Is Stamp Duty Changing In Scotland

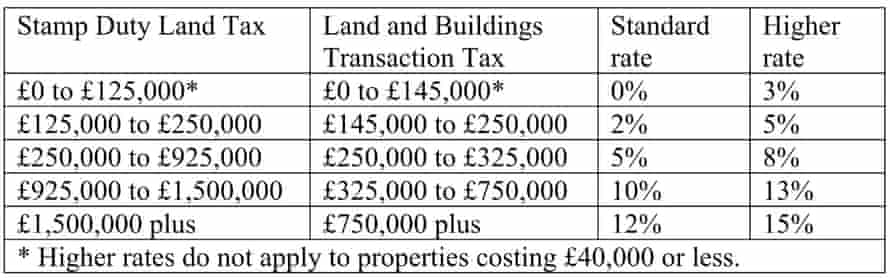

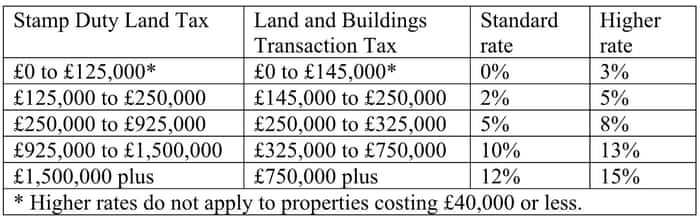

Stamp duty in Scotland has been replaced by Land and Buildings Transaction Tax LBTT. The SNP Finance Secretary increased the level at.

Insight Stamp Duty Land Tax For Uk Property Next Steps

Insight Stamp Duty Land Tax For Uk Property Next Steps

04032021 However the Finance Secretary for Scotland Kate Forbes said the temporary reduction to Land and Buildings Transaction Tax LBTT - the equivalent of stamp duty in Scotland - would still end in.

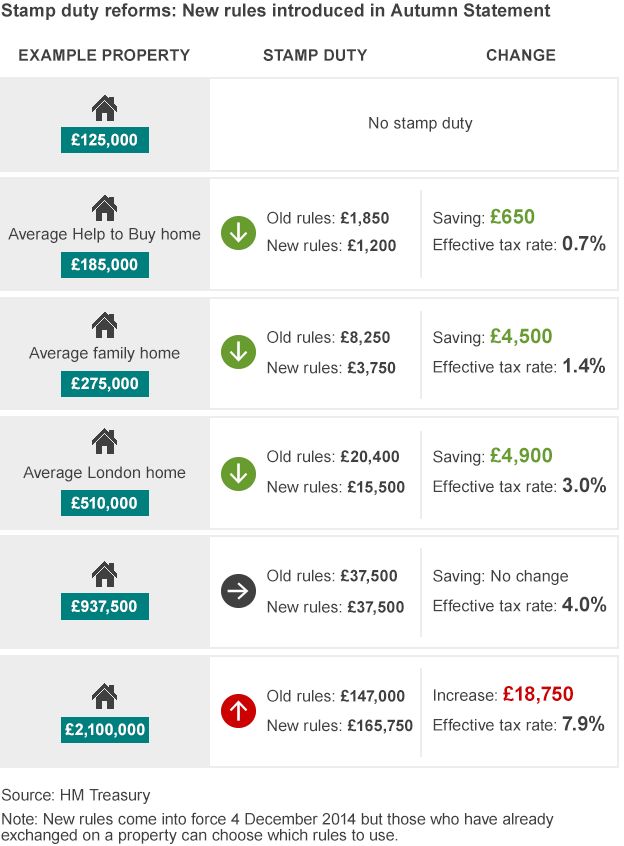

Is stamp duty changing in scotland. The tax-free limit for properties bought by first-time buyers is 175000 meaning that up to 80 of first-time buyers will pay no stamp duty at all. 08072020 The temporary increase to the nil rate band for Stamp Duty Land Tax SDLT which is the rate before you start paying SDLT on residential property has been extended. Chancellor Rishi Sunak says any property purchased up to 50000 0in England and Northern Ireland would be exempted from stamp duty until the end of March.

LBTT for first-time buyers. 05062020 The Scottish Government has tended to mirror the changes that have been made to Stamp Duty in England but it does not have to. Stamp duty in Scotland is now called land and buildings transaction tax LBTT.

What is the change. 1st April 2021 Following the announcement of a Stamp Duty holiday in England and Northern Ireland the Scottish Government confirmed that they would be temporarily raising the nil LBTT threshold from 145000 to 250000 on 15th July 2020. LBTT in Scotland works in a very similar way to Stamp Duty in the rest of the UK.

08072020 Since 30 June 2018 first-time buyers in Scotland have not been required to pay stamp duty on a property purchase up to 175000 Why do we pay stamp duty. Scotland has scrapped stamp duty in favour of their own system called Land and Building Transaction Tax which applies its own rates to its own price bands. The implementation is on 01 April 2015 although Revenue Scotland who will be administering it will be live from January.

04122017 Until 2015 those purchasing properties in Scotland had to pay stamp duty but this is devolved and was replaced with LBTT in 2015. 09072020 The starting point for land and buildings transaction tax LBTT is to rise from 145000 to 250000. He said the Scottish Government would get an additional 12 billion as a result of his Budget but Forbes said part of that cash had already been accounted for in spending.

Stamp Duty Land Tax will be replaced by Land. Stamp duty in Scotland. 13072020 The threshold at which Scotlands Land and Buildings Transaction Tax is paid by purchasers is to be raised from 145000 to 250000.

09072020 KATE Forbes today hiked the threshold on Scotlands version of stamp duty from 14500 to 250000 - but failed to say when the change will kick in. The move was aimed at helping buyers whose finances. 25022021 Scotland should follow Chancellor Rishi Sunaks lead and extend the stamp duty holiday said David Alexander joint chief executive of UK-wide lettings firm Apropos.

For this reason it is always important to make sure you are using the latest version of a good Land and Buildings Transaction Tax Calculator to calculate your LBTT. Buildings Transaction Tax for transactions affecting Scottish properties. The previous threshold of 145000 has been replaced with the new level of 250000 until 31st March 2021.

The Scottish LBTT system is broadly based on the existing SDLT scheme. Stamp duty was originally introduced in. Ms Forbes said this meant eight out of 10 house sales in Scotland would be exempt from the.

Buyers in Scotland currently pay no Land and Buildings Transaction Tax on purchases up to 250000 compared to the usual 145000 but the tax cut is due to end on March 31st. 05032021 Sunak said the stamp duty holiday which was due to end on March 31 would now remain in place until the end of June with a tapered period running until September. 06122014 Stamp Duty changes in Scotland take effect from Spring 2015.

01042021 Scottish stamp duty holiday. How did LBTT change and when did it end. 09072020 It looks like the stamp duty holiday for England and Northern Ireland already in effect following yesterdays announcement is unlikely to be replicated in Scotland.

The move comes as a response from the Scottish Government to the stamp duty holiday for properties selling at 500000 or below in England and Northern Ireland as announced last week by Chancellor Rishi Sunak. Changes to Stamp Duty in Scotland Following on from changes to Stamp Duty in England Wales and NIreland stamp duty in Scotland was reformed on April 1st 2015. The level at which it starts having to be paid was raised from 125000 to 500000 in July 2020.

The LBTT calculators and rates have been updated following the end of the LBTT holiday on 31st March 2021. Rather than ending on 31 March. In addition since April 2016 there has been a 3 additional stamp duty charged to anyone buying a property for over 40000 which is considered to be a second home although there are some exemptions and the ability for.

28022021 Duty Changes in Scotland The Scottish Government has changed its Land and Building Transaction Tax LBTT rates that come into force from the 15th July. 19042021 Stamp duty is a tax paid on property purchases.

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

Does The 3 Stamp Duty For Second Properties Apply In Scotland Money The Guardian

Does The 3 Stamp Duty For Second Properties Apply In Scotland Money The Guardian

Scotland Urged To Follow Suit In Extending Stamp Duty Holiday Propertywire

Scotland Urged To Follow Suit In Extending Stamp Duty Holiday Propertywire

This Perthshire Mansion Comes With Its Very Own Castle Mansions Mansions Homes Castle

This Perthshire Mansion Comes With Its Very Own Castle Mansions Mansions Homes Castle

What Is Stamp Duty Updated 2021 Aspen Woolf

What Is Stamp Duty Updated 2021 Aspen Woolf

What Bubble At The Moment After Pent Up Demand And Changes In Stamp Duty The Property Market Has Gone Cray Cr Stamp Duty Property Marketing Investing

What Bubble At The Moment After Pent Up Demand And Changes In Stamp Duty The Property Market Has Gone Cray Cr Stamp Duty Property Marketing Investing

Do New Stamp Duty Taxes Mean Bye Bye Buy To Let Buying To Let The Guardian

Do New Stamp Duty Taxes Mean Bye Bye Buy To Let Buying To Let The Guardian

Access Bank Offers To Pay Customers February To April Stamp Duty Charges Finance Retail Banking Bank

Access Bank Offers To Pay Customers February To April Stamp Duty Charges Finance Retail Banking Bank

Stamp Duty Cut How Will It Work A9 Architecture Ltd

Stamp Duty Cut How Will It Work A9 Architecture Ltd

Stamp Duty Changes How Will They Work Bbc News

Stamp Duty Changes How Will They Work Bbc News

The Implications Of The Uk S New Stamp Duty Rates Blog Rettie Co

The Implications Of The Uk S New Stamp Duty Rates Blog Rettie Co

Property Jargon And Terms Guide What Is Stamp Duty

Property Jargon And Terms Guide What Is Stamp Duty

Stamp Duty Rate Calculator Property Land Tax Calculator

Stamp Duty Rate Calculator Property Land Tax Calculator

Does The 3 Stamp Duty For Second Properties Apply In Scotland Money The Guardian

Does The 3 Stamp Duty For Second Properties Apply In Scotland Money The Guardian

Post a Comment for "Is Stamp Duty Changing In Scotland"