stamp Duty For Second Properties Apply In Scotland Money The Guardian

Does The 3 Stamp Duty For Second Properties Apply In Scotland Money The Guardian

Legal Fees Calculator Stamp Duty Malaysia 2017 Malaysia Housing Loan 2017 Calculator Quotations Malaysia

Legal Fees Calculator Stamp Duty Malaysia 2017 Malaysia Housing Loan 2017 Calculator Quotations Malaysia

Stamp Duty Updates For Overseas Property Buyers From April 2021 Benham And Reeves Uk

Stamp Duty Updates For Overseas Property Buyers From April 2021 Benham And Reeves Uk

Investors Welcome Stamp Duty Holiday Sevencapital

Investors Welcome Stamp Duty Holiday Sevencapital

Stamp Duty Land Tax Calculator Save Sdlt Youtube

Stamp Duty Land Tax Calculator Save Sdlt Youtube

Stamp Duty Calculator How Much Stamp Duty Will You Pay On Property

Stamp Duty Calculator How Much Stamp Duty Will You Pay On Property

Stamp Duty How Much And When Do I Pay Homeowners Alliance

Stamp Duty How Much And When Do I Pay Homeowners Alliance

How The Stamp Duty Holiday Will Reignite The Buy To Let Market Property Secrets

How The Stamp Duty Holiday Will Reignite The Buy To Let Market Property Secrets

Stamp Duty Calculator Uk Tax Calculators

Updated Sdlt Calculation Spreadsheet For Stamp Duty Holiday Property And Tenant Manager Blog

Updated Sdlt Calculation Spreadsheet For Stamp Duty Holiday Property And Tenant Manager Blog

Do New Stamp Duty Taxes Mean Bye Bye Buy To Let Buying To Let The Guardian

Do New Stamp Duty Taxes Mean Bye Bye Buy To Let Buying To Let The Guardian

Do New Stamp Duty Taxes Mean Bye Bye Buy To Let Buying To Let The Guardian

Do New Stamp Duty Taxes Mean Bye Bye Buy To Let Buying To Let The Guardian

Post a Comment for "Stamp Duty Calculator 2020 Btl"