Why Do Some Shares Have No Stamp Duty

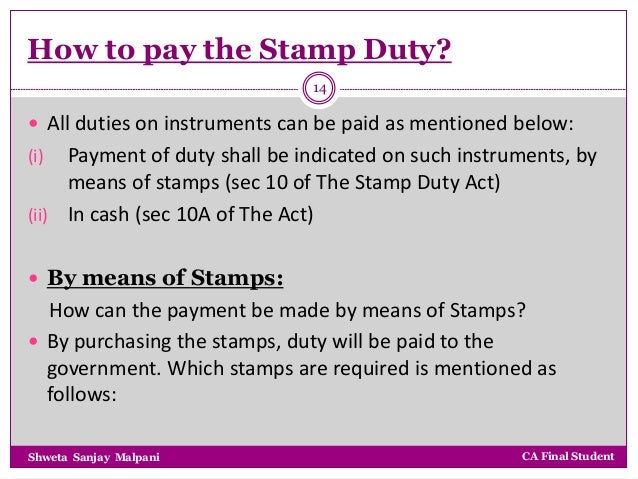

Youll need to pay stamp duty for things like. Where a Judge Referee or.

Types Of Stamps And Some Concepts Of Stamp Duty

Types Of Stamps And Some Concepts Of Stamp Duty

Theres no Stamp Duty to pay if transfers of stock meet certain conditions.

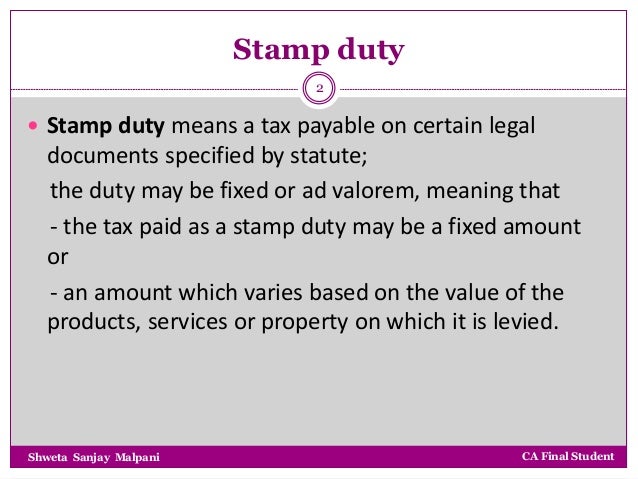

Why do some shares have no stamp duty. 22042004 Stamp duty is a tax that is levied on single property purchases or documents. Motor vehicle registration and transfers. Basically a foreign company is exempt from stamp duty as it does not maintains its shareholders register in the UK.

However if you exchange properties with another person you will each have to pay Stamp Duty on the property you receive based on its market value. More modern versions of the tax no longer require an actual stamp. Remember tax rules can change and depend on your personal circumstances.

Many City-based organisations have called for stamp duty on share purchases to be abolished to allow the London stock market to become more competitive against the major markets in the US. For example someone buying a. Grounds S22 14 SDA.

A stamp duty is the tax placed on legal documents usually in the transfer of assets or property. When purchasing UK shares which are able to. 10122014 Why some stocks do not have stamp duty on them.

07042020 Aim shares already receive preferential tax treatment. So if you buy shares in a company that is not incorporated in the UK and. Repurchases and stock lending.

In most cases these share are not subject to inheritance tax when the shareholder dies - provided they have. It is advised therefore that Stamp Duty is paid on documents required to be stamped because you never know when a transaction could end up in Court. UK stamp duty will be applied to all UK share purchases except the majority of.

22032010 Jan 11 2010. Actually we dont always have to pay stamp duty for share purchases because this tax only applies for shares in a company thats incorporated in the UK or in a foreign company that maintains a share register in the UK. How to Claim Refunds.

While stamp duty on transactions on quoted shares are usually collected through the Stock Exchange and the contract notes are made and stamped by the stock brokers with authorization from the Collector of Stamp Revenue contract notes and instruments of transfer of unquoted shares should be presented to the Stamp Office for stamping. Stamp duty is only payable if the company that one is buying shares from is incorporated or based in the UK. Note that there is one tax you cant escape even within an ISA.

11072014 Theres no Stamp Duty to pay when stock is transferred to a recognised intermediary. The duty is thought to have originated in Venice in 1604 being. Common Stamp Duty Remissions and Reliefs for Shares at a Glance.

Transfers of property such as a business real estate or certain shares. This is stamp duty which is payable when you purchase most shares apart from those listed on AIM and funds. 13102014 shares electronically youll pay Stamp Duty Reserve Tax SDRT shares using a stock transfer form youll pay Stamp Duty if the transaction is over 1000.

The W8-BEN exempts you from paying income and capital gains tax to the US taxman but you will still need to declare your income and capital gainslosses on the shares to the UK HMRC. A physical revenue stamp had to be attached to or impressed upon the document to show that stamp duty had been paid before the document was legally effective. Claiming Refunds Remissions Reliefs.

05052021 Remember that while most second home buyers and buy-to-let landlords have to pay the additional 3 surcharge they do benefit from the temporary stamp duty holiday. However S22 of the Stamp Duties Act also provides terms on which instruments not duly stamped may be received in evidence. 23042008 So do we always have to pay stamp duty whenever we buy shares.

If you transfer the deeds of your home to someone else either as a gift or in your will they wont have to pay Stamp Duty on the market value of the property. As blades says there is no stamp duty on US shares bought via UK broker. Yes stamp duty or stamp duty reserve tax SDRT is paid on all UK equity purchases at the prevailing rate at the time of dealing.

26062020 Stamp duty is tax that state and territory governments charge for certain documents and transactions.

Rates Of Stamp Duty In The State Of Gujarat Ebizfiling

Rates Of Stamp Duty In The State Of Gujarat Ebizfiling

Types Of Stamps And Some Concepts Of Stamp Duty

Types Of Stamps And Some Concepts Of Stamp Duty

What Is Stamp Duty In Hong Kong And How Much Is It Zegal

What Is Stamp Duty In Hong Kong And How Much Is It Zegal

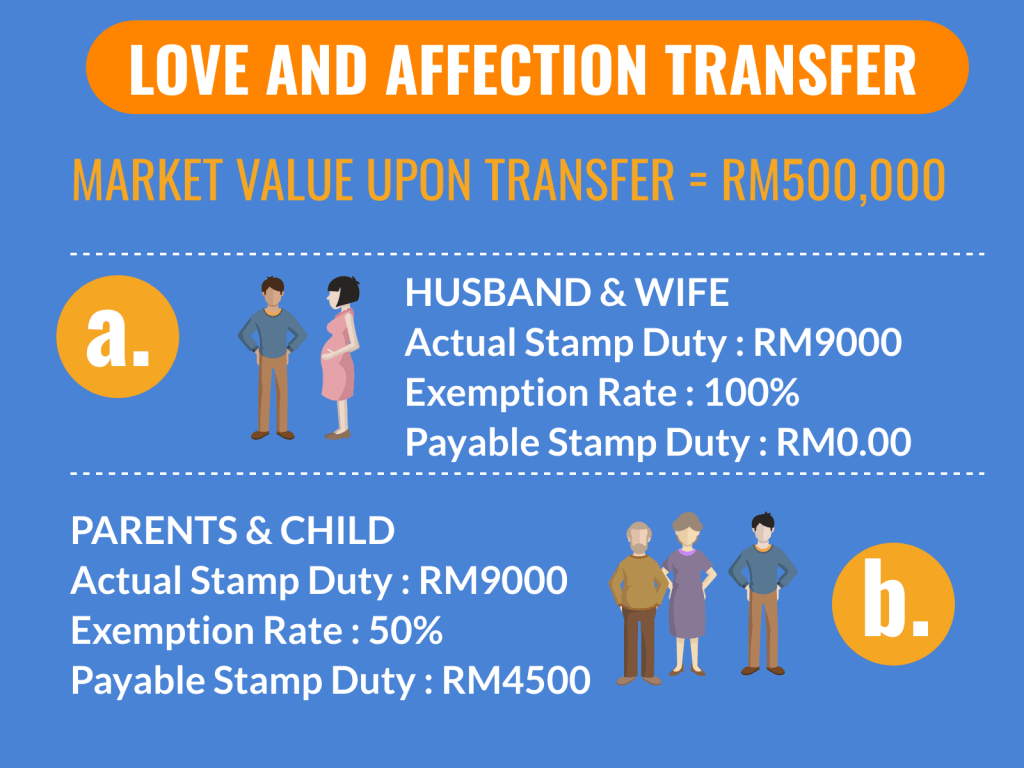

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

Stamp Duty Exemption London Stock Exchange

Stamp Duty Exemption London Stock Exchange

States Must Consider Cutting Stamp Duty To Boost Demand Housing Secretary Real Estate News Et Realestate

States Must Consider Cutting Stamp Duty To Boost Demand Housing Secretary Real Estate News Et Realestate

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Share Trade Stamp Duty Waiver Will Be For Firms With Rm200m Rm2b Market Cap The Edge Markets

Share Trade Stamp Duty Waiver Will Be For Firms With Rm200m Rm2b Market Cap The Edge Markets

Stamp Duty Valuation And Property Management Department Portal

Stamp Duty Valuation And Property Management Department Portal

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Types Of Stamps And Some Concepts Of Stamp Duty

Types Of Stamps And Some Concepts Of Stamp Duty

Lock Stock Barrel Set Aside Sum For Stamp Duty

Lock Stock Barrel Set Aside Sum For Stamp Duty

How Stamp Duty Applies When Buying A Singapore Company Singaporelegaladvice Com

How Stamp Duty Applies When Buying A Singapore Company Singaporelegaladvice Com

Https Blog Bluenest Sg Seller Stamp Duty

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Property Stamp Duty The Ultimate Guide To Ssd Bsd And Absd

Property Stamp Duty The Ultimate Guide To Ssd Bsd And Absd

.webp) Sdlt Stamp Duty Calculator Uk Calculate Stamp Duty Land Tax

Sdlt Stamp Duty Calculator Uk Calculate Stamp Duty Land Tax

Post a Comment for "Why Do Some Shares Have No Stamp Duty"