Is Stamp Duty An Allowable Expense For Capital Gains

Costs of transfer or conveyance including Stamp Duty or stamp duty land tax costs of advertising to find a buyer or seller costs reasonably incurred in making any valuation or apportionment. 13102014 Stamp Duty Land Tax and VAT unless you can reclaim the VAT You cannot deduct certain costs.

Brighton Accountant As Your Appointed Tax Advisers We Can Help Reduce Your Income Tax Ensuring All Allowable Expense Capital Gains Tax Tax Advisor Business Tax

Brighton Accountant As Your Appointed Tax Advisers We Can Help Reduce Your Income Tax Ensuring All Allowable Expense Capital Gains Tax Tax Advisor Business Tax

However since the stamp duty value of the premises was Rs2059 Crores Ld.

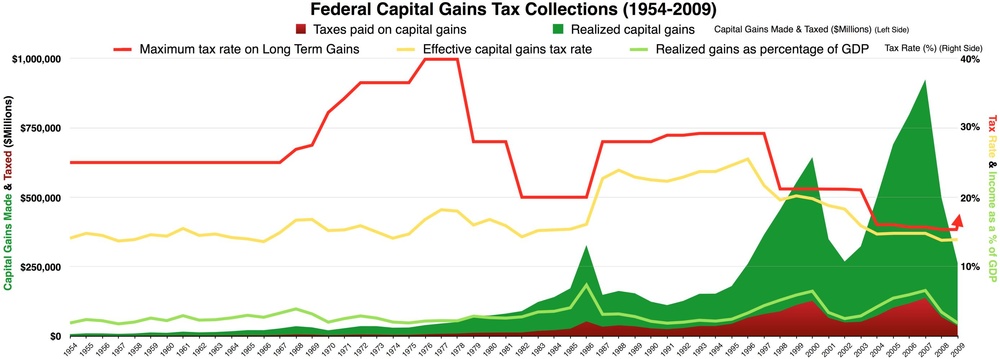

Is stamp duty an allowable expense for capital gains. Costs you can claim as. 20012020 Stamp duty is a form of tax charged by State and Territory Governments. Stamp duty capital gains tax and other tax considerations can be important elements of a corporate finance transaction.

19 Crores and offered short-term capital gains of Rs1149 Crores. Expenses incurred in the production of income Example. Where incurred as incidental costs of acquiring an asset.

AO invoking the provisions of Sec50C added the differential amount of. When selling an investment stamp duty can decrease your capital gains tax CGT liability through increasing the property cost base. 15102013 Similarly consideration received on sale of shares should be after deduction of service tax stamp duty brokerage etc except STT.

Appropriate tax planning can help ensure you minimise any stamp duty and capital gains tax liabilities when you buy or restructure a business. You sell the property for 400000. You purchase a property for 100000.

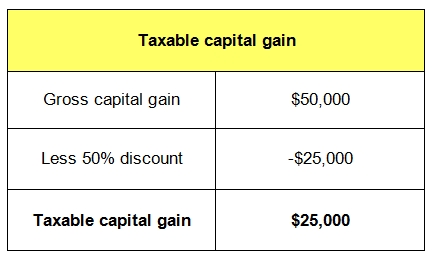

Following on from the same example. 31052012 In case there is a situation where the individual has incurred such expenses for the purpose of the transaction which would include the cost of stamp duty or some other forms of registration fees. Certain items are considered allowable deductions for capital gains where they are incurred wholly and exclusively in the following circumstances.

Perhaps you have these included in the 310K but just in case. Section 48 of the Income Tax. Assume you have no other capital gains losses or allowable expenditure.

05012017 You dont appear to have included any other purchase costs other than price and stamp duty did you not have any other purchase cost eg. 23072020 This means that for anyone that is a first-time buyer or only owns one property they wont pay any stamp duty up to 500000. 353 or upon the termination of a life interest in possession.

Stamp duty on buying shares is cost to the purchaser. Stamp duty is a capital cost and isnt immediately tax deductible. Payment for wages salary.

Broker fees or commission. The allowable expenditure may include fees in respect of. Stamp Duty on land would be a capital expense.

When you calculate capital gains tax you need to calculate. Payment of telephone bills. Allowable expenditure by a factor the multiplier.

Incidental costs of acquisition such as legal fees and stamp duty are allowable as part of the cost. Disposals are not limited to sales of assets a gift of an asset counts as a disposal and will be liable to CGT if a gain is made. Take your taxable gains.

Personal expenses Example. You spent 50000 improving the property. 07032019 Stamp duty paid on transfer of property.

Expenses for repair of premise and vehicles used for business purpose. You can offset any stamp duty you paid originally for your property against the final value for the purposes of capital gains tax. 11112020 During assessment proceedings it transpired that the assessee sold an office premises vide agreement dated 31032015 for a consideration of Rs.

Solicitor fees estate agent fees and surveyorarchitect fees when purchasing the house as these would be allowable too. Tax planning is also a key issue if you are thinking of selling a business. Posted 4 years ago.

Deduct the Capital Gains Tax allowance. EPF Payment Rental of business premise Interest on business loan. This is half of what they would have usually paid on a purchase price of 500000.

The acquisition and creation of the asset concerned. Companies or investors that own two or more properties will also benefit as under this incentive they will only pay 3 in stamp duty. Interest on a loan to buy your asset.

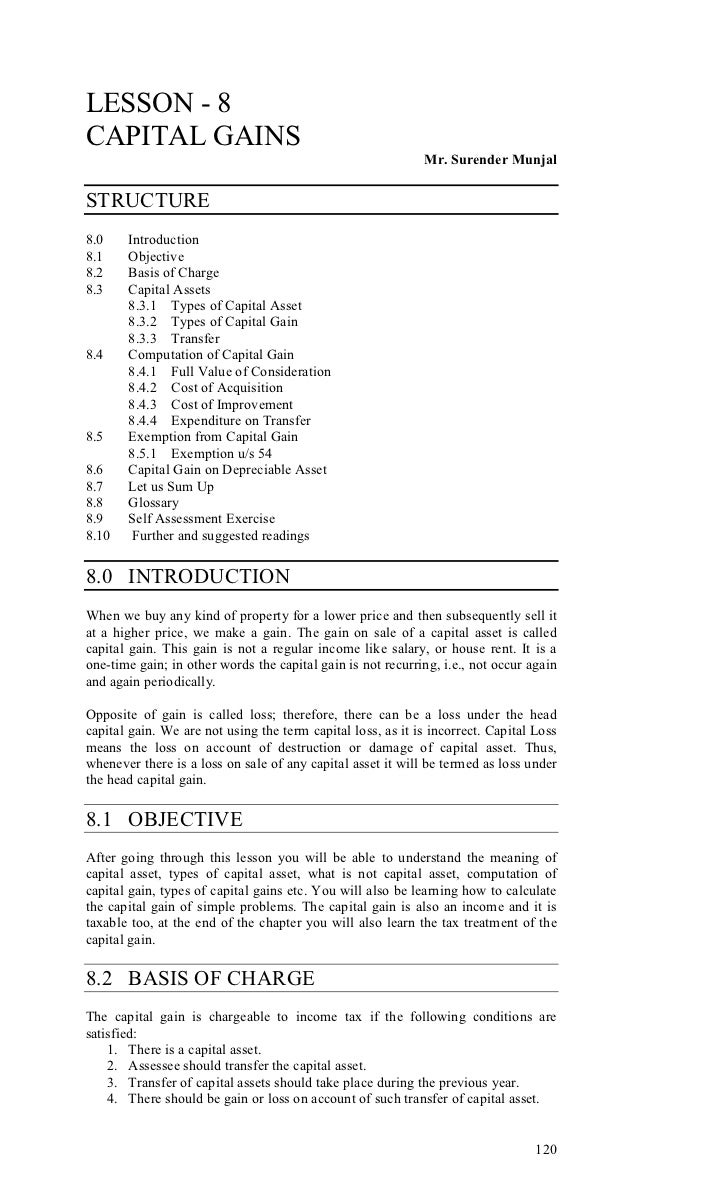

D The costs of legal and actuarial services including Stamp Duty on transfers and ancillary expenses incurred in varying or ending a settlement see CIR. To differentiate capital gains into long term and short term the period is 36 months and 12 months. Fees for professional advice - generally valuation services only.

V Chubbs Trustee 1971 47 TC. Please note that these expenses are not allowed as a deduction from any other heads of income. You spent 10000 on Stamp Duty and agency fees.

Deduct any allowable expenses. The multiplier to. 19032018 Offsetting stamp duty against capital gains tax.

Disposal proceeds 8000 Cost price 5000 Chargeable Gain 3000. All these expenses are allowed as deduction only for the purpose of calculating the Capital Gains. For enhancement of the asset.

Another reason to use an accountant. Capital Gains Tax CGT 21 Overview In general terms Capital Gains Tax CGT is charged on the value of the capital gain made on the disposal of an asset. The associated costs that you are allowed to deduct when calculating your Capital Gains on your shares funds and forex transactions are very limited but include.

Capital Gain Tax On Sale Of Inherited Property How To Calculate Fmv Of Property As On 2001 Taxpundit Youtube

Capital Gain Tax On Sale Of Inherited Property How To Calculate Fmv Of Property As On 2001 Taxpundit Youtube

How To Calculate Long Term Capital Gain Tax On Equity Shares And Mutual Fund From 1st April 2018 Capital Gains Tax Capital Gain Mutuals Funds

How To Calculate Long Term Capital Gain Tax On Equity Shares And Mutual Fund From 1st April 2018 Capital Gains Tax Capital Gain Mutuals Funds

Stocks Investment 101 Should You Invest For Capital Gain Or Dividend Yield

Stocks Investment 101 Should You Invest For Capital Gain Or Dividend Yield

With Accountants Brighton As Your Appointed Tax Advisers Brighton We Can Help Reduce Your Income T Mortgage Interest Rates Home Mortgage Current Mortgage Rates

With Accountants Brighton As Your Appointed Tax Advisers Brighton We Can Help Reduce Your Income T Mortgage Interest Rates Home Mortgage Current Mortgage Rates

Capital Gains Tax Replaced By Income Tax In 2021 Youtube

Capital Gains Tax Replaced By Income Tax In 2021 Youtube

Capital Gains Tax For Expats Experts For Expats

Capital Gains Tax For Expats Experts For Expats

Capital Gains Definition 2021 Tax Rates And Examples

Ultimate Guide To Capital Gains Tax Rates In The Uk

Ultimate Guide To Capital Gains Tax Rates In The Uk

Call Brighton Accountant Tax Consultants Accountants Hove For Your Tax Needs Tax Planning And Reducing Tax Bill Capital Gains Tax Tax Advisor Capital Gain

Call Brighton Accountant Tax Consultants Accountants Hove For Your Tax Needs Tax Planning And Reducing Tax Bill Capital Gains Tax Tax Advisor Capital Gain

How Much Is Capital Gains Tax Times Money Mentor

How Much Is Capital Gains Tax Times Money Mentor

Capital Gains Tax Australia Property Investment Uk Property Investment Csi Prop

Capital Gains Tax Australia Property Investment Uk Property Investment Csi Prop

Understand The Difference Between Capital Gains Tax Rates And Regular Income Tax Rates Inc Com

Understand The Difference Between Capital Gains Tax Rates And Regular Income Tax Rates Inc Com

Tax Lecture 3 Capital Gains Tax See Chapters 6 Ppt Download

Tax Lecture 3 Capital Gains Tax See Chapters 6 Ppt Download

Self Assessment Tax Returns Expertise Every Tax Payer Be It A Sole Trader Partnership Company Director High Net Tax Return Self Assessment Tax Accountant

Self Assessment Tax Returns Expertise Every Tax Payer Be It A Sole Trader Partnership Company Director High Net Tax Return Self Assessment Tax Accountant

Why Freelancers From India Working For Foreign Clients Online May Not Be Liable For Service Tax Taxworry Com Tax Service Capital Gains Tax

Why Freelancers From India Working For Foreign Clients Online May Not Be Liable For Service Tax Taxworry Com Tax Service Capital Gains Tax

Taxation Of Capital Gains For Individuals And Companies Taxation

Taxation Of Capital Gains For Individuals And Companies Taxation

Post a Comment for "Is Stamp Duty An Allowable Expense For Capital Gains"