Can You Pay Stamp Duty In Installments Victoria

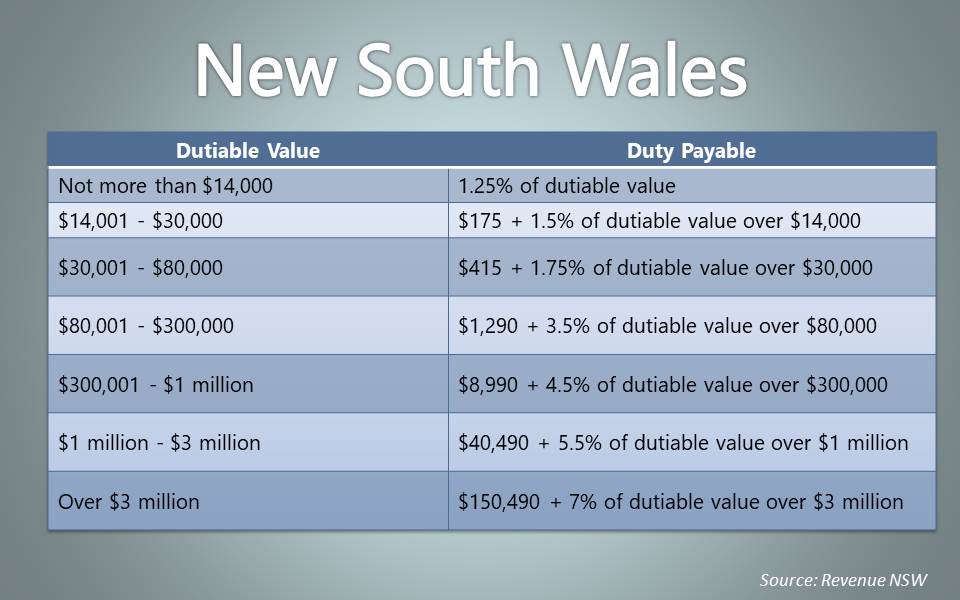

26062020 Youll need to pay stamp duty for things like. In NSW first home buyers going off the plan can defer their stamp duty to 12-months after the settlement date investors cant defer and must pay within the standard NSW time frame.

Stamp Queen Victoria United Kingdom Of Great Britain Northern Ireland Queen Victoria Embossed Mi Gb 5 Yt Gb Rare Stamps Kingdom Of Great Britain Stamp

Stamp Queen Victoria United Kingdom Of Great Britain Northern Ireland Queen Victoria Embossed Mi Gb 5 Yt Gb Rare Stamps Kingdom Of Great Britain Stamp

Of course its 300 you.

Can you pay stamp duty in installments victoria. Motor vehicle registration and transfers. For those buying existing homes a 25 stamp duty discount will apply. Stamp duty can add significantly to the purchase price of a property.

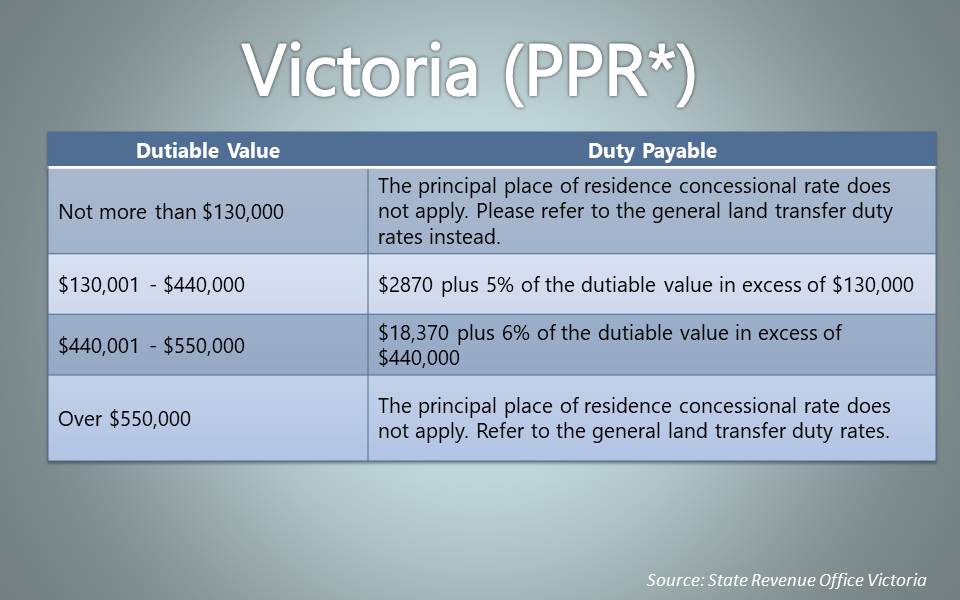

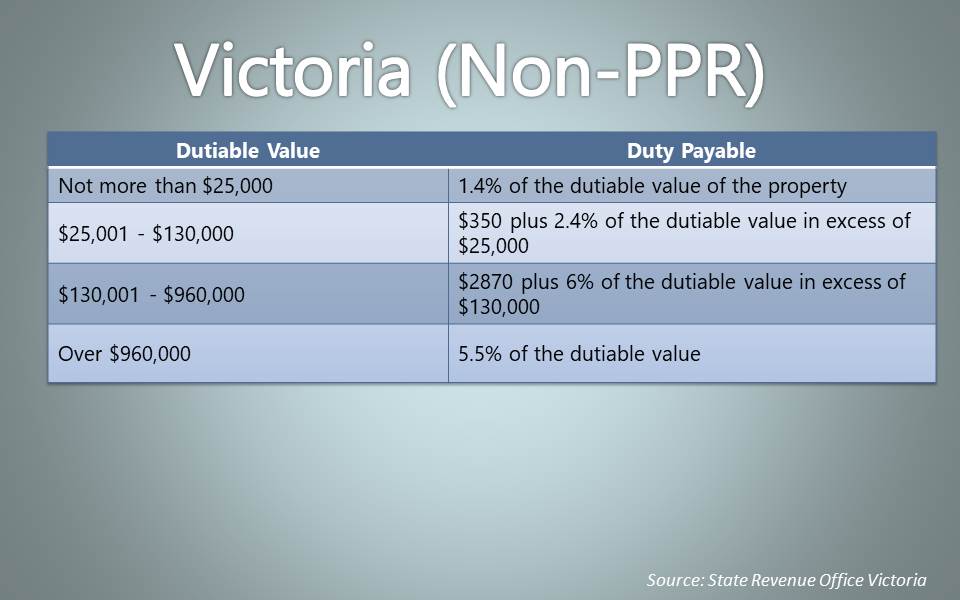

This table shows the rates of stamp duty payable in Victoria. Fortunately there are concessions and exemptions to help keep costs down for first home buyers. Just as the stamp duty rate varies from state to state so does the timeframe in which people need to pay it.

The exemption will be available for those who enter a purchase contract between 25 November 2020 and 30 June 2021. You will pay no Stamp Duty if the amount you pay for your main home is under 500000. When do you have to pay stamp duty.

You can read more about stamp duty concessions that apply to buying a first home here. 09122020 Victoria Stamp Duty Cost. 27042021 Get the basic estimate of what you may have to pay depending in which Australian state or territory you reside.

Victorias stamp duty also has differences depending on whether you are going to be permanently residing in the property or using it as an investment. When buying a 400000 property the stamp duty is 16370. In November 2020 changes to Victorian stamp duty were introduced that meant that buyers can now access discounts of up to 27500.

Yes stamp duty transfer duty is charged by the state government each time you buy residential property or land. It then applies a sliding scale to properties valued between 600000 and 750000. How much is the stamp duty on a 600000 house in VIC.

In Victoria you must pay stamp duty within 30 days after the liability arises to pay transfer duty on the transaction. Can stamp duty be added to your mortgage. So utilise our stamp duty calculator to estimate how much you will need to pay.

ACT payable within 28 days of settlement purchasers must pay stamp duty within 14 days of receiving a Notice of Assessment from. 13112015 Well if you pay the tax up to 12 months after the contracts are signed then HMRC will levy a small fee 10 of the duty - capped at 300. 08122020 Whichever way you obtain your property you must pay land transfer duty previously known as stamp duty on the transfer of the land from one individual to another.

You have 60 days from the date on the contract to pay it. If you do not pay in that time they then charge you interest. The stamp duty amount you will be charged will be calculated based on the propertys purchase price.

17092020 Use our Stamp Duty calculator to work out how much you might need to pay. It will then be broken down as follows. 25112020 A full 50 stamp duty discount will apply in Victoria for all buyers of newly built homes valued at up to 1 million.

Transfers of property such as a business real estate or certain shares The amount of stamp duty youll need to pay depends on the type and value of your transaction. But all of the parties have to be related. To find out if you can use your CPF to pay Stamp Duty please visit the CPF website or call CPF at 1800 227 1188 Monday to Friday 800 am -.

Thus taking it into account is vital whenever you plan to buy your new home. For example if two people x and y jointly purchased a property using andor nominee and then wanted to transfer it to xs dad theyd have to pay stamp duty. 600000 is the most popular property value entered into our stamp duty calculator for Victoria.

In Victoria the State government has abolished stamp duty for first home owners if the home is valued at less than 600000 and the purchaser lives in the home for 12 months. Stamp duty rates and how it is calculated vary from state to state. In Victoria stamp duty is usually calculated from the.

When is stamp duty payable in VIC. The amount of duty depends on the value of your property how you use it if you are a foreign purchaser and if you are eligible for any exemptions or concessions. Using CPF funds to pay Stamp Duty including ABSD is subject to the terms and conditions under the Private Properties and Public Housing Schemes.

If you re purchasing additional properties you wil l still have to pay an extra 3 in Stamp Duty on top of the revised rates for each band. For more help navigating your way through stamp duty and discretionary trusts get in touch with LegalVisions taxation lawyers on 1300 544 755 or fill out the form on this page. 23102017 In Victoria you will pay stamp duty known as land transfer duty when you purchase a home or investment property.

You can also nominate a company or trust that doesnt yet exist. 01032010 But stamp duty does not have to be paid immediately. 18072018 If you have to pay stamp duty on the settlement of your trust ensure you do so within the relevant time frame to avoid unnecessary penalties.

Victoria Revenue Stamp Catalogue Postage Stamp Collecting Vintage Postage Stamps Revenue Stamp

Victoria Revenue Stamp Catalogue Postage Stamp Collecting Vintage Postage Stamps Revenue Stamp

Victoria Queen Victoria Inscription Stamp Duty New Designs 1886 Used Australian Painting Vintage Stamps Stamp

Victoria Queen Victoria Inscription Stamp Duty New Designs 1886 Used Australian Painting Vintage Stamps Stamp

Malaya Perak Scott 21 Overprint On Straits Settlement Queen Victoria Stamp Mh Ebay

Malaya Perak Scott 21 Overprint On Straits Settlement Queen Victoria Stamp Mh Ebay

Forged Stamps Of Hong Kong Queen Victoria Surcharged Rare Stamps Stamp Hong Kong

Forged Stamps Of Hong Kong Queen Victoria Surcharged Rare Stamps Stamp Hong Kong

Victoria 1d One Penny Rare Stamps Old Stamps Vintage Stamps

Victoria 1d One Penny Rare Stamps Old Stamps Vintage Stamps

Revenue Stamps Of Victoria Wikiwand

Revenue Stamps Of Victoria Wikiwand

Stamp Duty Revenue Stamp Stamp Stamp Duty

Stamp Duty Revenue Stamp Stamp Stamp Duty

1901 Stamps Of Victoria Rare Stamps Old Stamps Uk Stamps

1901 Stamps Of Victoria Rare Stamps Old Stamps Uk Stamps

Stamp Duty Victoria Vic Stamp Duty Calculator

Stamp Duty Victoria Vic Stamp Duty Calculator

Victoria 1899 Scott 181 1d Bright Rose Rare Stamps Vintage Stamps Stamp Collecting

Victoria 1899 Scott 181 1d Bright Rose Rare Stamps Vintage Stamps Stamp Collecting

Item Of Interest Stamps Stamp Stamp Collecting Postage Stamps

Item Of Interest Stamps Stamp Stamp Collecting Postage Stamps

New South Wales 75 241b 1885 86 10 Mauve And Claret Q Victoria Overprinted Postage In Blue Perf 12 Bluish P Rare Stamps Stamp Collecting Postage Stamps

New South Wales 75 241b 1885 86 10 Mauve And Claret Q Victoria Overprinted Postage In Blue Perf 12 Bluish P Rare Stamps Stamp Collecting Postage Stamps

Everything You Need To Know About Stamp Duty In Victoria First Things First

Everything You Need To Know About Stamp Duty In Victoria First Things First

Revenue Stamps Of Victoria Wikiwand

Revenue Stamps Of Victoria Wikiwand

1886 Stamps Of Victoria Rare Stamps Postage Stamp Art Vintage Stamps

1886 Stamps Of Victoria Rare Stamps Postage Stamp Art Vintage Stamps

Post a Comment for "Can You Pay Stamp Duty In Installments Victoria"