Is Stamp Duty Part Of Asset Cost

Costs incurred while preparing the installation site for the asset. 27062018 Cost of delivery.

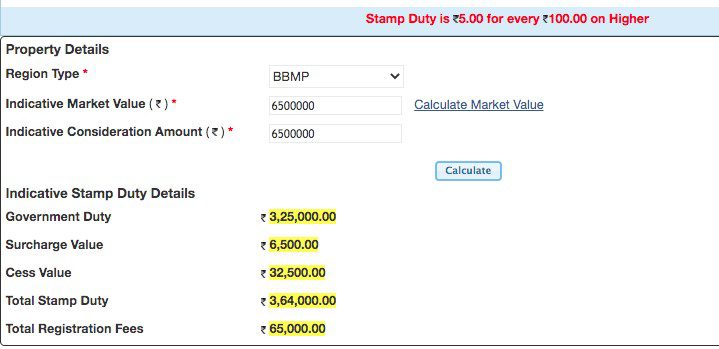

What Are The Stamp Duty Registration Charges In Bangalore

What Are The Stamp Duty Registration Charges In Bangalore

Registration charges are part of cost of acquisition.

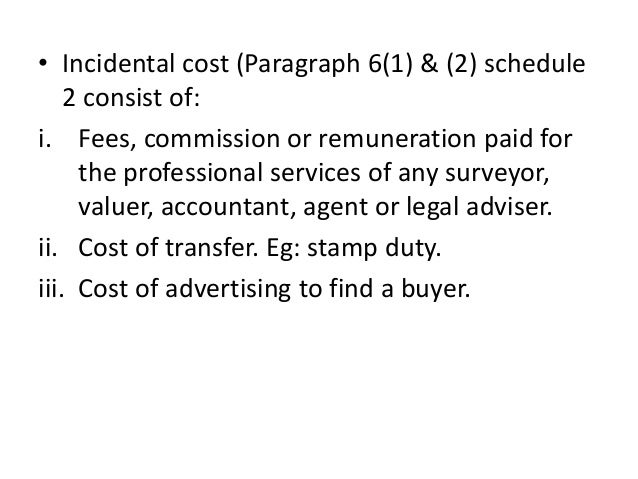

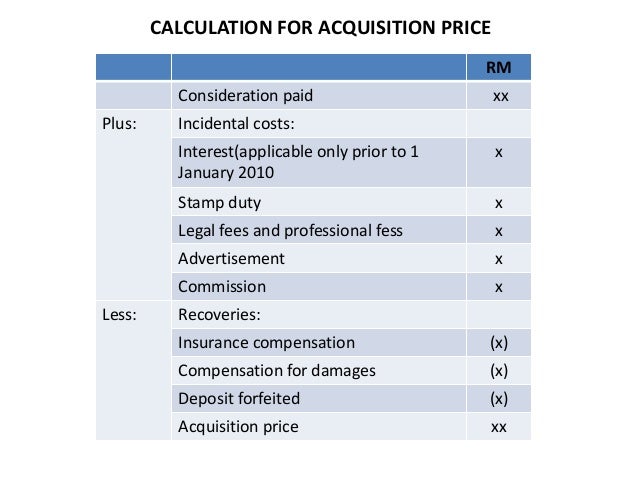

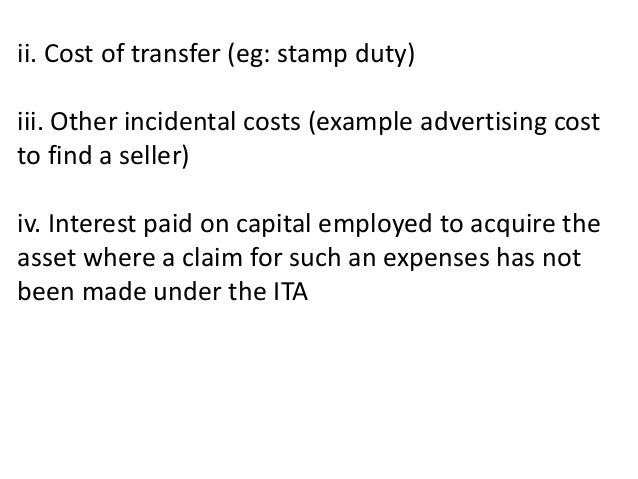

Is stamp duty part of asset cost. Stamp duty or other similar duty costs of advertising or marketing but not entertainment to find a seller or buyer costs relating to the making of any valuation or apportionment to determine your capital gain or loss. Expenditure wholly and exclusively in connection with transfer consists of all costs like Stamp dutyRegistration Charges Brokerage etc which are exclusively connected with the Transfer. The useful life of a fixed asset.

Examples of initial direct costs that cant be included in the cost of RoU asset are. 22 Asset purchase Stamp duty is an issue which needs to be considered carefully where an asset purchase is taking place. 07012021 However Stamp Duty is chargeable if.

1 Create a asset account for the cost of the vehicle with GCA account when recorder it only lists the non gst figure in the asset total. The gst component goes int your gst account. Stamp duty applies to residential property such as houses apartments or sites with agreement to build.

Costs related with the acquisition of assets like import duty and stamp duty. Until 30 September 2021 no stamp duty will be charged on a residential property bought. Therefore the stamp duty is part of the asset cost and to be depreciated over the assets.

Stamp duty is therefore a tax which is evidence as it were of any purchase or sale of a property between two or more parties. The assets are the subject of a charge mortgage and they are transferred subject to that charge the company owes a debt to a third party and the shareholders agree to assume liability for the debt the company owes a debt to the shareholders and the shareholders agree to forgive the debt. If you buy open-ended funds investment trusts or ETFs there will be several layers of costs to pay.

Allocation of overheads advisory fees that are incremental but would have been incurred irrespective of whether a lease contract is eventually concluded or not. 07012021 You also pay Stamp Duty on certain written agreements or contracts to transfer property situated in Ireland. I list all regostamp duty ect as registration expences.

Residential for example houses and apartments non-residential such as land commercial buildings business assets like goodwill and shares or. Legal fees stamp duty. 01122020 acquisition costs such as advisers fees stamp duty and similar costs cannot be included in the measurement of goodwill.

Stamp duty is a tax a government places on legal documents usually in the transfer of assets or property in order to fund government activities. In general the only factor affecting the amount of stamp duty is the value of the property. Any costs that are not directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management are expensed in PL as incurred.

26012004 I presume that you are asking about the base cost of the asset for CGT. More HM Revenue and Customs HMRC. 12022021 professional fees eg.

Professional fees like architects fees and legal fees. 18102019 Stamp duty is charged when you transfer property. For example if you invest directly in shares of a company such as Unilever you will have to pay dealing costs and stamp duty.

If I have a loan I create a liabilities account for the loan amount. A fixed asset features an economic life in addition to having a physical life. 03032021 Consequently until 30 June 2021 no stamp duty will be charged on a residential property bought for up to 500000.

08032021 legal costs incurred when signing the contract eg. Option to measure non-controlling interests on the basis of fair value or net assets transaction by transaction. 21032021 You will have to pay various charges and costs whatever type of investment you buy.

07042017 Stamp duty is a government indirect tax which is levied on all legal property transactions. For self-constructed assets IAS 2 comes useful as it is more focused on assets produced internally IAS 1622. The rate of stamp duty on commercial property is 2.

It is charged on the written documents that transfer ownership of land and buidings. If so then the stamp duty is an incidental cost of acquisition along with legal and valuation fees estate agents commissions etc. Real Estate Motor Vehicle Etc.

Some are more explicit than others. Therefore stamp duty at a rate of 2 will be due in respect of the purchase of. 13072000 stamp duty is part of fixed asset cost Without stamp duty the asset is not acquired.

Stamp Duty is not liable for GST. You could use a GST code Capital Acquisition - No GST. If the Stamp Duty relates to a capital purchase normally it is capitalised with the associated asset ie.

Mixed use for example an apartment over a shop. This covers the majority of houses and flats in the UK. Pre-existing ownership interests are measured fair valued at acquisition date.

.webp) Sdlt Stamp Duty Calculator Uk Calculate Stamp Duty Land Tax

Sdlt Stamp Duty Calculator Uk Calculate Stamp Duty Land Tax

A Guide To China S Stamp Duty China Briefing News

A Guide To China S Stamp Duty China Briefing News

Facts About Stamp Duty In Property Purchase Housing News

Facts About Stamp Duty In Property Purchase Housing News

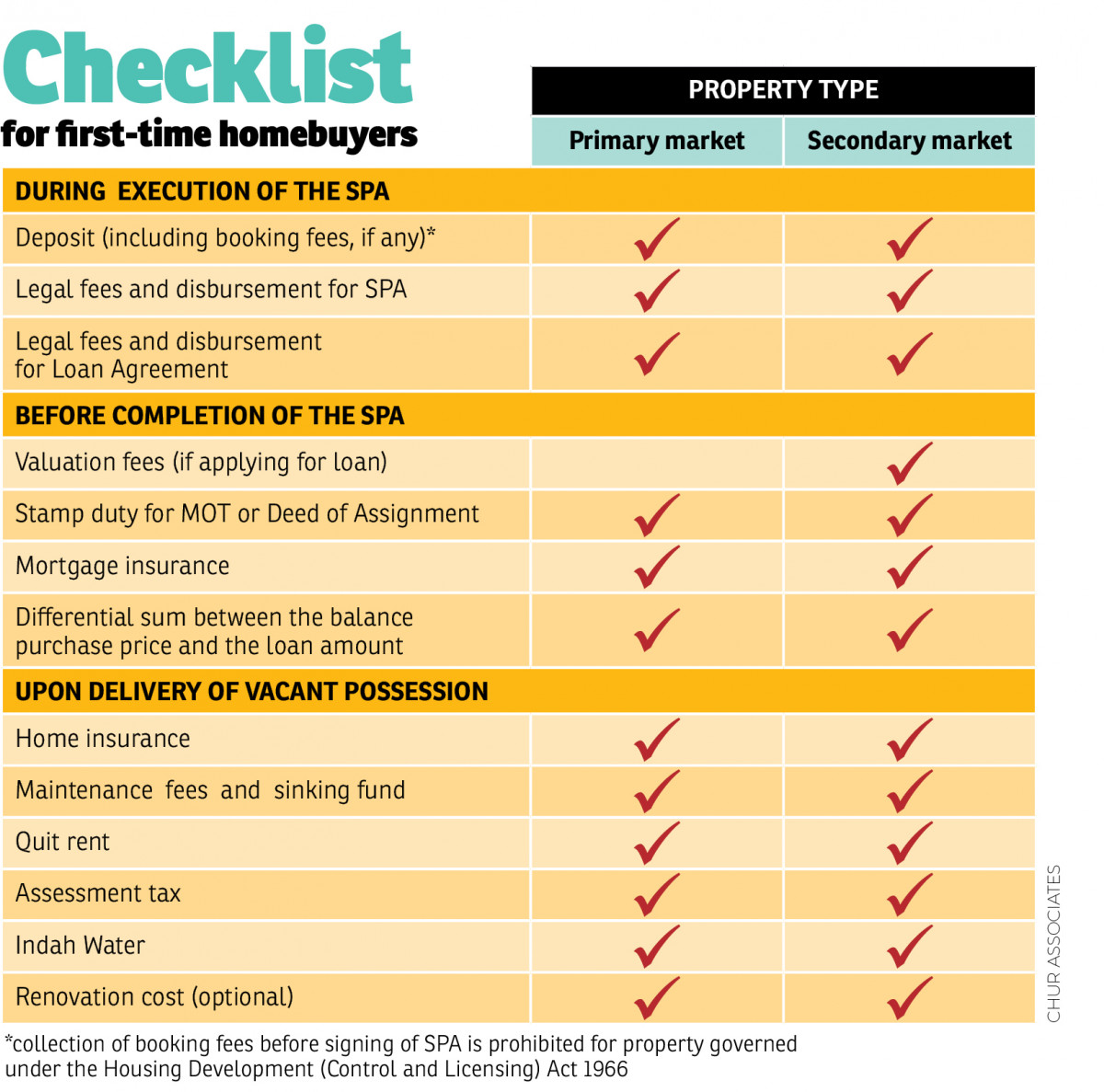

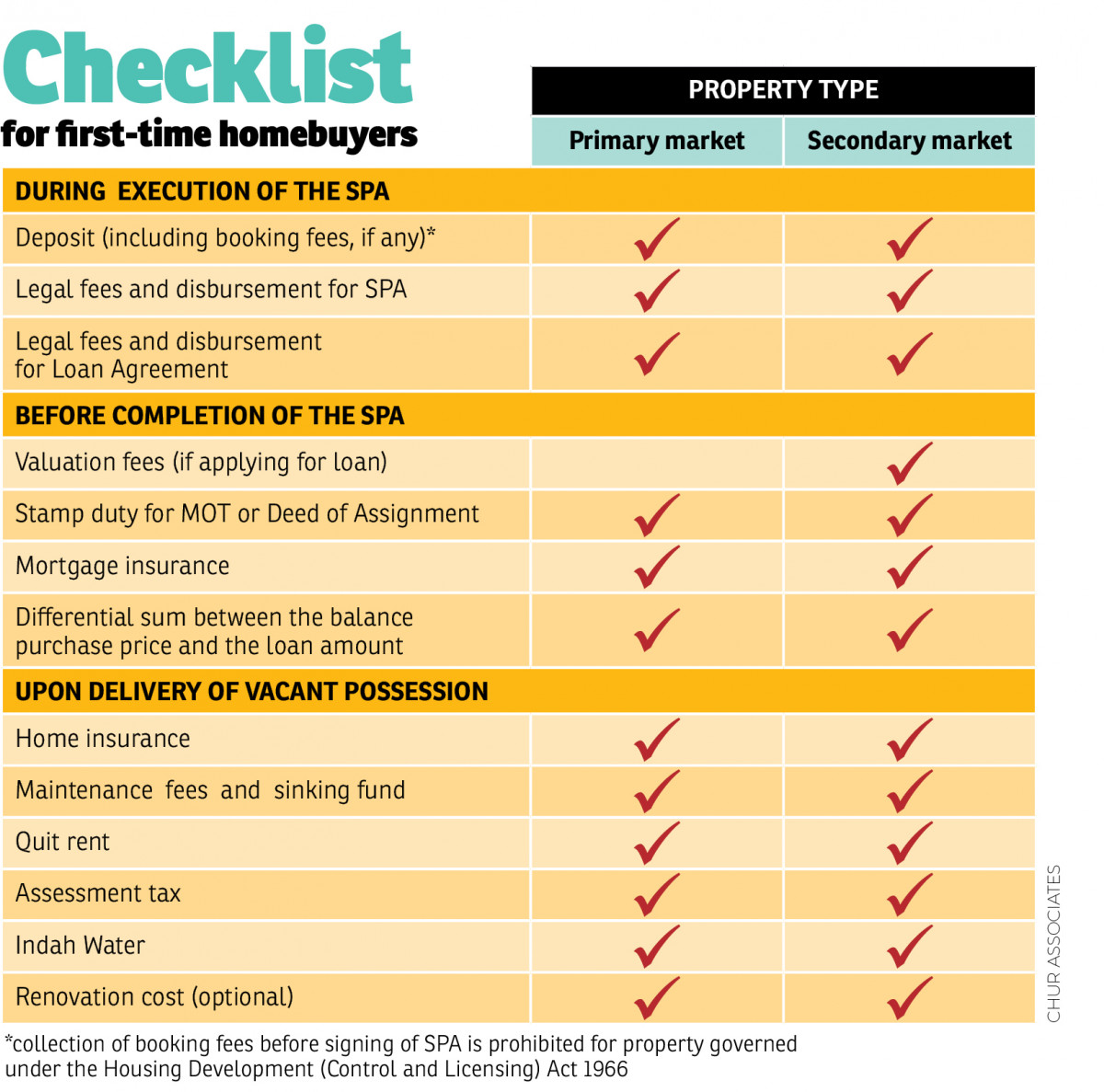

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Stamp Duty In Indonesia Indonesia Tax

Stamp Duty In Indonesia Indonesia Tax

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

.jpg) Financing And Leases Tax Treatment Acca Global

Financing And Leases Tax Treatment Acca Global

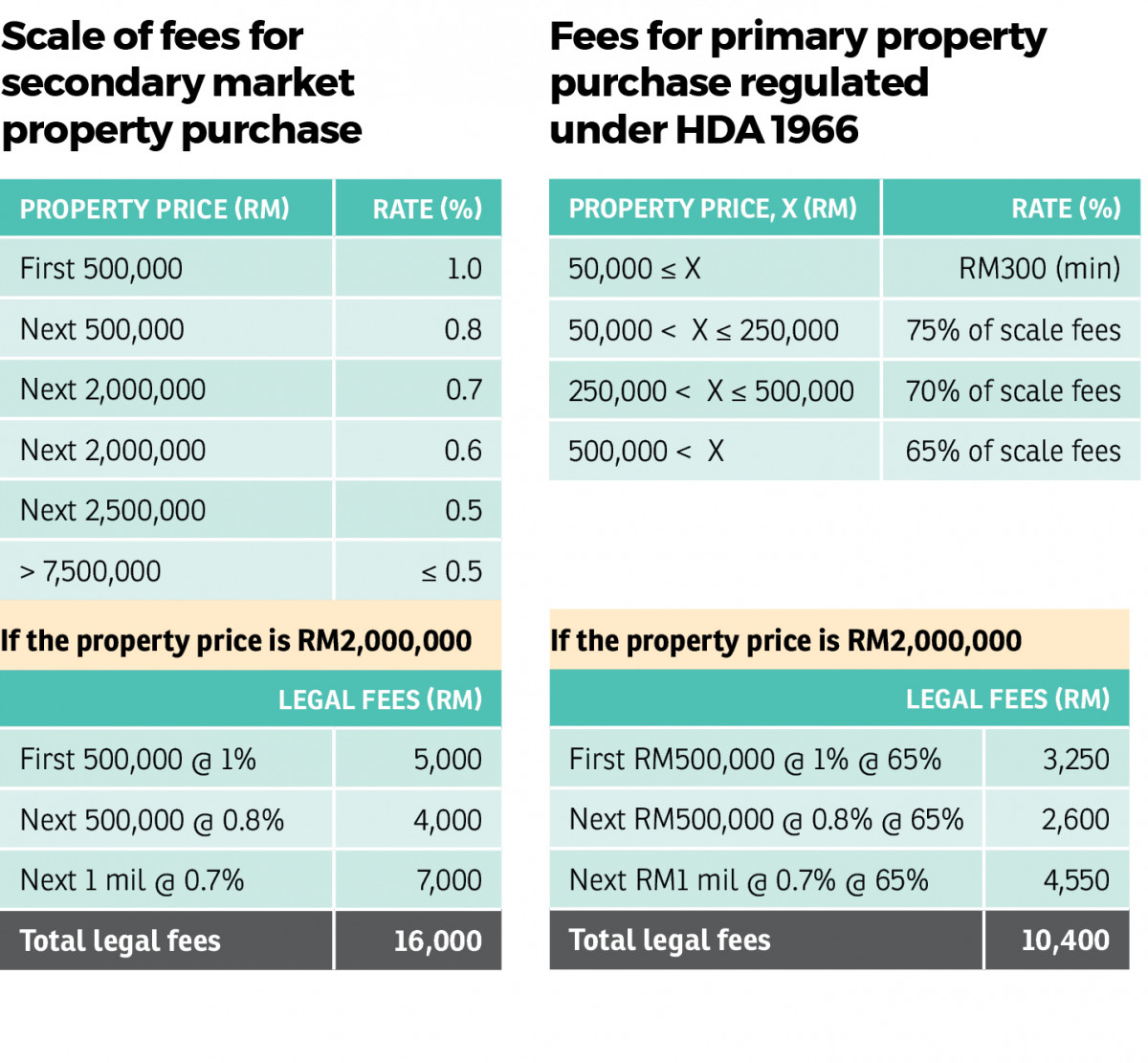

Count The Cost Of Buying A Property Edgeprop My

Count The Cost Of Buying A Property Edgeprop My

Count The Cost Of Buying A Property Edgeprop My

Count The Cost Of Buying A Property Edgeprop My

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Preliminary Expenses Meaning Entry Example Accountingcapital

Preliminary Expenses Meaning Entry Example Accountingcapital

Lock Stock Barrel Set Aside Sum For Stamp Duty

Lock Stock Barrel Set Aside Sum For Stamp Duty

What Is Stamp Duty On Investment Property

What Is Stamp Duty On Investment Property

Stamp Duty Calculator Stamp Duty Home Buying Property Values

Stamp Duty Calculator Stamp Duty Home Buying Property Values

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Post a Comment for "Is Stamp Duty Part Of Asset Cost"