Can I Pay Stamp Duty In Installments Victoria

Against the backdrop of heightened job insecurity and slow income growth due to COVID-19 there is a bipartisan push by state ministers in both New South Wales NSW and Victoria for the abolishment of stamp duty. Chat_bubble Chat with An Expert.

You can read more about stamp duty concessions that apply to buying a first home here.

Can i pay stamp duty in installments victoria. Last week Leader News highlighted the fact that Victorians have been unable to pay car rego in instalments unlike drivers in other states. 27042021 Get the basic estimate of what you may have to pay depending in which Australian state or territory you reside. Get an estimate of how much stamp duty you might need to pay on a property.

Stamp duty can be paid in the following ways. Our bank account details are on the assessment or return that we issued to you. If you buying your first home you might be eligible for stamp duty exemption.

13112015 Well if you pay the tax up to 12 months after the contracts are signed then HMRC will levy a small fee 10 of the duty - capped at 300. 600000 is the most popular property value entered into our stamp duty calculator for Victoria. If I dont pay stamp duty within 30 days of purchasing the property I am charged 10 of the amount capped at 300 within the first year.

25092017 Victorian car rego hits 800 but now you can pay in instalments UPDATE. It then applies a sliding scale to properties valued between 600000 and 750000. If you do not pay in that time they then charge you interest.

Thus taking it into account is vital whenever you plan to buy your new home. You can pay the stamp duty yourself but if you have a conveyancer acting on your behalf then they will do this for you on your day of completionYour solicitor or conveyancer should ensure that you do not miss the deadline for paying stamp duty. And now that has been changed.

It must be paid in full. You will pay no Stamp Duty if the amount you pay for your main home is under 500000. If you re purchasing additional properties you wil l still have to pay an extra 3 in Stamp Duty on top of the revised rates for each band.

Then it goes up incrementally by 10 each year I think. So utilise our stamp duty calculator to estimate how much you will need to pay. 25112020 The Victorian state budget has just been announced and homebuyers are set to save a small fortune with a stamp duty discount of up to.

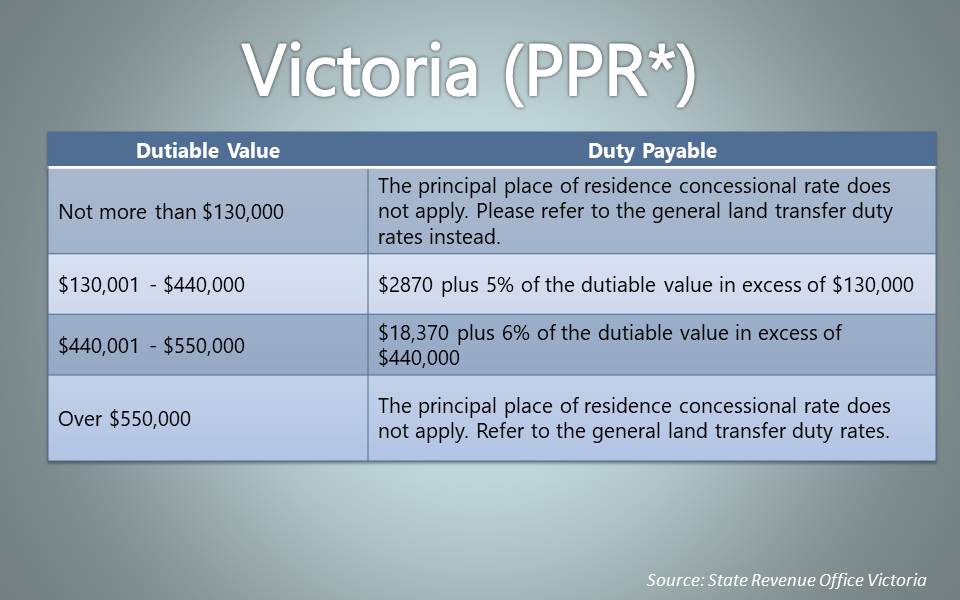

This would mean 5k upfront cost. Victoria also provides a concession to all purchasers of properties valued between 130000 and 550000 from paying stamp duty where they intend to use that property as their principal place of residence. 23102017 In Victoria you will pay stamp duty known as land transfer duty when you purchase a home or investment property.

You have 60 days from the date on the contract to pay it. Prior to the additional stamp duty changes that came into effect on 1 July 2015 duty in Victoria was applied on a sliding scale. If you are seeking an arrangement to pay an overdue assessment by instalments over a period of less than six months please phone 13 21 61.

01102020 You can transfer your payment to us online directly from your cheque or savings account. Stamp duty can add significantly to the purchase price of a property. In November 2020 changes to Victorian stamp duty were introduced that meant that buyers can now access discounts of up to 27500.

Can I get a stamp duty exemption in Victoria. 20052020 And it leaves states overly dependent on property booms for revenue which then is highly cyclical. 01032010 But stamp duty does not have to be paid immediately.

Sam Bidey and. Fortunately there are concessions and exemptions to help keep costs down for first home buyers. In Victoria the State government has abolished stamp duty for first home owners if the home is valued at less than 600000 and the purchaser lives in the home for 12 months.

There is no instalment payment for Stamp Duty. A discounted rate of stamp duty will apply on a sliding scale to any property purchased by a first home buyer for between 600001 and 750000. The current Victorian policy says that if this property is your principal place of residence and you live in it for at least twelve months you will pay no stamp duty when you buy a property for 600000 or less.

Phone 1300 323 181. In Victoria you must pay stamp duty within 30 days after the liability arises to pay transfer duty on the transaction. If I can defer this for a year at the cost of only 300 that.

Im looking at a 400k property first-time buyer. This kicked in at 14 per cent for properties valued at 25000 and rose to 55 per cent for properties valued at 960000 and above. Stamp duty will not apply to any property purchased by a first home buyer for under 600000.

05072017 The Victorian Government announced today in the 2017-2018 State Budget that from 1 July 2017. How much is the stamp duty on a 600000 house in VIC.

New South Wales 2 Pence Stamp Duty Revenue Stamp Postal Stamps Philately

New South Wales 2 Pence Stamp Duty Revenue Stamp Postal Stamps Philately

Victoria Queen Victoria Inscription Stamp Duty New Designs 1886 Used Australian Painting Vintage Stamps Stamp

Victoria Queen Victoria Inscription Stamp Duty New Designs 1886 Used Australian Painting Vintage Stamps Stamp

Stamp Duty On Property In Singapore Buy Stamps

Stamp Duty On Property In Singapore Buy Stamps

Stamp Duty On Property In Singapore Buy Stamps

Stamp Duty On Property In Singapore Buy Stamps

Revenue Stamps Of Victoria Wikiwand

Revenue Stamps Of Victoria Wikiwand

Legaldesk Com Stamp Duty Payment Api Stamp Duty Stamp Payment

Legaldesk Com Stamp Duty Payment Api Stamp Duty Stamp Payment

Stamp Duty On Property In Singapore Buy Stamps

Stamp Duty On Property In Singapore Buy Stamps

Everything You Need To Know About Stamp Duty In Victoria First Things First

Everything You Need To Know About Stamp Duty In Victoria First Things First

Victoria Revenue Stamp Catalogue Postage Stamp Collecting Vintage Postage Stamps Revenue Stamp

Victoria Revenue Stamp Catalogue Postage Stamp Collecting Vintage Postage Stamps Revenue Stamp

Revenue Stamps Of Victoria Wikiwand

Revenue Stamps Of Victoria Wikiwand

I B Australia Nsw Revenue Stamp Duty 5 Revenue Stamp Stamp Duty Stamp Catalogue

I B Australia Nsw Revenue Stamp Duty 5 Revenue Stamp Stamp Duty Stamp Catalogue

Stamp Duty In Nsw How Does It Work Australia Youtube

Stamp Duty In Nsw How Does It Work Australia Youtube

Stamp Duty On Property In Singapore Buy Stamps

Stamp Duty On Property In Singapore Buy Stamps

Stamp Duty Calculator Queensland What Does Transfer Duty Cost In Qld

Stamp Duty Calculator Queensland What Does Transfer Duty Cost In Qld

Stamp Duty Revenue Stamp Stamp Stamp Duty

Stamp Duty Revenue Stamp Stamp Stamp Duty

Post a Comment for "Can I Pay Stamp Duty In Installments Victoria"